November 30th, 2022 | 12:01 CET

Profit now from the energy transition - Rock Tech Lithium, Power Nickel, Shell

In the past, the internal combustion engine was at the center of the automotive industry, but this is now to change as quickly as possible in order to achieve the specified climate targets. Electrification is the magic word. However, there are high hurdles to overcome in implementing this. For example, it is still not certain whether the battery metals required for this, such as lithium, cobalt, copper and nickel, are available in sufficient quantities. Demand for the critical metals already exceeds supply. The beneficiaries are undoubtedly the producers of the scarce goods.

time to read: 5 minutes

|

Author:

Stefan Feulner

ISIN:

ROCK TECH LITHIUM | CA77273P2017 , Power Nickel Inc. | CA7393011092 , Shell PLC | GB00BP6MXD84

Table of contents:

"[...] In 2020, the die is finally cast in the automotive industry towards electromobility. [...]" Dirk Harbecke, Executive Chairman, Rock Tech Lithium Inc.

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

Power Nickel - Significant drilling results and spin-off fantasy

The current weakness in the commodities sector due to continuing recession fears is unlikely to last too much longer, especially for urgently needed battery metals for the electrification of transport. That is because the gap between increased demand and scarce supply is drifting further and further apart. For example, the share of demand for nickel from the electromobility industry is currently around 8%. According to market forecasts, this is expected to rise to 25% as early as 2025. The largest nickel resources are in Indonesia. However, a supply chain problem could arise in the future, as the larger nickel producers in the Asian country are already under Chinese influence. As a result, producing one's own supply from the Western world is also likely to become important.

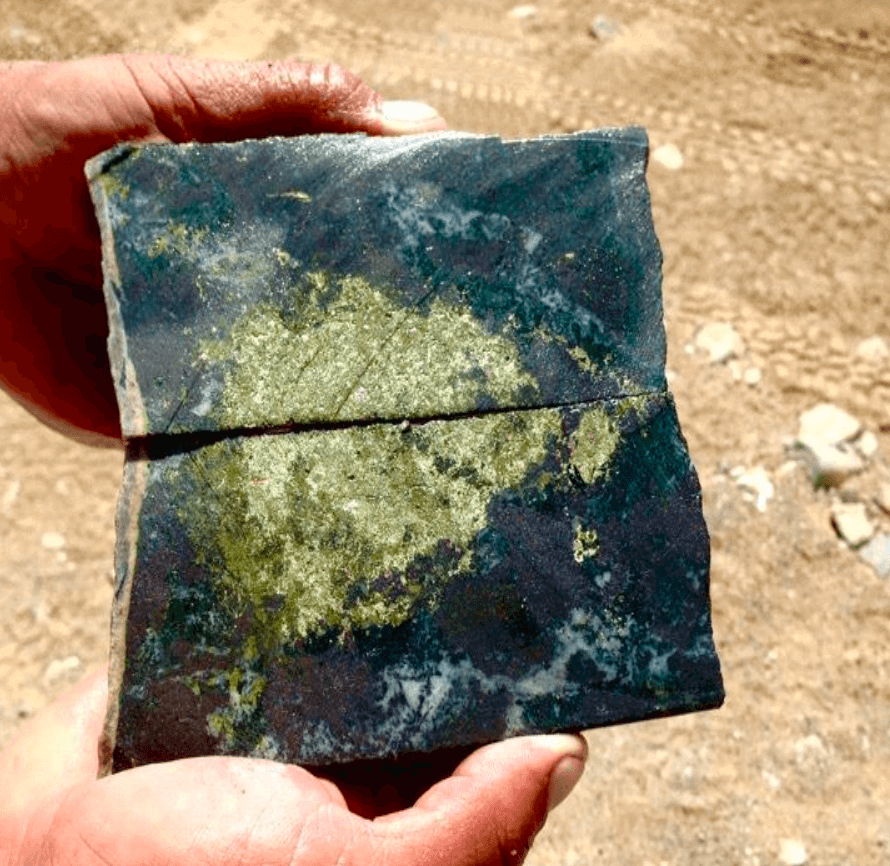

One of the hopefuls for critical raw material production is the Canadian Company Power Nickel. According to CEO Terry Lynch, the medium-term goal is to develop the NISK project into one of the world's most sustainable sources of battery metals. NISK comprises a large land position with 20km of strike length and is located near James Bay in Quebec, ideally situated to take advantage of low-cost, low-carbon hydropower for sustainable development of its resources. Last year, Power Nickel completed the acquisition of the option to acquire 80% of the property from Critical Elements Lithium Corp.

To date, high-grade mineralization of nickel has been proven, as well as the mineralization of copper, cobalt, palladium and platinum. Comparing the existing, proven grades of the individual metals with the peer group, Power Nickel, with a share price of CAD 0.16 and a market capitalization of USD 11.51 million, is significantly undervalued compared to comparable players such as Noron Eagles Nest (USD 480 million) or Panoramic Savannah (USD 233 million), according to management.

On the other hand, the Canadians have another ace up their sleeve. For some time now, there have been plans to bring the non-core assets into a separate company, spin it off and float it on the stock exchange, which should bring significant added value for the existing shareholders. Consolidation Gold and Copper's portfolio is expected to include 100% interest in the Golden Ivan project in British Columbia's Golden Triangle, several concession rights in Chile, and the Copaquire Royalty.

With the latest results from the current drill program, Power Nickel has confirmed high-grade Ni-Cu-Co-PGE mineralization at NISK, extending the mineralization by an additional 150m at depth and to the east and below the central area. Peak values were 25.86m at 1.17% nickel, 0.80% copper, 0.08% copper and 1.46 ppm palladium and 0.23 ppm platinum and 11.00m at 1.50% Ni, 0.93% Cu, 0.10% Co, 1.85 ppm Pd and 0.36 ppm Pt. Further results from the 7,000m drill program are expected in the coming weeks. In addition, Phase 3 of the drill program, which is already funded and includes up to 10,000m of drilling, is scheduled for January.

NISK's exploration modeling indicates great expansion potential. In addition, with the announced spin-off, the Company has attractive upside potential and trades at a significant discount to its peer group. For risk-conscious investors who are betting on the future of electromobility, Power Nickel could represent an attractive investment.

-

Shell - Renewable energies on the upswing

Black gold continues to flush high cash flow into the coffers of the world's largest petroleum and natural gas company. Nevertheless, the London-headquartered giant is focusing on a transformation toward green energy to become a net-zero emissions energy company by 2050. The swing is to be achieved by providing more CO2 energy. This includes, for example, charging electric vehicles, hydrogen and electricity from solar and wind power. To ensure that this supply is matched by demand, Shell is partnering with companies, including in sectors that are difficult to de-carbonize, such as aviation, shipping, road transport and industry.

Tens of billions more are likely to flow into the acquisition of green projects over the next few years to provide a broad range of green energy. The oil giant's next object of desire is to strike a deal with Danish biogas producer Nature Energy Biogas for a purchase price of EUR 1.9 billion. Energy Biogas is considered one of Europe's largest producers of renewable natural gas (RNG). The merger is expected to go through in the first quarter of 2023. Biogas is not extracted from the ground like fossil natural gas but is produced from biogenic materials, for example, during the decomposition of organic material in landfills or waste plants.

This is the second acquisition in the biogas sector within a few weeks, following the takeover of producer Archaea Energy by competitor BP for around USD 4 billion. Canadian bank RBC left its rating on Shell at "outperform" with a price target of GBP 3,200 on the occasion of the planned acquisition in the renewable energy sector.

Rock Tech Lithium - Piece by piece

Operationally, things continue to go according to plan at Rock Tech Lithium. After the announced deal and an offtake agreement with Mercedes Benz, the string of pearls is completed piece by piece. Thus, a binding offtake agreement has been signed with Mercedes-Benz AG for an average of 10,000t of lithium hydroxide per year. With a duration of 5 years with a qualification phase starting beforehand, the contract covers an estimated sales volume of around EUR 1.5 billion. It is expected to utilize around 40% of the converter's capacity planned in Guben, Brandenburg. In addition, Rock Tech announced economic viability data for the Guben converter and positive results from the pre-feasibility study (PFS) for the "Georgia Lake" project. Accordingly, the PFS supports open pit and underground mining operations and the construction of a 1 million tpy spodumene concentrator.

Another important step in the permitting process for the construction of Europe's first lithium hydroxide converter was also the submission of the next sub-application. The first partial application is currently being reviewed by the authority conducting the procedure, the State Office for the Environment in Potsdam. Commenting on the progress of the permitting process so far, Dirk Harbecke, CEO at Rock Tech Lithium, says: "We are very pleased that we have been able to work so constructively and goal-oriented with the Brandenburg State Office for the Environment so far. The submission of the next partial application is one of the last major steps for us on the way to the start of construction of our converter in Guben."

The analyst firm Montega sees Rock Tech Lithium's stock as a buy candidate and assigns a price target of CAD 10.00. That means an upside potential of over 220% at the current price level.

The energy transition requires an increased demand for critical battery metals. Rock Tech Lithium is expected to see strong demand with the construction of Europe's first lithium hydroxide converter. Power Nickel has a world-class nickel deposit and also spin-off fantasy. Whether Shell's long-term cash flow from renewables will be as bubbly as its oil and gas business is currently uncertain.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.