May 11th, 2023 | 07:50 CEST

Plug Power, Canadian North Resources, RWE - Critical metals as a sticking point

The dream of a climate-neutral world still exists, at least in the minds of politicians. Thus, many companies that took on the transformation of the transport and energy sectors were also given plenty of advance praise. However, there are still problems with the implementation and the leap into the profit zone. One reason for the weakening margins is the raw materials needed for the energy transition, which are still at high levels. However, due to the scarcity of many critical metals, a reduction in base prices is likely to remain a pipe dream.

time to read: 4 minutes

|

Author:

Stefan Feulner

ISIN:

PLUG POWER INC. DL-_01 | US72919P2020 , CANADIAN NORTH RESOURCES INC | CA1364271017 , RWE AG INH O.N. | DE0007037129

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

Plug Power - Groundhog Day, every day

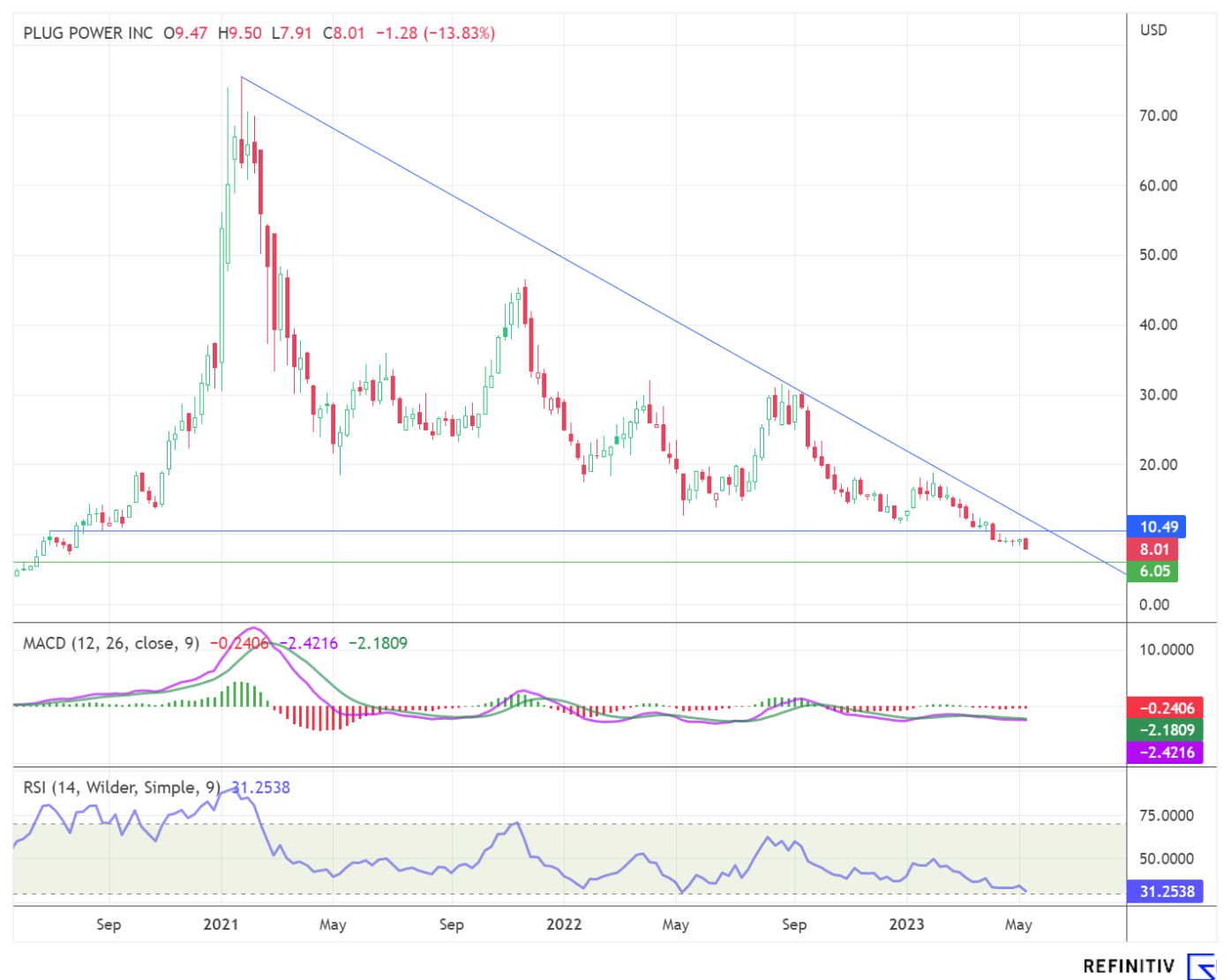

It seems to be more the rule than the exception for the hydrogen specialist to undercut forecasts made months ago. After weak annual figures, when only USD 701.4 million made it into the books after the still estimated USD 900 to 925 million in October, the US company disappointed once again when publishing the figures for the first quarter. Although turnover rose by 49% to USD 210.30 million compared to the same period last year and exceeded analysts' forecasts, the net loss of minus USD 209.80 million was nearly as high and clearly missed the set targets. The overall gross margin deteriorated to minus 33% from 25% in the first 3 months of 2022.

As losses continued to mount, cash and cash equivalents fell to USD 474.86m. As we pointed out months ago, another corporate action is likely inevitable this year. According to the press release, Plug Power already has non-dilutive financing options available to support the expected growth and expansion of its green hydrogen network. Several financing options are currently being explored with counterparties, including, but not limited to, the Department of Energy, strategic project investment partners and asset-backed loan facilities from major banks.

Investors acknowledged the once again lower-than-expected metrics with a sell-off of over 25% to a new low for the year of USD 8.01. The next prominent support is currently at USD 6.05. Various analyst firms also lowered their thumbs. The US investment bank JP Morgan cut its price target from USD 20 to USD 14. On the other hand, the experts at BMO Capital Markets are much more skeptical. Their target price is USD 7.50, and their verdict is "market perform".

Canadian North Resources - All in one place

The high prices for the critical metals needed for the energy transition and the electrification of transport are gnawing away at companies' margins. On the other hand, the primary beneficiaries are the producers and developers of the scarce raw materials. Canadian North Resources, which focuses on mining metals for clean energy, electric vehicles, batteries and high-tech applications, is entering precisely this niche. The advantage of the 100% owned, 253.8 sq km Ferguson Lake nickel, copper, cobalt, palladium and platinum project is that virtually all the raw materials needed for climate change are in one place.

According to NI 43-101, the property contains considerable resources of 1,402 million pounds of copper, 872 million pounds of nickel, 99 million pounds of cobalt, 3.2 million ounces of palladium and around 0.56 million ounces of platinum. The project, which has been in operation since 1950, has already seen an investment of more than CAD 160 million in exploration involving more than 200,000 m of drilling and 650 drill holes, as well as the development of world-class infrastructure.

To date, the potential for lithium minerals in the Ferguson Lake area has not been explored. However, extensive granitic pegmatites have been identified that may contain lithium minerals. Canadian North Resources plans to conduct dedicated lithium exploration programs for the first time this year. A possible discovery of a lithium resource would add significant value to the project. Since the beginning of April, the exploration program has been running with diamond drilling. A total of more than 20,000 m are to be drilled to test the 15 km long main mineralization formation.

With a cash balance of CAD 11 million, the Company, which has a market capitalization of CAD 250 million, is well-equipped for the next steps. In terms of stock exchange trading, Canadian North Resources has reached another milestone and is now also listed on the OTCQX Best in the US. This gives the Canadians exposure to a broader investor community, which should significantly raise the profile of this high-grade project.

RWE - Viva Espana

It would be another blow to the German industry and the planned energy turnaround in the Federal Republic - the online news service "OK Diario" reported that the Spanish utility Iberdrola is planning to acquire its German counterpart. Talks were already underway with the US bank JP Morgan regarding the financing of the venture. However, a quick denial came from Bilbao.

A company spokesperson denied the rumours. However, the Spanish company, which stands as the European market leader, is planning further investments until 2025, with a focus on electricity grids and the generation of renewable energies. Iberdrola has invested more than EUR 10 billion in renewable energies and grids in the past 12 months.

From a chart perspective, RWE continues to be in the upward trend established since March 2020. At EUR 42.18, the share price is close to reaching a new high for the year, which is EUR 43.03.

Plug Power disappointed once again with its first-quarter figures. A potential merger between Iberdrola and RWE referred to as a "marriage of elephants," was promptly denied. Canadian North Resources should benefit from the long-term rising prices of critical metals for the energy transition.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.