Comments

Commented by Fabian Lorenz on December 16th, 2025 | 07:25 CET

Big news at Barrick Mining! First Majestic Silver shares hit record high! Gold gem Kobo Resources on the rise!

Precious metals are shining particularly brightly this year. The two industry heavyweights, Barrick Mining and First Majestic Silver, are benefiting from this. Barrick recently caused a stir with its announcement that it was considering an IPO of its US assets. Is this to prevent a hostile takeover? First Majestic Silver has taken advantage of the mood and raised several million USD to repay more expensive debt and possibly make a takeover. One takeover candidate in the gold sector is Kobo Resources. The Company plans to publish its resource estimate in early 2026. The stock has finally taken off, still has a lot of potential according to analysts, and is now also actively traded on the Frankfurt Stock Exchange.

ReadCommented by André Will-Laudien on December 16th, 2025 | 07:20 CET

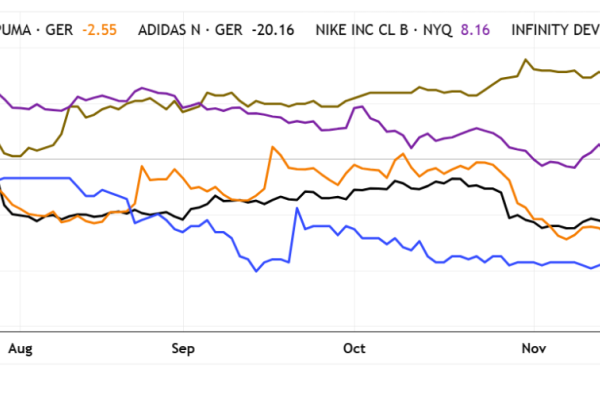

Impact investing, with super dividends into 2026 – Nike, RE Royalties, Adidas, Puma, and Infinity Development

Impact investing has become increasingly important in recent times as investors increasingly recognize that capital flows generate not only returns but also social and environmental impacts. In light of climate change, resource scarcity, and social imbalances, many market participants are no longer satisfied with using financial metrics alone as a benchmark. Regulatory authorities are promoting this development through stricter ESG requirements and greater transparency requirements for companies and financial products. At the same time, younger generations are demanding that their assets be consistent with their values and have a measurable positive impact. If you are looking for something, you will find suitable investments!

ReadCommented by Fabian Lorenz on December 16th, 2025 | 07:15 CET

Novo Nordisk makes a statement! TUI shares jump! Globex shares strong!

Novo Nordisk can end the horror year of 2025 on a positive note. The EMA has issued a positive opinion on a higher Wegovy dosage. Sales could start as early as January. Globex Mining shares have gained over 35% in the current year. There is much to suggest that the share price will continue to rise. With Globex Mining, investors benefit from the commodities boom in a legally secure region with diversified risk. The tourism boom could soon be over, given the economic development in Europe. These prospects dragged down the shares of TUI. However, the stock has reacted strongly in recent days.

ReadCommented by Stefan Feulner on December 16th, 2025 | 07:10 CET

Rheinmetall, Almonty Industries, Theon – Peace talks open up opportunities

Hopes for a ceasefire in Ukraine are currently influencing not only politics but also the stock markets. While a possible peace plan is being negotiated at the highest level in Berlin, defense stocks are coming under short-term pressure. Investors are pricing in a scenario in which the military escalation subsides. However, looking beyond the daily headlines reveals a different picture. Regardless of the outcome of the Ukraine summit, Europe is facing a long-term security policy realignment, with permanently higher defense spending. For the defense industry, this means short-term volatility, but attractive prospects for investors in the medium to long term.

ReadCommented by Armin Schulz on December 16th, 2025 | 07:05 CET

The trio for the raw materials revolution: Why you should invest in European Lithium, Standard Lithium, and Lynas Rare Earths

The global hunt for the critical raw materials of the 21st century is on. Driven by rapid electrification and geopolitical upheaval, demand for lithium and rare earths is exploding, while supply is struggling. This fundamental discrepancy is creating a historic market imbalance and catapulting companies that can close strategic supply gaps into the spotlight. Three companies in particular are coming to the fore, whose stories are directly interwoven with the biggest megatrends of our time: European Lithium, Standard Lithium, and Lynas Rare Earths.

ReadCommented by Fabian Lorenz on December 16th, 2025 | 07:00 CET

Great potential in the defense sector! RENK, Hensoldt, NEO Battery Materials

Milestone at NEO Battery Materials! With the lease of its new operational battery facility, NEO Battery is now ready to start commercializing its high-performance battery technology for defense, automotive and energy sectors. The new factory eliminates the need for time-consuming and costly construction. Orders and partnerships are also already in place. It is likely only a matter of time before batteries are also used in tanks. In Germany, RENK, for example, is developing drives for vehicles weighing up to 70 tons. Analysts consider the recent sell-off in defense stocks to be exaggerated. Their current favorite is Hensoldt. However, the sensor specialist is not recommended as a buy by all experts.

ReadCommented by Carsten Mainitz on December 16th, 2025 | 06:55 CET

Comebacks with doubling potential – Power Metallic Mines, Puma, TeamViewer!

Dips and corrections – these are often exciting entry points for building or expanding positions. For value-oriented investors, it becomes interesting when the price paid on the stock market differs significantly from the true or intrinsic value of the Company. In addition, technical chart markers can provide signals. Even though the following stocks are very different, they all have one thing in common: high price potential and the chance to be among next year's top performers.

ReadCommented by Fabian Lorenz on December 15th, 2025 | 07:25 CET

Alarm bells ringing at Evotec! BioNTech and Vidac Pharma achieve success in the fight against cancer! Analysts recommend buying!

Alarm bells are ringing at Evotec. A major shareholder has completely withdrawn from the German biotech company. The security is trading at 2016 levels. Vidac Pharma, on the other hand, has reached a milestone. In the EU, the Phase 2b clinical trial for the ointment Tuvatexib (VDA1102) against a particularly active, fast-growing precursor of skin cancer can begin. BioNTech is also continuing the fight against cancer. Initial results from the global Phase 2 trial of the non-specific antibody candidate Pumitamig showed encouraging anti-tumor activity in advanced triple-negative breast cancer. Analysts recommend buying shares in Vidac and BioNTech.

ReadCommented by Stefan Feulner on December 15th, 2025 | 07:20 CET

Canopy Growth, American Atomics, Palantir – Energy and cannabis with powerful potential

The end of the week spoiled a positive weekly performance for the stock markets due to disappointing figures from software group Oracle. High-flying AI stocks in particular took a significant hit, as Oracle's AI offerings fell short of analysts' forecasts. In contrast, cannabis stocks soared once again, driven by statements from US President Donald Trump.

ReadCommented by André Will-Laudien on December 15th, 2025 | 07:15 CET

Gold, AI, and Bitcoin – A record year in 2026? Strategy, B2Gold, Kobo Resources, and Allied Gold

In mid-December, investors are keeping a close eye on the coming year 2026. Will the old winners also be the new ones? Bitcoin was a disappointment in 2025, as the cryptocurrency is actually down slightly to date. Artificial intelligence and sought-after high-tech suppliers were the focus of attention, with returns of several hundred percent, with Palantir and quantum computing specialist D-Wave, for example, achieving extreme performance. But how will things proceed next year? The majority of analysts believe that the highest-valued high-tech segment will cool down. The primary focus is on NVIDIA, which, with a 1,250% increase since 2021, is now one of the most expensive stocks in the world. The outlook is challenging, as a significant correction or even a crash would also be long overdue. Gold has gained over 60% in the last 12 months, and the trend is fully intact. Could it soon reach USD 5,000?

Read