January 16th, 2026 | 07:10 CET

AI, defense, and the energy crisis - Things are looking up! E.ON, CHAR Technologies, DroneShield, BayWa

Things are continuing where they left off in 2025. The colorful US President Trump is now threatening Greenland and Iran at the same time, raw materials remain in demand, and the Western industrial world is worried about its supply chains. At the same time, the increasing use of artificial intelligence is keeping energy efficiency and supply issues at the forefront of public and corporate attention. Sophisticated business models allow investors to identify promising strategies that are resilient in a fragile and uncertain world. Below, we highlight a few notable examples.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

E.ON SE NA O.N. | DE000ENAG999 , CHAR Technologies Ltd. | CA15957L1040 , DRONESHIELD LTD | AU000000DRO2 , BAYWA AG NA O.N. | DE0005194005

Table of contents:

"[...] Internally we expect the resource to significantly grow the deeper we mine. [...]" Dennis Karp, Executive Chairman, Manuka Resources

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

E.ON – Starting the new year with good news

German energy service provider E.ON is at the forefront of the energy transition. The DAX-listed company is increasingly positioning itself as a central infrastructure and network operator for the energy transition. Its business model clearly focuses on the expansion and efficiency of electricity and gas networks, while traditional generation and nuclear energy no longer play an operational role. The aim is to make a system heavily dominated by renewable energy sustainable and stable in the long term, with management emphasizing that the transformation can only succeed with strict cost control and a market-oriented approach.

CEO Leonhard Birnbaum initially expects a noticeable reduction in electricity and gas prices for end customers in 2026. Government intervention in grid fees and the aftermath of the 2022 energy crisis are likely to contribute to a three-person household paying significantly less for basic services than in the previous year. However, management sees this phase of falling prices as a transition, as costs are expected to rise again from 2027 onwards. Prices are also likely to rise in the gas sector, as fixed network costs will be spread across fewer users.

With around 1.6 million km of pipeline network, E.ON plays a key role in the restructuring of energy supply in Europe. From an investor's perspective, E.ON stands for stable, regulated earnings and high, long-term, predictable investments. The latest bond issue of EUR 1.6 billion with long maturities and coupons between 3.4% and 3.9% underscores the Company's good access to capital markets and creates financial leeway for further network expansion. But the dividend is also impressive at 4.8%. Technically, the stock has now broken out, exceeding EUR 16.80. Analysts on the LSEG platform expect an average 12-month price target of EUR 16.95. They have likely not yet sufficiently factored in the latest developments. In the long term, E.ON is a stable and conservative anchor in any portfolio.

CHAR Technologies – Clean energy from biomass on the way

When it comes to innovative ideas for modern energy concepts, Canadian cleantech company CHAR Technologies is very well positioned. The newcomer to the market is positioning itself with an integrated approach to waste recycling, energy generation, and industrial decarbonization, thereby addressing several structural future markets at the same time. At the heart of this is the Company's proprietary high-temperature pyrolysis technology, which converts non-marketable wood residues and organic waste into renewable gas and solid biocarbon. This biocarbon serves as a low-carbon substitute for coal in emission-intensive industries, while at the same time keeping waste out of landfills.

With the commissioning of its first commercial plant in Thorold, the Company is making the transition from the development to the production stage. The plant is expected to reach an annual capacity of around 5,000 tons of biocarbon in the short term, which will serve as proof of concept for industrial scalability. The modular plant architecture enables decentralized expansion, reduces logistics costs, and increases the attractiveness for regional value creation partnerships. To ensure implementation, CHAR is consistently focusing on industrial collaborations, including with major steel and forestry players. A key growth driver is the project in Espanola, for which infrastructure partner BMI has already committed CAD 10 million in financing. With an annual capacity of up to 50,000 tons, the planned plant is expected to achieve a multiple of previous production levels, marking a technological leap to industrial scale. The location benefits from existing infrastructure and extensive sources of forestry residues, which favors rapid scaling. At the same time, the engineering and design phase is being pushed forward, which will lay the foundation for the transition to construction.

In addition, CHAR is tapping into another regulatory-driven market segment with high margin potential with the destruction of PFAS pollutants. The successful demonstration of this technology underscores the flexibility of the HTP platform beyond the energy sector. On the financing side, a recent private placement strengthens the liquidity base for ongoing project development. Further political tailwinds are provided by Canada's 2050 climate targets, which favor low-carbon industrial solutions. Against the backdrop of moderate market valuation and a clearly visible project pipeline, CHAR Technologies offers an asymmetric opportunity profile for investors focused on scalable decarbonization solutions. Since January 2025, the market value has doubled to over CAD 40 million. But the story is just getting started!

IIF moderator Lyndsay Malchuk talks to CEO Andrew White about the plans for 2026.

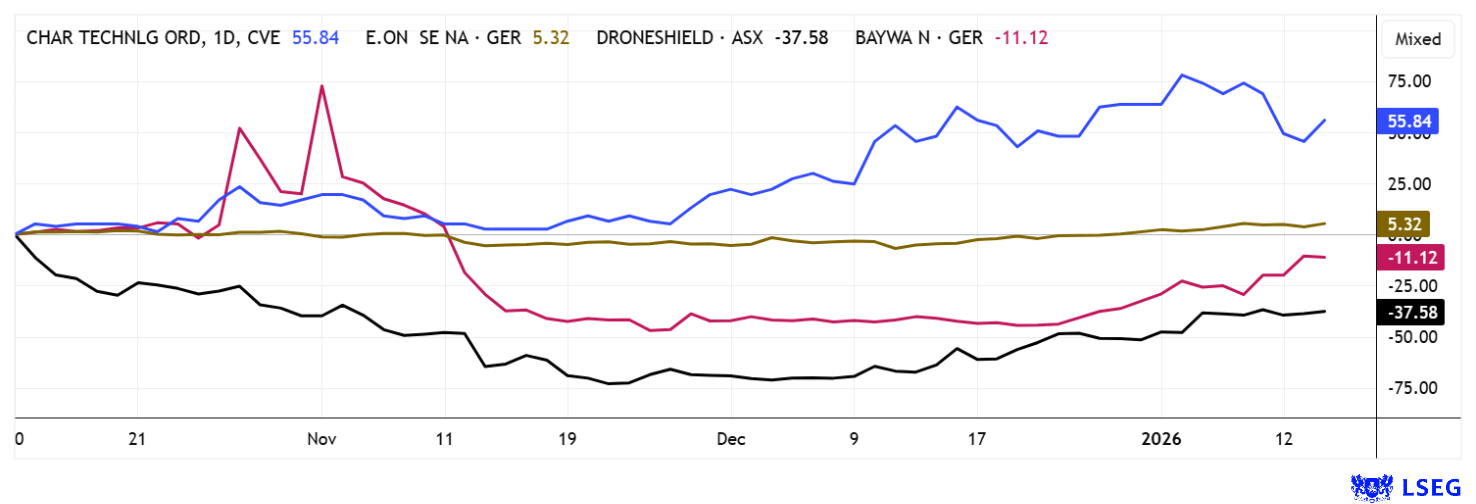

DroneShield and BayWa – High volatility pleases all traders

The Australian defense stock DroneShield has been very volatile over the past three months. The quarrels over massive insider and employee sales became exciting when the AUD 200 million revenue hurdle was reached. The share price fell to EUR 0.80 after trading at around EUR 3.80 in October. But what happens next? Driven by investment considerations for defense in the unmanned aviation sector, several contracts have been awarded in the EU and NATO, which makes DroneShield look quite good again at the beginning of the year. The stock was therefore able to quickly triple from its low point on massive revenue. However, skepticism about the next bonus shares remains, and the valuation with a revenue multiple of almost 10 times is making fundamental analysts shudder. Only interesting for momentum traders!

At BayWa AG, the moment of truth came in 2025. Former CEO Klaus Josef Lutz left behind a disastrous balance sheet, and the subsequent management boards now have to deal with potentially incorrect accounting. Prosecutors are currently conducting searches and investigations. However, the new shareholders who are supporting the restructuring program apparently view the consistent reappraisal very positively and are buying back the stock, which had fallen by over 80%. In just a few days, the brave have been able to earn a 40% gain since the beginning of the year. Still very speculative!

Such volatility is rarely seen. While selected special stocks such as DroneShield and BayWa are still struggling with the recent crashes, E.ON and CHAR Technologies are rising sharply. The journey is likely to continue here. As always, good diversification protects against major portfolio movements.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.