Comments

Commented by Mario Hose on January 15th, 2026 | 17:09 CET

CEO Buys Again After the Rally: Is Almonty Industries Setting Up for the Next Big Move?

When a stock has already delivered a strong rally, most CEOs turn cautious — they wait, stay quiet, and avoid adding risk. Lewis Black is doing the opposite. The CEO of Almonty Industries Inc. has expressed his commitment not once, but three times in recent months, backing his conviction with real capital. For investors, that’s often one of the most powerful signals in the market: Insiders don’t buy for attention. They buy because they believe something is coming.

ReadCommented by André Will-Laudien on January 15th, 2026 | 07:30 CET

Acquisition Breakthrough: D-Wave, First Hydrogen, and Plug Power in focus

In an increasingly fast-paced world, investors are seeking timely information on stocks that have been highly volatile in recent weeks. Often, the key opportunities lie in turnaround situations, driven partly by operational news and partly by technical chart patterns. Today's selection of stocks reflects exactly this picture. D-Wave is impressing with a complementary acquisition deal, First Hydrogen with a successful capital raise, while Plug Power is unfortunately facing negative analyst commentary. What is happening on the price board?

ReadCommented by Nico Popp on January 15th, 2026 | 07:25 CET

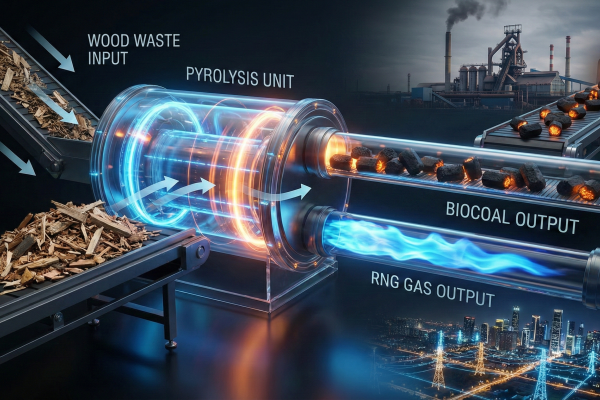

Double returns: How CHAR Technologies is closing the gap between ArcelorMittal's coal hunger and Montauk's gas profits

We are witnessing a historic turning point for global heavy industry. We are currently seeing not only a technological evolution, but also a fundamental revaluation of industrial assets, driven by two parallel megatrends: the decarbonization of primary steel production and the monetary revaluation of waste streams for energy security. While regulatory constraints are forcing steel giants such as ArcelorMittal to reinvent their blast furnaces, and specialists such as Montauk Renewables are demonstrating the enormous valuations possible in the renewable natural gas (RNG) market, CHAR Technologies is positioning itself at the intersection of these two worlds. With its proprietary high-temperature pyrolysis technology, the Canadian company provides the answer to both questions at once: it produces biochar for the steel industry and RNG for the energy grid – from a single waste source.

ReadCommented by André Will-Laudien on January 15th, 2026 | 07:20 CET

Silver, gold, copper, and uranium - The stuff dreams are made of! Nel ASA, American Atomics, and Siemens Energy in focus

Commodities are off to a strong start again this year. As they are irreplaceable raw materials for industry, energy distribution, and e-mobility, high prices are also accelerating inflation in Western jurisdictions. With the exception of gold, critical metals have been trading at "safety premiums" for several months. This is a result of fragile supply chains, geopolitical constraints, and increasing supply uncertainty. Solar module manufacturers in China are now said to be hoarding silver because speculators are virtually buying up the procurement markets for physical goods. Silver has gained around 200% in the past 12 months, with physical demand now exceeding annual production. According to experts, this trend is far from over. Are portfolio rebalancing measures necessary?

ReadCommented by Armin Schulz on January 15th, 2026 | 07:15 CET

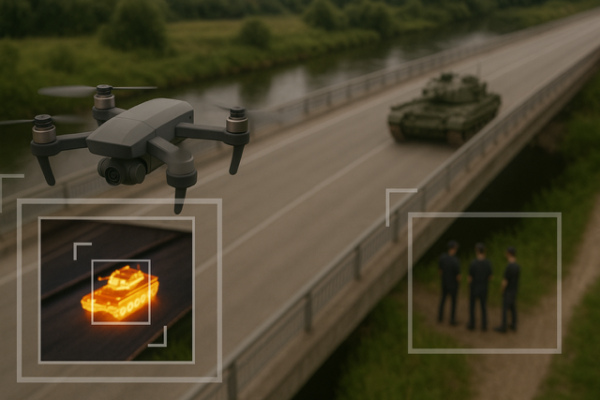

Lithium shortage grows: How BYD, NEO Battery Materials, and DroneShield are benefiting

A new era of scarcity is dawning. Lithium prices are skyrocketing. As lithium becomes the strategic oil of the 21st century, entirely new technologies are fueling the appetite for energy. Electric mobility, drones, robotics, and AI all have one thing in common: they are driving up demand for energy storage systems that need to be more powerful, more efficient, and simply more robust. In this race for what is arguably the most important resource of our time, what counts most is secure supply chains. Without them, the much-vaunted technology of the future will fall by the wayside. We take a look at three specific companies that are benefiting from the new technologies: BYD, NEO Battery Materials, and DroneShield.

ReadCommented by Carsten Mainitz on January 15th, 2026 | 07:10 CET

Power Metallic Mines: Top Commodity Pick Backed by Renowned Investors!

Many market experts have proclaimed this the decade of commodities. Last year was dominated by a precious metals boom, with silver in particular seeing a sharp increase in momentum in recent weeks. Critical raw materials, such as rare earth elements and strategic metals, are also attracting significant attention. The market is dominated by China, and export restrictions put additional pressure on the West to develop new deposits outside of China and establish secure supply chains. This is putting companies that own properties in secure Western jurisdictions at the center of investor interest. One such company is Power Metallic Mines. The Canadians have one of the largest polymetallic deposits in North America. Several prominent investors have already taken positions, underscoring the Company's potential. Analysts also see significant upside for the stock.

ReadCommented by Armin Schulz on January 15th, 2026 | 07:05 CET

Undervalued in transition - plus dividends? Analysis of Mercedes-Benz, WashTec, and Sixt

The fundamental transformation of mobility is creating two contrasting realities: while established manufacturers are groaning under massive pressure to innovate and shrinking margins, surprising profit opportunities are emerging in the niches of change. The strategic responses to this tension could hardly be more different. A premium automaker, a vehicle care equipment supplier, and a mobility service provider exemplify where the future of driving can also be lucrative for investors. It is therefore worth taking a closer look at the paths of Mercedes-Benz, WashTec, and Sixt.

ReadCommented by Nico Popp on January 15th, 2026 | 07:00 CET

The USD 88 shock: Are UBS and Citigroup forcing the silver market to its knees, or are we witnessing the ultimate short squeeze? Opportunities at Silver North Resources

The year is still young, and a drama is unfolding on the precious metals markets that could go down in history. The price of silver has shattered historical resistance levels and is trading above the USD 88 per ounce mark. What was long dismissed as the wild fantasy of "gold bugs" is now a harsh reality: a sudden decoupling of physical scarcity from paper-based pricing mechanisms. As the spot market explodes, all eyes are on the big players in the financial world. Rumors are growing louder that major banks such as UBS and Citigroup may have gotten themselves into dangerous trouble through massive short positions. In this toxic environment of mistrust and panic, investors are seeking refuge in unencumbered assets - and finding it in junior explorers such as Silver North Resources, which owns exactly what the banks are said to have shorted: physical silver in the ground, high-grade and safely located in Canada.

ReadCommented by André Will-Laudien on January 14th, 2026 | 07:40 CET

Price explosion ahead! Alibaba flexes its muscles, RE Royalties up 40%, and TeamViewer on the launch pad!

The markets are proving highly dynamic at the start of the year. Yesterday, the DAX climbed to a new all-time high of over 25,400 points. There have been minor corrections among the high-tech winners of 2025, but the focus is now shifting to small caps and old favorites, which can now take off unchallenged. Alibaba is making an impressive comeback in China, RE Royalties is off to a strong start with a 40% gain, and the much-maligned TeamViewer is finally posting a satisfactory quarter. How quickly will investors return here?

ReadCommented by Fabian Lorenz on January 14th, 2026 | 07:35 CET

Fraunhofer Sounds the Alarm! Will Batteries Soon Be Scarce from China? NEO Battery Materials Offers an Alternative – Launching in 2026!

Fraunhofer is sounding the alarm with unusual clarity. Europe's largest research and innovation organization warns that China's new trade policy measures on battery technology pose a strategic risk. In extreme cases, an export ban could become a reality "in a very short time." What is particularly explosive is that Beijing is not only targeting batteries and preliminary products, but also the machines without which no cell factory can start up. This could not only slow down German car manufacturers' race to catch up in electromobility but also create bottlenecks in drones, robotics, and other emerging technologies. Battery suppliers from "Western" production, such as NEO Battery Materials, could benefit from this development. The Company's revolutionary technology is market-ready, with mass production set to begin in South Korea. NEO shares currently appear undervalued.

Read