January 15th, 2026 | 07:30 CET

Acquisition Breakthrough: D-Wave, First Hydrogen, and Plug Power in focus

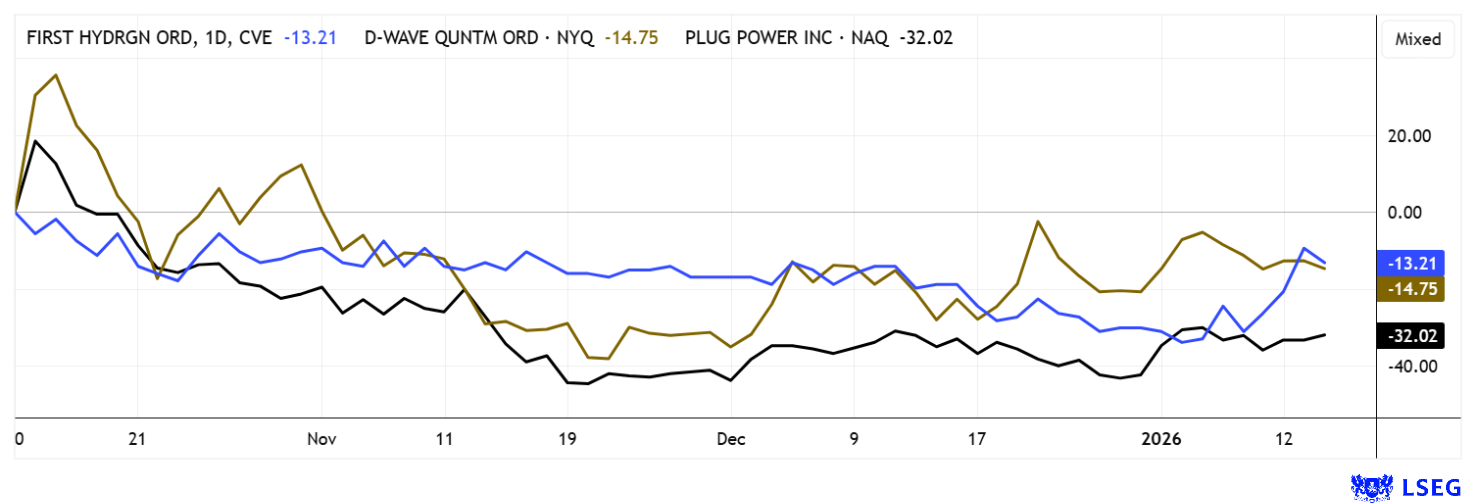

In an increasingly fast-paced world, investors are seeking timely information on stocks that have been highly volatile in recent weeks. Often, the key opportunities lie in turnaround situations, driven partly by operational news and partly by technical chart patterns. Today's selection of stocks reflects exactly this picture. D-Wave is impressing with a complementary acquisition deal, First Hydrogen with a successful capital raise, while Plug Power is unfortunately facing negative analyst commentary. What is happening on the price board?

time to read: 3 minutes

|

Author:

André Will-Laudien

ISIN:

D-WAVE QUANTUM INC | US26740W1099 , First Hydrogen Corp. | CA32057N1042 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

"[...] dynaCERT's HydraGEN™ device offers a retrofit solution for diesel engines designed to protect the environment while providing economic benefits. [...]" Bernd Krueper, President & Director, dynaCERT Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

D-Wave – A takeover deal to start the year

A brilliant start to the year for D-Wave. The quantum computing specialist has taken a strategically significant step toward strengthening its market position in the quantum sector with the announced acquisition of Quantum Circuits for around USD 550 million at the beginning of 2026. The transaction marks the first major deal to be realized with the recent cash inflows in the billions. Strategically, the transaction aims to expand D-Wave's previous focus on quantum annealing to include gate model technology, thereby significantly increasing the range of addressable applications. Quantum Circuits brings many years of experience in building gate-based systems to the table. This technology promises higher-quality qubits with lower hardware costs and could enable D-Wave to offer competitive gate model systems for the first time, starting in 2026. The purchase consists of cash and new shares, as D-Wave still has no significant revenue and is dependent on shareholder contributions. At least D-Wave has been able to strengthen its international presence through partnerships in Europe and the Asia-Pacific region. The stock celebrated with a rise from USD 25 to almost USD 33 at its peak. Of course, the old high of around USD 46.7 is still a long way off. Only trade with tight stops; in this case, USD 25 makes perfect sense.

First Hydrogen – An innovator in the clean energy sector

Positive news also from First Hydrogen. The Canadian clean energy company is increasingly positioning itself as an integrated provider with a focus on hydrogen, zero-emission mobility, and baseload energy sources. A key strategic component is a research program launched in 2025 with the University of Alberta that focuses on molten salt fuels for small modular reactors (SMRs). In this early phase, non-radioactive substitute materials are being investigated that replicate the physical properties of real nuclear fuel salts as closely as possible. This approach allows the Company to reduce technological risks at an early stage and to advance laboratory and prototype work without regulatory complexity. The results will form the basis for further development decisions, such as building in-house laboratory capacities and collaborating with material suppliers.

In the long term, First Hydrogen's vision is to couple stable SMR-based energy with electrolysis to provide green hydrogen for industry, data centers, and AI infrastructure. This is a broadly welcome field of activity that has attracted international attention. Molten salt reactors in particular are considered an attractive alternative because they offer safety advantages, high efficiency, and a constant energy supply. Financially, First Hydrogen announced a private placement of up to CAD 3 million at the end of 2025, providing additional resources for research. First Hydrogen (FHYD) shares have rebounded to the CAD 0.44 to 0.48 range, valuing the innovative company at CAD 30 million. From a technical perspective, the stock could quickly rise back toward CAD 1.50 if it breaks through the CAD 0.60 mark. Risk-aware investors are stocking up and going with the trend!

Plug Power – This could backfire

Plug Power, likely the best-known hydrogen stock, is struggling with the technical breakout in the USD 2.25 to 2.50 zone. After a sell-off to USD 0.75 last year, the US company was able to announce several large orders for electrolysers. Unfortunately, issues with building permits are repeatedly leading to cancellations, which is making strategic planning even more difficult. The Company, which is still operating at a loss, has had to postpone its turnaround into profitability several times. Analysts now expect the Company to break even in 2029. The 2025 annual figures are expected to be published on February 26. Experts on the LSEG platform estimate the loss per share at USD 0.81. The 25 analysts agree on an average price target of USD 2.65 over a 12-month period. BMO Capital stands out from the crowd. They recently lowered their rating to "Underperform" and see a target of USD 1.30. That takes a lot of courage!

The start of 2026 is proving very volatile. In addition to sought-after commodity stocks, alternative energy remains key. Even beyond the "Drill Baby Drill" statement from the US Trump administration, governments are giving a lot of thought to how energy demand can be met in the coming decades. First Hydrogen and Plug Power are accompanying this trend, while D-Wave is more of a consumer when it comes to electrical computing power.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.