January 16th, 2026 | 07:00 CET

Trash to gas: How A.H.T. Syngas, EQTEC, and 2G Energy are making companies self-sufficient

German industry is undergoing one of its toughest trials. The "trilemma" described by analysts - volatile energy prices, rising CO2 taxes, and the physical uncertainty of the power grids - has driven production costs to a level that poses a massive threat to competitiveness. While politicians debate hydrogen pipelines that will take years to complete, innovators are already creating a new reality: decentralized energy supply from waste materials. Three players are emerging in this booming sector, working together to solve the puzzle of energy self-sufficiency. While CHP market leader 2G Energy provides the hardware for a green future with its engines and British supplier EQTEC validates gasification technology worldwide, Germany's A.H.T. Syngas Technology closes the crucial gap for small and medium-sized enterprises. With compact plants, A.H.T. transforms industrial waste into the clean gas that keeps the engines running – regardless of Putin's war or price jumps on the Leipzig energy exchange EEX.

time to read: 3 minutes

|

Author:

Nico Popp

ISIN:

A.H.T. SYNGAS TECH. EO 1 | NL0010872388 , EQTEC EO-_001 | IE00BH3XCL94 , 2G ENERGY AG | DE000A0HL8N9

Table of contents:

"[...] Internally we expect the resource to significantly grow the deeper we mine. [...]" Dennis Karp, Executive Chairman, Manuka Resources

Author

Nico Popp

At home in Southern Germany, the passionate stock exchange expert has been accompanying the capital markets for about twenty years. With a soft spot for smaller companies, he is constantly on the lookout for exciting investment stories.

Tag cloud

Shares cloud

2G Energy: The engine is ready, but the fuel is missing

For investors who are betting on the infrastructure of the energy transition, 2G Energy has been a fixture for years. The Heek-based company has carved out a moat position for itself in terms of technology. As recent analyst comments from Metzler and Warburg point out, 2G is the undisputed market leader for combined heat and power (CHP) plants that are "hydrogen-ready." Although the Company recorded a decline in sales in the third quarter of 2025, experts consider this to be a temporary effect caused by delays in grid expansion and regulatory uncertainties.

The order book is full because the industry knows that the old diesel generator has had its day. 2G's new engines are technological masterpieces capable of switching flexibly between natural gas, biogas, and hydrogen, making them the backbone of supply security during the dreaded "dark doldrums." But this is also the Achilles heel of the model: an engine is only as good as the fuel you put in it. Green hydrogen from the grid is expensive and scarce, and natural gas is becoming increasingly burdensome due to the cost of CO2. The industry needs a local source of green molecules to operate 2G machines economically.

EQTEC and global proof: Waste is energy

A glance across the English Channel shows that the solution to this problem lies in the thermal utilization of waste. The British company EQTEC has made a name for itself internationally by implementing complex waste-to-energy projects. In markets such as France, Italy, and the US, EQTEC is proving that the gasification of biomass and refuse-derived fuel (RDF) is no longer a niche experiment, but a key technology in the circular economy that can withstand even rigorous due diligence.

The British are breaking the ice for the acceptance of this technology. They are demonstrating that stable synthesis gas (syngas) can be produced from various materials. However, EQTEC often focuses on larger, complex project developments. For the typical German SME that wants to keep its production running and does not want to operate its own power plant department, these solutions are often too large. This is precisely where the market niche opens up for the specialized technology provider A.H.T. Syngas from Germany.

A.H.T. Syngas: The missing piece of the puzzle for medium-sized companies

A.H.T. Syngas Technology supplies precisely the decentralized component that completes the system. The Company specializes in compact gas generators that can be installed directly on the factory premises. The technological highlight is the proprietary "double-fire" process. As described in technical documentation on Scribd and the Company website, this process produces a tar-free synthesis gas of such high purity that, except in cases of extremely high requirements, it can be converted into electricity directly in highly efficient gas engines without the need for complex gas scrubbing.

This is the decisive economic lever: a company that uses A.H.T. technology does not have to purchase its gas at high prices. Instead, it uses its own production waste, waste wood, or sewage sludge, which previously often had to be disposed of at a cost. By converting this cost center into an asset, customers of A.H.T. Syngas become independent of grid fees and electricity price fluctuations.

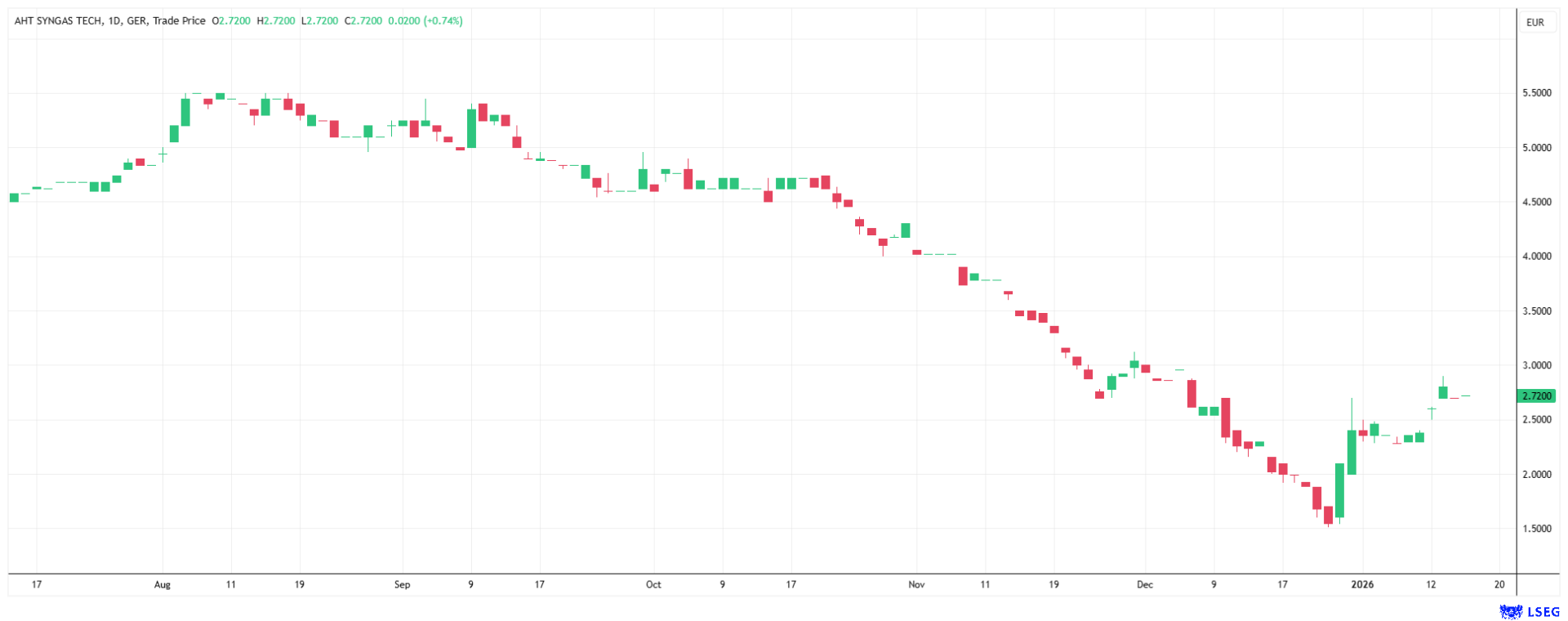

A.H.T. is therefore the ideal partner for 2G Energy customers and prospective customers who are just beginning to explore renewable gas. While 2G supplies the engine, A.H.T. consistently provides the necessary fuel. At a time when security of supply is becoming the hardest currency in industry, the combination of A.H.T. gas production and 2G power generation offers an unbeatable argument. For investors, A.H.T. Syngas is therefore an exciting, highly scalable bet on decentralization, while 2G Energy remains a solid basic investment in engine construction. Although both companies are benefiting from the same trend, A.H.T. is at the beginning of the value chain. The stock has lost significant ground in recent years, but has stabilized recently. Since A.H.T. also has a patent for separating hydrogen from its process, the Company is attractive to many interested parties from the SME sector and energy suppliers.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.