January 16th, 2026 | 08:15 CET

Up 700% and still going strong! Almonty, Deutz, and Infineon under the microscope

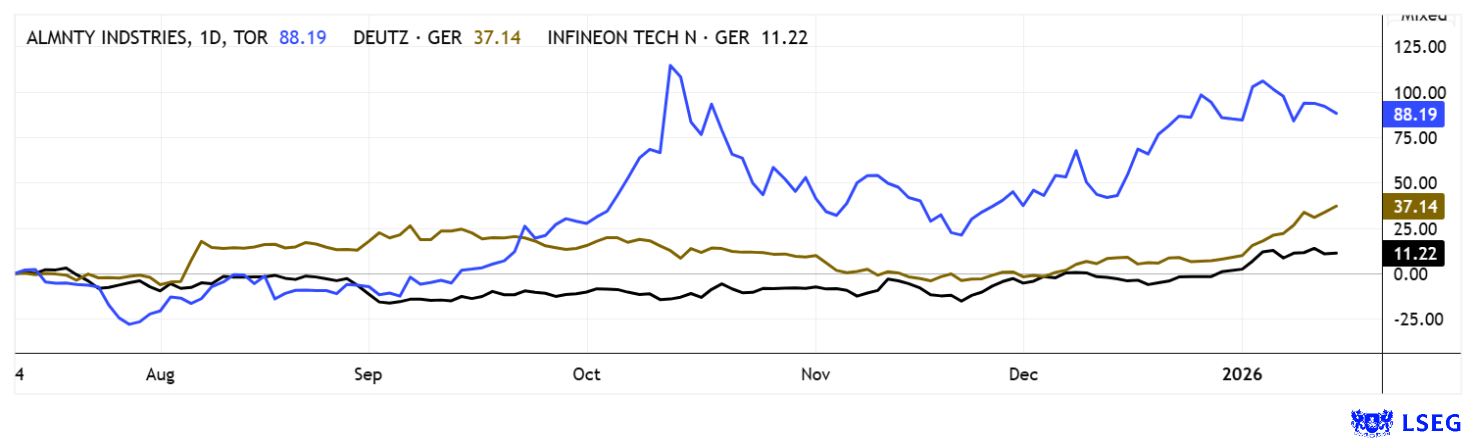

It goes without saying that stocks that are performing well do not necessarily have to stop. Often, new business models only become interesting over time, or companies change their focus to become attractive targets for investors again. Almonty Industries is considered a representative of critical metals. The stock has risen 700% in the past 12 months. However, so much has changed in the group that analysts now have to recalculate here as well. Drive specialist Deutz is consistently focusing on military applications, and Infineon is discovering its relevance in solving energy problems in large computing facilities and in e-mobility. New concepts, new valuations – the world keeps turning! Where should investors get in now?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

ALMONTY INDUSTRIES INC. | CA0203987072 , DEUTZ AG O.N. | DE0006305006 , INFINEON TECH.AG NA O.N. | DE0006231004

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Almonty Industries – The story is becoming clearer

With two major capital increases on the NASDAQ totaling around USD 180 million, the mine development in Korea is now well funded. At the end of 2025, CEO Lewis Black proudly announced the start of operational mining at the Sangdong property. The same district also hosts an extensive molybdenum resource, which is no longer on the radar due to the high volatility of tungsten deliveries. There is currently a lot of movement in the stock, as Trump's efforts toward Greenland also clearly highlight the particular relevance of secure supply chains in the area of critical and rare metals. The entire sector is therefore in turmoil, and further upward revaluations are possible at any time.

In recent trading days, Critical Metals has once again seen its share price jump. Such erratic movements were also seen in Almonty shares in October. The reason: tungsten and molybdenum are in the spotlight because they are indispensable for defense technology, semiconductors, aerospace, and the expansion of AI infrastructure. Operationally, Almonty is now underpinned by a clearly structured growth path. In Portugal, the Panasqueira mine is being prepared for higher production levels through an extensive drilling program. Still, the Sangdong mine in South Korea remains by far the most important value driver. With the start of active ore mining and the commissioning of the processing chain, large-scale commercial operation is within reach. This profile is strategically reinforced by the complete control of the Gentung Browns Lake project in the US, which has comparatively low development risks due to existing infrastructure and solid metallurgy. From 2026 onwards, this project is expected to deliver additional production volumes and consolidate Almonty's presence in the North American market.

The recent addition of experienced capital markets and finance expert Guillaume Wiesenbach de Lamaziere to the management team signals a stronger focus on governance, capital discipline, and strategic development. CEO Lewis Black will thus regain a large part of his tied-up management capacity and can now once again devote more time to the strategic and visionary issues that have made Almonty a USD 2 billion company. Shareholders will therefore continue to enjoy the stock in 2026. As Wall Street traders like to say, "Buy every dip!" – In the case of Almonty, this has always been the right thing to do.

CEO Lewis Black spoke at the 17th International Investment Forum (www.ii-forum.com) on December 3 without the use of a presentation, making his remarks all the more impactful. Click here for the video.

IIF moderator Lindsay Malchuk highlights the different facets of the tungsten deal in Montana in this video.

Deutz – From tractor engine to defense player

Former tractor engine expert Deutz is also increasingly positioning itself as a security and defense-related drive specialist, thereby systematically expanding its business model, which has been clearly dominated by the civilian sector to date. The expansion of the military business is not opportunistic, but systematic, in line with the core competence of "drive systems." This is clearly good for Deutz shares, as the share price has risen by 145% since the beginning of 2025.

At the heart of the recently announced expansion is the development of an 800 kW V8 engine-transmission unit, which can be used for the first time in heavy wheeled and tracked vehicles. The spectrum extends to battle tanks, which are very popular with NATO. The pre-financing of the development from its own funds signals the strategic conviction and market confidence of the management. At the same time, the margin-stable repowering business remains an important lever. Scalability is structurally interesting for investors, because with production capacities of over 100,000 engines per year in Cologne and Ulm, Deutz can meet the rapidly growing military demand on an industrial scale, a clear competitive advantage over smaller defense tech providers. Battery and hybrid solutions for military vehicles (e.g., Fennek, Bushmaster) and GenSets for command posts and Patriot systems complement the portfolio. The acquisition of system integrator FRERK further strengthens the depth of value creation.

Deutz management is aiming for medium-term revenue of EUR 4 billion, which is equivalent to a doubling. Around 10% of this is expected to come from the defense sector. With a current market capitalization of EUR 1.57 billion, the stock is not yet too expensive in the club of well-performing defense stocks. There are already six "Buy" recommendations, with price targets ranging between EUR 11.50 and EUR 12.60. As with Rheinmetall, an increase is likely to occur gradually as new orders are announced. Collect!

Infineon – In the storm of Western dependence

Alongside SAP and Siemens, Infineon shares represent another important technology stock in the DAX. The stock had been overlooked for a long time, but in recent months, the Munich-based company has been recognized as an important component of device-oriented energy infrastructure. This is because the Company has recently evolved from a traditional chip supplier to a key provider of physical AI infrastructure, optimizing important energy paths from the power grid to the data center. With energy-efficient power semiconductors based on silicon, silicon carbide, and gallium nitride, the Company is addressing the increasing performance requirements of modern AI servers without a proportional increase in energy consumption. The "grid-to-core" approach aims to cover the entire energy supply chain, from the medium-voltage level to the AI accelerator itself, with highly integrated power supply solutions. Collaborations on new high-voltage and 800-volt architectures in AI racks underscore the Company's claim to be the architect of the next generation of AI data centers.

At the same time, Infineon is expanding its range of specialized controller and sensor solutions that intelligently combine power semiconductors, cooling, and system monitoring. In industrial and edge AI applications such as robotics, vehicles, and connected factories, Infineon aims to act as an enabler for AI in the physical world. The stock has now gained traction; technically, the only thing left to do is to overcome the 2021 high of around EUR 43.50. Analysts on the LSEG platform expect an average price target of EUR 44.30. Perhaps a little too low, as the momentum in the stock is noticeable.

Despite high volatility, the winners of 2025 are back in the spotlight in 2026. For companies such as Almonty Industries, their position in the critical metals sector is becoming increasingly clear. This is because governments have a keen interest in protecting and promoting Western sources. The situation is similar for technology companies Deutz and Infineon. They have been significantly undervalued for years compared to US companies. However, this penalty could gradually be reversed in 2026.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.