January 19th, 2026 | 07:05 CET

Undiscovered energy stock for the AI boom! CHAR Technologies set for breakthrough in 2026!

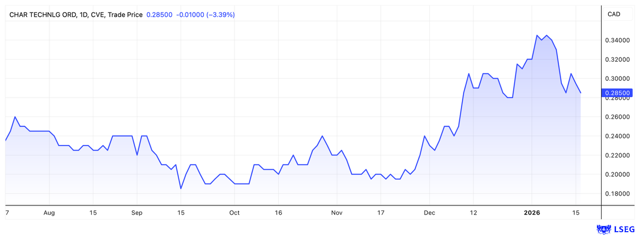

In 2026, investors are once again rushing to buy energy stocks that are benefiting from the AI boom in the US. Bloom Energy, for example, has already exploded by over 50% in the early part of the year. However, with a value of USD 35 billion, the Company is anything but a bargain. CHAR Technologies is still an undiscovered gem in this sector. The Canadians produce coal and gas substitutes from waste materials. Research is no longer being conducted; instead, production is taking place on an industrial scale this year. The stock appears to be far too cheap and should take off in 2026.

time to read: 3 minutes

|

Author:

Fabian Lorenz

ISIN:

CHAR Technologies Ltd. | CA15957L1040

Table of contents:

"[...] Recovery rates of more than 90% rare earths are another piece of the puzzle on the way to the economic viability of our project. [...]" Craig Taylor, CEO, Defense Metals

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

Energy will determine the AI winners

The AI boom in the US is increasingly acting as a stress test for the entire energy system. More and more experts are convinced that it is not the performance of semiconductors, but the question of "secure and affordable kilowatt hours" that will determine who sets the pace in the AI race and finishes as the winner – in the US and against China. Power plants, grids, and substations can hardly be built fast enough. Everything that can supply electricity in the short, medium, and long term is booming: Renewables are being expanded, nuclear power is experiencing a revival, gas is considered a flexible option, and even coal is being relied on because every available megawatt hour counts. In this logic, energy becomes the new currency of digital supremacy.

Coal and gas replacement from waste materials

It should be clear to most people that fossil fuels such as coal and gas cannot be the long-term solution. At the same time, the technology is proven, and the infrastructure is in place. The ideal solution is therefore to produce coal and gas from renewable sources. And this is precisely what CHAR Technologies does. The core of its business model is the conversion of forestry residues – of which there is more than enough in North America – into marketable products such as biochar and biogas. Important for investors: The Company has already outgrown the laboratory and testing phase. The first high-temperature pyrolysis plant in Thorold, Canada, recently went into operation. This means that test runs with industrial customers are now generating revenue and cash flows. For the upcoming scaling, financially strong partners such as steel giant ArcelorMittal and the Canadian BMI Group have been brought on board.

Commercialization starts now

The year 2026 is starting with a milestone for CHAR Technologies. With the commissioning of the Thorold Renewable Energy Facility, 5,000 tons of biochar are to be produced annually in the first phase. This confirms the planned production targets. In addition, the major expansion work for Phase 2 is to take place in 2026 in order to also produce renewable natural gas in the future.

An evaluation of a demonstration project in Baltimore is also currently underway. There, sewage sludge was used to generate energy in a char plant over a period of six months. So far, nothing has been reported that would argue against future commercialization.

Partner finances million-dollar project

The BMI Group is also going full throttle. Most recently, it provided CAD 10 million to advance the large-scale project for the production of biochar in Ontario, Canada. A feasibility study is to be completed in the first quarter.

The goal is to build a plant that converts locally available wood waste into low-CO₂ biochar and synthesis gas. The planned capacity is up to 50,000 tons of biochar per year, which is significantly higher than that of Thorold. The synthesis gas will either be used directly on site or marketed as a natural gas substitute in a later expansion stage. Both partners emphasize the strategic logic of the project: CHAR can scale the technology massively, and BMI can use its residual materials and reindustrialize the site thanks to clean energy.

Companies in the development phase often struggle on the stock market, and this also applies to CHAR Technologies. However, with commercialization beginning this year, the stock appears due for a revaluation. With a market capitalization of less than CAD 50 million, the Company appears significantly undervalued. This is particularly compelling given that the technology is well-suited to supplying energy to data centers. In addition, there is a global need for reliable base load alternatives to coal and gas - an area in which CHAR's waste-based solution fits squarely. With strong partners on board, risks are reduced, and the Company could also represent a potential takeover candidate.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.