April 11th, 2024 | 07:15 CEST

Nvidia, Super Micro Computer, Carbon Done Right Developments - Sell artificial intelligence now!

The stock market has been celebrating a significant advancement in productivity on this planet for months: the replacement of human labor with learning machines. What James Cameron envisioned in the 1980s with his movie "Terminator" has now become a reality. The era of job destruction is now underway around the globe. Standard services or control processes, such as those in call or quality centers, are particularly affected. The friendly voice on the phone that takes care of your problem could already be an AI-generated response. You may only notice it when asking questions that deviate from the norm. Economists predict a leap in productivity of over 20% in the next 10 years. However, it is doubtful whether high-tech stocks on the NASDAQ will continue to perform as erratically as they have recently. It may be time to consult a stock market AI. We have a few ideas on this matter.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

NVIDIA CORP. DL-_001 | US67066G1040 , SUPER MICRO COMPUT.DL-_01 | US86800U1043 , CARBON DONE RIGHT DEVELOPMENTS INC | CA14109M1023

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Artificial intelligence - Global energy demand is growing

According to Statista, global energy demand will continue to rise in the coming years. In particular, rapid growth in developing countries will increase energy demand by a third. China, India and Brazil are the biggest drivers, but Africa will also play a significant role by the end of 2040. Current technological trends such as artificial intelligence, the mining of cryptocurrencies and the electrification of mobility will increase energy demand by several percentage points.

Renewable energy sources are currently the fastest-growing energy source worldwide, but nuclear energy, known as the "net zero" source, will also increase in the coming years. As fossil fuels will continue to be responsible for load balancing for decades to come and still dominate the energy supply in emerging markets, their demand will remain high. CO2 pollution will, therefore, only decrease slowly, but the political goals for climate change provide important anchor points for the industry.

Nvidia and Super Micro Computer - Urgent need to cool down

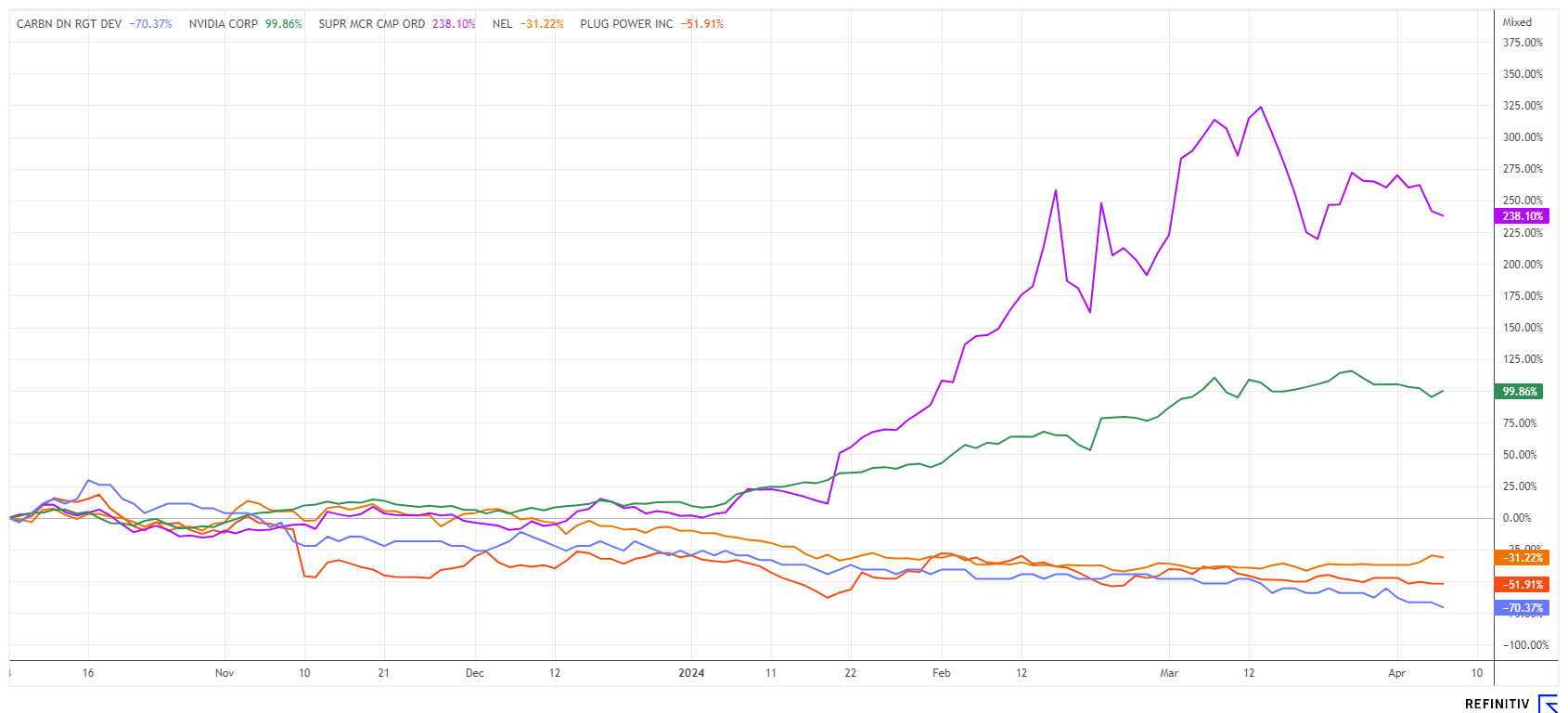

The popular AI titles Nvidia and Super Micro Computer have gone completely off the rails. In the last few months alone, they have risen by 100% and 240%, respectively. Analytically, the experts' price targets have long since been reached. What happens now?

Nvidia must be classified as a fundamental special case. Analysts can no longer process the current rapid growth in the required time. In the first quarter alone, the share had 58 new ratings and updates. The sales estimate for the current year is causing increasing headaches for experts, as the consensus has risen from an initial estimate of USD 37 billion to just under USD 61 billion within six weeks. In 2025, the figure is even expected to reach USD 110 billion. The growth comes from the AI-related "Data Center" segment, a hub for the large-scale processing of Big Data. 53 out of 57 experts give the stock a thumbs up and expect an average target price of USD 985, around USD 100 above the last quote.

12 out of 16 analysts are bullish on Super Micro Computer, but the average price target is only USD 935. A high of USD 1,229 was set in March; since then, the price has corrected by 25%. Many investors may be looking for new entry points, but chart-wise, a head-and-shoulders formation may soon be confirmed, indicating a downward price target of around USD 750. A year ago, the share price was still at around USD 100 and has risen twelvefold at its peak. This is a terrific performance for the specialist in the liquid cooling systems sector. If the shares are unable to gain any further ground, there is likely a risk of a medium-term slowdown. Technically, both momentum and the MACD are already pointing downwards, and the slow stochastics have already moved down considerably as a result of the recent consolidation.

Since both stocks have already exhausted the fundamental framework, skillful timing is now crucial. However, be careful at the platform edge; the market is in an absolutely hot top formation phase! Strong interim rises and subsequent consolidations are also possible in a single day. Fund managers will always try to invest in these stocks to keep investors visually satisfied.

Carbon Done Right Developments - A transparent market is emerging

Speaking of the energy transition. Financial regulation of climate pollution has been in place for some years now through the tradability of carbon certificates. These certificates aim to value CO2 emissions for the purpose of pricing and passing them on to industry. The fact is that certain production processes can only be technologically converted to a lower energy load over a more extended period of time. The new process landscapes require investment and the will of management to prioritize these requirements accordingly. Those who need more time than the legislator tolerates must purchase the corresponding certificates on the market for "usage rights" to compensate for their excess CO2 emissions. On the other hand, some companies can generate these carbon certificates through recognized environmental measures and offer them for sale on an exchange. A market is emerging in which ecological responsibility and industrial necessity go hand in hand.

The Canadian company Carbon Done Right Developments (formerly Klimat X) is committed to offsetting climate pollution. It offers CO2 polluters corresponding investment opportunities in environmental projects that focus on forest and water regeneration. To better address the market and establish new business models, the Company has announced its intention to acquire the blockchain-based trading platform London Carbon Exchange (LCE) in an all-share transaction valued at USD 450,000 at the time of the next placement from Supernova Digital Assets Plc. At the same time, there will be a secondary listing of Carbon Done Right Developments on the London Growth Exchange AIM. The Canadians also want to introduce the highly innovative Carbon Quantification System (CQS) to increase transparency in transactions with emission certificates. The goal is to further strengthen the Company's commitment to the rapid growth of investments in large-scale carbon credit projects to restore and conserve degraded and threatened lands. Through the use of blockchain technology, each transaction is carefully recorded in a decentralized ledger so that the origin, ownership and complete transaction history of each certificate is verifiable and immutable.

Furthermore, a decentralized marketplace for emission certificates is to be created for trading current and future emission certificates. Tokenization will make them even more tradable and further increase transparency. The platform enables real-time tracking of the growth and performance of reforestation and conservation areas using AI and machine-driven Tree Counter technology developed in collaboration with the University of Copenhagen. Carbon Done Right Developments is reaching a new level in the carbon certificate business with blockchain technology and the "tree-to-trade" philosophy. Strong future growth is imminent. Risk-tolerant investors can currently get in on a valuation basis of a low CAD 3.8 million in Frankfurt or on the TSX Venture Exchange.

Artificial intelligence is experiencing a fabulous hype. The hydrogen sector, on the other hand, is currently at the lower end from a technical point of view, and a cyclical buyback could soon be on the cards here. Carbon Done Right offers access to modern, blockchain-based exchanges for CO2 certificates and can actively shape a new growth segment.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.