September 18th, 2024 | 07:30 CEST

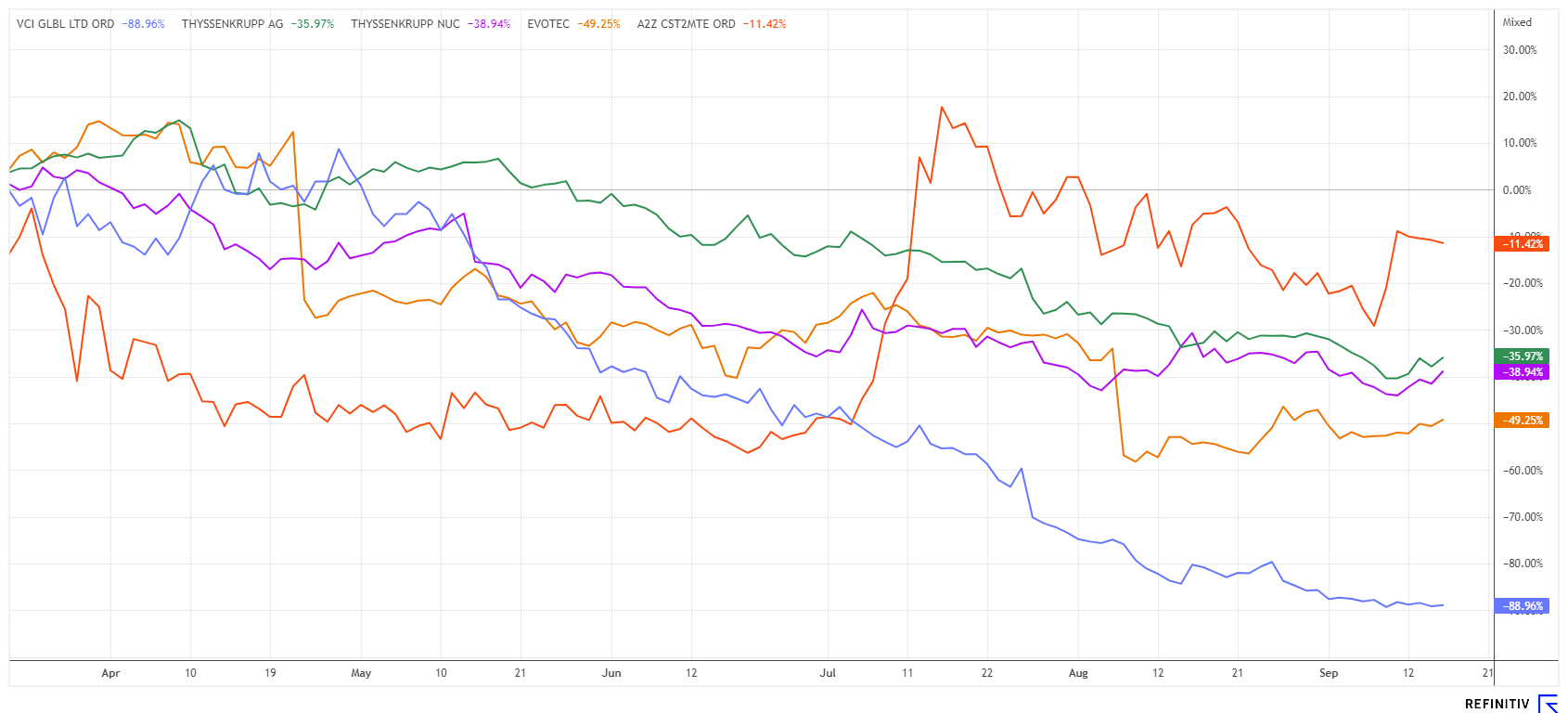

Turnaround stocks – Here we go! 250% returns with thyssenkrupp, nucera, Evotec, VCI Global and A2Z Cust2Mate

The stock markets are going up and up, even in the most challenging stock market month of the year. Because the market had already corrected in July, the bulls say that the need to catch up is all the greater due to upcoming interest rate cuts by central banks. The bears believe that the valuation of tech and AI stocks, in particular, is already far too advanced and are hoping for a correction. Yet, green signals dominate daily, and now the question is which lagging stocks to invest in. Of course, it does not work without fundamentals, but sometimes insider buying is enough to lift sentiment. We select promising risk-return profiles for risk-conscious investors.

time to read: 6 minutes

|

Author:

André Will-Laudien

ISIN:

THYSSENKRUPP AG O.N. | DE0007500001 , THYSSENKRUPP NUCERA AG & CO KGAA | DE000NCA0001 , EVOTEC SE INH O.N. | DE0005664809 , VCI GLOBAL LIMITED | VGG982181031 , A2Z SMART TECHNOLOGIES | CA0022091049

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

thyssenkrupp – The prices of the parent company and subsidiary are rising

Who would have thought it? After months of turmoil in the steel division and the loss of key managers, a solution may now be emerging at thyssenkrupp. Reports suggest that Czech investor Daniel Křetínský could further expand his stake this year. The rumor mill estimates that the next package will be around 30%. The investor paid EUR 100 million for his current 20% stake. In the medium term, a 50/50 split will likely be sought, with the new CEO Miguel López apparently stepping up the pace. No wonder, with a 60% loss in 12 months, the stock is one of the weakest in the MDAX. An increase in Křetínský's stake and possible financial injections from the investor are being viewed positively on the stock market, with the thyssenkrupp share price rising 3.5% to EUR 2.99 yesterday. The investment bank Baader gives a "Buy" rating with a target price of EUR 5.40 – a potential 80% upside. Speculative investors are jumping on board!

The thyssenkrupp spin-off nucera is also currently interesting. The price fell by over 60% to EUR 7.68. In the last 3 trading days, the price then turned around to a good EUR 8.50. The hydrogen company was one of the disappointing IPOs of 2023. However, unlike its completely overpriced competitors, Plug Power and Nel ASA, it has been profitable from the start. High investment costs are expected to push the Company into a loss in 2024. Still, Nucera is making a big name for itself internationally with the world's largest electrolysis project, NEOM, in Saudi Arabia. Should Kamala Harris win the election, green power will be in demand again. This is another stock that risk-conscious investors can buy, as the valuation is very low, with a 2025 price-to-sales ratio of 1.2.

Evotec – Turnaround announced

We have covered the Hamburg-based drug manufacturer several times, but now time is of the essence, as the turnaround is in full swing. After several insider buybacks, the stock broke through the resistance at EUR 6.25 yesterday and rose by 3% to EUR 6.43. A new cooperation with Scientist.com was also reported, but much more important are the follow-up purchases by management. The new CEO, Christian Wojczewski, has also made a move. Although the purchase was only worth EUR 61,087, it is still a sign, as it followed a series of other insider purchases. The crux of the matter is that further increases could force the short sellers to cover their positions, which might accelerate the stock even further. We entered below EUR 6.00 and are now raising the stop-loss to EUR 6.15. The next chart hurdles are lurking at EUR 6.80 and EUR 7.30, which would represent significant gains. Keep collecting!

VCI Global Ltd – New AI services launched and share buyback announced

Since our coverage of VCI Global Ltd. (VCIG), the Company has announced a number of operational advances and collaborations. For some inexplicable reason, the share price has nevertheless fallen dramatically. Allegedly, a large short seller has also committed to this stock. At times, VCI trades over 10 million shares a day in New York. With around 84 million shares issued, more than 10% of the shares change hands. Amazing!

The management team around CEO Victor Hoo has now published plans to restructure the AI business, raise capital, and implement an upcoming share buyback program. The AI business under the AI Secure label has been restructured into four central business segments: GPU servers starting in October 2024 and the opening of the AI Computing Center in Malaysia to kick off GPU cloud computing. This will set in motion the AI data center business, with services scheduled to begin in the second quarter of 2025, as previously announced. Similarly, Large-Language-Model (LLM) solutions are being advanced to actively offer them to customers. In the area of security, VCI Global is continuously improving its cybersecurity solutions and focusing on broader and more sophisticated offerings in the AI space. In particular, the German Cogia AG, with CEO Pascal Lauria, who had contributed the largest parts via his Socializer Messenger, is responsible here. It is noticeable that there is tangible progress in operations. The capital raising round for the AI business has also been successfully completed.

In line with its strategic objectives, VCI Global intends to launch the previously announced share buyback program in the first quarter of 2025. VCI is ideally positioned to take advantage of the growth of the digital economy in Southeast Asia. The short sellers are likely to get burned on this good news. The small Cogia AG, which is currently undeservedly receiving little attention, also remains exciting. In both stocks, a significant revaluation is obvious for 2025 because the technologies are "Ahead of the Curve"!!

A2Z Cust2Mate - Rollout in France and AI patent applied for

A2Z Cust2Mate, a provider of smart shopping systems, has made significant progress since spring. The rollout of the latest generation of AI-driven shopping carts confirms that more and more shop owners are following the Israeli model. No wonder because by using artificial intelligence, big data analysis, and modern tracking technology, it is possible to increase the size of the shopping baskets and even to introduce new, advertised products that the consumer had not even thought of before shopping. In addition to the shop owner, A2Z also earns money from the additional sales generated.

Due to the commercial promise of this approach, A2Z has filed a patent application for its Shopping Cart Inventory Change Indicator System. This solution solves retail shrinkage with the help of advanced technologies based on sophisticated, proprietary artificial intelligence (AI). According to a report in the WSJ, US retailers suffered an estimated USD 142 billion in losses due to stolen goods in 2023, around 25% more than in 2022. A2Z is now tackling the problem.

The new patent-protected CII-driven module detects anomalies by using deep learning algorithms. They monitor and analyze customer behavior in real-time, identifying patterns that may indicate theft or other irregular activity. In addition, the system includes a barcode scanner for item tracking, a computer vision system with high-resolution cameras for product recognition, and a security scale that measures the weight of items to detect discrepancies. CEO Gadi Graus commented: "A2Z focuses on using artificial intelligence to provide sophisticated solutions to retail challenges". The stock is currently in the process of breaking through the USD 0.70 mark again. Furthermore, the market capitalization of USD 35 million is far too low for the expected revenues and profits from 2025. Risk-conscious investors are snapping up the AI small cap.

High-tech stocks remain in focus, as market participants are betting on rapid interest rate cuts by the FED. The ECB has already presented last week. In our selection of fallen stocks, thyssenkrupp and nucera are slowly making their way up, while Evotec is benefiting from insider purchases. With the two NASDAQ stocks VCI Global and A2Z Cust2Mate, things are really getting down to business with different dynamics. A closer look is worthwhile.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.