September 17th, 2024 | 07:20 CEST

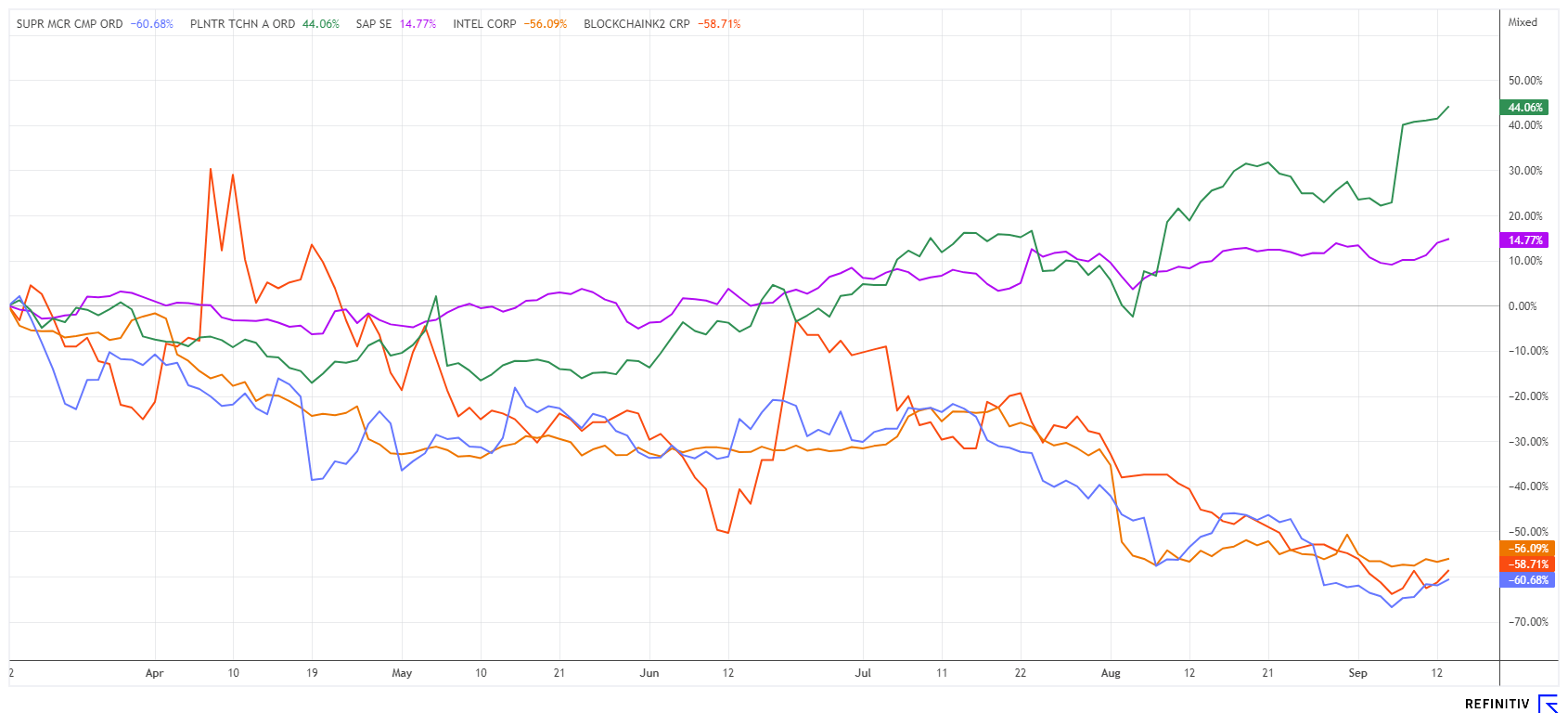

All-time highs and lows! 100% with SMCI, BlockchainK2, and Intel, but Caution with SAP and Palantir

The buying frenzy in the tech sector continues, but performance remains highly differentiated. While the stocks that have performed well are correcting for the time being, the rally continues unabated for the stock market darlings. Interest rate cuts are the fuel driving prices ever higher. The old PE ratio admonishers have been ignored for several quarters now; what matters most now is momentum and sentiment. This week, it is happening again - an interest rate cut by the FED is on the agenda. And as the saying goes: Never fight the FED! Where are the opportunities for dynamic investors?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

SUPER MICRO COMPUT.DL-_01 | US86800U1043 , BLOCKCHAINK2 CORP | CA09369M1077 , INTEL CORP. DL-_001 | US4581401001 , SAP SE O.N. | DE0007164600 , PALANTIR TECHNOLOGIES INC | US69608A1088

Table of contents:

"[...] Most of all we were on a mission to MAKE CRYPTOCURRENCY ACCESSIBLE [...]" Justin Hartzman, CEO, CoinSmart Financial Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Palantir and SAP - Close to all-time highs

Due to its strong performance in 2024, Palantir Technologies will now be included in the S&P 500 index. However, not all investors are convinced of a further appreciation. Cathie Wood, for example, has sold off a good 180,000 Palantir shares and is now turning her attention to other opportunities with her ARK Invest fund. Palantir had doubled in value over 12 months, rising from USD 36 to USD 72 and reaching a market capitalization of USD 80 billion. The manufacturer of AI systems and big data analysis software for military information systems can look forward to a good increase in orders in a geopolitically unstable environment. However, the valuation with a 2025 P/E ratio of 144 is quite ambitious in our opinion. We are curious to see whether the rally will continue.

In the current tech frenzy, the German software leader SAP from Walldorf is also performing exceptionally well. The price is currently being driven by the good figures of the US database company Oracle, which recently reported impressive quarterly numbers and announced a cloud agreement with Amazon subsidiary AWS. As a result, SAP's share price is also rising from one record to the next; yesterday it reached a new all-time high of over EUR 202. This means that the Walldorf-based company is now worth EUR 234 billion and has advanced to become the largest DAX stock, well ahead of Telekom, Siemens, and Allianz. According to analysts on the Refinitiv Eikon platform, earnings per share will be able to develop from an estimated EUR 2.54 to EUR 5.61 by 2025. The P/E ratio for next year would then be around 36. From this perspective, the German software giant appears significantly cheaper than the much-hyped Palantir.

BlockchainK2 Inc – Asset Management Services on Demand

Digitalization is advancing in all areas, and the financial sector is also trying to automate many things. Forecasts suggest that the market for asset management software, for example, will grow at a double-digit rate annually through 2030 as companies move to more modern, efficient, and secure systems. Large asset managers are increasingly turning to digital solutions to manage their assets more efficiently. AI and machine learning are also being used increasingly to optimize data-based decisions and automate processes, increasing the demand for advanced software. Cloud applications and security tools also play a significant role in establishing better protection against cybercrime.

The Canadian company BlockchainK2 Inc. is the publicly listed holding company of RealBlocks, which was founded in New York City in 2017. RealBlocks' primary focus is on its white-label online platform, which develops advanced features for alternative investment managers and their investors. RealBlocks is a pioneer in the use of Web3 blockchain technology and traditional, cutting-edge technologies to provide a complete onboarding and management platform for fund managers operating worldwide. The goal is to be a one-stop shop, which is why artificial intelligence is used here from the very first minute. The RealBlocks team has decades of experience working with some of the world's largest asset management and distribution firms.

With a market capitalization of just CAD 5.7 million, the shares of the holding company BlockchainK2 are more affordable than they have been since the start of 2024 despite experiencing significant price jumps earlier in the year. The shares, which are also liquidly tradable in Germany, are currently trading at EUR 0.10. For those actively following the bullish industry trends, this is a head-turner. Highly interesting for speculative investors.

Super Micro Computer – Is a 70% correction enough?

A real drama has taken place in the last 6 months with the stock of Super Micro Computer (SMCI). At its peak, the price lost 70% of its value from USD 1,150 to 350. Short-selling experts from Hindenburg Research targeted the stock, accusing the Company of undisclosed transactions with related parties and failures in export control compliance. A three-month investigation is said to have been conducted, including interviews with several former Super Micro employees and the review of litigation files and other documents.

The postponement of the filing of the annual 10-K report also shook investor confidence. Now the SEC has been called upon to clarify the circumstances. Meanwhile, SMCI is laboring under its heavy price losses and was at least able to climb again from USD 350 to USD 450 in one week, a full 25% from the bottom. However, this does not eliminate the uncertainty surrounding the Nvidia follower. It is only possible that the aggressive shorts will now be covered in the next few days, as they are doing quite well. Whether the share will recover adequately from the major price shock is questionable. For that to happen, the fundamentals would have to be very strong, and all regulatory doubts would have to be dispelled. Technically, there might be room for further percentage point gains, but overall, it remains a high-risk situation – it is still all a game of chance!

Also, keep an eye on Intel. According to rumors, 15,000 jobs are to be cut and the investment in Magdeburg is under review. After a crash of almost 70%, the stock has regained its footing and is cheaper than ever. Analysts on the Refinitiv Eikon platform are formulating a 12-month average price target of USD 25.50 – representing 30% upside potential and a compelling turnaround story!

It remains challenging! High-tech stocks on the NASDAQ are reacting differently to the prospect of interest rate cuts. While AI business models have already completed a decent rally, chip stocks are currently stagnating. Software stocks such as SAP, Palantir, and BlockchainK2 should continue to perform well, as they are paving the way for digitalization. And this megatrend is only just beginning. A technically lagging country like Germany could spend trillions on this, but Berlin has no money. Unfortunately!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.