August 28th, 2025 | 07:05 CEST

Nvidia figures: Will the bull market continue? Rheinmetall, Almonty, and BYD also offer excitement!

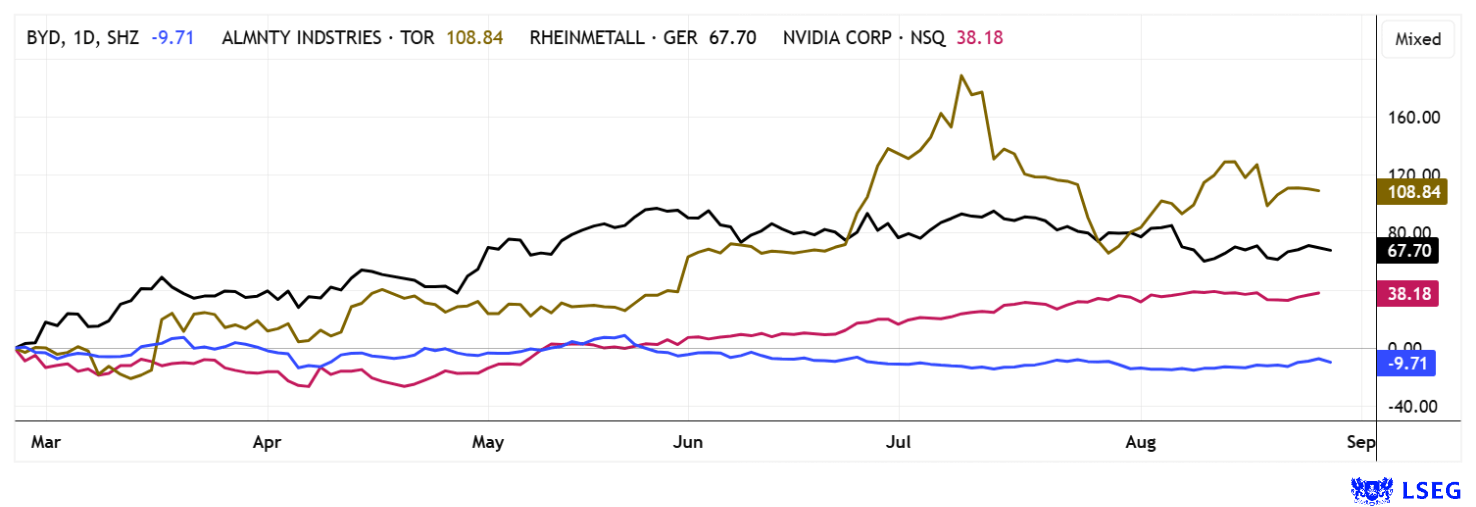

Today, Nvidia's figures will dominate stock market activity. In the slipstream of the 3,000% stock, there are, of course, other key players such as Rheinmetall and BYD, which have also multiplied in value over the last three years. Both companies reported good figures, but even a stock split at BYD did not help to prevent the downward correction. Almonty Industries raised USD 90 million through a NASDAQ listing and then faced short sellers, who are now starting to tremble. This is because the consolidation appears to be over, and the start of mining operations in South Korea is within reach. The stock market is clearly not a one-way street, especially as AI algorithms increasingly determine trading activity and attempt to mislead inexperienced investors with short-term moves. It is beneficial to maintain a clear head. Here are a few ideas.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NVIDIA CORP. DL-_001 | US67066G1040 , RHEINMETALL AG | DE0007030009 , ALMONTY INDUSTRIES INC. | CA0203987072 , BYD CO. LTD H YC 1 | CNE100000296

Table of contents:

"[...] While tungsten has always played an important role in the chip industry, it is now being added to batteries for e-cars. [...]" Lewis Black, CEO, Almonty Industries

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Almonty Industries – The path to expansion is clear

What a rollercoaster ride! Critical minerals, such as tungsten, have evolved from mere commodities into strategic factors that influence not only prices and supply chains but also geopolitical power relations. Access to these elements is now a key concern for decision-makers in defense, climate policy, and industry. This is because the global supply of tungsten remains tight, with stocks in the US and Europe dwindling while demand in the defense and clean tech industries is rising. China dominates the market, accounting for around 90% of processing, which has led to supply shortages and a 30% price increase since 2023, resulting in a decline in strategic reserves to a historically low level.

Almonty Industries' Sangdong project in South Korea represents a near-political turning point. For the first time, it offers the Western world a model for how targeted raw material strategies, supply chain diversification, and political alliances can reduce dependence on China. A supply contract is no longer just an industrial or diplomatic decision—it is also a geopolitical signal and a logistical challenge. For the US government, tungsten from allied countries is a shield against supply risks, not just a raw material. Subsidies, tax incentives, and strategic raw material buffers are being used as instruments of foreign policy, as the EU's Critical Raw Materials Act shows. Contracts between Western companies and alternative supplier countries therefore serve not only to secure supply, but also to limit China's influence on strategic metals.

Added to this are the challenges of the energy transition. Tungsten is indispensable for modern wind turbines, electronics, and energy-efficient technologies. The overlap of climate, industrial, and security goals is driving demand beyond mere market orientation. In a world characterized by geopolitical uncertainty and growing demand for green technologies, transparency is becoming a key resource for governments, companies, and investors alike. Almonty Industries' stock has stabilized after the recent correction surrounding its Nasdaq listing and is now once again in high demand on German stock exchanges. With anchor shareholders Deutsche Rohstoff AG and the Plansee Group, the forces are more on this side of the Atlantic. CEO Lewis Black is proud of this positioning and is now taking the final steps to become a global supplier. Analysts on the LSEG platform attest to the Company's clear valuation trend with price targets of up to CAD 9.00 and an expected average of approximately CAD 7.00. The rally is therefore likely to resume soon!

Learn more about the tungsten business in the latest interview with GBC analyst Greiffenberger on Stockhouse: Click here!

BYD – Free electricity as a leasing incentive

Chinese electric vehicle pioneer BYD is currently making headlines in two ways. Firstly, British energy supplier Octopus Energy is promoting a new business model: customers can lease the compact BYD Dolphin electric vehicle for USD 350 a month, including free electricity for up to 12,000 km per year. This comes with a wallbox installed by Octopus, which not only charges the vehicle but can also feed electricity back into the grid. This converts the vehicle's battery into a mobile energy storage device, relieving the strain on the power grid by absorbing surplus green electricity and feeding it back in when needed, an innovative example of vehicle-to-grid (V2G) technology.

At the same time, BYD is massively expanding its international business. It was recently announced that the Company will also start exporting to the European Union from its new production base in Thailand. This not only secures BYD a logistically favorable location in Southeast Asia, but also direct access to the European market, which is currently seeing increased demand for affordable and efficient electric vehicles. BYD combines innovative energy and mobility solutions with a clear global expansion strategy. For investors and consumers alike, this could be a further indication that BYD is continuing to expand its pioneering role in the global e-mobility market. Nevertheless, the upturn in BYD shares has stalled. At 110 yuan, the stock is 40% below the price targets of analysts on the LSEG platform. With better Q3 figures, the price could soon turn around.

Rheinmetall – The big move takes a break

Since the end of May, Rheinmetall shares have been moving sideways between EUR 1,940 and EUR 1,480. The Q2 figures were slightly below expectations, but the long-term outlook was reinforced. Investors realize that the big party at the defense manufacturer is now over and that it could be months before the next price surge. Respect to those who can sit through the analysts' price targets on the LSEG platform, which range from EUR 2,300 to a weighted 12-month average of EUR 2,060. However, no one knows what will happen in the meantime. One thing is certain, though: if efforts to find a peaceful solution in Ukraine bear fruit, higher discounts are to be expected in the short term. In this case, dynamic investors should wait between EUR 1,100 and EUR 1,300, as there are numerous technical support lines in this range. Then, in terms of valuation, the entry point will once again fit in with the long-term upward scenario.

All eyes are on Nvidia today. The stock clearly leads the global rankings with a market capitalization of USD 4.4 trillion. The fact that international stock markets have to align themselves with the stock's performance is due solely to its weighting in the major ETF portfolios. In the short term, however, Almonty Industries and Rheinmetall have outperformed the AI chip expert. The next price surge is likely to come soon for the tungsten supplier.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.