July 4th, 2023 | 07:50 CEST

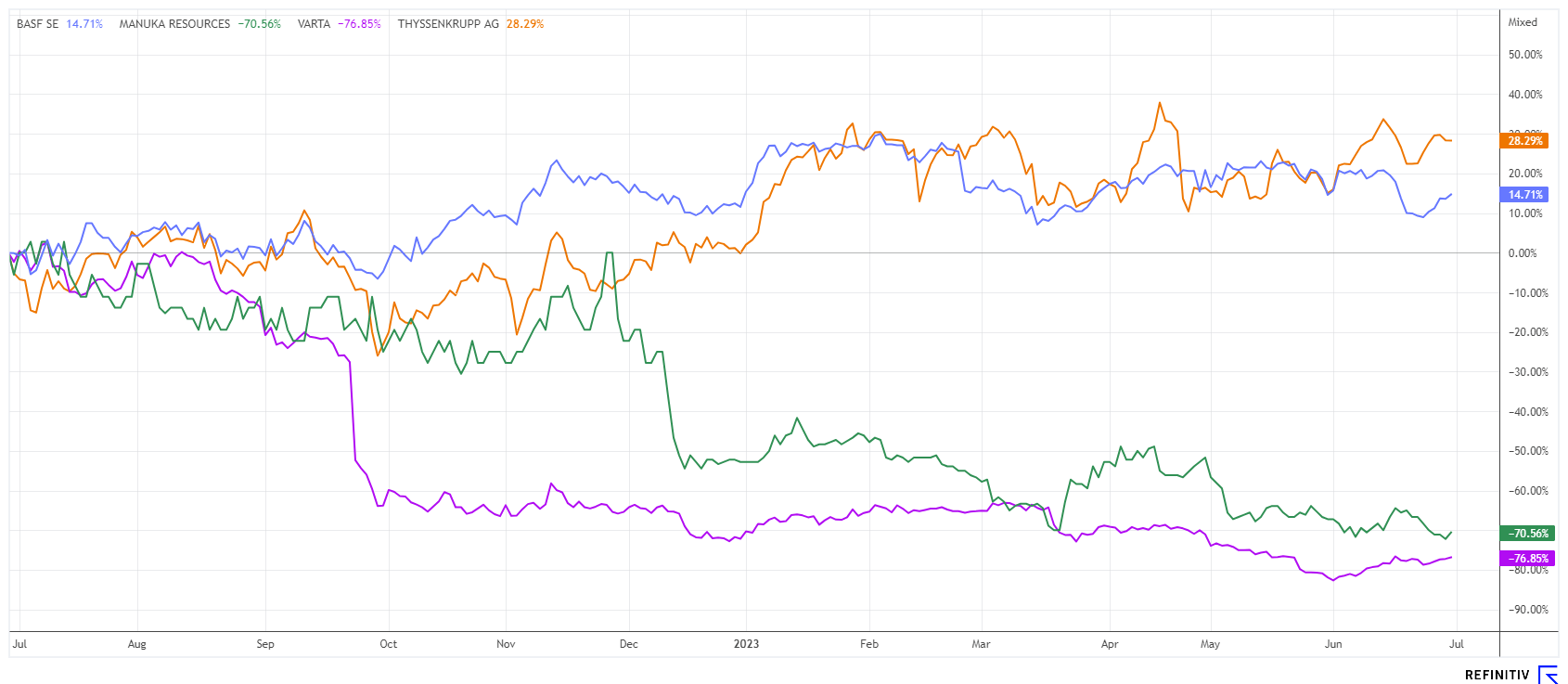

Nucera IPO boosts Greentech shares: Varta, Manuka Resources, BASF and ThyssenKrupp on the buy list

Many companies have set themselves the goal of contributing to offsetting man-made emissions and combating climate change. One proven means is gradual decarbonization, for example, in the energy-intensive heavy industry sector. The IPO of ThyssenKrupp's hydrogen subsidiary, Nucera, is important from this perspective because the newly raised funds will be used to advance green steel production. It is a German project that could set an international precedent. We take a deeper look into an emerging sector.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

VARTA AG O.N. | DE000A0TGJ55 , Manuka Resources Limited | AU0000090292 , BASF SE NA O.N. | DE000BASF111 , THYSSENKRUPP AG O.N. | DE0007500001

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

ThyssenKrupp - Nucera's IPO is now on track

With some delay, the time has come: ThyssenKrupp is launching its hydrogen subsidiary Nucera on the stock market. Those who still want to get in on the action should hurry because the subscription period, with a price range of EUR 19.00 to EUR 21.50, only runs until July 5. Unlike Porsche or Ionos, this IPO is not about paying out existing shareholders. Around 30 million shares are being offered, 26 million of which will come from a capital increase that will bring the newcomer proceeds of around EUR 494 to EUR 560 million.

The long-awaited IPO of Nucera is only the second real IPO this year, as the debut of Internet service provider Ionos flopped in the spring. Nucera plans to invest the fresh capital to fuel its strong growth. The booming hydrogen market provides a solid foundation for the electrolysis equipment manufacturer. Since 2020, Nucera has already increased its sales by 50% to EUR 383 million. Unlike its competitors, Nucera was already profitable in 2022, even though the industry as a whole is not yet making money. However, with a 5% EBITDA margin, there is still much room for improvement. The signs for the current fiscal year are good: EUR 12 million in net profit has already been earned, and the order backlog at the end of the first quarter was EUR 1.4 billion. The Company is debt-free and has EUR 300 million in cash reserves before the IPO.

With a stock market valuation of around EUR 2.6 billion, the parent company ThyssenKrupp is also benefiting, as it retains a 66% share in the newcomer to the stock market. The higher valuation in the Group improves balance sheet ratios, which is urgently needed after the arduous transformation years. Analysts on the Refinitiv Eikon platform are still skeptical but expect an average price of EUR 9.45 in 12 months. A good 30% premium over the current price.

Manuka Resources - Raw materials for a new battery generation

High-tech is currently being played out again on the stock market. Whether artificial intelligence, digitization or cloud technologies, they are all in high demand. Investors often overlook the fact that technical revolutions, in particular, depend on the availability of raw materials. During the AI hype of the past months, precious metal companies in particular had a hard time as they were simply ignored or overlooked.

Today, it is advantageous for commodity companies to have several pillars, thus reducing their dependence on one resource. Manuka Resources Limited, based in the Cobar Basin, New South Wales, not only has two very promising projects in gold and silver with historic production but is also positioning itself in the area of critical metals with the acquisition of the South Taranaki Bight Project (STB), which will be completed in 2022. Of interest is the huge deposit of vanadium, which is increasingly coming into focus as a new metal for battery production.

Manuka had recently reported that gold production at the former Mt. Boppy gold mine has resumed. According to the latest estimate, 20,000 to 25,000 ounces of gold are to be extracted from the ground annually in the future, and a good 10,000 ounces can still be achieved in 2023. The cash flow in the Company enables the management to continue its exploration activities on the company-owned properties. Mt. Boppy, in particular, is believed to have much higher mineralization. Later, work will be extended to the McKinnons Mine and Pipeline Ridge properties. With small financing, Manuka has raised even more cash.

In addition to the gold and silver deposits, Manuka has the vanadium trump card up its sleeve. It could play a significant role in the Company's future valuation. The stock currently trades at AUD 0.05 and is valued at a low AUD 28.6 million due to the cyclical undervaluation of mining stocks. The low level is attractive for a speculative entry.

BASF and Varta - Turnaround is initiated

Two stocks are currently sparking true turnaround fantasy because things are happening again in the battery sector. With the announcement of additional giga-locations for the production of energy storage, the environment has once again become more dynamic. Megatrends such as artificial intelligence and cloud computing strengthen the need for efficient, energy-based solutions.

The Ludwigshafen-based chemical company BASF is one of the most important battery material producers. For years, it has also collaborated with key players in the industry, namely, CATL, BYD, Toshiba and Panasonic. After strong growth years, BASF is falling back somewhat in production in 2023, and write-downs on oil and gas subsidiary Wintershall DEA are also weighing on the balance sheet. On July 28, the Company will look at its books for the year's first half. It will be interesting to see whether the global corporation has suffered greatly from the current rise in energy prices. At the same time, the first fruits of the cost-cutting program for Ludwigshafen should be evident. With a EUR 10 billion investment in China, management is already sending clear signals against Germany as an industrial location. When fully completed, Zhanjiang will be BASF's third largest Verbund site worldwide, after Ludwigshafen and Antwerp.

The darkest days should now be over for Varta. After a sell-off to EUR 13.90, the chart has now recovered to EUR 19.20 - a 40% premium to the all-time lows. As part of the job cuts, Varta has launched a volunteer program at its Ellwangen site. In this context, the Company has agreed with employee representatives to cut 88 jobs, with a total of around 800 jobs to be eliminated within 2 years. It is important for Varta to achieve a margin again with these cost reductions, as sales prices have recently increased again. Now it is time to make a move into the attractive e-mobility sector. Varta is already playing along in the energy storage sector. On July 11, the Company will hold its Annual General Meeting. That should be exciting. Collect speculatively in the range of EUR 17 to EUR 20.

Greentech stocks were recently somewhat punished due to existing margin pressure. Currently, AI and IT stocks are on the rise. However, the stock market is cyclical and will eventually turn its attention back to the energy and e-mobility sectors. With the latest sales figures from Tesla, the Californians are already heading back to a 9-month high. The potential of Manuka Resources is extraordinary, but it is still largely undiscovered.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.