September 12th, 2023 | 09:05 CEST

Now it is getting dangerous! Hydrogen crash: Nel and Plug Power down, dynaCERT steps on the gas!

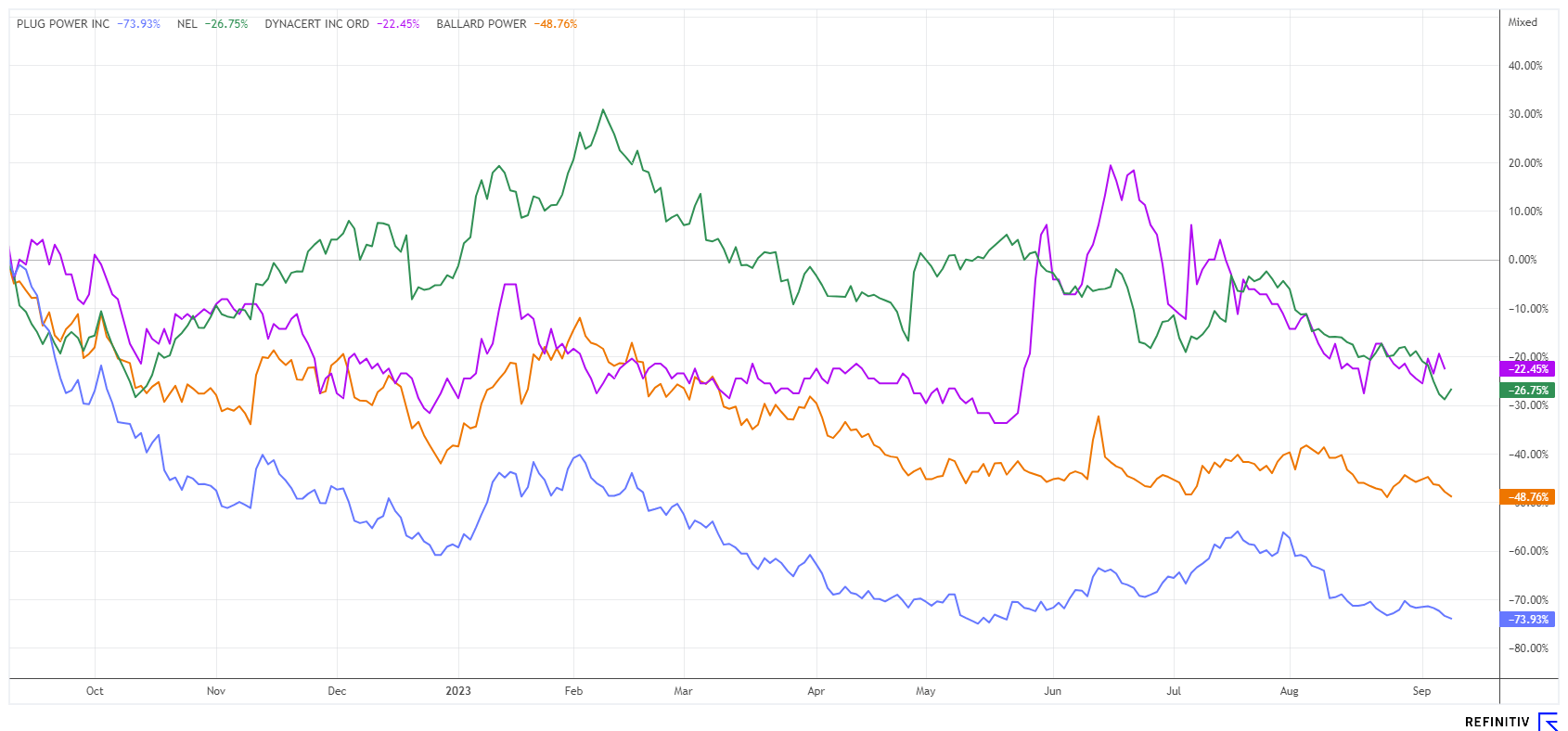

While the stock markets recently reached new highs and are now consolidating somewhat, there is widespread gloom in the hydrogen sector. Since the last hype at the beginning of 2021, the stocks have been trending downward. The Joe Biden Administration's Inflation Reduction Act and the EU hydrogen offensive had only been able to give the sector a short-term boost, and most recently, the protagonists marked new, multi-year lows. Nevertheless, there are also positive signs. We examine the risk-reward ratio.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , PLUG POWER INC. DL-_01 | US72919P2020 , DYNACERT INC. | CA26780A1084

Table of contents:

"[...] We can convert buses and trucks to be completely climate neutral. In doing so, we take a modular and incremental approach. That means we can work with all current vehicle types and respond to new technology and innovation [...]" Dirk Graszt, CEO, Clean Logistics SE

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Plug Power - Has the overvaluation now set in?

The US top dog in the hydrogen electrolyser business, Plug Power, has reported several large orders in recent months. This helped the share price jump in valuation by over 80% between May and August. Then, the Company published its half-year figures. Despite significantly increased sales, losses widened dramatically. Investors are asking themselves when the expected economies of scale will become noticeable. **Despite doubling sales in 2023 to around USD 1.4 billion, operating losses remain around USD 700 million. Breakeven is now expected in the course of 2025.

Considering a price-to-sales ratio of 6, analysts on the Refinitiv Eikon platform are still in an astonishingly good mood. 30 experts assess the figures, with 70% concluding with a buy recommendation. The achievable 12-month target price of USD 16.6 is around 100% above the currently traded price. Plug Power's largest single shareholder is a Korean conglomerate, SK Group. They took a 10% stake in 2021 at USD 29.90 and are currently developing the first Korean gigafactory for hydrogen with their US partner. In Canada, the SK Group is involved in another USD 5 billion project. One can only hope that the Nujioqonik megaproject also holds some orders for Plug Power because, currently, growth only comes through public contractors. The negative energy efficiency in the conversion of water does not yet attract private investors. We therefore expect further valuation discounts for Plug Power by the end of the year.

dynaCERT - One deal follows the next

Also in Canada is the technology company dynaCERT (DYA). The Toronto-based company surprises almost weekly with new technology partnerships and large orders. Together with its partner Cipher Neutron, they were able to seal a new contract with Strategic Resources for the production of green hydrogen in mid-August. It is for the supply of anion electrolysers to the metallurgical plant of the BlackRock project, owned by Strategic Resources in Saguenay, Quebec. The H2 project is a precursor to green steel production. The collaboration agreement will enable Strategic to accelerate its hydrogen development plan and work toward producing near-zero emissions of ferrous metal products for use in electric arc furnaces and steel foundries. The leased industrial site at the Port of Saguenay provides an ideal location for the deployment of Cipher Neutron's AEM Green Hydrogen electrolysers.

Last week, dynaCERT announced the formation of a funding team to implement the "Stream 2" program of the Green Freight Program of Natural Resources Canada, a division of the Government of Canada. The program provides financial assistance of up to 50% to qualified buyers in acquiring climate mitigation technologies, including dynaCERT's HydraGEN technology. This is another step in the decarbonization of Canada for the benefit of future generations. With a final commitment from VERRA, dynaCERT's products are also expected to receive the coveted environmental certification so that users can earn carbon credits for their savings. Eligible technology retrofits must be permanent modifications that have been shown to reduce diesel fuel consumption in medium- and heavy-duty vehicles and reduce greenhouse gas emissions by switching the fuel used to a lower-carbon alternative.

Shares of dynaCERT are currently actively trading in the CAD 0.19 to CAD 0.22 range. Presumably, these are already initial prepositionings on the expected news flow in the coming weeks. With a market capitalization of CAD 76 million, only the development investments already made are paid for, but the anticipated revenues from various decarbonization projects could be many times higher in the future.

Nel ASA - The chart is broken for now

With a sharp initial move, the Nel ASA price fell below the critical EUR 1.00 mark last week. For a long time, the price had been able to hold above the support, but due to continued weakness, dynamic selling has now set in. Operationally, however, things are not so bad. After all, the order book shows NOK 2.97 billion at mid-year, and there is still NOK 4.1 billion in cash to cover the necessary pre-financing.

Unfortunately, the popular public stock with a market capitalization of EUR 1.5 billion is still valued at 15 times sales. For many investors, the adjustment to significantly lower valuations is likely to continue for some time. From a technical point of view, the chart is now battered, and the next perceptible support can only be identified at around EUR 0.70. Until then, it is a case of buckle up or simply sell. On the Refinitiv Eikon platform, the 26 analysts are completely divided. The spectrum ranges from "Strong Buy" to "Sell". The experts likely need a few more months to assess the significantly weaker growth in the sector adequately. Caution on the platform edge!

The hydrogen sector is one of the weakest sectors in the first half of 2023. Losses run through all segments; growth expectations had been set too high in 2022. Plug Power and Nel ASA should consolidate further, whereas Canadian dynaCERT can already report significant progress in its operating business.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.