April 23rd, 2025 | 07:10 CEST

No Trump frustration with 123fahrschule and Mutares, but caution is advised with defense stocks such as RENK, Hensoldt, and Steyr!

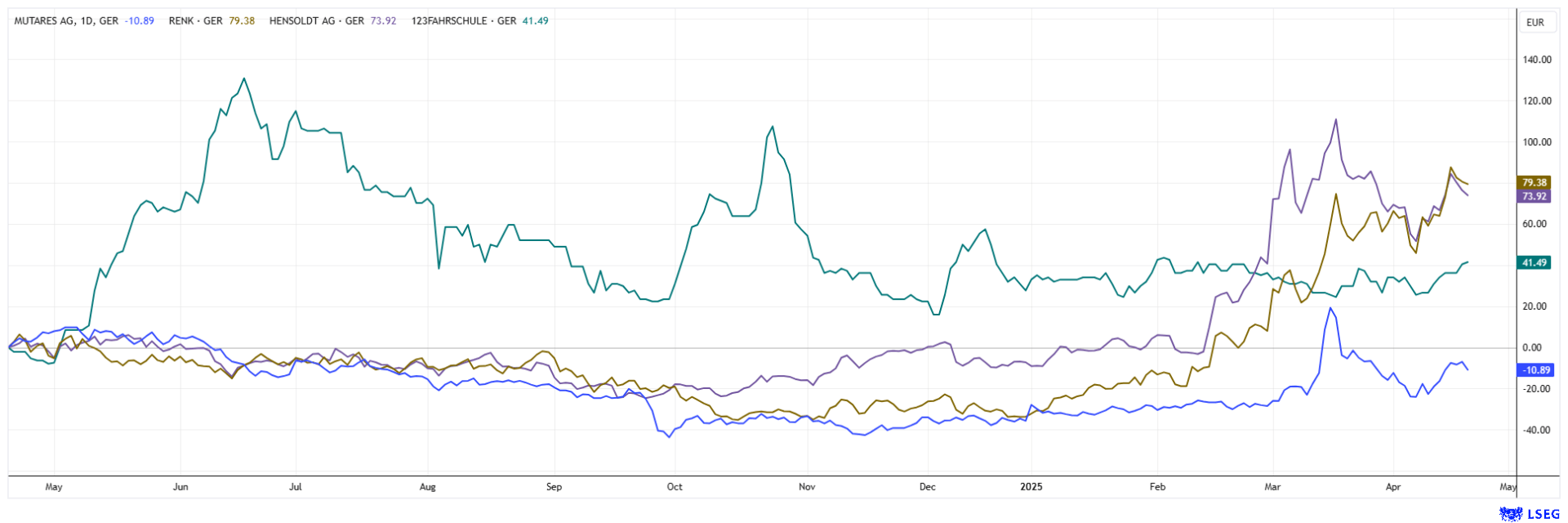

The daily news is driving stock market activity. After a rollercoaster ride caused by Trump, popular tech stocks such as the Magnificent 7 are now down a good 20%. In the case of Nvidia, the stock is now USD 50 below its peak. For many, this is an opportunity to finally take a breather and think about the rest of the stock market year. Small caps such as the successful 123fahrschule continue to work on their growth programs, and Mutares is making good progress with its investments. The hot defense stocks RENK and Hensoldt appear somewhat overpriced. Those who want to generate returns now must be very selective and invest in specialties. After gains of just under 10% per annum, global ETF savers will likely take a break from returns in 2025. In the meantime, flexible investors will come out on top. Here are a few ideas.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

123FAHRSCHULE SE | DE000A2P4HL9 , MUTARES KGAA NA O.N. | DE000A2NB650 , RENK AG O.N. | DE000RENK730 , HENSOLDT AG INH O.N. | DE000HAG0005 , STEYR MOTORS AG | AT0000A3FW25

Table of contents:

"[...] Having Investors like Robert Friedland and Rob McEwen come in with CVMR and Terra Capital really was terrific. [...]" Terry Lynch, CEO, Power Nickel Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Mutares and Steyr – The golden coup

The investment company Mutares is proving to have a good instinct. It was not long ago that the Munich-based company got involved in the restructuring of the specialist engine manufacturer Steyr Motors. Then, the war in Ukraine began, and the Austrian company's military divisions were discovered. In October 2024, the Company was successfully listed, and since then, the asset managers have gradually reduced their stake by a total of 1.6 million shares, generating proceeds of approximately EUR 74 million. Investors can, therefore, expect another solid distribution after the next AGM in June. The proposed dividend stands at EUR 2.25 – a respectable 6.8% based on the current price of EUR 32.85. Accumulating in the corridor of EUR 30 to 33 is considered attractive; analysts on the LSEG platform expect EUR 39 within 12 months.

Steyr shares themselves have had an eventful six weeks. In mid-March, the share price exploded to EUR 380 after some speculators had apparently taken on too many short positions. The Upper Austrian engine manufacturer is currently exploring the market for external acquisitions. Following the special loans approved in Germany, management expects defense budgets to rise in other major European countries as well, along with very high demand from international allies. Steyr produces high-performance engines, such as main engines for special military vehicles and boats, as well as auxiliary units for battle tanks and locomotives. Products for military purposes now account for the majority of sales. In 2024, revenues rose 9.2% compared to 2023, reaching EUR 41.7 million. Market capitalization peaked at a crazy EUR 2.2 billion, and as of yesterday stood at EUR 242 million. That is still almost six times revenue! Far too expensive.

123fahrschule – Steep growth is inevitable

The business model of 123fahrschule SE appears much more peaceful by comparison. While Germany still has much catching up to do in terms of digitization, the listed driving school provider sees digitization as part of its DNA. After all, Chancellor-in-waiting Merz has already announced plans to establish a Ministry of Digital Affairs - demonstrating the importance of the issue at the highest level.

CEO Polenske has proven experience in this area, having founded KlickTel at the turn of the millennium and successfully taken it public. 123fahrschule was then founded in 2016. The Company specializes in the further digitization and modernization of the driving school industry and combines innovative technologies such as online registration, app-based appointment management, and driving simulators with traditional driving school services. It is now one of Germany's largest driving school chains and focuses on further growth through new openings and acquisitions. With approaches such as a learning app, a modern driving simulator, blocked theory training, and targeted exam preparation, 123's offering stands out from the market. The goal is to make a Class B driver's license available for EUR 2,000 to EUR 2,500.

123fahrschule recorded year-on-year growth of 9.3% in the 2024 financial year, achieving revenue of EUR 22.5 million. EBITDA improved by EUR 1.42 million to an operating surplus of EUR 532,000. The Company successfully completed the acquisition of simulator manufacturer Foerst GmbH, which will significantly strengthen its position in the digital driver training market. The visible improvement in cash flow and the 25% growth in student registrations highlight the operational success of the past year. For fiscal year 2025, 123 expects revenue in the range of EUR 28 to 30 million, with a current EBITDA forecast of EUR 1.5 to 2.5 million. The analysts at mwb research updated their model in March and have now added estimates for 2027. With only minor adjustments, the analysts confirmed their "Buy" recommendation with a price target of EUR 6.20. Following a successful capital increase, 5.558 million shares are now in circulation, and the market capitalization stands at EUR 14.7 million. The share price is currently fluctuating between EUR 2.60 and EUR 2.70, which is a good result if you consider mwb research's target price to be an achievable target.

RENK and Hensoldt – High security premiums

Things remain turbulent for defense stocks RENK and Hensoldt. The Augsburg-based specialist gearbox manufacturer achieved a market capitalization of a whopping EUR 5.2 billion with a share price high of EUR 52.70. However, the Company is only expected to generate estimated revenue of just over EUR 1.5 billion in 2025. Ongoing operational optimization will limit the increase in earnings per share to around EUR 1.4, putting the current P/E ratio at a hefty 35.5. Next year, it will only fall to 28.2. The 11 analysts on the LSEG platform who are positive about the stock are voting in favor of this, with an average price target of EUR 47.90. This is below yesterday's price of EUR 50. Time to sell!

The valuation picture does not look much better for Hensoldt. With prices around EUR 65, the market capitalization is a good EUR 7.5 billion. Here, too, the 2025 revenue estimate of EUR 2.6 billion is only a third of the valuation. On top of that, according to accompanying analysts, the Company will only grow by an average of around 10-12% per year until 2027. Here, too, the very optimistic P/E ratio is 36 and 30 for the next two fiscal years. The average price target of LSEG experts is correspondingly low at EUR 58 in 12 months. First quarter figures are expected on May 7. If there is no positive surprise with a great outlook, investors should quickly cash in their accumulated profits. However, the recommended stop of EUR 63.50 will likely be triggered before then.

Investing is becoming a long-term monster challenge. While high-tech stocks continue to consolidate, defense stocks are gradually entering heavily overvalued zones. 123fahrschule is benefiting from positive sentiment toward digitization and has a robust growth program ahead of it. When investing in defense stocks, set strict stop losses - e.g., RENK at EUR 47.50, Hensoldt at EUR 63.50, and Steyr at EUR 42.50 - to secure the generous gains.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.