December 29th, 2022 | 09:24 CET

Nio, Altech Advanced Materials, Rheinmetall - Still on trend

The prevailing themes from last year will continue to be in vogue in 2023. Due to the political strategy of achieving peace through heavy weapons, the order situation for defense companies should improve even further. In addition, electric carmakers should continue to top the sales figures from the fiscal year ending in 2022. In terms of the efficiency of the battery, which is essential for electromobility, several companies worldwide are fighting for the crown. One German company has two hot irons in the fire.

time to read: 3 minutes

|

Author:

Stefan Feulner

ISIN:

NIO INC.A S.ADR DL-_00025 | US62914V1061 , ALTECH ADV.MAT. NA O.N. | DE000A2LQUJ6 , RHEINMETALL AG | DE0007030009

Table of contents:

"[...] When we acquire something, we want to make sure that the acquisition fits with our strategy and has the potential to be successful for our shareholders. [...]" John Jeffrey, CEO, Saturn Oil & Gas Inc.

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

Altech Advanced Materials - Race for the super battery

The switch from the internal combustion engine to the electric car has been approved by politicians for some time now. The most critical component of the car of the future is the required battery. For years, a fierce battle has been going on to see who can develop the most efficient and longest-lasting energy source. Altech Advanced Materials, based in Heidelberg, Germany, is at the forefront of this race and could make its mark in the future with two innovations.

Altech Advanced Materials is in a huge growth market. The global market for battery storage systems is expected to rise from USD 4.4 billion in 2022 to USD 15.1 billion in 2027. In the longer term, it is expected to grow from 20 GW in 2020 to over 3,000 GW in 2050. The advantages of the innovation, which is the result of a joint venture with the Fraunhofer Institute for Ceramic Technologies and Systems IKTS, are impressive. Compared to the current standard lithium-ion battery, CERENERGY batteries are non-flammable and, therefore, fire- and explosion-proof. The battery technology requires only common salt and a small amount of nickel, but neither lithium, which is already in short supply, nor cobalt, graphite or copper. In addition, the production costs of CERENERGY batteries are about 40% lower than those of lithium-ion batteries, according to the Fraunhofer Institute. In the future, production of the miracle battery will occur in Saxony, or more precisely, in Schwarze Pumpe. The goal of the first line is an annual output of 100 MWh.

In addition to CERENERGY, the Heidelberg-based company is conducting research with its Australian partner Altech Chemicals Ltd. on a novel nanocoating of high-purity aluminum oxide and an enrichment of silicon that increases battery performance by 15% and extends battery life by 30%. In addition, further research showed that by increasing the silicon content in Silumina Anodes, performance could be doubled.

Altech Advanced Materials' market capitalization is currently EUR 27.06 million. Should one of the two innovations find its way into the mass market, this valuation should quickly become a thing of the past. It is also interesting to take a closer look at Altech Chemicals, with a market capitalization of EUR 66.42 million. After all, the Company from Down Under owns a 75% share in the Silumina Anodes project and the absolute majority in the CERENERGY joint venture with 56.25%.

Nio - Forecast cashed

Particular supply and production challenges and ongoing supply chain issues prompted management at the Chinese electric car maker to lower its delivery expectations for the fourth quarter of 2022. Despite record sales of more than 31,000 e-vehicles in the third quarter, Nio has struggled with ongoing supply chain disruptions caused by China's "Zero-COVID" restrictions. The Company added that it now expects 38,500 to 39,500 deliveries in the fourth quarter, down from its previous forecast of 43,000 to 48,000. Compared to the fourth quarter of 2021, the increase in shipments would still be around 50%, even under a worst-case scenario.

Despite the forecast cut, US investment bank Morgan Stanley remains positive on the Chinese automaker. The analysts continue to rate the stock as "overweight", with a price target of USD 16.10.

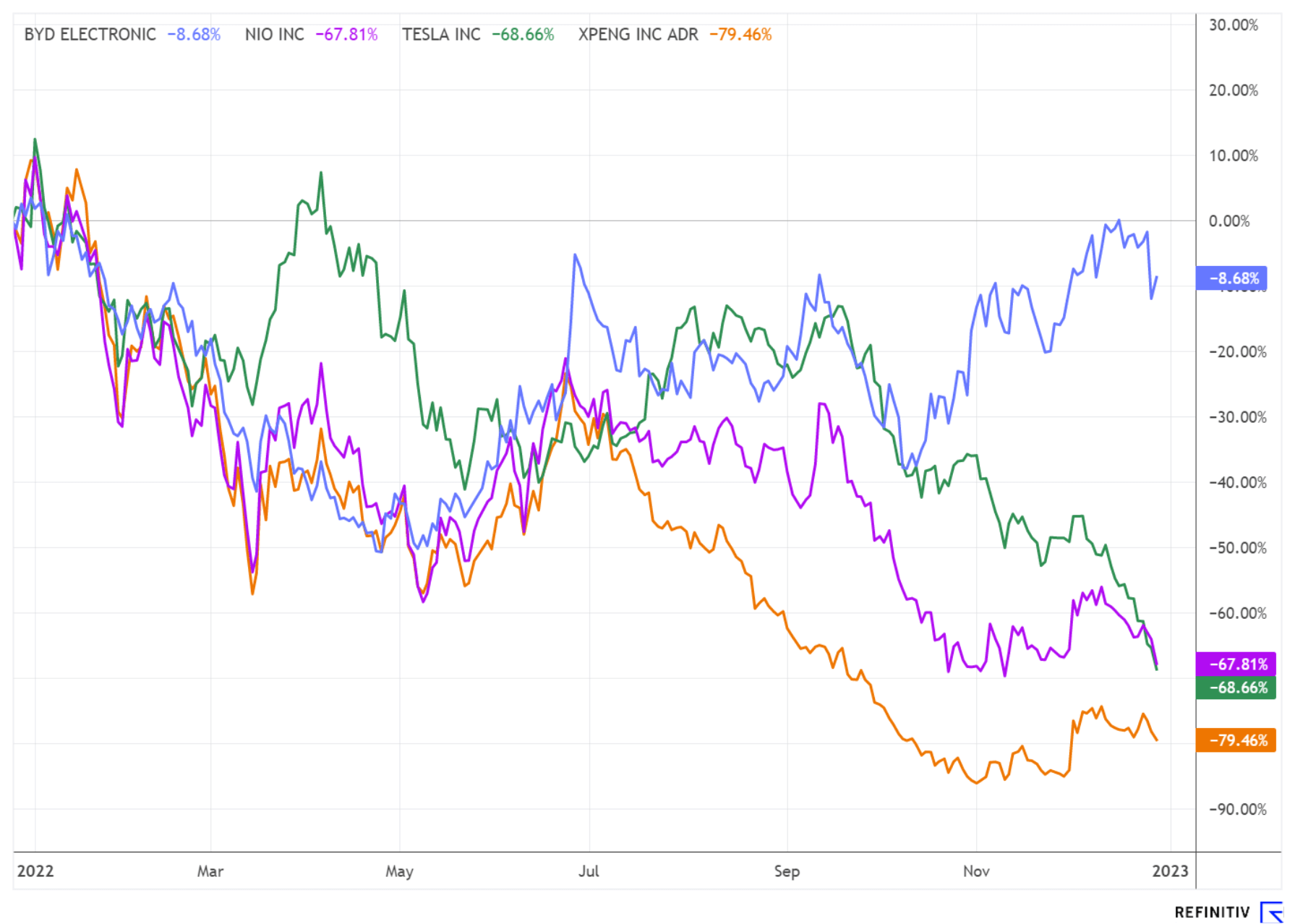

From a chart perspective, however, the situation remains threatening. In the event of a sustained slide below the support at USD 9.67, the yearly low at USD 8.38 is again threatened. Over the year, the stock has already lost around 68% of its value.

Rheinmetall - Largest single order ex-armaments

The supplier to the German armed forces has made a name for itself not only in the armaments sector but also in the automotive business. This time, however, a big order came from a completely different sector. The volume amounts to EUR 770 million and is the largest single order Rheinmetall's non-military division has ever received outside the classic automotive business.

The industrial customer has ordered a refrigerant compressor model with DC electronics, for which a long-term supply contract has been concluded, the Düsseldorf-based company announced. The compressor type is similar in design to those used in motor vehicles.

At EUR 193.25, the defense group is trading just below the downward trend it formed at the end of June. If the EUR 200.50 mark is broken, the Company is likely to make another attempt to reach its all-time high of EUR 227.90. The share is currently receiving a tailwind from the indicators. Both RSI and MACD are close to generating new buy signals.

The 2022 trends should continue to gain momentum in the new year. At the same time, the electric carmakers look battered from a chart perspective. Rheinmetall, on the other hand, could shoot up to new heights. In the long-term, the technology of Altech Advanced Materials could become a game-changer in the battery market.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.