August 2nd, 2023 | 09:55 CEST

Nikola Motors share unstoppable: Strong news also from BASF and Manuka Resources

Forget about a recession. These stocks are on the fast track or the verge of a breakout. For example, the Nikola share gained more than 15% in value yesterday. The reason was a new order in the US. This means that the shares of the manufacturer of zero-emission trucks have multiplied within two months. The Manuka Resources share could also be on the verge of a breakout. Due to the ramped-up gold production, exploration activities are expected to be financed through the next three years. An added kicker for the Australians could be their involvement in battery raw materials. As for BASF, the recent profit warning hardly affected them. Analysts express positivity, but the possibility of a dividend cut remains on the table.

time to read: 3 minutes

|

Author:

Fabian Lorenz

ISIN:

NIKOLA CORP. | US6541101050 , BASF SE NA O.N. | DE000BASF111 , Manuka Resources Limited | AU0000090292

Table of contents:

"[...] Silumina Anodes® is a ceramic-coated graphite/silicon anode composite material that we plan to produce in Schwarze Pumpe, Saxony. Here, we aim to supply manufacturers of batteries for e-cars with an application-ready drop-in technology that is low-cost, high-performance and safe. [...]" Uwe Ahrens, Direktor, Altech Advanced Materials AG

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

Manuka Resources: Exploration fully financed

Will the Manuka Resources share break out of the sideways trend in the coming months? The chances of this are good. That is because the Australian commodity explorer is ramping up its gold and silver production and can thus pay exploration costs out of its pocket. This should take the pressure off capital measures for the time being.

The Company has announced that it will be able to generate a positive cash flow from the start of gold production at the Mt. Boppy mine from the current quarter and thus fully finance the exploration programs for the next 3 years. The Mt. Boppy mine is one of Australia's historically richest gold mines. Using modern prospecting technologies, up to 25,000 ounces of gold per year are expected to be mined over the next 4 years. In addition, drilling is already underway to expand the resource estimate. Exploration is also underway at the McKinnons Mine and Pipeline Ridge projects. In addition, Manuka owns the Wonawinta Silver project. With a mineral resource estimate of 51 million ounces, this is one of Australia's largest silver deposits.

The South Taranaki Bight project could become a price kicker. This world-class iron sand project is located off the coast of New Zealand. It has a reported resource of 3.2 billion tons of VTM iron sand with 1.6 million tons of contained V2O5 (vanadium pentoxide), making it one of the largest known drilled vanadium resources globally. The mining license has been issued, and the Company is awaiting EPA environmental permits to begin mining. Manuka initially plans to mine approximately 5 million tons of VTM iron ore concentrate with 10,000 tons of recoverable vanadium metal annually. The mine is expected to have a 20-year lifespan. Vanadium-based batteries lose significantly less energy than lithium-ion batteries** and are suitable for use in solar and wind power plants, among other applications.

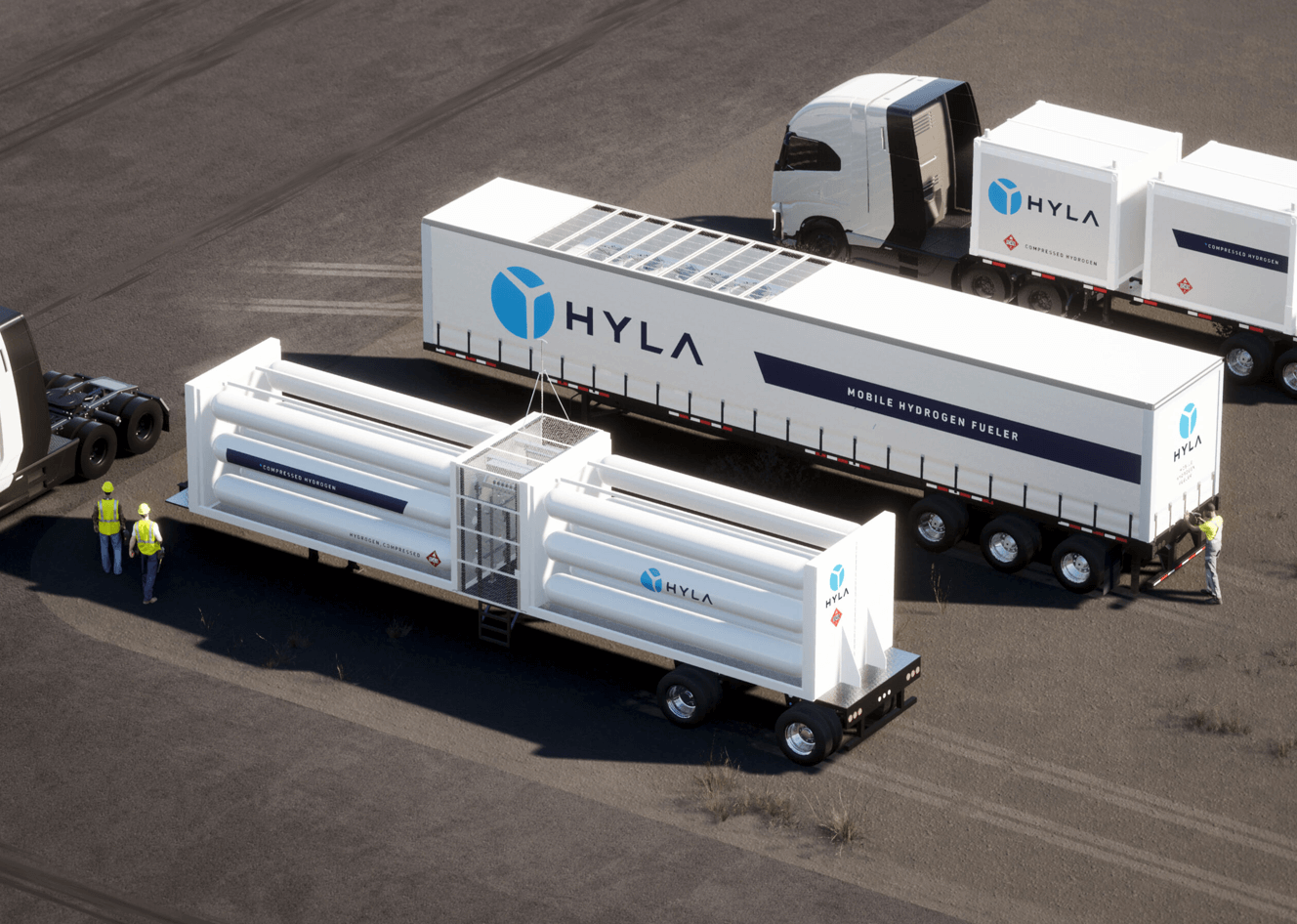

Nikola: Share price driver USA

While the chart breakout for Manuka is still to come, the Nikola share is running at full speed. Yesterday, the share price surged by more than 15%, multiplying its value from USD 0.55 to over USD 3 since early June. The market capitalization is again at a proud USD 2 billion. Yesterday's jump in the share price was due to a new order. Nikola Motors received an order in the US to deliver 13 zero-emission trucks. These include ten models with battery drive and three with fuel cells. The first vehicle is to be delivered this month. "It is important for us to be at the forefront of new technologies and innovative solutions that have the potential to change the way we move freight," says Nick Hobbs, COO and President of Contract Services at J.B. Hunt. "Nikola's trucks help us reduce CO₂ emissions through viable solutions."

The stock price rally began when Nikola reported a USD 41.9 million grant from the California Transportation Commission (CTC) in early June. The funds will go toward constructing six heavy-duty hydrogen fueling stations in Southern California as part of the Trade Corridor Enhancement Program (TCEP). Carey Mendes, President of Nikola Energy: "This award will allow us, in partnership with Caltrans, to accelerate the development of zero-emission hydrogen fueling infrastructure, which is essential to the successful launch of our hydrogen fuel cell electric vehicles in July."

BASF: Analysts express a positive view

Despite the recent profit warning, BASF's stock is performing positively. The share is receiving support from several analysts at once. At the beginning of the week, Baader Bank upgraded BASF shares from "Reduce" to "Add". The price target is EUR 53. The chemical giant's management was confident that business development had bottomed out and order momentum would start to improve. A possible cut in the dividend remains a risk.

Deutsche Bank also commented positively on BASF. EBIT in the past quarter had been just below the consensus estimate. Nevertheless, the analysts rate the shares of the DAX-listed company as a "buy". The price target is EUR 56. The share is currently trading at EUR 48.80.

The Nikola share currently knows no stopping. But the valuation is now again ambitious with over USD 2 billion. Manuka's market capitalization is currently around AUD 30 million. At the same time, cash flow should pick up significantly, and capital measures should be off the table. The share is currently trading at AUD 0.055. In November 2022, it was still AUD 0.18. At BASF, the bulls are now in the driver's seat, but beware if there is a dividend cut or even a suspension of dividends.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.