December 5th, 2023 | 06:30 CET

Next lithium boom in 2024? Freyr Battery, Edison Lithium, VW, Mercedes - Where are the 100% gainers?

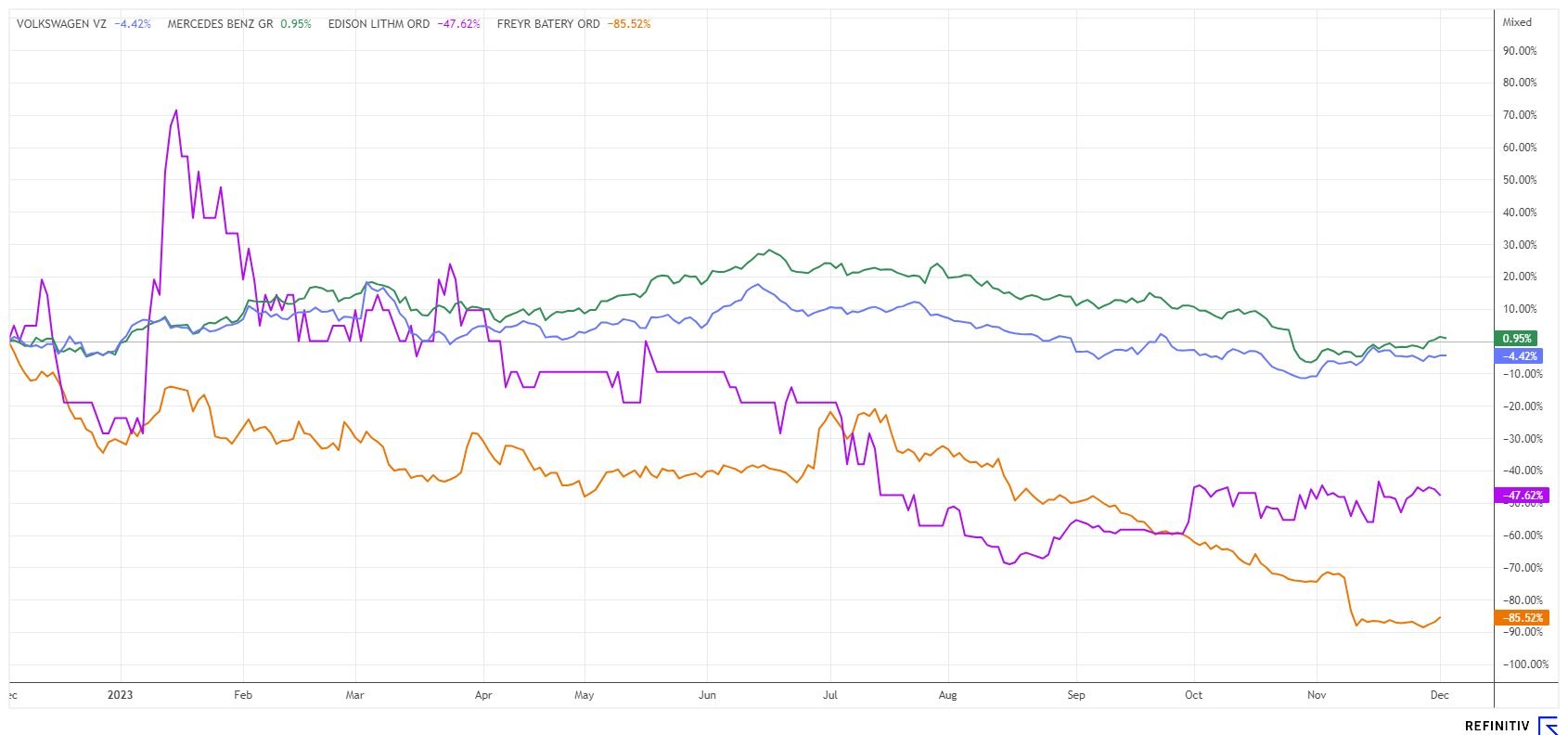

The year 2024 promises to be highly interesting, that much is certain. The so-called electric boom has not yet taken place, and the falling lithium price of minus 80% in the current year speaks volumes. Of course, major investments such as a relatively expensive electric vehicle depend on the general situation and subsidies. However, neither of these contextual factors bode well. On the contrary, state subsidies are falling, and high inflation is weighing on private household budgets. So why not get the good old diesel through the MOT again? After all, continuing to drive an old vehicle is 100 times more sustainable than buying a new electric vehicle with rare and difficult-to-extract metals. While green thoughts are commendable, the costly construction of so-called gigafactories continues. On the stock market, the question arises: Who will ultimately emerge as the winner?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

Freyr Battery | LU2360697374 , Edison Lithium Corp | CA28103Q2080 , VOLKSWAGEN AG VZO O.N. | DE0007664039 , MERCEDES-BENZ GROUP AG | DE0007100000

Table of contents:

"[...] In 2020, the die is finally cast in the automotive industry towards electromobility. [...]" Dirk Harbecke, Executive Chairman, Rock Tech Lithium Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Edison Lithium - Lots of lithium in Argentina

According to Benchmark Mineral Intelligence, the deficit in the supply of lithium carbonate is likely to increase from the current 26,000 tons to over 80,000 tons by 2025, which means that prices for the white metal should soon turn around. In the last 12 months, contract prices for lithium carbonate have fallen from USD 70,000 to around USD 15,000. However, if the experts are to be believed, the search for new resources makes sense, as demand is likely to increase by at least 50%. Whether e-mobility or renewable energies, virtually all high-tech segments seek the best energy storage systems. And lithium will continue to play a key role here for years to come.

Argentina has gigantic lithium deposits. However, the country is unstable and has just completed a dazzling election. The right-wing populist Javier Milei won the run-off election against the incumbent economy minister, Sergio Massa, by a margin of 11 percentage points. The self-proclaimed "anarcho-capitalist" promises a radical turnaround from the policies of the ruling Peronists, who had relied on a strong welfare state. He wants to close the central bank, dissolve most ministries, drastically cut social spending, and introduce the US dollar as a means of payment. He also promises free trade without state restrictions or privileges. The US dollar as a benchmark would even support the mining industry in its import and export activities.

The coveted battery metal lithium comes from salt pans or salt lakes, and evaporation and purification systems are used to extract it. In addition to the large mining companies such as Livent, the Canadian lithium and cobalt explorer Edison Lithium Corp. also owns a concession area covering 148,000 hectares. They are located in Salar Antofalla and Salar Pipanaco, and initial geophysical tests show a brine zone that could be up to 300 meters thick. In addition to these lithium projects, the Company has claims for a cobalt deposit in the Canadian state of Quebec. The area developed by Thomas Edison in the early 1900s now covers 4440 hectares. Mineralization of 0.14% cobalt and 0.68 grams/tonne gold is found here. The Kittson Cobalt Project will now be spun off to existing shareholders on a one-for-one basis, and the new shares are expected to be listed soon. Edison CEO Nathan Rotstein commented: "We are excited about this news, which advances the process of being able to offer two pure play vehicles in the important battery metals space."

EDDY shares have come under pressure due to the fall in lithium prices. The 14.5 million shares are currently trading at a low CAD 0.22. The long-term chart shows a bottom formation at around CAD 0.16 to 0.20. Edison Lithium is an interesting addition to the portfolio for future battery metal producers due to its abundant deposits and the imminent spin-off of the cobalt projects.

Freyr Battery - Rebound after the sellout?

The Norwegian battery manufacturer Freyr Battery is making headlines again. With the recent Q3 figures, the Company reported sales of only USD 3 million but corresponding losses of USD 128 million. This put the share price under considerable pressure. It fell to EUR 1.29 at the end of November, after which the rebound began. The price gained almost 40% to EUR 1.78 in just three trading days. What happened?

Management surprisingly announced some operational progress. Following successful modifications to the cathode casting facility, Freyr can now continue working on its SemiSolid™ platform. Looking ahead to 2024, Freyr's top priority is to complete the commissioning of its Consumer Qualification Plant (CQP) and start producing specifiable, tested batteries. There are just a few technical requirements to meet, and test production can begin. This appeases the many free shareholders and creates a spark of optimism once again. The Company has been valued at over EUR 2 billion and, after an 11-month correction, is available at a valuation of EUR 233 million. One downside: the next capital increase will likely occur at a slightly higher level. Nevertheless, consider adding the stock to your watchlist.

VW and Mercedes - Is there a chance against China?

German premium manufacturers are having a tough time against China in the business of the electric vehicles of the future. While Chinese manufacturers such as BYD or NIO are pushing into the European markets with significant momentum, the market share of VW and Mercedes in China is declining noticeably. With 740,000 vehicles of all Group brands, 5.7% more VW models were delivered up to August 2023 than in the weak same month of the previous year, after which demand fell significantly.

The Wolfsburg-based company has now reacted and drastically reduced its prices. As a result, they have recently increased sales of electric models again. According to rumors, however, the losses per vehicle are immense. Mercedes is doing somewhat better, having almost doubled its sales of e-vehicles by the end of September, selling 175,000 vehicles, particularly in the upper-price segment. The analysis shows that expensive vehicles, in particular, are in demand among China's increasingly affluent middle class. In the high-price sector, "Made in Germany" can score points, whereas the lower segment will probably soon go completely to low-cost Asian manufacturers.

The shares of VW and Mercedes have stabilized significantly since the end of October. VW rose from EUR 98 to EUR 108, and the Stuttgart-based company also managed a 10% increase from EUR 55 to EUR 60. Investors should consider the fundamental data: 2024 P/E ratio of 3.5 at VW and 5.1 at Mercedes. On top of that, both companies pay a dividend of 8%. It could hardly be more attractive.

Who would have thought it! Instead of new record figures from the e-mobility sector, sales figures are currently falling. The price of lithium is also correcting by around 80%. However, as the resolutions on climate neutrality remain in place, new laws are likely to ensure "mandatory sales". Perhaps the current sell-off prices in the sector are a historic buying opportunity. VW and Mercedes are very cheap standard stocks, and Freyr and Edison Lithium also have their speculative charm.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.