May 17th, 2023 | 07:30 CEST

Newmont, Tocvan Ventures, Rheinmetall - The lights are green

With a weaker-than-expected fall in inflation worldwide, plus a war in Ukraine that continues to escalate, the general conditions point to a long-term rise in the gold price above its all-time high reached weeks ago. With a threatened default in the United States, another argument for a gold bull market could now be added. Be prepared.

time to read: 4 minutes

|

Author:

Stefan Feulner

ISIN:

NEWMONT CORP. DL 1_60 | US6516391066 , TOCVAN VENTURES C | CA88900N1050 , RHEINMETALL AG | DE0007030009

Table of contents:

"[...] We quickly learned that the tailings are high-grade, often as high as 20 grams of gold per tonne; because they are produced by artisanal miners, local miners who use outdated technology for gold production. [...]" Ryan Jackson, CEO, Newlox Gold Ventures Corp.

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

Newmont - Takeover signed and sealed

The deal is in the bag, and the precious metals sector has a new giant. Australian mining company Newcrest agreed to a takeover bid by industry giant Newmont, further extending Newmont's rank as the largest gold producer. Only the approval of the regulatory authorities and the shareholders is still pending. If all goes as planned, the new Newmont group will own gold mines and projects in North and South America, Australia, Africa and Papua New Guinea and further increase its copper share of production.

Newcrest Mining has officially agreed to Newmont Mining's takeover bid, which is the largest acquisition in the recent history of the gold sector. The deal has an estimated value of around USD 19.2 billion. Newcrest shareholders will receive 0.4 shares of Newmont for each of their shares and are expected to hold 31% of the merged company upon completion of the transaction.

This mega takeover is increasing the pressure on Barrick Gold to follow suit. For this reason, Barrick CEO Mark Bristow had already announced that he was also on the lookout for takeover opportunities. Despite good developments, the Company's projects will not be enough to hold a candle to Newmont. The merged group will have a pro-forma production of over 8.2 million ounces of gold and thus be almost twice as big as Barrick.

Tocvan Ventures - Consistent silver grades available

With the takeover wave among industry giants in full swing, the next step will likely be to expand it to smaller producers and promising exploration companies. The state of Sonora is the location with the world's largest silver production and the site where around 40% of all Mexican gold is mined. The Canadian company Tocvan Ventures is implementing its gold and silver projects, Pilar and El Picacho, in this area. They are located close to productive mines and thus benefit from the first-class infrastructure.

In particular, Tocvan Ventures' Pilar project recently achieved outstanding drill results, moving it ever closer to producer status. Pilar is a low sulphidation epithermal system in andesite rocks, dominated by structural controls. Three zones of mineralization have been identified, although the Main Zone and the "4-T" trends have not yet been fully explored, and there are other parallel zones. The mineralization extends over a distance of 1.2 km, with only half of this distance explored to date by drilling over a total length of 23,000 m.

Two other events are likely to positively impact the share price going forward. First, Cascade Copper, a company formed to work on Tocvan's original Rogers Creek project, received its listing and has already been trading on the CSE since late April. Tocvan plans to distribute the Cascade shares acquired through the sale of Rogers Creek to shareholders.

On the other hand, the management around CEO Brodie Sutherland was able to report further positive successes on the Pilar project. The processing of the extensive sample is in full swing. The first samples taken from the material from the crushing plant or duplicates during the first two crushing days of the mixed material showed consistent gold and silver values. A total of 15 samples were taken, with an average value of 1.64 g per tonne gold and 8.8 g per tonne silver. A further 130 samples were sent to the ALS facility for comprehensive gold and silver content analysis using fire assay and ICP techniques, although results are still pending here. Over 800t of bulk sample material has already been prepared for processing. In addition, 350 tonnes of crushed material and 250 tonnes of raw material are available to conduct gravity recovery and subsequent leach tests.

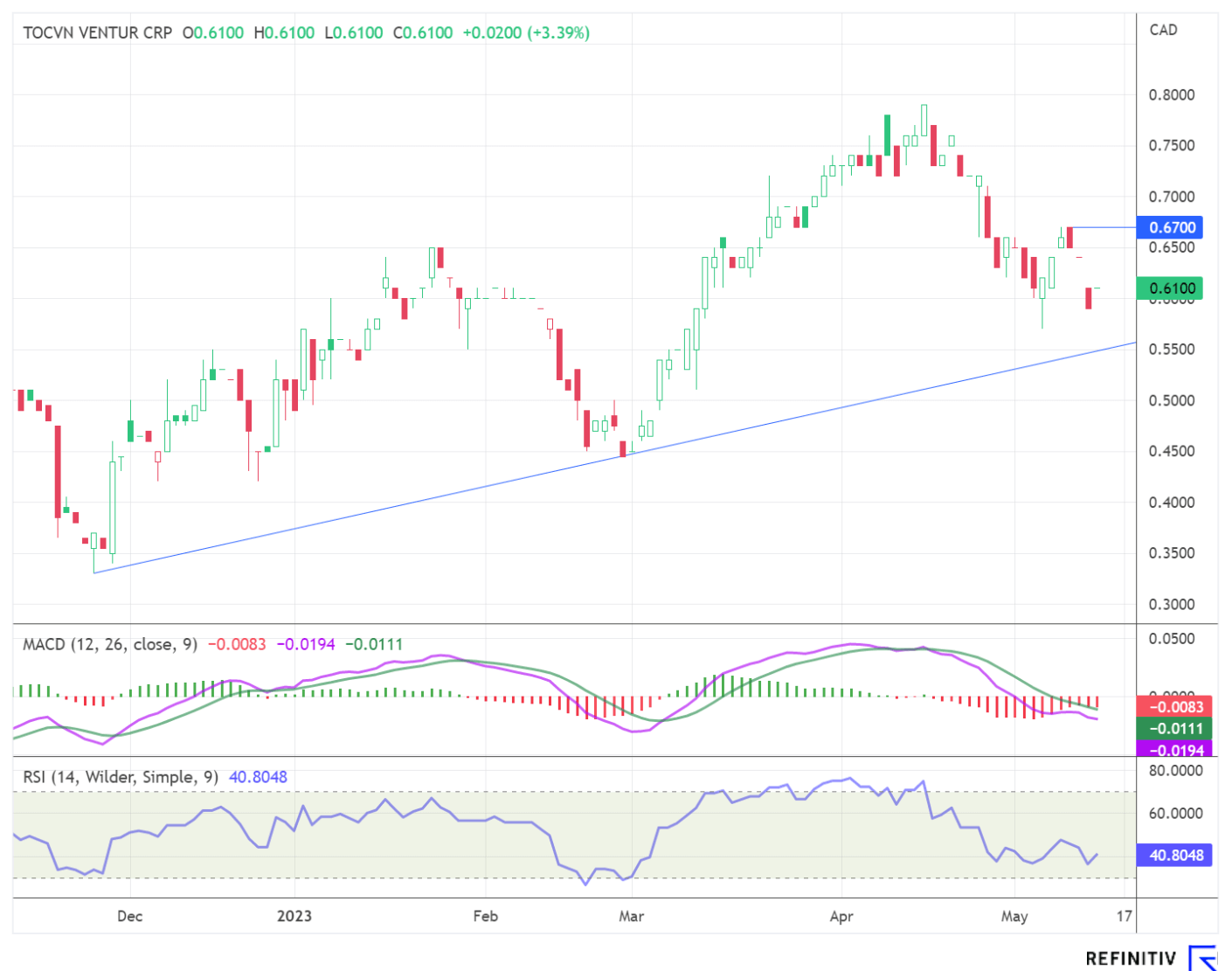

The market capitalization of Tocvan Ventures is currently EUR 16.07 million. After peaks of CAD 0.79 in April, the share price is correcting at around CAD 0.60. The established upward trend since November 2022 is at CAD 0.56. It is expected that investor buying interest will increase again, especially at this level.

Rheinmetall - Becoming increasingly important

The integrated technology group from Düsseldorf is becoming increasingly important in the Ukraine conflict. A strategic cooperation has been agreed upon with the Ukrainian state-owned company Ukroboronprom, which is active in various areas of defence systems production. The cooperation aims to strengthen Ukraine's defence economic base and ultimately ensure the country's national security by gradually establishing joint defence technologies in Ukraine.

As a first step in the cooperation, a joint venture is to be established, subject to the necessary regulatory approvals, which will create a link between Rheinmetall and Ukraine's existing state defence industry. Initially, the cooperation is to start in the field of repair of military vehicles provided to Ukraine within the framework of ring exchange projects of the German government as well as direct deliveries. Later, the cooperation will focus on comprehensive technology transfer and joint production of selected Rheinmetall products in Ukraine. In addition, new military systems could be developed in cooperation with Ukrainian and German experts and exported from Ukraine.

The share of the DAX group was able to avoid a sell signal after the consolidation of the last few days. Thus, the upward trend established since mid-October 2022 and a break through the 50-day line were successfully defended. Currently, the price is at EUR 269.70, just ahead of the short-term downward trend at EUR 273.40. A break of this trend would once again release price potential at least to the current all-time high at EUR 281.30.

The DAX group was able to avoid a buy signal for the time being. The acquisition wave continues with the elephant wedding of Newcrest and Newmont. The news flow from Tocvan Ventures remains consistently positive.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.