June 15th, 2023 | 07:50 CEST

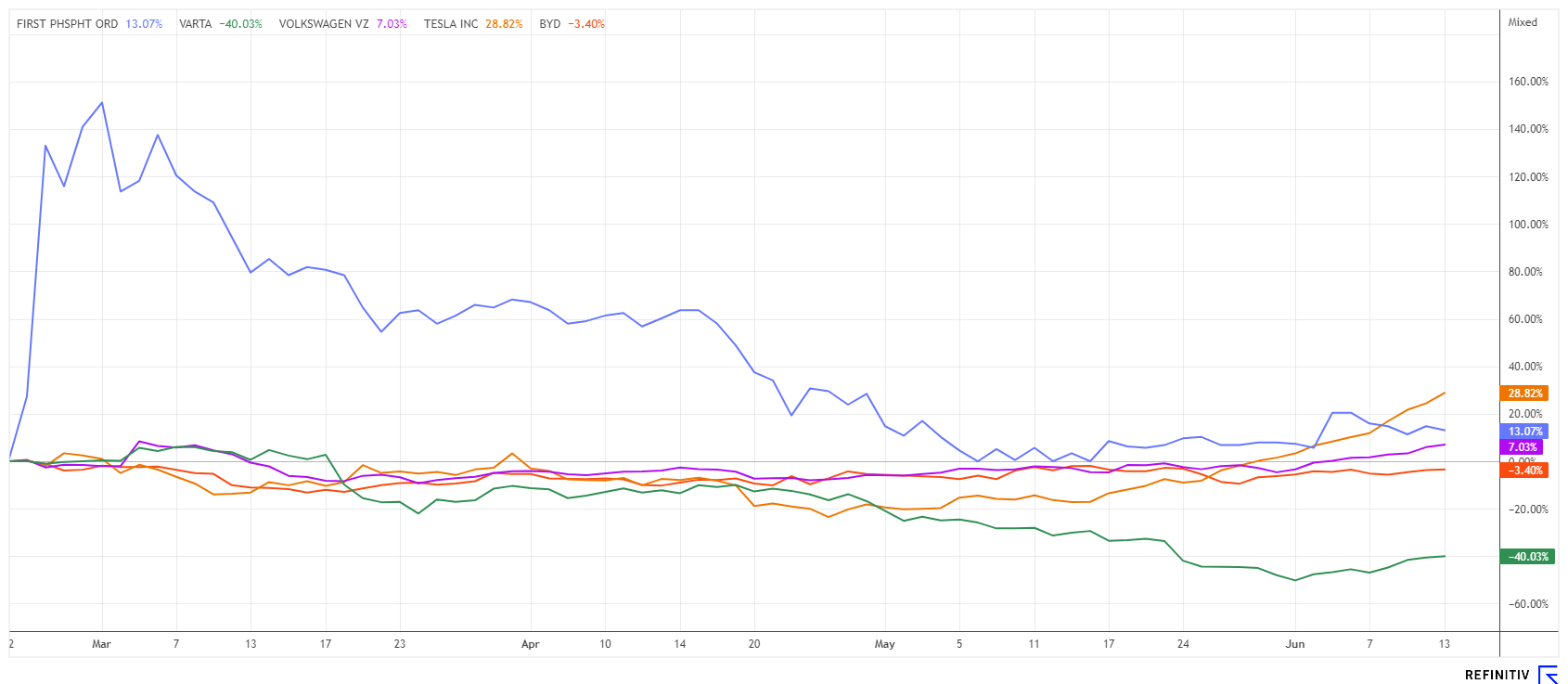

New record prices every day, but where is the perfect battery? Varta, First Phosphate, Volkswagen in focus

Without the next evolutionary step in traction batteries, it will probably be a long time before e-mobility can replace the combustion engine market. Short service life, limited flexibility and high production and disposal costs stand in the way of an economic approach, even if the red-green government likes to downplay these facts. In the end, politics has also failed to provide electricity in an appropriately "sustainable" manner and at an affordable price. Therefore, anyone who wants to promote ecology through politics must ensure that electricity prices are halved, and all currently required fossil components are eliminated from the energy mix. Otherwise, the enlightened consumer may revert to purchasing fuel-efficient internal combustion engine vehicles, even if they eventually have to import them into the EU at some point. Where are the opportunities for dynamic investors?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

VARTA AG O.N. | DE000A0TGJ55 , FIRST PHOSPHATE CORP | CA33611D1033 , VOLKSWAGEN AG ST O.N. | DE0007664005 , VOLKSWAGEN AG VZO O.N. | DE0007664039

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Volkswagen - Shaking up the market with a new technology

This news could become a gamechanger in battery technology. According to the latest news, Volkswagen wants to save several hundred euros in the future with a new production process for e-mobility units. It is about a dry coating, which instead of wet coating should reduce the energy consumption in cell production by about 30%, explained Sebastian Wolf, a board member of the VW battery subsidiary PowerCo.

For years, engineers have been searching for an environmentally friendly and at the same time economical revolution in battery technology. CEO Wolf is sure this novel technology, which has been researched since 2020, could also find worldwide use. A pilot plant will now be installed at the group's battery plant in Salzgitter, where further tests will be carried out. After an initial budget of EUR 40 million, VW wants to invest millions more in development. One of the largest gigafactories in Europe will be built in Valencia by 2026. VW also plans to invest in Canada in the near future. It will be exciting to see whether German engineers succeed in making the new technology suitable for mass production. Elon Musk has already tried but has recently waved it off in public.

The Wolfsburg-based carmaker has fallen somewhat behind in the international e-mobility rankings; the cheap competition from China is currently too strong. With the new process, however, the Company wants to roll up the market in the future. The VW share would benefit from a vitamin injection because despite new DAX highs, the heavyweight is still down 8% at mid-year.

First Phosphate - Step by step into the supply chain

Phosphate is repeatedly being considered as a possible raw material for a new battery technology. Whether and when a new type of unit can really gain traction on the market is so far more than questionable because carmakers worldwide are counting on the continued existence of Li-ion technology. This is despite the fact that service life, charging cycles and range still represent major limitations.

The Canadian raw material explorer First Phosphate (PHOS) has secured more than 1,500 sq km of concession areas in the Saguenay-Lac-St-Jean region of the province of Quebec, which the Company is now actively developing. The goal is to create an industrial mining site for high-purity phosphate concentrate, which is essential for future technologies. Phosphate has been traded for several years as a battery material in addition to its use in agriculture.

First Phosphate currently reports a strengthening of its management team with Isobel Sheldon, a well-known entrepreneur from the battery sector. She comes from the consulting firm Oakpolytech Ltd. and will be a new member of First Phosphate's advisory board. An industry veteran, she has been involved in the lithium-ion battery industry for 20 years. She has already been awarded the Order of the British Empire by Her Majesty the Queen of England for her many years of service to the development of e-drive batteries." "Ms Sheldon is an excellent fit for our team. She is passionate about the development and sustainability of the battery industry. With her many years of experience in this field, she will be an important guide in the coming stages of development", says John Passalacqua, CEO of First Phosphate. The primary goal will be to shape the development of domestic supply chains for the high-growth battery industry in the megatrend of decarbonization.

First Phosphate can make an important contribution here to transforming the transport and traffic sector in an efficient and environmentally sustainable way. There are strategic plans to integrate directly vertically from the mining source into the supply chains of larger North American LFP battery manufacturers. These require active battery-grade LFP cathode material from a consistent and secure supply source. PHOS shares are currently consolidating at around CAD 0.50 but have reached prices above CAD 1.15 in February. The future is being traded here!

Varta - This looks like a turnaround

The share of battery and storage manufacturer Varta now seems to have mastered the turnaround. After selling off at EUR 13.95 at the beginning of June, the stock was able to pull away powerfully in the direction of EUR 18. We had already noted recently that analysts were unanimously in a bad mood and that now, in the spirit of "once everyone has sold, it can only go up", there has been a nice recovery. In any case, the chart gives us hope!

Of course, in the fundamental sense, this does not mean that the operational problems have already been solved. On the contrary, there will still be disappointments and adjustments in the current quarter. The necessary job cuts have still not been implemented, and the cost side for energy and raw materials is not sending a green signal either. However, what could continue to drive the price up is the necessary coverage of short sellers, who earn substantial negative returns when prices rise. In this respect, the lights are still green in the short term. Those who have invested deeply should now put in a trailing stop with a 10% gap and "let the cow graze in the pasture".

Technological development in the field of e-mobility is still in its infancy compared to the almost 150-year-old combustion engine market, although the speed is already impressive. In addition, politics suggests a green footprint with this new technology, even if it has only been coloured ideologically and does not stand up to any scientific scrutiny. VW, Tesla and BYD are driving the highly dynamic market. Traditional companies like Varta have to come to terms with the new realities. First Phosphate is acting in the right direction on the raw material side and can grow into a material supplier.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.