July 31st, 2023 | 09:00 CEST

New hydrogen hype! More than 100% possible with Plug Power, dynaCERT, ThyssenKrupp Nucera and Nel ASA

While the use of wind and solar has long been established, this step is still to come for hydrogen. The EU's recent decision to produce around 20 million metric tons of the highly flammable fuel by the year 2030 is a major step forward. The aim is to replace natural gas supplies from Russia. This move is expected to help the new energy source establish itself more rapidly within the EU. Currently, 50 billion cubic meters of natural gas are used in Europe to produce so-called grey hydrogen. According to recent studies, a rapid switch to green hydrogen would make it possible to replace around 12% of gas consumption by 2030. Quite impressive! Which stocks will benefit from the approaching boom?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

PLUG POWER INC. DL-_01 | US72919P2020 , DYNACERT INC. | CA26780A1084 , THYSSENKRUPP NUCERA AG & CO KGAA | DE000NCA0001 , NEL ASA NK-_20 | NO0010081235

Table of contents:

"[...] We can convert buses and trucks to be completely climate neutral. In doing so, we take a modular and incremental approach. That means we can work with all current vehicle types and respond to new technology and innovation [...]" Dirk Graszt, CEO, Clean Logistics SE

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Plug Power - Is this the breakout to the upside?

Many investors had long since written off the fuel cell specialist based in Latham, New York State. After experiencing up to 1000% performance in the years 2020 to 2021, the stock price plummeted by over 85%, nearly wiping out the gains made during that time. This happened because the current CEO, Andy Marsh, had made significant business promises in his outlooks during that period, which has now resulted in the Company facing lawsuits from thousands of disgruntled investors. Of course, the figures promised at the time could only be partially met. Gullible investors found themselves misled and sued for damages for the lavish negative returns the Company had earned since its interim high of around EUR 60 in January 2021.

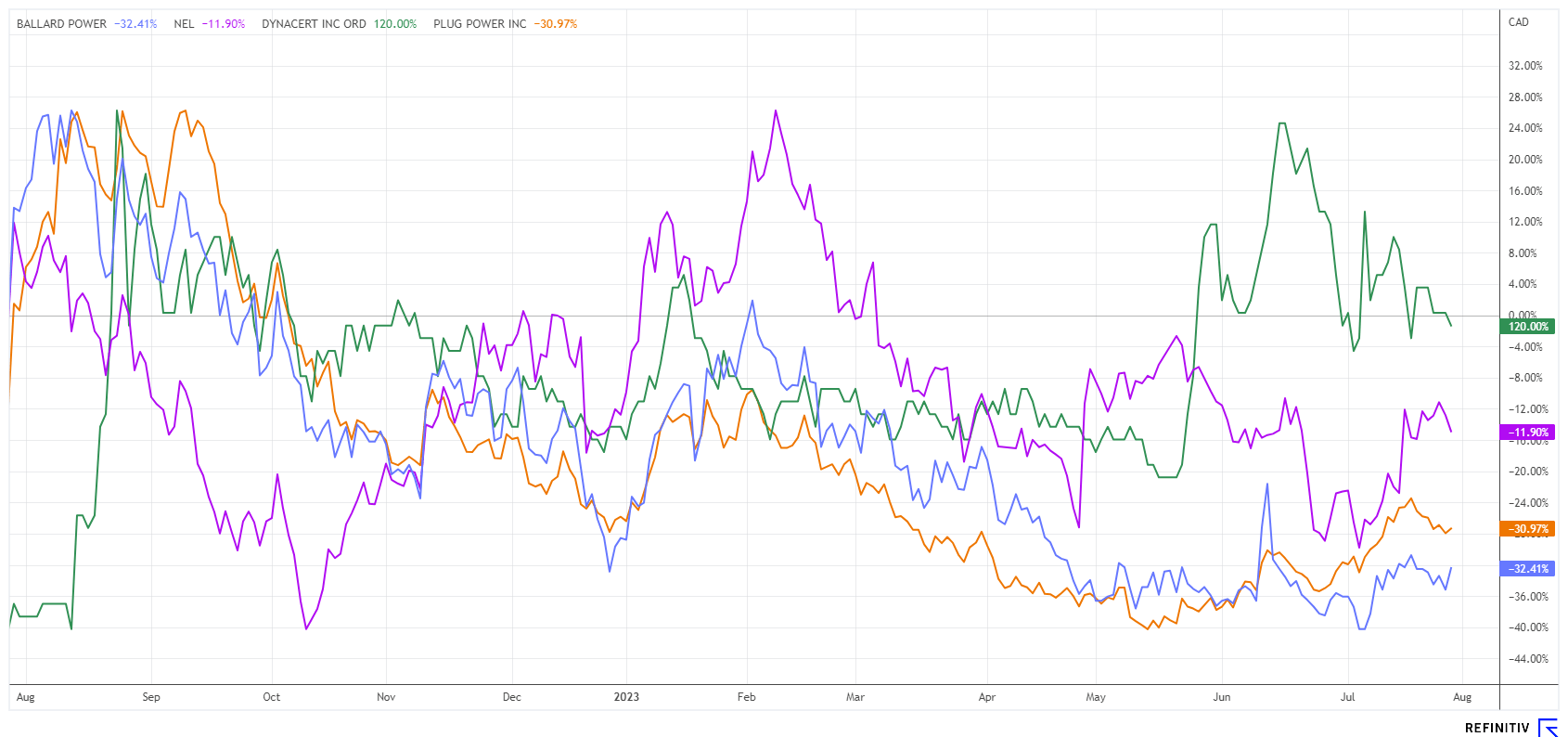

Despite negative press, however, Plug Power was able to break away again from its lows at around EUR 6.80 and double in price in the last three months. This not only sends out chart signals. In a recent study on the cleantech sector, the US bank JPMorgan is now also more positive again. And Northland Securities, with a price target of USD 22, has gone one better. The analysts expect tax credits for the Greentech sector from the Biden Administration's Inflation Reduction Act (IRA). Plug Power is followed by 31 analysts on the Refinitiv Eikon platform, and there is no longer a sell recommendation. The average 12-month price target has even risen again to USD 16.85. The roughly USD 7 billion valuation still puts a 3.5 times revenue valuation against the revenue forecast of around USD 1.9 billion in 2024, but nevertheless, the upside momentum has returned to the sector.

dynaCERT - The pace increases noticeably

dynaCERT is currently surprising with new technology partnerships almost weekly. With partner Cipher Neutron, there have already been two deals in July for the sale of AEM electrolyser technology. The first customer is Blade Hydrogen of Taiwan, where the 10-kilowatt AEM stack electrolysers are to be supplied for green hydrogen generation. Since dynaCERT will manufacture the units at its Toronto facility, it has taken an early 50% equity stake in Cipher Neutron. **Thus, future projects will benefit both companies.

Blade Hydrogen is a Taiwanese company specializing in fuel cell manufacturing and development, formed by a spin-off from the development department of the Industrial Technology Research Institute (ITRI) there. The Company has been advocating the importance of electrolysis for green hydrogen production in Taiwan for many years and will continue to work closely with Cipher Neutron. Another order of the same magnitude comes from the African Kuber Group. Kuber is a power plant and infrastructure development group headquartered in Ghana and seven African countries, plus Portugal, the US and the UK. Major contracts are expected from both directions.

For further research, Cipher Neutron and the University of Alberta have begun discussions to collaborate on AEM membrane research. The goal is to develop membrane catalysts that will significantly increase the efficiency of green hydrogen production. All things considered, all that is missing now is VERRA certification, and dynaCERT's stock price should go through the roof.

Nel ASA - Now the big orders are coming from all over the world

The Q2 figures of the Norwegian hydrogen pioneer Nel ASA turned out somewhat better than expected by experts. Nevertheless, EBITDA could only make a small step towards profitability. Compared to the previous year, the loss decreased marginally from NOK 197 million to NOK 138 million. Net income fell more sharply into the red, at minus NOK 342 million. Nevertheless, sales of alkaline electrolysers increased a full 383% compared to Q2-022.

With the steady expansion of production capacities, Nel is creating the basis for the realization of large orders. A cooperation agreement has been signed with the state of Michigan to build an H2 gigafactory with a target capacity of 500 to 1000 megawatts. In order to be able to meet the high upfront costs, Nel has accumulated a respectable NOK 4.1 billion in cash through several capital increases. Nel's share price rose slightly to EUR 1.23 after the quarterly figures, but the stock is still down 27% in the last 12 months. As profits are not yet being made, a price-to-sales ratio of 12 is still considered too high.

ThyssenKrupp Nucera - Good start for the Dortmund-based company

After months of struggle, the Dortmund-based company ventured onto the stock market at the beginning of July. The roughly 30.3 million shares were issued at EUR 20, valuing Nucera at around EUR 2.6 billion at the start. After exercising the greenshoe option, the parent company ThyssenKrupp still holds around 50.2% of the shares and intends to remain on board long-term.

Already profitable in recent years, the Thyssen subsidiary also got off to a pretty good start in 2023. Last week, the Group's parent ThyssenKrupp received a 2 billion subsidy check from Brussels to enable the climate-friendly conversion of steel production. The stock exchange assumes that a large part of the hydrogen production plant will be designed and supplied by the Company's subsidiary. Recently, a contract was signed with the US company Air Product for a 2 GW plant in Saudi Arabia. Nucera should be able to generate double-digit profits from this. The construction will take 2 years and start in 2024. Despite the good order situation, the share is only valued at the lower end of the field with a price/sales ratio of 5 compared to its peers. Investors should nevertheless have a lot of patience and be able to withstand erratic volatility.

The hydrogen sector is slowly beginning to pick up traction internationally. Still, companies in the sector are grossly overvalued in terms of sales and earnings. Plug Power gives hope chart-wise. Nel ASA and ThyssenKrupp Nucera should still consolidate a bit. The pace at Canadian dynaCERT is increasing noticeably, and things should soon get exciting here.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.