July 5th, 2023 | 07:10 CEST

New hydrogen hopes: Nel, ThyssenKrupp and First Hydrogen

Attention Nel and Plug Power shareholders! After numerous hydrogen pure-plays had massively disappointed in the past few years, it was hard to get past the two industry giants. But now new players are coming into focus, like ThyssenKrupp Nucera and First Hydrogen. The subscription period for the Nucera IPO ends today. The eagerly awaited initial listing will take place on Friday. Is the entry worthwhile? Excitement is also mounting at First Hydrogen. Tests of its hydrogen fuel cell commercial vehicles in the UK are going better than expected and could soon lead to larger orders. The Company is also working to build a hydrogen production facility. And what is Nel doing? While the stock is battered on the chart, analysts see more than 50% upside potential.

time to read: 3 minutes

|

Author:

Fabian Lorenz

ISIN:

NEL ASA NK-_20 | NO0010081235 , THYSSENKRUPP AG O.N. | DE0007500001 , First Hydrogen Corp. | CA32057N1042

Table of contents:

"[...] The VERRA certification adds credibility to dynaCERT's emission reduction technologies by demonstrating compliance with internationally recognized standards for carbon emissions reductions and sustainable development. [...]" Jim Payne, CEO, dynaCERT Inc.

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

First Hydrogen too cheap?

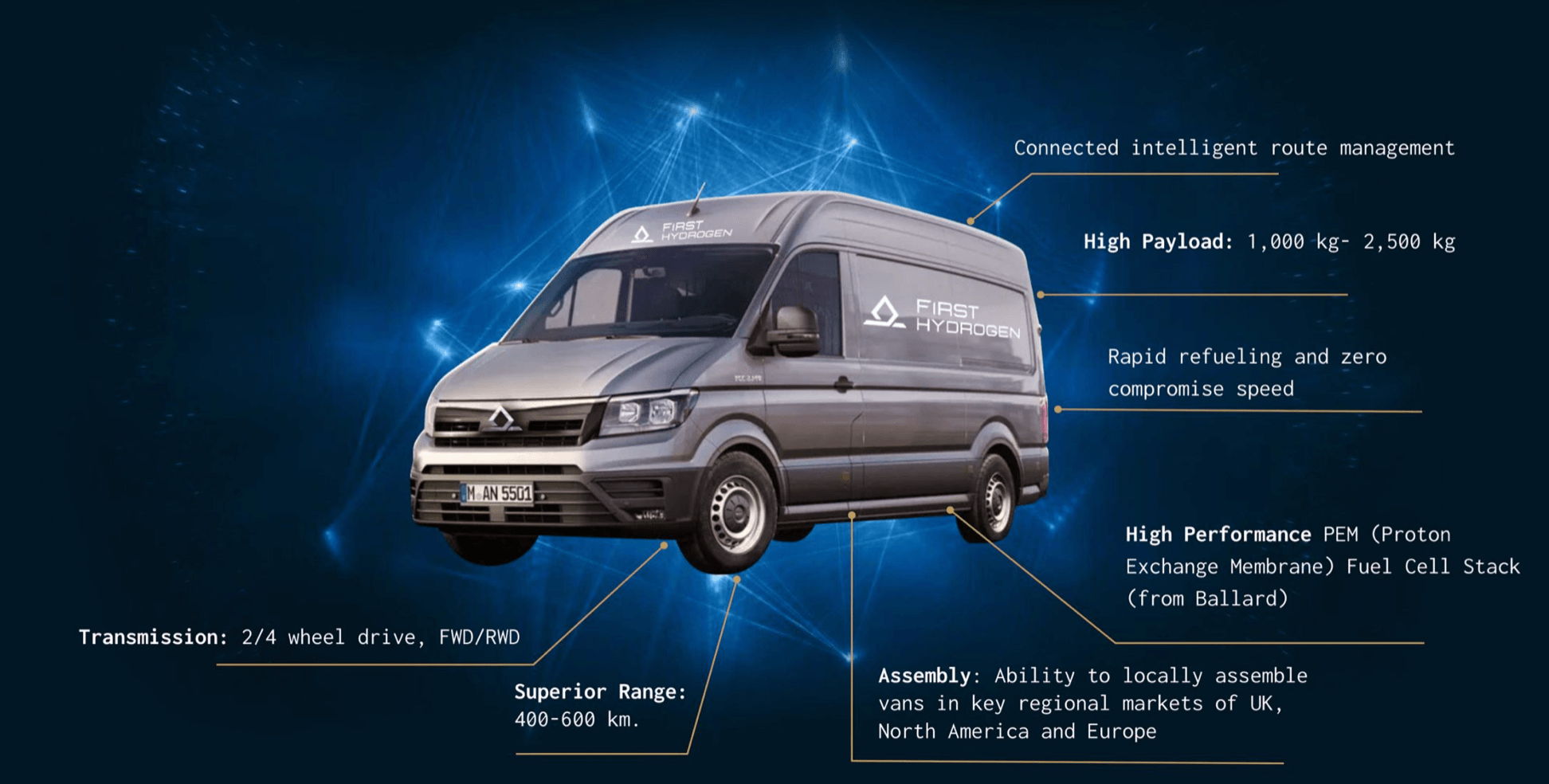

Canada will play an important role in supplying Germany and Europe with hydrogen. This has been shown, among other things, by the visit of Federal Chancellor Scholz and Economics Minister Habeck this year, and this is exactly what First Hydrogen is counting on. The Canadian company is developing hydrogen fuel cell commercial vehicles and plans to build its own production facilities for green hydrogen.

The first-generation hydrogen commercial vehicle is well advanced. And there is positive news: the first series of tests under real road conditions in Great Britain at the fleet operator Rivus went well. Ranges of well over 500 km were achieved. Refueling took 5 to 7 minutes, which is similar to the time required for fossil fuel vehicles. Currently, other fleet operators are starting road tests. As a result, First Hydrogen is tapping into a market worth billions. The experts at researchanalyst.com estimate that the Company could soon be turning over up to EUR 1 billion a year with its commercial vehicles. Currently, the market capitalization is around EUR 100 million. The share price contains significantly less advance praise than, for example, Nel or Plug Power.

In addition, First Hydrogen has been working on building a hydrogen ecosystem since last year. It is currently developing a prototype for a customized refueling system. In the future, First Hydrogen plans to produce green hydrogen in Canada and sell it in North America and Europe. Two properties have now been purchased in the Canadian state of Quebec. A plant to produce up to 35 MW of green hydrogen annually is to be built there. A full update from researchanalyst.com is available here.

ThyssenKrupp in the Nucera hype?

On the sales side, ThyssenKrupp Nucera is already ahead of First Hydrogen, but also on the valuation side. The hydrogen subsidiary of the ThyssenKrupp Group is valued at EUR 2.4 to EUR 2.7 billion in the current IPO. In the first six months of fiscal 2022/23, Nucera increased sales by around 74% to EUR 306 million. EBIT stood at around EUR 13 million. Nucera employs more than 600 people and sees itself as a world-leading technology provider for high-efficiency electrolysis plants. The Company focuses on alkaline water electrolysis, which enables a larger and more centralized production of green hydrogen on an industrial scale.

The subscription period for the new shares ends today. The IPOs will offer up to 30.3 million shares in the price range of EUR 19 to EUR 21.50. As reported by the news agency Bloomberg, the issue price is to be set at EUR 20. The shares are then to be traded on the stock exchange from Friday. The issue price in the middle of the price range indicates that lavish short-term subscription gains are not to be expected. This may well be positive for the medium-term performance of the share. After all, a valuation of around EUR 4 billion was still considered possible some time ago. Nel is currently valued at around EUR 1.8 billion, and Plug Power at around USD 6 billion. Both companies are far from being in the black.

Nel: Analysts see price potential

The share of the Danish hydrogen pure-play is recommended as a buy by RBC. They say the latest order for the construction of 16 hydrogen refueling stations in the US state of California is a positive signal. According to the report, Nel will deliver the hydrogen refueling stations to California before the end of the current year. The order is worth USD 24 million. RBC analysts have a price target of NOK 22. The Nel share is currently trading at NOK 12.60, which means it continues to be battered on the chart. It has been in a clear downtrend since the annual high in February at NOK 18.86. The annual low from last fall is NOK 9.83 and should not be undercut.

Previous investor favourites Nel and Plug Power should certainly not be written off. However, they have often disappointed operationally in the past. Sales growth has been lower than expected, and losses have been higher. Accordingly, it is understandable to look at new players like Nucera and First Hydrogen. The IPO of Nucera does not seem hyped, and the Company is profitable. First Hydrogen is not highly valued at EUR 100 million. If commercialization succeeds in the coming years, then much higher prices are realistic.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.