October 31st, 2024 | 07:45 CET

New gold record at almost USD 2,800 and takeover circus! 1000% chance with Desert Gold

Why are precious metal prices rising so sharply?

For three weeks now, prices for gold and silver have been soaring. Yesterday, the price of gold reached a new record high of USD 2,795. The price is being driven by speculation about falling interest rates and the uncertain outcome of the US presidential election. Among the key price drivers is the speculation on lower interest rates, especially after major central banks like the Fed and the ECB have officially initiated a shift in their monetary policy by lowering their key interest rates. Since gold does not yield any market interest, speculation about further falling financing rates and crumbling government bond coupons automatically leads to higher demand for gold. Then there are the ongoing geopolitical conflicts around the world, which are moving into a new dimension with the attacks and retaliatory strikes between Israel and Iran. The impending election also plays a significant role, with market participants preparing for a potential presidency under Donald Trump, as polls indicate his victory is becoming more likely. Here, too, gold is benefiting from the prospect of an election victory by the former president, as he is likely to massively expand the country's debt due to the announced investments in industry and security, but at the same time, force the Fed to cut interest rates further to make this course of action financially viable. However, since a Trump presidency remains uncertain, the precious metal should have further upside potential in the short term while also experiencing significant fluctuations.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

DESERT GOLD VENTURES | CA25039N4084

Table of contents:

"[...] One focus will be on deposits near the surface. These would be good arguments for a quick production decision using the low-cost heap leaching method. [...]" Brodie Sutherland, CEO, Tocvan Ventures

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Analysts and the World Gold Council expect further demand

In light of the price increase, the industry association World Gold Council (WGC) recorded a nearly 6% increase in demand from 1,252 to 1,313 tons in the third quarter. In its regular report, the association notes that the positive trends in demand should be seen as a hedge against inflation and possible recession risks. Both risks have recently manifested themselves, even though overall inflation is falling slightly. Although no precise price target was given, they assume that the gold price will remain relatively strong and could rise further by the end of the year, particularly if macroeconomic pressure persists or central bank purchases remain stable. In particular, the BRICS countries are increasingly turning their backs on the US dollar and converting their foreign exchange holdings into gold. According to a report by Goldman Sachs Research, the price of the precious metal is expected to rise more sharply than previously expected as central banks in emerging markets have expanded their purchases. Research analyst Lina Thomas has raised her price target to USD 2,900 per troy ounce by the beginning of 2025. A survey among major investment banks yielded a median price expectation of USD 3,150 by the end of 2025.

Desert Gold – More than 1 million ounces in West Africa

Africa has been a continent rich in precious metals and raw materials for several hundred years. There is huge untapped potential in important metals and minerals across the continent. Traditionally, the connection to Western investors is also a guarantee for investments on the continent. The Canadian explorer Desert Gold Ventures has had its sights set on the Senegal-Mali Shear Zone (SMSZ) for several years, where 1.1 million ounces of gold have already been identified near the surface. The current resource should be significantly expanded by ongoing new discoveries, and the report could also document the viability of mining the oxide and transition mineral resources in the Barani East and Gourbassi West gold deposits. This would make low-cost heap leaching production feasible from 2025. A preliminary economic assessment (PEA) is already in progress and will clarify the production details. With the first free cash flow, Desert Gold can put itself in a position to further explore the 440 km2 property. The expansion of the resource is directly linked to an increase in market value.

Industry experts and long-term investors expect a super cycle

There are many indications that the gold and silver sector is on the verge of a multi-year upward cycle. Situations like that of Desert Gold are not new to legendary investors like Ross Beaty or Eric Sprott. They have already been through several cycles and amassed billions in profits. Consequently, they have recently significantly expanded their investments in junior companies. Because in times when the world's largest gold producers, such as Barrick Gold and Newmont, are struggling with stagnating output and rising production costs, companies like Desert Gold Ventures are becoming increasingly important. The reason is that existing mines are losing their best zones, and exploitation levels are declining. In order to keep production levels even close to stable, miners must always ensure that their portfolio includes new mining zones. With a strategic location alongside industry giants such as Allied Gold, Endeavour, B2Gold, and Barrick Gold, along with a license for gold production, Desert Gold Ventures could very quickly become the next takeover candidate.

The takeover fantasy in the sector is increasing

If the gold price continues to soar, the low-priced Desert Gold stock is a leveraged ticket for the commodities portfolio. After all, in the end, it should be possible to get a good price for shareholders by attracting interested parties. With a market capitalization of only around USD 12 million, each ounce of gold in the ground at Desert Gold is currently valued at around USD 10.50. Compared to the current spot price of almost USD 2,800 per ounce, this represents sensational potential. Such a discrepancy in valuation could hardly be more enticing for investors. After all, comparable projects have been sold for between USD 70 and USD 150 per ounce of gold in the ground in bull markets. Assuming USD 100 per ounce as a plausible price, the enterprise value would be at least USD 100 million or CAD 0.65 per share. Based on a market capitalization of just under USD 12 million, this represents a whopping 800% opportunity for speculative investors. At the stock exchange, a good 1 million shares are traded daily, providing an attractive window for positioning or increasing stakes.

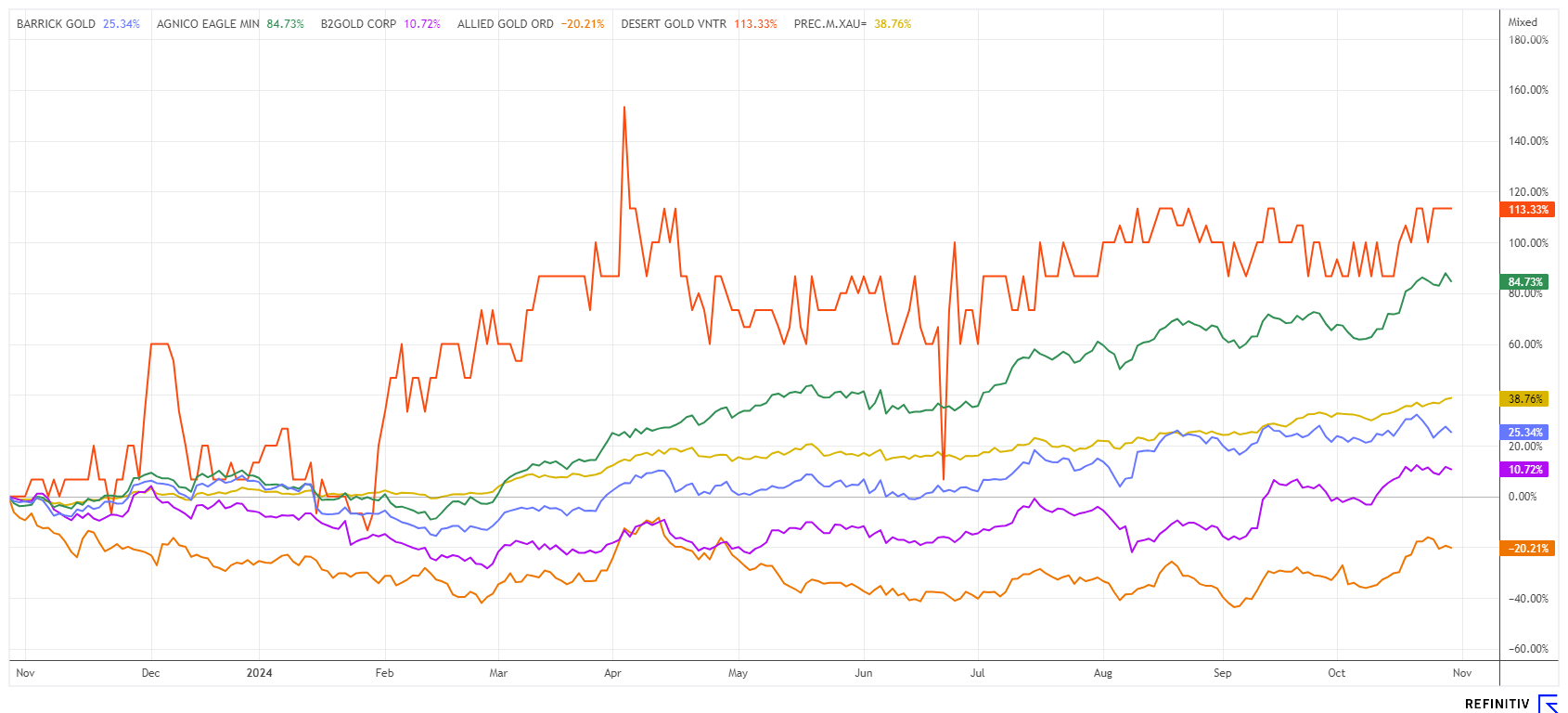

Desert Gold: A high flyer in sector comparison

Precious metal prices have been trending in only one direction for several months: Up! This is causing a lot of turmoil and upward pressure, especially for mining and mine stocks. While producers also have to contend with rising costs, for explorers or juniors, the pure amount of gold in the ground counts. In some cases, there have already been dramatic price increases, but some stocks have also simply been overlooked because of their size. With its properties in Mali, the small Desert Gold share is one of the hottest takeover candidates!**

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.