October 27th, 2025 | 07:10 CET

NASDAQ super bull market continues! Bet on Bitcoin now with Strategy, Metaplanet, Coinbase, Nakiki, and MARA Holdings

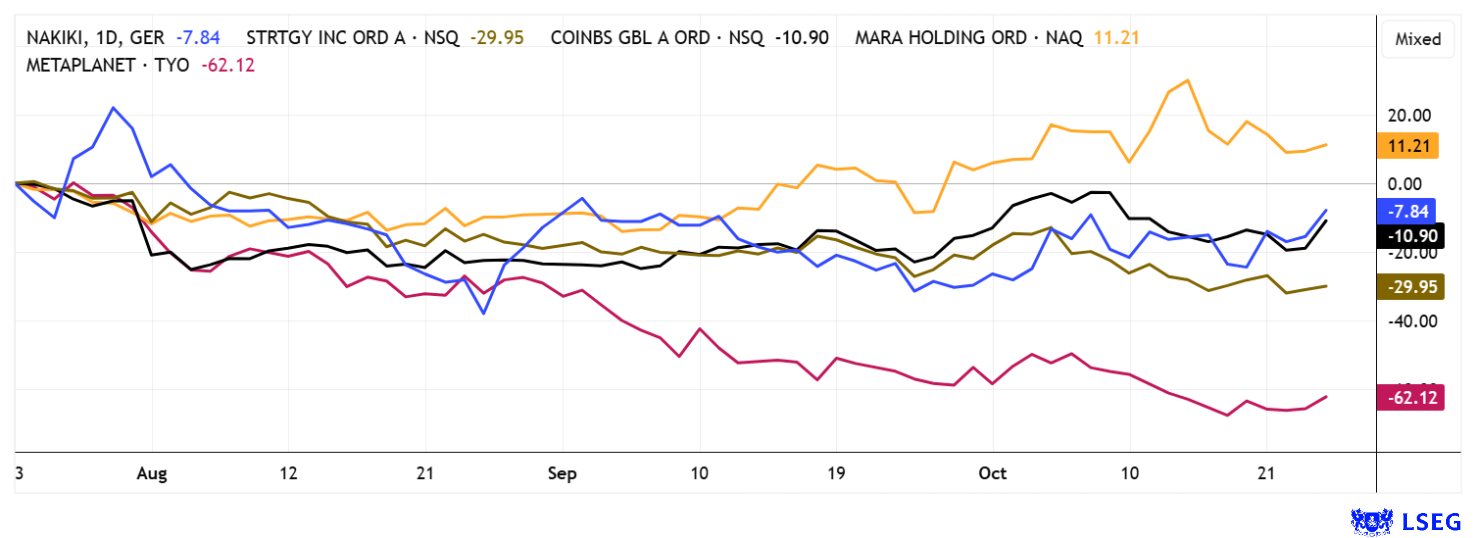

Another volatile week on the stock market is behind us. Once again, the NASDAQ hit a new high of 25,418 points amid much fanfare, with investment banks now predicting price targets of up to 27,500 before year-end! After a strong rebound in AI and tech stocks, the momentum could be sufficient this time, especially since many investors have long since reduced their aggressive portfolio positions. The discussion of the "wall of worry" continues. Meanwhile, the crypto world is once again in the spotlight, now increasingly seen as a "global currency" amid FIAT instability. This perspective cannot be ignored, as the US dollar's purchasing power has fallen by around 70% over the past decade. The focus, therefore, remains on Bitcoin and the companies active in this sector. Here is an overview of the opportunities and risks.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

STRATEGY INC | US5949724083 , METAPLANET INC | JP3481200008 , Coinbase | US19260Q1076 , NAKIKI SE | DE000WNDL300 , MARA HOLDINGS INC | US5657881067

Table of contents:

"[...] Most of all we were on a mission to MAKE CRYPTOCURRENCY ACCESSIBLE [...]" Justin Hartzman, CEO, CoinSmart Financial Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Strategy and Metaplanet – It is not that simple

Michael Saylor, through Strategy Inc., remains the world's largest institutional Bitcoin collector – and he has made another purchase. According to a statement on X, Strategy purchased 168 BTC worth USD 18.8 million last week at an average price of USD 112,051. The increase came during the Bitcoin sell-off on Black Friday, when the price briefly fell below USD 104,000. The Company now holds a total of 640,418 BTC, purchased at an average price of USD 74,010 per coin, for a total value of approximately USD 72 billion. Compared to the massive purchases in the spring, with some exceeding 25,000 BTC per month, the pace has now slowed considerably. At the same time, Strategy shares lost around 12% last month and are now trading at around USD 290. With a market capitalization of only USD 83 billion, the premium to Bitcoin is now manageably small. Not to be forgotten: The Company also has outstanding bonds with a volume of USD 8.2 billion. These must bear interest and will eventually have to be converted or redeemed.

In recent months, Metaplanet has also been in the spotlight, although this has not been to the delight of many investors. After a 1,400% increase since November 2024, the price lost over 80% of its peak value between May and October. The Japanese company, which switched entirely to Bitcoin as an asset instrument in the summer of 2024, now holds 30,823 BTC worth around USD 3.4 billion. The market capitalization of Metaplanet shares corresponds almost exactly to its BTC holdings, meaning the premium has essentially disappeared. Since its last purchase on September 30, Metaplanet has made no further acquisitions, apparently waiting for more stable conditions after the rapid sell-off from the all-time high of around USD 126,000. Both Strategy and Metaplanet have clearly stepped off the one-way street to the top, so investors should carefully do their math. Both companies illustrate how strong the dynamic between institutional accumulation and market volatility remains in the crypto sector. It is not that simple!

Nakiki SE – Successful roadshow in Germany and Switzerland

Bull's eye! With its recent roadshow in Germany and Switzerland, the Nakiki team appears to have struck a chord with the Bitcoin community. The Company was able to transparently demonstrate that investing in a BTC asset manager makes sense for many market participants, especially for those interested in Bitcoin who have been hesitant to integrate this new asset class into their portfolios. With its business model, Nakiki SE handles many of the complex steps in this highly dynamic market segment, from market analysis and timing to meeting all regulatory requirements for BTC processing. New investors in this area appreciated the opportunities that Nakiki SE can offer, particularly with the upcoming issuance of an 8 million bond tailored for those looking to gain exposure to Bitcoin.

It does not matter if the Berlin-based FinTech aifinyo follows a similar path, because competition is known to stimulate business. The sheer number of active participants in this stock market segment also creates the potential for a "self-fulfilling prophecy." Much like the so-called "MAG7" stocks, investments in such aggregates often become a sure-fire success when the community grows steadily. Important: Bitcoin is capped at 21 million units, whereas MAG7 stocks already hold a 12% weighting in global portfolios. This scarcity effect has also influenced Nakiki shares. In the last trading week, the share quickly jumped 20% on solid volume. The 2024 balance sheet is expected to be completed soon, and then things will really heat up. Nakiki SE is still a bargain at around EUR 5 million, but that could change overnight!

At the most recent International Investment Forum on October 8, Bitcoin icon Marc Guilliard and COO Markus Geisbüsch provided an overview of the next steps.

MARA Holdings and Coinbase – Ups and downs here too

If you broaden the universe of the crypto stock market a little further, you come across MARA Holdings and Coinbase. MARA Holdings is primarily active in the field of Bitcoin mining and digital energy infrastructure. The Company generates new Bitcoins by operating energy-intensive data centres that solve complex mathematical problems. The latest report for September 2025 shows that MARA produced 736 new BTC, an increase of 4% over the previous month. Total holdings grew to 52,850 BTC. This makes MARA a highly capitalized player whose value creation depends directly on mining efficiency, energy consumption, and the global hashrate. The Company is increasingly investing in sustainable energy sources, such as wind farms in Texas, to reduce costs and mitigate regulatory risks. The business model is based on converting energy into digital capital, with returns generated from both holding and occasional sales of Bitcoin. The stock remains highly speculative.

Coinbase, on the other hand, operates as a crypto trading platform and financial services provider. The Company generates revenue from transaction fees, custody, staking services, and institutional solutions, rather than mining. Its success depends on trading volume, market liquidity, and regulatory acceptance. Coinbase benefits from high user activity during bull markets, while MARA benefits disproportionately from the increase in value of its holdings during periods of rising Bitcoin prices. Both operate within the same ecosystem, but at different stages of the value chain. While Coinbase builds bridges between traditional financial markets and crypto assets, MARA provides the raw material in the form of newly mined Bitcoin. Together, these models illustrate the vertical integration of the crypto market: from energy and computing power to trading and financial services. A nice roundup for crypto-based stock investing.

A dream scenario is currently unfolding on the stock markets. While tech and AI stocks in particular continue to strive northward, the entire crypto sector is showing volatile sensitivity. This is because the rebound from the new all-time high of around USD 126,000 initially led to a downturn in the crypto asset management sector. This was not the case for the up-and-coming Nakiki SE, which rose 20% in one trading week thanks to a roadshow in Germany and Switzerland. The rally here is likely to continue.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.