March 13th, 2025 | 06:55 CET

NASDAQ crash, inflation, and price shocks – Gold protects! Golden Cariboo, TUI, Lufthansa, and Carnival

Just three weeks ago, euphoria reigned on the markets, with the DAX, NASDAQ and EURO STOXX reaching new heights – now the tech rally seems to be over for the time being. Germany has voted, and a grand coalition must now take charge of the current issues. However, the challenges remain formidable, and exploratory talks are proving correspondingly tricky. It remains to be seen whether a new government will be formed soon. Donald Trump is taking a unique path in the US and is alienating all former allies. He has boldly taken up the cause of resolving the Ukraine conflict – but so far nothing has happened! China is reporting a slump in exports, while in Europe, the debt ceiling is to be relaxed in order to overcome the tough transformation of the modern age. Infrastructure has been neglected for too long, digitization is in its infancy, and now there is a dramatic need for rearmament. This smells like more debt, higher prices, and further currency devaluation - a fertile ground for gold investments, as the precious metal recently reached a new high of USD 2,950 while everything else is falling. What happens next?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

GOLDEN CARIBOO RESOURCES LTD | CA3808134025 , TUI AG NA O.N. | DE000TUAG505 , LUFTHANSA AG VNA O.N. | DE0008232125 , CARNIVAL PLC DL 1_66 | GB0031215220

Table of contents:

"[...] We have built one of the largest land packages of any non-producer in the belt at over 440 sq.km and have made more than 25 gold discoveries on the property to date with 5 of these discoveries totaling about 1.1 million ounces of gold resources. [...]" Jared Scharf, CEO, Desert Gold Ventures Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Gold as protection against inflation – History speaks volumes

Inflationary trends keep the prices of gold and silver high, with gold currently trading at USD 2,915 and silver at USD 32.80, both at 3-year highs. Persistent inflation is fueled by defense spending that did not exist at this level before 2022. For governments, this means high interest rates. Meanwhile, 10-year US bonds are again offering well over 4%, creating alternatives to highly valued equities and making the commodities market a volatile sector. For mining and exploration companies, the current environment is burdened by difficult refinancing, although a supercycle for metals is expected. Meanwhile, however, governments and private individuals are secretly increasing their gold reserves to protect their own currencies, which tend to depreciate when the money supply is constantly increasing. In 2024, several countries were net buyers of gold and significantly increased their gold reserves: Poland, China, India, Turkey, and the Czech Republic were among those highlighted by the World Gold Council. The yellow metal is experiencing a renaissance, and risk-conscious investors can benefit from it!

Golden Cariboo – British Columbia back in 1860

Canada is a country rich in natural resources and is very popular with tourists. The rather peaceful existence of the North American state is currently only being clouded by challenges from Washington. The Trump administration appears to be seeking confrontation with one of its largest trading partners on the continent. In the west lies the province of British Columbia. Its tradition of gold mining goes back to the famous Cariboo Gold Rush of the 1860s when thousands of fortune seekers flocked to the region. Towns like Barkerville were built during the gold rush and became important mining centers before they were largely abandoned after the gold discoveries dwindled. Today, British Columbia remains an important center for gold mining, with active mines such as Brucejack and Red Chris extracting high-grade deposits.

Exploration company Golden Cariboo (GCC) is relaunching the Cariboo Gold Rush by conducting targeted drilling programs on the Quesnelle property. The property is contiguous with Osisko's and extends along the Spanish and Eureka thrust faults, covering 94,889 hectares of land. The Quesnelle quartz-gold-silver deposit was discovered in 1865 in conjunction with placer mining activities and is now back in focus. At the end of February, further exploration results were reported from the focused Halo zone. Drill hole QGQ24-20 intersected 0.71 grams per tonne (g/t) gold with 6.96 g/t silver over 341.96 meters. Subsections of the drill core returned gold grades between 0.99 and 16.35 g/t and silver grades between 9.8 and 164.95 g/t. These intercepts extend the Halo Zone a further 100 meters horizontally to the northwest from previously released hole QGQ24-19. The Halo zone now covers an irregular body measuring approximately 320 meters by 290 meters by 320 meters, which will require further investigation in the future.

CEO Frank Callaghan comments: "Drill hole QGQ24-20 caps off a remarkable year in which we have advanced 100 meters and found another exceptional intersection, confirming the Halo zone as a significant discovery in the Cariboo gold district. Greenstone contact is home to many of the world's best gold deposits, and we have now identified one just 4 km from a major highway and community in central British Columbia. The next chapter of another source of bedrock in the long and storied Cariboo goldfields is now being written in Hixon." In March, the second tranche of a financing of CAD 1.2 million to date was closed. Work is now being consistently continued. The Golden Cariboo stock is currently trading at around CAD 0.13, bringing the 60.3 million shares to a total value of CAD 7.8 million. If the results of the next drilling point in the same direction, the price could quickly go up; at the beginning of 2024, the stock was already at CAD 0.36. Collect!

CEO Fran Callahan in a live interview with Stockhouse at this year's PDAC conference. Click here for the video.

TUI, Lufthansa, and Carnival - Is the travel industry out of the woods?

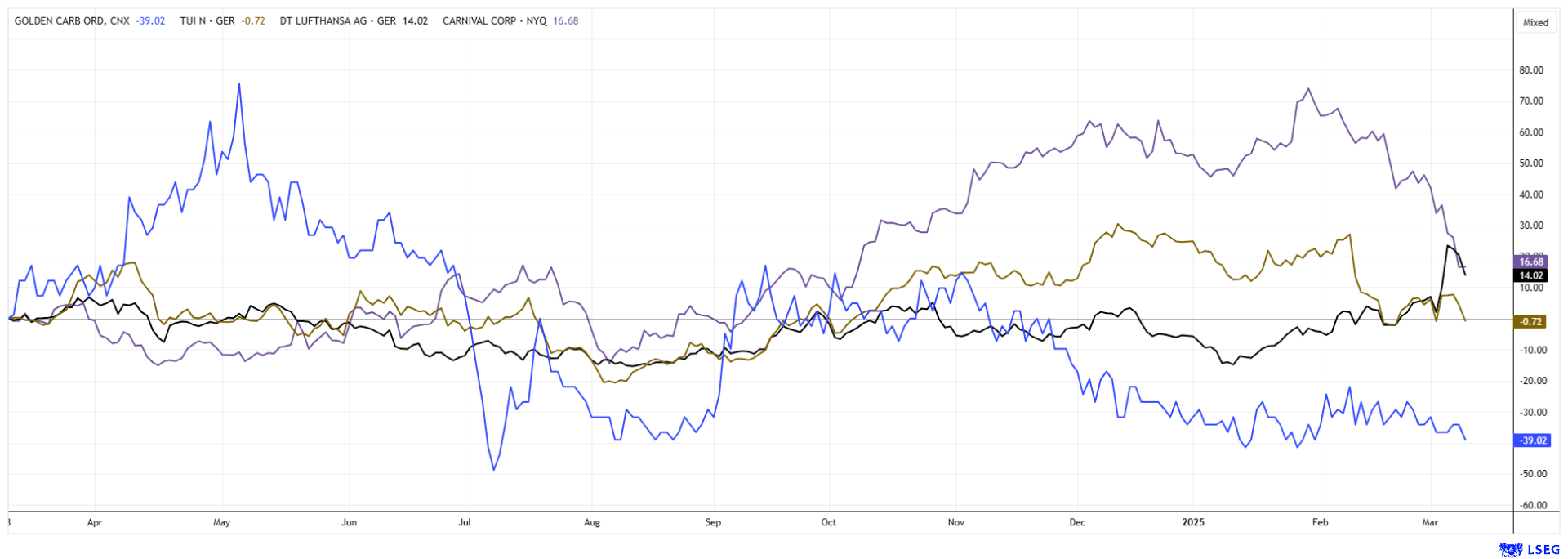

How is the travel industry doing in a highly inflationary environment? While Lufthansa is having major problems with its often striking workforce, tour operators TUI and Carnival continue to grow. Recently, the crane airline reported its figures for 2024. Although they show a new revenue record with sales of EUR 37.6 billion, adjusted EBIT fell from EUR 2.7 billion to EUR 1.6 billion, pushing the operating margin down to 4.4%. Management blamed the many strikes and flight cancellations for the decline in profits. Following the 30% increase in bookings at TUI and Carnival, the sector has returned to pre-COVID levels. However, further pressures are now looming from regulations and rising raw material costs.

The TUI share price rose by almost 60% from mid-2024 to January 2025, while Carnival's share price quadrupled from EUR 6 to EUR 24 in 2023 after a successful restructuring. However, rising inflation and the seemingly never-ending wars are again having a negative impact on the balance sheets. TUI lost 25% in just six weeks, dropping to EUR 6.70, while Carnival experienced a real sell-off, dropping from EUR 24 to EUR 16, as the Company issued another billion-dollar bond. For years, investors have been concerned about the rising debt of the British. The two German providers, TUI and Lufthansa, have largely repaid state aid, and now they are anticipating price hikes of up to 40% for their wealthier clientele. However, in Germany, citizens' budgets continue to shrink as wage increases lag far behind the true cost of living.

Analysts remain skeptical, with the price corrections speaking for themselves. The major Swiss bank UBS lowered its target price for TUI from EUR 8.28 to 8.00 but left the rating at "Neutral". On the LSEG platform, the experts expect a price of EUR 10.30 in 12 months. For Lufthansa, the target of EUR 6.85 is even below the current price of EUR 7.44. Only 4 out of 22 analysts can bring themselves to make a "Buy" recommendation. For Carnival, the experts remain positive and expect 2,150 GBp in 12 months, a premium of a good 60%. The current market technique does not speak in favor of the travel providers. The companies are likely not out of the woods yet.

Leaps of joy on the stock market are a thing of the past. Despite sectoral enthusiasm for defense stocks, technology stocks are shifting into reverse. The current rise in interest rates is a response to the loose fiscal policy of recent years, and now gold stocks are coming back into focus. Golden Cariboo stands out for its high project quality, but its valuation is still very low. In our opinion, tourism stocks should continue to consolidate. Inflation protection with gold – history speaks volumes.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.