April 29th, 2024 | 07:00 CEST

More than 100% with Gold, Bitcoin and Tourism: TUI, Lufthansa, Desert Gold and Deutsche Bank

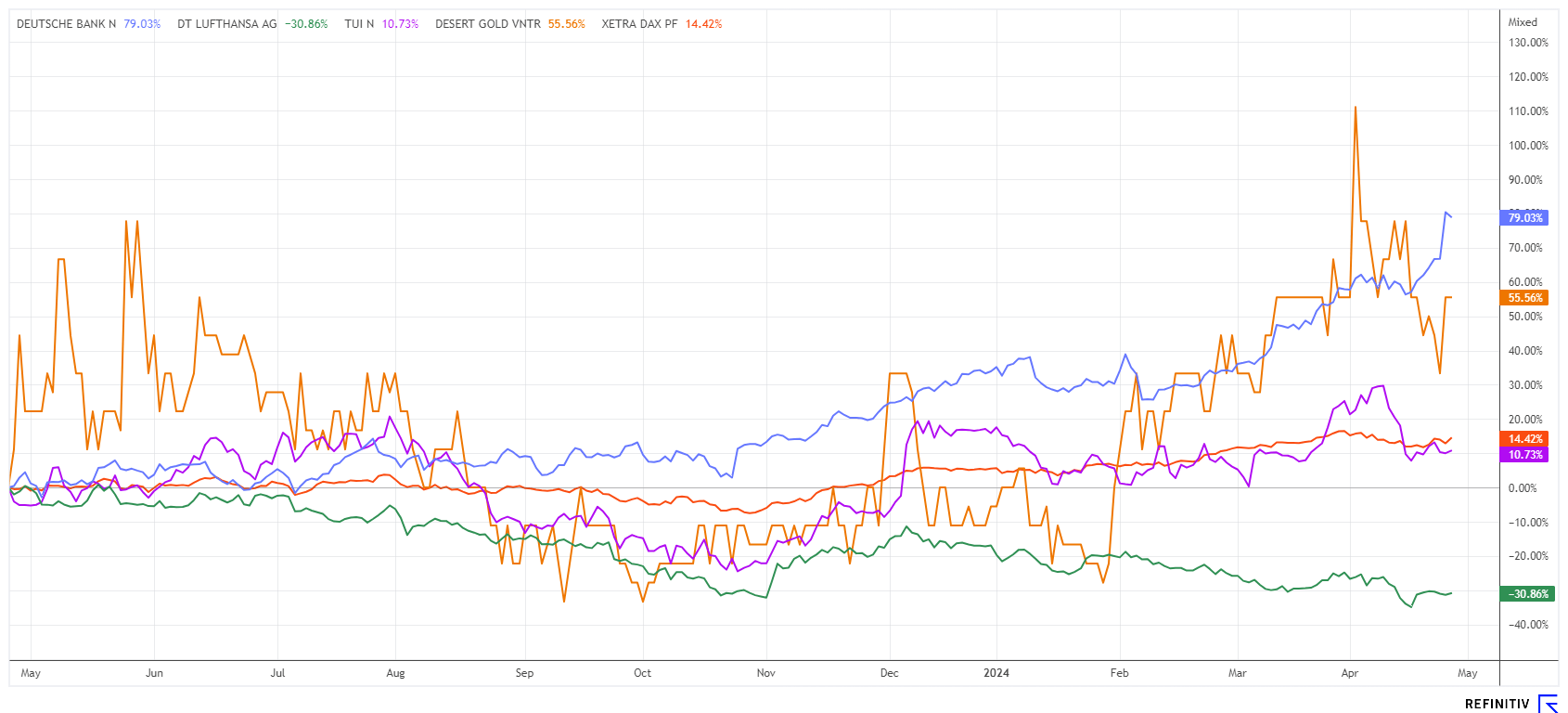

The stock market has already performed very strongly in 2024. The focus has been on the artificial intelligence, high-tech, crypto and defense sectors. Many signs indicate that a sector rotation is imminent in the coming weeks. Precious metals, for example, have already made significant gains, but mining companies are lagging behind. Shares in the tourism sector have been equally subdued so far, although the COVID-related declines in the travel business should have long since been offset. In the financial sector, Deutsche Bank is attracting attention. After Nvidia, Microsoft, Meta and Rheinmetall, where are the next 100-percenters lurking?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

TUI AG NA O.N. | DE000TUAG505 , DESERT GOLD VENTURES | CA25039N4084 , DEUTSCHE BANK AG NA O.N. | DE0005140008

Table of contents:

"[...] We will trigger indirect creation of 1,665 new jobs nationwide, while directly employing 300 staff - 270 operational and 30 administrative. [...]" Dennis Karp, Executive Chairman, Manuka Resources Limited

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Deutsche Bank - Quietly surges 70%

Following the outstanding Q1 figures, there was no stopping Deutsche Bank's share price. Serious cost-cutting efforts and bubbling earnings in the capital market business brought the Frankfurt-based private bank a billion-dollar profit at the start of the year. At the same time, Germany's largest financial institution is bracing itself for further setbacks in the commercial real estate market due to the IT breakdowns at Postbank. Pre-tax profit increased by 10% to a good EUR 2 billion compared to 2023, with shareholders receiving a net profit of around EUR 1.3 billion. "This is the best result since 2013," expressed CEO Christian Sewing enthusiastically.

The image was recently severely tarnished by mishaps at Postbank, which is part of the Group. The transfer of customer business to Deutsche Bank's computer systems last year cut off several 1,000 customers from their accounts. Because the problems dragged on for months, the financial supervisory authority BaFin sent a special commissioner to the bank. According to Deutsche Bank, the chaos at Postbank will likely cost around EUR 100 million. For the year as a whole, the Group anticipates risk provisions of EUR 1.5 billion, which corresponds roughly to the previous year's level. A further 3,500 jobs are expected to be lost in the ongoing transformation.

Broker recommendations went into overdrive after the figures were announced. There are 10 "Buy" recommendations from 21 ratings on the Refinitiv Eikon platform, with an average 12-month price target of EUR 15.60. However, the share price has already exhausted its potential since October with a plus of 70% to just under EUR 17, making Deutsche Bank the clear winner in the DAX 40 index. Our tip: Let profits run and tighten the stop to EUR 14.85.

Desert Gold - Mining giant spotted during site visit

With a price increase of just under 18% this year, gold is in the process of making up for the devaluation of the last three years, confirming the general expectation that precious metals will compensate for the loss of purchasing power over time. However, gold enthusiasts had to wait three years before the highs from 2021 were reached again. Meanwhile, the banks' future forecasts have risen sharply. Last year, the consensus on Refinitv Eikon was USD 2,150, which, in the last 3 months, has increased to USD 2,450 for 2024. In an environment of increasing geopolitical risks, precious metals remain a sought-after haven of security. Central banks have also increased their holdings by an average of 4% in 2023.

Due to the sharp rise in extraction costs in the western hemisphere, major mining companies are increasingly turning their attention to Africa, bringing the raw materials continent more and more into the international spotlight. In addition to gold, there is also huge potential in important metals such as uranium, lithium and copper. The Canadian explorer Desert Gold Ventures is focusing on the Senegal-Mali Shear Zone (SMSZ). The Company owns the mining rights for a 440 sq km area here, where 1 million ounces of gold have already been identified near the surface in the last two years. Surrounded by the mining giants Barrick, Endeavour, B2 Gold, and Allied Gold, Desert Gold's activities are not going unnoticed. With production rates exceeding 800,000 ounces per year, the majors are constantly on the lookout for mine expansions.

Barrick's management was recently spotted at the Desert Gold camp. The doubling of the Desert share price since February could be a reflection of a rapprochement, as turnover has also increased significantly. The Company is currently raising a further CAD 910,000, bringing the total placement volume to CAD 2 million. The proceeds of the financing will primarily be used to complete additional drilling at the Mogoyafara South deposit and the southeast extension of the Barani East deposit. Desert Gold is currently valued at only EUR 10 million, a small amount for Barrick & Co. - a tenfold increase is possible here! The share is also tradable on German stock exchanges, but orders should be placed with limits.

TUI and Lufthansa - Hand in hand into the new tourism year

EUR 6.75 - this was the price quoted for TUI and Lufthansa last week. The first quarter was very bumpy for Lufthansa, as permanent strikes in all sectors, from on-board and ground staff to airport employees and air traffic control, caused a record number of flight cancellations. Due to the large number of cancellations, the remaining aircraft were hopelessly overbooked, and the airline had to dig deep into its pockets again. Customer service clearly fell by the wayside. Finally, all wage agreements have been signed and sealed, and there should be peace until 2026.

**Despite all the joy over the end of the labour disputes, it is not yet certain how well the tourism year 2024 will go because, on the one hand, there are still Corona catch-up effects; on the other hand, high ticket prices and constant geopolitical conflicts are slowing down people's desire to travel. TUI, the world's largest tourism group, announced last week at an investor conference at its headquarters in Hanover that the Group's strategic focus is initially on regaining the trust of investors. In order to achieve this, dividend payments are also to be cut in favor of a more significant reduction in debt in the near future. This also includes the repayment of the last tranche of the KfW loan of around EUR 550 million.

In order to generate stronger growth, the Company plans to invest around EUR 500 million annually over the next few years. A look at the consensus figures reveals a 2024 P/E ratio of 6.7 and an increase in revenue of around 3.5% over the next four years. According to expert estimates, external debt will fall to zero by 2028. TUI AG is on a good course if no new crises hit the balance sheet.

Lufthansa and TUI are currently consolidating somewhat. Weighed down by the strikes and the inflation spikes of the last 3 years, the tourism stocks must first create an adequate margin situation again. But beware: the budgets of German households are leading to lower booking totals; in extreme cases, the number of trips per year will be noticeably reduced. Whether the drastic wage increases can be passed on so easily remains questionable.

After reaching new all-time highs at just under 18,500 points, the DAX has entered a consolidation phase for the time being. This is due to emerging doubts about the central banks' course of interest rate cuts. Tourism stocks are doing well again after overcoming the pandemic. A lot has happened at Deutsche Bank, and the share is on the upswing. However, precious metal stocks are also in focus as inflation continues. Desert Gold is excellently positioned in Africa, and Barrick Gold has obviously already noticed this.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.