June 13th, 2023 | 07:00 CEST

More than 100% with energy storage! Varta and Plug Power curious, BYD and Power Nickel mix up the battery sector!

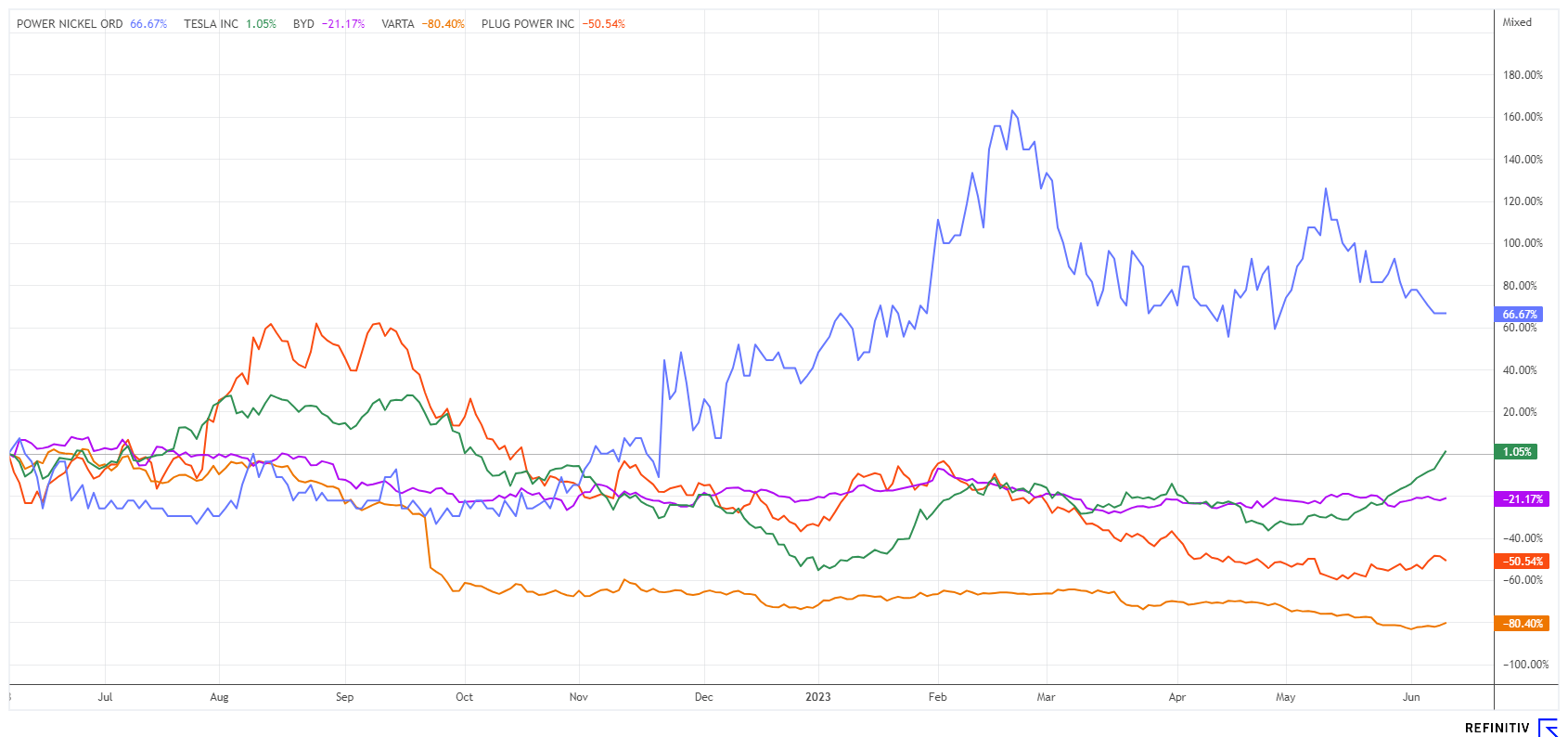

There you go! In the last trading week, Varta and Plug Power turned up the heat and posted a price gain of almost 20%. After a long sell-off, this is the first technical rebound of the Fallen Angels. Long-term investors are wondering if there has been a fundamental change. Momentum traders are not interested in balance sheets, because rising prices attract buyers. We look at the shaken energy storage sector. Are there arguments for a buyback?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

VARTA AG O.N. | DE000A0TGJ55 , PLUG POWER INC. DL-_01 | US72919P2020 , Power Nickel Inc. | CA7393011092

Table of contents:

"[...] Nickel, therefore, benefits twice: firstly from its growing importance within batteries and secondly from the generally growing demand for such storage. [...]" Terry Lynch, CEO, Power Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD - Consistently good sales figures give a boost

The Warren Buffet share "Build Your Dreams" is gaining momentum again. While many carmakers are currently looking to the future with great concern, things could hardly be better for the Chinese company. Last month BYD once again set new sales records. There is no need to delve deep into the fundamentals to understand why. It is mainly due to the cost advantages over the competition, which, despite two major rounds of price cuts, are struggling to gain a foothold in the market.

According to press reports, the "Seagull" model became a sales hit shortly after its release. BYD sold over 14,000 units of the relatively new electric car in May. Equally in demand were the Han and Tang models, both of which are in the price range of EUR 26,000 to EUR 39,000. On average, these prices are 25% lower than comparable Tesla models. European competitors had to cope with further declines of 12 to 18% in the Chinese market in May.

BYD continues to benefit from its vertical integration, which significantly lowers production costs and minimizes procurement risks. While delays in new car orders are to be expected for all manufacturers due to the still difficult supply chain situation, BYD is able to meet its demand well. In addition to CATL products, BYD's in-house Blade Battery is one of the best-selling powertrains in the electric mobility sector. The BYD share is showing renewed strength and is technically trending upwards. After breaking above the EUR 28.50 mark, the next resistance level is at EUR 31. The old high from 2022 is around EUR 42 and thus still 40% away.

Power Nickel - Now it is getting really exciting

An important raw material for battery production is nickel because the white metal is an integral part of common batteries. Up to now, nickel has been used predominantly in the steel industry, but the raw material has recently become increasingly scarce. The transition metal is currently indispensable in electromobility. About 5% of global consumption is used there - with a strong upward trend. The share could rise to 21% as early as 2025. Depending on the scenario, we assume that global nickel demand will increase from around 2.4 million tonnes in 2021 to around 3.4 million tonnes in 2025," explains Michael Szurlies, nickel expert at the Federal Institute for Geosciences and Natural Resources (BGR).

A new supplier of the sought-after metal could soon emerge in Canada under the name Power Nickel (PNPN). The Company's concession area comprises the extensive NISK property totalling 20 km in strike length with numerous high-grade mineralized intercepts. Power Nickel is focused on expanding historically high-grade nickel-copper-PGM mineralization with a series of drill programs. The Company also holds other properties in the Canadian province of British Colombia and Chile. At the end of May, Power Nickel announced some drill results. These indicate up to 1.69% nickel, 0.12% copper, 1.59 g/t palladium and minor mineralization in gold. All assay results will be processed into a new NI 43-101 standard resource estimate by Q3.

The PNPN share is great fun because the market is waiting for high-quality nickel from Canada. Western high-tech producers can thus reduce their dependence on Asia. The current price correction is an opportunity to increase holdings in the stock.

Varta and Plug Power - Strong countermovements at low levels

Now, the mood seems to be turning. For months, the daily plunge in Varta and Plug Power shares has been a joy-fest for short sellers. Last week, however, some insider buying did the rounds and the oversold shares jumped nicely.

Recent reports from Varta's board of directors, Markus Hackstein and Rainer Hald, are striking. Whatever the motivation for these buying actions, it helped the 90 % lower Varta share price to get back on its feet. In the course of the week, the bombed-out battery manufacturer rose from EUR 13.95 to EUR 16.45, an increase of 18%. Of course, there is still no news on the ongoing restructuring process. At the end of May, DZ Bank made the rounds with its "sell" recommendation and a target price of EUR 10. Perhaps this was a bit too much pessimism and immediately mobilized anti-cyclical buyers.

The situation looks even more dramatic for Plug Power. According to the Insider Monkey platform, the shares of the US hydrogen expert are one of the world's most short-sold stocks, with over 20%. Therefore, Market experts expect a violent "short squeeze" if rising prices throw the pessimists out of their rhythm. The first initial blow was enough for a juicy recovery from EUR 7.20 to EUR 9.30. But be careful at the edge of the platform. Fundamentally, the share is still far too expensive with a price-to-sales ratio of 4, and the current positive momentum can quickly turn downwards again.

The development of e-mobility continues at a rapid pace. Technologically, there is currently no way around nickel, but market supply is tight. BYD is well positioned, while Varta and Plug Power are trying to turn things around. The "Canadian" Power Nickel is preparing to take on an important role in the large battery metals market.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.