November 20th, 2024 | 08:25 CET

Missiles for Russia! Returns lurk at thyssenkrupp, Rheinmetall, Almonty, Renk and Hensoldt?

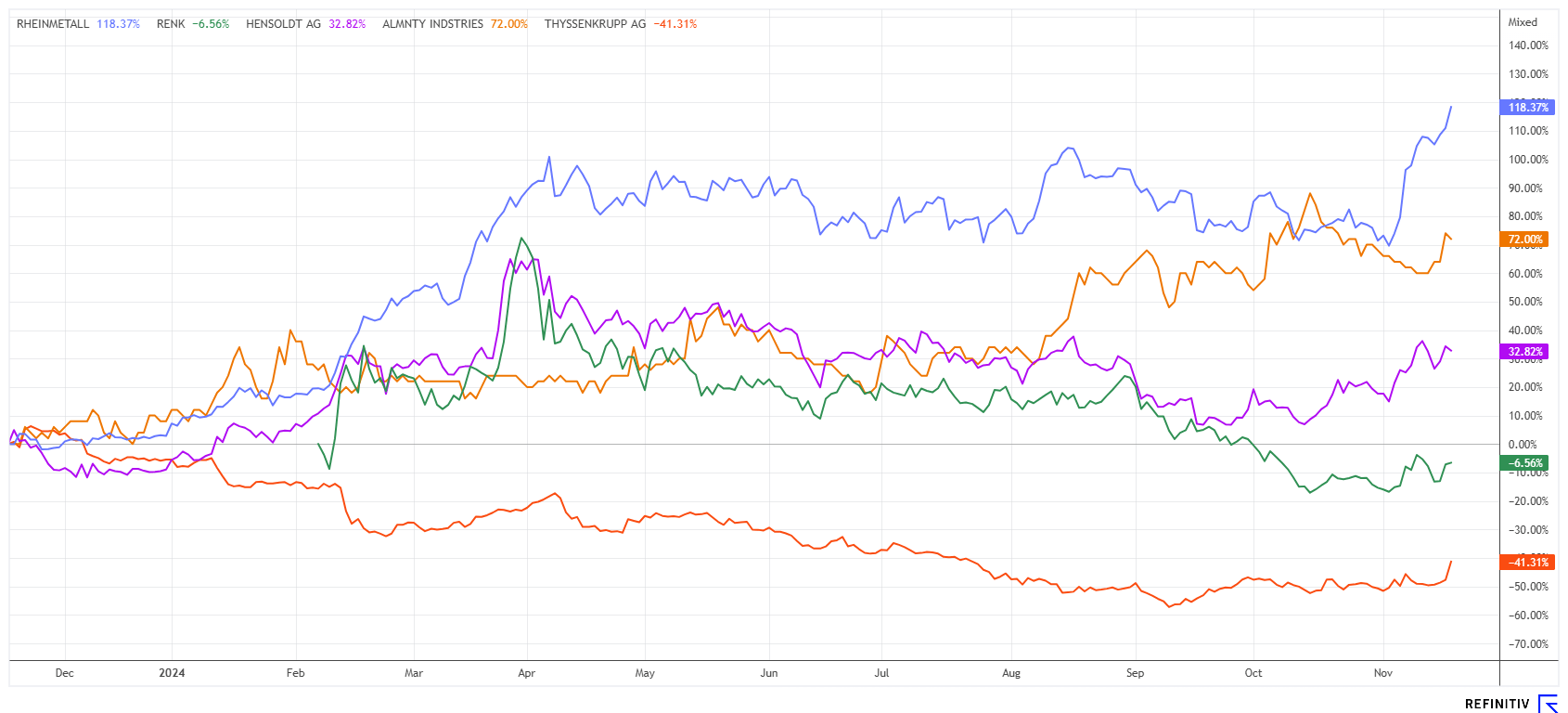

Western missiles for Russia! A new escalation in the Ukraine conflict hits the trading floors of the stock markets, leading to significant losses for the DAX - dropping 400 points in just 24 hours. Portfolios now have to be quickly restructured as armaments are back in demand again. In addition, critical metals are also gaining traction because special elements such as tungsten are also needed to harden ammunition and military equipment. Those who pivot their portfolios swiftly could benefit from rapid revaluations.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

THYSSENKRUPP AG O.N. | DE0007500001 , RHEINMETALL AG | DE0007030009 , ALMONTY INDUSTRIES INC. | CA0203981034 , RENK AG O.N. | DE000RENK730 , HENSOLDT AG INH O.N. | DE000HAG0005

Table of contents:

"[...] While tungsten has always played an important role in the chip industry, it is now being added to batteries for e-cars. [...]" Lewis Black, CEO, Almonty Industries

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

thyssenkrupp – Like a phoenix from the ashes

Although the industrial group thyssenkrupp's figures remain in the red, investors are celebrating the latest restructuring. In addition to holding on to Green Steel, the majority of investors hope for a golden spin-off of the Marine Systems division. Among speculators, this part is already valued higher than the entire group. Yesterday, the Essen-based company reported another billion-dollar loss for the year, with the financial year ending on September 30. Consolidated sales fell by 7% to EUR 35 billion, which was slightly better than expected.

"Significantly weaker demand from key customer industries such as the automotive industry, mechanical and plant engineering, and the construction industry impacted the group's key financial figures in the past financial year," the management announced. The bottom line was a net loss of EUR 1.4 billion, compared with EUR 2 billion in the previous year. Nevertheless, a dividend of 15 cents per share is to be paid. Analysts are still divided. While Baader confirms its "Buy" rating with a target price of EUR 5.40, Barclays is concerned about a low cash position and another transition year in 2024/25. The vote is "Underweight", and the target price is EUR 4.40. We called for a countercyclical entry at EUR 2.92 and are now raising the stop-loss to EUR 3.54.

Almonty Industries – An important link in the chain

Critical metals are an essential component of high-tech and defense technologies. The industry must find a way to secure the supply of these elements. The escalating conflicts in Ukraine and the Middle East, as well as the rapprochement between Russia and China, demonstrate the international complexity. Western industrialized nations are compelled to seek alternatives. A shortage looms for tungsten, especially when large quantities are required, as the rare metal is relatively scarce in the Earth's crust. So far, China accounts for over 70% of global production of this heat-resistant hardening metal. The largest mine outside of China is expected to open next year in South Korea, with investors eagerly anticipating the first oxide output.

The Canadian company Almonty Industries (AII) already operates several tungsten deposits in Europe and is now focusing on the development and revitalization of the South Korean Sangdong mine. Important partners have already been brought on board with Deutsche Rohstoff AG, the KfW Group and Plansee from Austria. Now, the final phase of the development of the flotation processing technology is starting before the installation of the entire complex. The South Korean Ministry of Trade, Industry and Energy (MOTIE) announced at the Korea Local Era Expo 2024 ceremony in Chuncheon that six regions in Gangwon Province have been designated as special industrial zones. Among these zones is Yeongwol County, home to Almonty's Sangdong mine. This designation supports the county's strategic focus on critical minerals and provides some tax breaks, subsidies and infrastructure improvements to encourage industry-specific growth. As a responsible participant in the special zone, Almonty, on the other hand, is committed to sustainable practices, minimizing environmental impacts and working with the local community. It should be ensured that the expansion of the Sangdong mine is aligned with regional development objectives.

"We are very pleased with the commitment of the national and local governments to support our project with a state-of-the-art materials complex near Sangdong," said Lewis Black, CEO and Chairman of Almonty Industries. "This appointment and the planned industrial complex underscore the strategic role of the Sangdong mine as part of the South Korean plan to ensure a stable supply of critical minerals needed by South Korean industry." Almonty's shares are currently trading at around CAD 0.88, bringing the 258.6 million shares to a total market value of CAD 226 million. The valuation is a no-brainer in view of the upcoming start of production next year. We expect a rapid multiplication in the stock.

Rheinmetall, Renk, or Hensoldt – Back at the top

The German defense sector is getting down to business. Rheinmetall has now gained a good 15% in just 2 weeks, Hensoldt follows with a roughly 10% increase, only Renk is languishing just above the recent lows at around EUR 18.50. At least the title has now been able to jump back over the EUR 20 mark; however, the Augsburg-based company was still trading at just under EUR 28 in the summer. Yesterday, Rheinmetall reported an expected doubling of revenue to over EUR 20 billion by 2027, with an operating margin of 18%. The Company is thus growing into the stock market's already high valuation. It marks a historic development for the German military technology leader. The key drivers of this growth strategy are market entry in the US and a new joint venture with the Italian defense giant Leonardo. These partnerships have secured Rheinmetall access to key markets, enabling it to benefit from the increased defense spending of NATO countries. Chart-wise, Rheinmetall has now broken through the resistance at EUR 580. Hensoldt and Renk appear to be only in the spotlight to a limited extent but are benefiting from the general industry trend. Those who recently bought Rheinmetall in the area of EUR 470 can now simply set the stop-loss just below the breakout line, for example, at EUR 578. Exciting!

Defense stocks are now at the top of investors' buy lists following the missile strikes involving Western military equipment. A further escalation is anticipated, which will further drive the war machinery and its operational landscape. In the strategic metals space, Almonty Industries should be a clear outperformer over the next 12 to 24 months, especially with the upcoming mine opening in South Korea.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.