November 10th, 2025 | 07:30 CET

Mental mobilization! The EU places orders with Rheinmetall, Hensoldt, Antimony Resources, thyssenkrupp, and TKMS

With Russia stepping up attacks on Ukraine's energy infrastructure, parliamentarians in Brussels are realizing that only swift and decisive action can help close Europe's major security gaps. This means trillions in investments in defense technology and intensified Europe-wide cooperation. There is no room for hesitation or tactical maneuvering; funds must be saved elsewhere in order to protect the continent from potential aggression from the East. Time is short because by 2027, Europe aims to have a credible level of defense readiness. Investors can participate in this trend through carefully selected defense stocks. We cannot make the choice for you — but we do have a few ideas.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , HENSOLDT AG INH O.N. | DE000HAG0005 , ANTIMONY RESOURCES CORP | CA0369271014 , THYSSENKRUPP AG O.N. | DE0007500001 , TKMS AG & CO KGAA | DE000TKMS001

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

TKMS and thyssenkrupp – A good example of rapid success

With the successful IPO of TKMS on October 20, thyssenkrupp's naval subsidiary took an important step toward independence. Existing shareholders benefited from a spin-off dividend at a ratio of 20:1, with 49% of the new shares going into free trading. The parent company retains 51% of the shares, securing a strategically valuable asset worth more than EUR 5 billion. The spin-off has eased the burden on the balance sheet, reducing both the debt and pension pressure that thyssenkrupp has been under in recent years. At the same time, the revenue guarantees for the new subsidiary, amounting to around EUR 10 billion, have been restructured, strengthening the credit rating of the entire group.

While TKMS shares are now trading steadily between EUR 70 and EUR 85 after an initial jump above EUR 100, the value of the parent company's shares fell to around EUR 9 as a result of the spin-off. Shareholders therefore had to accept a short-term discount, even though the Company will emerge stronger from the reorganization in the long term. Parallel to the capital market story, TKMS is making a mark operationally: The Company announced an order to supply state-of-the-art HMS-12M mine hunting sonars to the German Navy. The systems will be installed on a total of ten MJ332-class vessels and are intended to modernize the national fleet technologically. With the integration of the new three-frequency sonars, the navy will be able to detect mines both in the water and on the seabed with much greater precision, significantly increasing operational safety in international waters. Production will start early so that retrofitting can take place during regular shipyard intervals. This will ensure the fleet's operational capability until at least 2040. Industry experts see the order as proof of TKMS's innovative strength. Within the Company itself, the lines of communication are now so short that the mobilization sought by Berlin is actually possible. In the long term, investors should be able to benefit solidly from the growth scenario of the new TKMS share. At present, the share price still appears to be ambitiously valued.

Antimony Resources – Canada's answer to the global raw materials shortage

Although China's export restrictions on strategic metals are now having a more moderate impact on the Western world due to Trump's recent trade agreements, the pressure to develop domestic mining sites remains enormous. This is because the desire for independence from Far Eastern geopolitical games is putting the spotlight on domestic raw material deposits. Shares in Canadian exploration company Antimony Resources clearly caught the attention of dynamic investors in October. However, even CEO Jim Atkinson must have been surprised by the 200% surge in just five trading days.

Antimony, a critical metal for electronics, defense, and battery technology, is currently controlled by China, Russia, and Tajikistan (over 90%), but the high-grade Bald Hill antimony project in New Brunswick offers a strategic response. Canada is a region that offers excellent infrastructure and year-round drilling opportunities. The first phase of drilling covered 3,150 m, with stibnite mineralization at high grades of up to 14.91% Sb over 3 meters discovered in 75% of the drill holes. These results confirmed the historical estimate of up to one million tons at approximately 4-5% antimony content. In September, the Company commenced the second drill phase with a target scope of at least 6,000 m to extend the known ore zones to the north and south while filling gaps for the calculation of an initial resource. Incoming results show an extension of the main zone by more than 100 m and confirmed mineralization to a depth of 400 m, significantly increasing the potential of the deposit. In addition, a second mineralized zone was discovered to the southeast, further investigation of which suggests a larger contiguous system. The Bald Hill mineralization consists of massive stibnite veins and breccias that run open-ended in all directions in several zones over a strike length of more than 700 m.

With the release of the NI 43-101 Technical Report on November 4, Antimony Resources was able to nearly double its previously known potential figures. The report now indicates a possible tonnage range of 2.7 million tons at grades of 3% to 4% Sb, corresponding to 81,000 to 108,000 tons of antimony contained. These values are based on a new 3D model created by Orix Geoscience, which identified four coherent mineral zones and confirmed the geological context of the entire system. CEO Jim Atkinson emphasizes that the latest drill results have exceeded expectations. The Company, therefore, believes it is on track to present an initial resource estimate in the first quarter of 2026. With a still modest market capitalization of around CAD 20 million and growing geopolitical relevance, Antimony Resources offers early positioning in a reopening key market - the current consolidation provides an excellent entry point near the 50-cent mark.

Rheinmetall and Hensoldt – Knocked down, but back on their feet

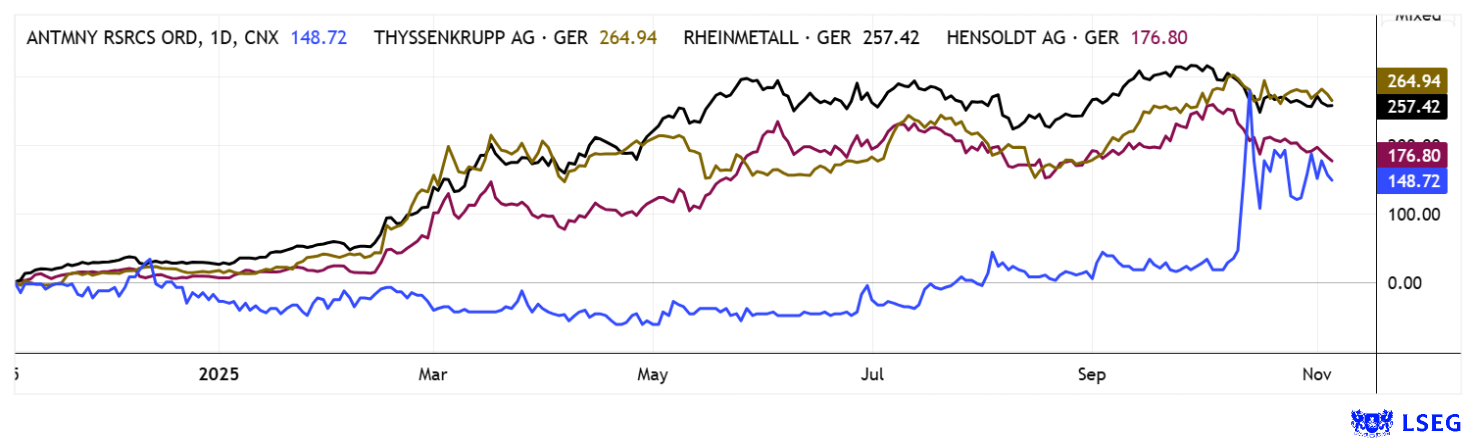

As we reported in recent issues, German defense stocks Rheinmetall and Hensoldt have hit their ceiling somewhat with their highs in 2025. As reported, the subsequent consolidation came as no surprise and led to a 20% decline in Rheinmetall to around EUR 1,660 after a record high of EUR 2,005. The 2027 P/E ratio has at least eased to 25.5 in this wave, while the P/S ratio is still a respectable 4. Hensoldt experienced a somewhat more severe decline. The high was at EUR 117.60, while last week's levels around EUR 85 bring the 2027 P/E ratio to 32.5 and value the Company at 4.5x sales. Analysts attest to both companies' ability to grow into their current valuations. In the short term, however, investors should be prepared for further consolidation – especially if ceasefire negotiations in Ukraine become a realistic scenario. According to public analyses, there is strong order momentum and significant growth potential over the next 3 to 5 years, which will be financed largely by European taxpayers and new debt. Defense is now seen by investors as a welcome growth sector in an otherwise shrinking economy. Welcome to the new world!

Global tensions are making security and commodity sovereignty the new investment logic. Antimony Resources stands at the intersection of geopolitical necessity and industrial progress. Together with established defense stocks, the Company forms a peer group with a strong strategic setup. Those betting on geopolitical trends should diversify across the entire security and raw materials complex.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.