September 25th, 2023 | 08:35 CEST

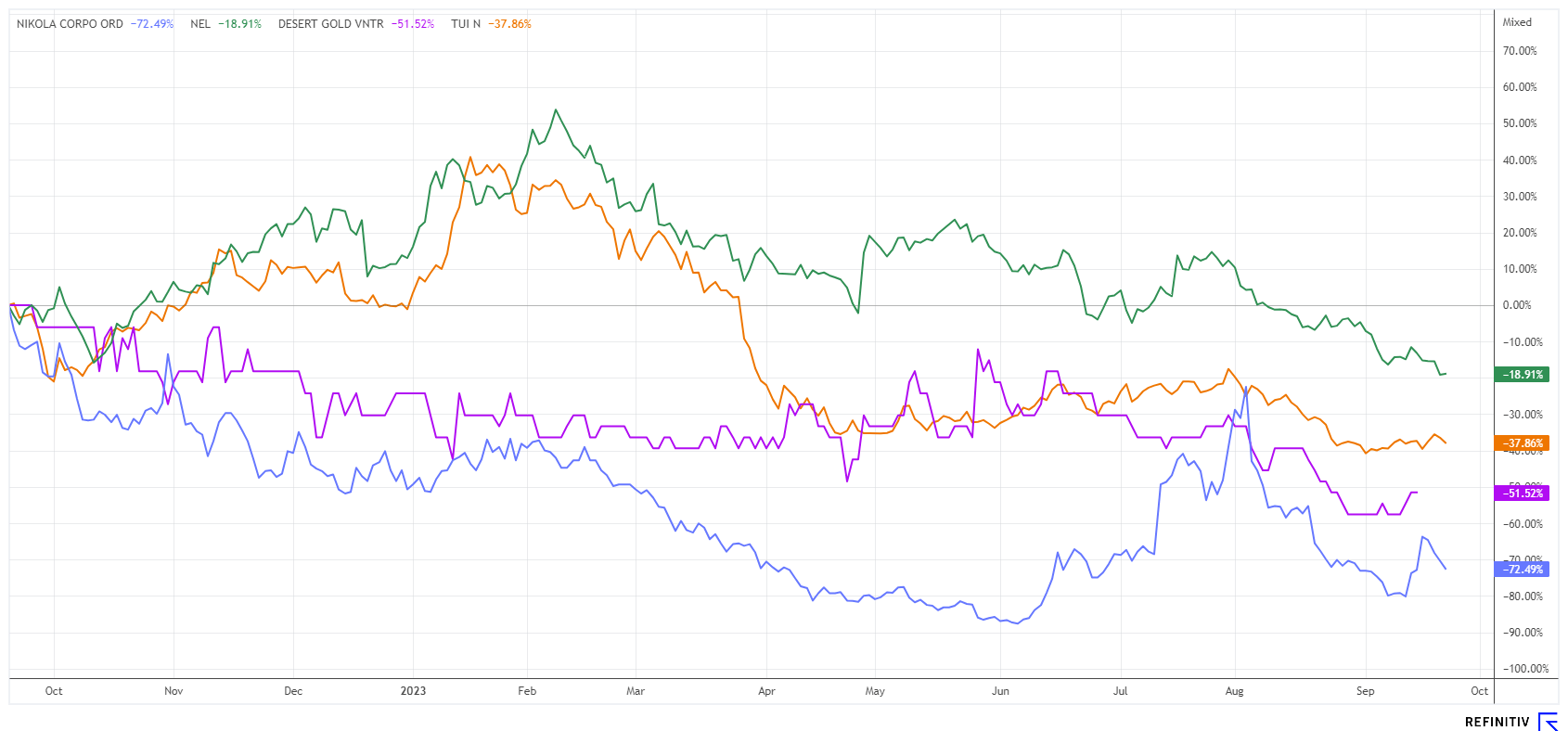

Make a return instead of sitting on the sidelines! Nel ASA, Desert Gold or Nikola Motors - Who belongs on the buy list?

Despite the bull market, the hydrogen sector is feeling the global investment slump, not to mention precious metals. Once again, the US Federal Reserve has issued warnings on the inflation front, but this time, after 11 consecutive hikes, it has not turned the interest rate screw. The refinancing rate remains at 5.5%, but the accompanying wording has greatly unsettled the markets. Capital market rates shot up, reaching a whopping 4.55% for 30-year US Treasury bonds - the highest level in 10 years. We take a look at values that have fallen sharply. Where can adequate yields be expected?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , DESERT GOLD VENTURES | CA25039N4084 , NIKOLA CORP. | US6541101050

Table of contents:

"[...] The processes in Namibia are predictable and the country itself is very safe. [...]" Heye Daun, President and CEO, Osino Resources Corp.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nel ASA and Nikola - Overvaluations take their toll

Recently, the shares of Nel ASA came under significant pressure as stop-loss sales followed the breach of the EUR 1.00 mark at the beginning of September. Fundamentally, the Norwegians can report rising orders, but since the share has been considered overvalued for some time, the selling pressure is correspondingly high. There are two reasons for this: The Company does not expect to generate profit until 2026, and current sales for 2023 are valued at a factor of 9.5. With a market capitalization of approximately EUR 1.5 billion, it is by no means cheap, so the stock only provides an appropriate playing field for momentum speculators.

The share price of Nikola Motors is even higher. As if by magic, the shares of the electric-hydrogen truck project company shot up from EUR 0.50 to EUR 3.00 in just 7 weeks. After another sell-off to EUR 0.70, there are increasing rumors that Nikola has mandated a distribution partner for North America in the form of ITD Industries. However, whether the first functional, alternatively powered truck will still roll off the production line in the fourth quarter of 2023 remains questionable. New hopes are emerging for shareholders, as H2 trucks are not affected by the large-volume, heavy batteries of their all-electric counterparts. The extreme volatility in the NKLA stock will likely continue, and the still high short interest is certainly supportive.

TUI - The booking wave is not over yet

TUI was unable to save the recently observed share strength into the weekend. But there was further support from analysts. The unconvinced experts of the broker Jefferies changed their vote after the initiated balance sheet restructuring from "Underperform" to "Hold". They significantly changed the price target from EUR 2.10 to a full EUR 6.10. The keen observer is always surprised how so-called DCF models can bring about such sharp changes in assessment. In an environment of continuously rising interest rates, these so-called valuation gaps sometimes arise very quickly. When the operational outlook turns positive, the present value of future cash flows can change rapidly and violently. This creates the need for adjustments.

Operationally, TUI is performing better again. Although bookings are still below pre-pandemic levels, the revenue level is already within reach again due to strong price increases averaging 27%. Management also expects the excellent booking situation to extend from summer into fall and winter. Evidently, inflation-stressed households prefer to book one more vacation before rising living costs force them to stay home. On the Refinitiv Eikon platform, there are now 6 buy recommendations with an average price target of EUR 8.75, about 60% above last week's closing price. The lows at EUR 5.30 should be history for now. Buy a few shares below EUR 5.70 on weak days!

Desert Gold Ventures - Waiting for the big swing in gold

Despite rapidly rising inflation and correspondingly high capital market interest rates, precious metals are currently showing little of their value-preserving characteristics. Gold has been bobbing along for months relatively listlessly in the range of USD 1,880 to 1,950. North American commodity experts speak of a grossly "oversold market". Some figures support this statement because, over a period of 125 years, the gold to S&P 500 ratio is 0.44, which is rarely seen. The long-term average of this ratio is 1.66; the highest level was reached in 1981 with a factor of 6. If we use 1.66 as a benchmark, gold should be about USD 7,200. It is hard to imagine today what that would mean for mining stocks large and small.

A good opportunity is currently offered in West Africa. Because of ongoing political conflicts, listed companies have been given risk discounts. The Canadian explorer Desert Gold Ventures (DAU) is searching for precious metal deposits in Mali. Mali has experienced two consecutive military coups since 2020 and is, therefore, in a politically uncertain situation. Operationally, however, Desert Gold's operations in the Senegal-Mali Shear Zone (SMSZ) have not been affected. The mining operations of Barrick, B2 Gold and Allied Gold, known in the immediate vicinity, are also running at full speed. In the medium term, their pressure to further expand their resources increases; thus, Desert Gold's 440 sq km property comes into focus. With a market cap of just under CAD 8 million, Desert Gold Ventures is worth a second look. The major mining companies have certainly already unpacked their binoculars. However, due to market tightness, orders should be limited.

**The major indices are now also prone to profit-taking. Just a few weeks ago, the DAX 40 index and the NASDAQ were setting new records. The air is now somewhat out due to the summer season, and the sharp rise in interest rates continues to create uncertainty. Hydrogen-related stocks still appear to be overvalued, but it might make sense to consider speculative positions in TUI and Desert Gold.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.