June 2nd, 2025 | 07:05 CEST

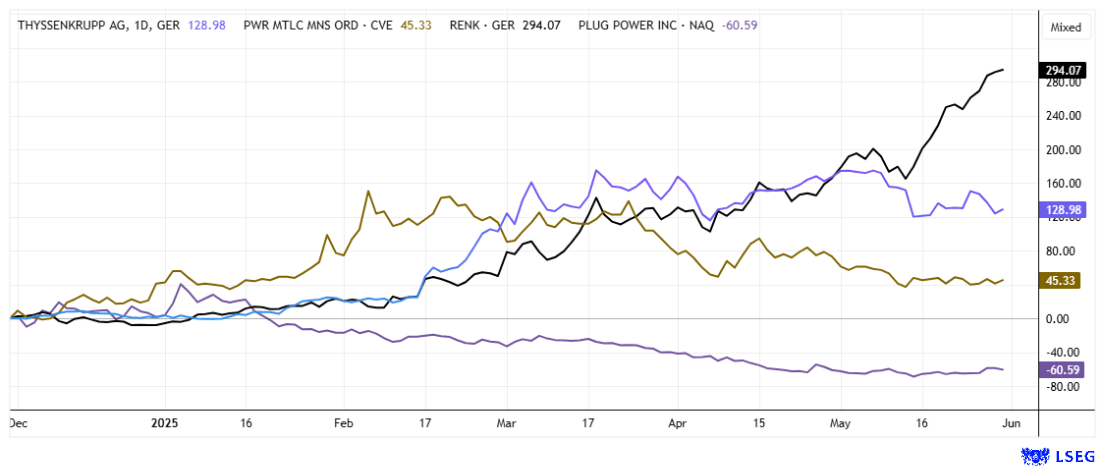

Madness: New tariffs - no, yes, or maybe not? Trump moves thyssenkrupp, Power Metallic, RENK, and Plug Power

The stock markets have rarely seen such volatility. At this point, there are multiple shifts in direction on every trading day, triggered by the latest headlines from the White House. Last week was almost entirely about tariffs, with Putin's war and Trump's peace promises already forgotten. The world continues to live in uncertainty due to the prevailing war scenario, with no stone left unturned. This environment makes it clear: secure supply routes for raw materials will be essential in the coming period. In the defense industry in particular, metal shortages could become a showstopper. Investors can benefit from the current trends through careful selection as Western industrialized nations are stepping on the gas. Where are the big return generators hiding?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

THYSSENKRUPP AG O.N. | DE0007500001 , POWER METALLIC MINES INC. | CA73929R1055 , RENK AG O.N. | DE000RENK730 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

"[...] Nickel, therefore, benefits twice: firstly from its growing importance within batteries and secondly from the generally growing demand for such storage. [...]" Terry Lynch, CEO, Power Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

thyssenkrupp – Restructuring creates value

When considering metals in Germany, one inevitably ends up at the industrial conglomerate thyssenkrupp. The more than 130-year-old company, headquartered in Essen and Duisburg, has been undergoing restructuring for several years but still consists of five core divisions: Steel, Materials, Automotive, Decarbonization, and Marine Systems (TKMS). Due to the poor performance of the steel division, the IG Metall union currently expects the loss of up to 20,000 of the nearly 100,000 jobs. Investors are calling for a breakup of the Company. The breakup story is not new to the stock market, but with the spin-off of TKMS at the end of the year, it is now gaining momentum again. As a result, the share price has already risen by 86% over the past 12 months despite the poor economic situation. The first half of the year went better than investors had expected. The Company achieved a noticeable turnaround in EBIT from minus EUR 156 million to plus EUR 291 million. And thyssenkrupp is sticking to its outlook for the full year of adjusted EBIT between EUR 0.6 and 1.0 billion. Many analysts see significant value creation in the Company's breakup. The experts at Baader maintain a "Hold" rating with a price target of EUR 8, and Deutsche Bank takes a similar view with a target price of EUR 9. This is not much of an increase on the current price, as the high level of debt is calling for tough decisions. The positive news: as a defense stock, the Duisburg-based company is now back on many buy lists. The revaluation could therefore continue.

Power Metallic Mines – The next attempt begins

Canadian raw materials explorer Power Metallic Mines is in high demand in the context of critical metals. Over the past 12 months, the stock has staged a phenomenal rally from CAD 0.60 to CAD 1.95. The reason: its largest properties are high-grade multi-metal resources that are attracting the attention of industrial producers amid increasing geopolitical instability. The aim is to secure supply chains to meet the rising demand in the coming years. This is because demand from the high-tech and defense sectors is increasing the need for raw materials many times over. North America, in particular, is trying with all its might to break away from its dependence on Far Eastern regimes. Power Metallic Mines is working its way forward step by step and plans to publish a feasibility study in the near future. More than 100,000 meters of drilling will be used for this purpose. The excitement is building!

In an interview with the Ellis Martin Report at the end of May, CEO Terry Lynch once again highlighted the enormous potential of the properties owned by the Company. With Quebec, the explorer is located in one of the best jurisdictions imaginable, with 50% of drilling costs available as tax credits, excellent infrastructure, and outstanding relations with the First Nations. CEO Lynch notes that good drilling results have already been achieved, but "the best drilling is yet to come." The ore body indicates a potentially massive deposit. A unique triangle relationship between nickel, copper, gold, and PGEs often characterizes the world's most valuable mining operations. Based on the initial copper-nickel mineralization, Lynch believes that huge, as yet unquantified nickel tonnages could be discovered here.

CEO Lynch advises investors to prepare for a major revaluation of the mining sector in the near future, and with good reason. Well-funded projects with active drilling are at the forefront. Power Metallic has raised over CAD 100 million in new capital over the past 12 months. That is enough to make a big difference! The PNPN share has consolidated to as low as CAD 1.05 over the past three months – one is unlikely to get the stock any cheaper than this.

RENK Group – Too much of a good thing

The Augsburg-based specialist gear manufacturer RENK is a good example of how imagination can bear fruit. When financial investor Triton floated the first shares at EUR 16, the price rose by over 100%. The value then consolidated again to below EUR 20. Recently, however, imagination has run wild again because, in addition to a revenue increase of over 25% in 2025, the Company is now also expected to grow organically. In the context of NATO's rearmament, the order situation is so large that new capacities are needed. The sector was shaken up again last week by the call from the German Armed Forces Inspector General Carsten Breuer for the military to be upgraded in preparation for a possible Russian attack on NATO territory by 2029 and by the increasingly slim prospects of a ceasefire in Ukraine. The research firm Jefferies recently left its rating for RENK at "Buy" with a target price of EUR 60. Experts on the LSEG platform see an average target price of EUR 56 in 12 months. On Friday, the Augsburg-based company's share price reached over EUR 80. With a 2025 P/E ratio of 58, shorting is likely not a bad idea either. A normalization downwards to EUR 15 to 25 should bring the overbought chart back into balance in the medium term!

Plug Power – Hard work on the turnaround

The hydrogen sector has moved in the diametrically opposite direction. The Donald Trump administration vehemently denies climate change, so fossil fuels remain on the agenda. Further investments in hydrogen as an alternative are only expected as part of the packages already approved by Biden. After three multi-billion-dollar capital increases and a more than 90% drop in its share price, Plug Power saw a technical bounce of 15% last week. The Company announced that it had achieved the highest monthly production of liquid hydrogen in the US to date at its facility in Georgia. 300 tons of the coveted gas were delivered in April. This marked a new milestone in the industry for Plug. The charismatic CEO Andy Marsh emphasized the commercial viability of his business model and explained that the Georgia plant was delivering "real hydrogen at real scale" and was not just a pilot project but a source of commercial H2 production. Nevertheless, investors' doubts remained, causing the news to fizzle out fairly quickly and the share price to fall sharply again on Friday. The all-time low of EUR 0.63 is now 20% away. The stock is only suitable for speculative investors with a green streak!**

**The search for safe jurisdictions will remain a defining feature of commodity investments. North America, with its endless resources, is the focus here. Under Trump, mining permits are now being issued more quickly, and Canada is also speeding up the process in many areas. Defense stories such as thyssenkrupp and RENK thrive on stable supplies. Power Metallic is a top property that could be launched in the next few years.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.