October 26th, 2023 | 14:25 CEST

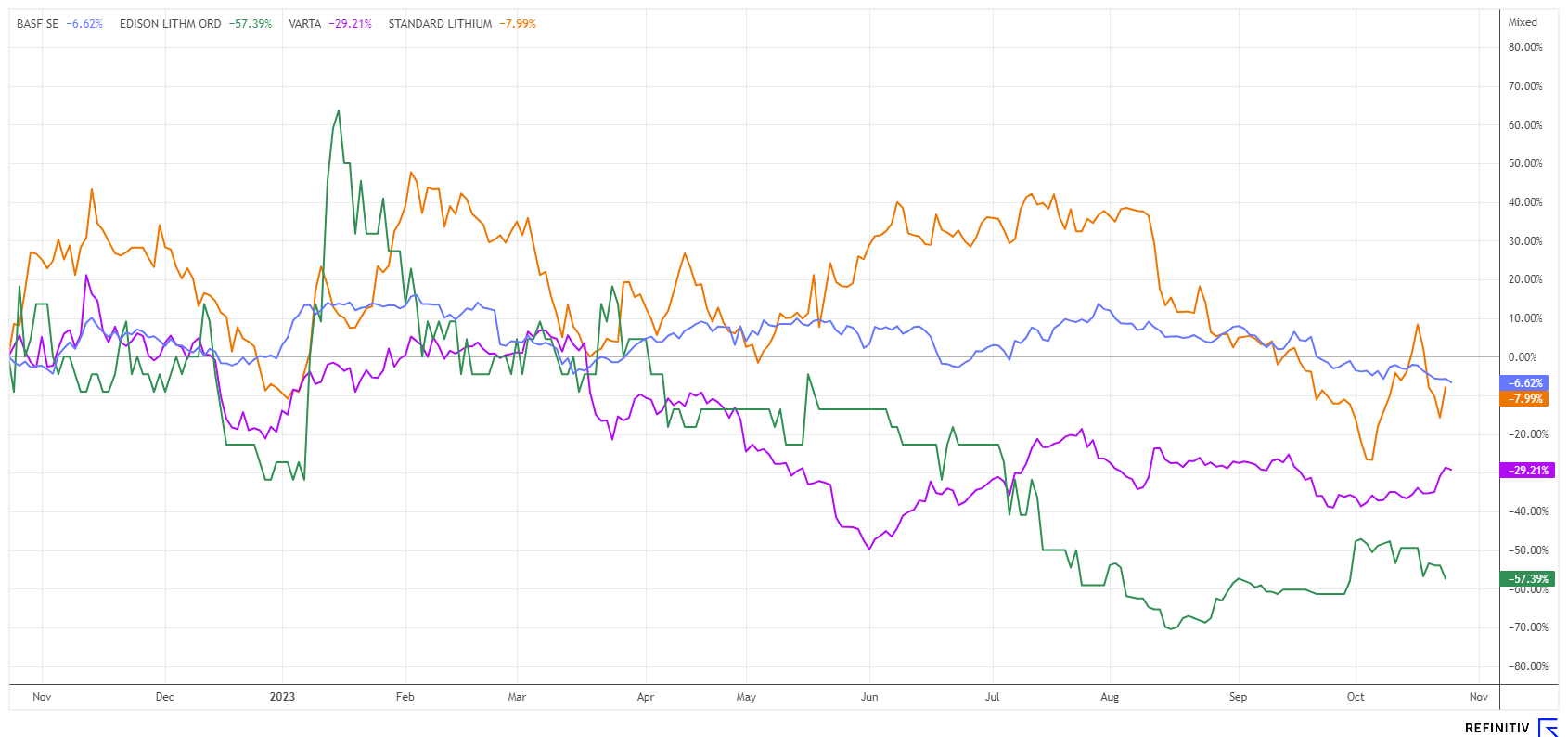

Lithium: The million-ton question! BASF, Standard Lithium, Edison Lithium, Varta - The Top List for 2024

Lithium-ion batteries are the most widely used battery type for electric vehicles and stationary energy storage. Estimates vary widely, but by 2025, we will need between 500,000 and 850,000 thousand tons of lithium, but in 2022 only 130,000 tons were produced. Against the backdrop of continued high global demand for e-vehicles, many high-performance batteries will be needed. Four gigafactories are currently being built in Europe, and the demand seems enormous. Each auto manufacturer has its own sourcing strategy, but there is currently a problem on the supply side because not every raw material is easy to obtain. Lithium is one of the most essential raw material components of a battery, along with nickel, cobalt, graphite and copper. Prices across the battery segment are under pressure due to the approaching economic downturn. What should investors look out for now?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BASF SE NA O.N. | DE000BASF111 , STANDARD LITHIUM LTD | CA8536061010 , EDISON LITHIUM CORP. | CA28103Q2080 , VARTA AG O.N. | DE000A0TGJ55

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BASF - The top dog in battery materials

The Ludwigshafen-based chemical giant BASF is the top dog among battery material producers. As the global market leader in various areas of chemical precursors, BASF has launched a sustainable value chain for battery materials. In addition to environmentally friendly production, recycling used batteries is also on the agenda. After all, electromobility is one of the key technologies that reconciles the global desire for individual mobility with the need to reduce local exhaust emissions. This is especially true when renewable energies are used. At the heart of this development are advanced technologies to limit emissions, which BASF is launching in cooperation with automotive companies. Extensive framework agreements are in place with CATL, the world's largest battery supplier, to achieve global climate neutrality targets. However, production conditions in Germany have become difficult due to energy intensity. High local prices are putting pressure on margins, so BASF is making its next mega-investments of over EUR 10 billion in China.

Currently, the Ludwigshafen-based company's figures are on a downward trend. BASF has had to issue increasingly smaller profit warnings to the market in the last 9 months; it should be exciting next week, on October 31. BASF will then report on the third quarter of 2023. Analysts expect average earnings per share of EUR 0.366, with a full-year projection of EUR 3.50. At prices around EUR 40, the market capitalization is just half the estimated sales of almost EUR 73 billion. 25 experts rate BASF shares on the Refinitiv Eikon platform. There are only 6 buy recommendations, and the average price target has gradually decreased from EUR 56.70 to EUR 49.10 in the last 12 months. The current poor economic development could once again weigh on the results. On a 2-3 year horizon, BASF's P/E ratio is already well into single digits, with an estimated payout of 7 to 8%.

Edison Lithium - Lithium and Cobalt in the Portfolio

Global lithium production is still limited to a few states. The white metal mined in Australian mines amounted to a volume of 61,000 tons in 2022. This means that the fifth continent produces the largest share of lithium globally. Taken together, Australia and Chile alone account for around 80% of international mine and brine production and thus currently play a key role in determining the supply of the coveted raw material on the global market. In addition to these two countries, other countries have significant resources and economically recoverable reserves, including Argentina. The South American country is already the fourth largest lithium producer in the world. Despite the current economic crisis with inflation of over 140%, the government intends to further increase its efforts to improve infrastructure and investment conditions. In the current presidential election, the left-liberal Economy Minister, Massa, is well in the running. He is expected to do well in the mining sector.

Argentina has vast lithium deposits, which come from salt pans or salt lakes and are processed by means of evaporation methods. The Canadian lithium and cobalt explorer Edison Lithium Corp. has a land area of 148,000 hectares in the Antofalla Salar and Pipanaco Salar geological zones. Geophysical surveys indicate the presence of a potential brine zone with a thickness of at least 300 meters. In addition, Edison owns the prospecting rights of the Kittson Property, with cobalt deposits totaling 4,440 hectares in northeastern Ontario. To continue drilling, the Company has now made a private placement at CAD 0.12 and raised CAD 480,000. The current 14.5 million shares add up to a market value of CAD 2.9 million. A bargain among listed lithium stocks with great potential.

Standard Lithium and Varta - Not out of the woods yet

US-based Standard Lithium owns two interesting large projects in Arkansas. The stock is one of the lithium blockbusters from 2021, with over 1000% performance. However, that former luster is now gone. Arkansas also has to face the realities of the lithium market. A recently published feasibility study shows an investment requirement of USD 365 million for the current construction project. After all, production is expected to last 25 years and ultimately yield 5,400 tons of lithium carbonate. The Phase 1A project, located at specialty chemicals company Lanxess' El Dorado site, is expected to be North America's first commercial direct lithium production facility. The share price is probably a bit scared of the huge capital requirement and has dropped 40% since July 2023. At CAD 3.60, there are technically only minor supports at CAD 3.00. **In the now-beginning tax-loss season, the share should see its lows. Additionally, it is still unclear how the financing for the planned mine will be secured.

Investors eagerly await clear signals from the German battery expert, Varta, regarding when the ongoing cost-cutting measures, in place for over 10 months, will lead to significantly reduced expenses. After several profit warnings, analysts at Refinitiv Eikon have agreed on a sales target of EUR 814 million, but Varta is not expected to report profits again until 2025. It is tragic, considering that Varta AG was once valued at almost EUR 10 billion and now, at EUR 19.40, carries a market capitalization of only EUR 850 million. On the positive side for newcomers, the technology stock is now valued at a price-to-sales ratio of only 1.1. Should the figures improve in the medium term, the long bottoming out between EUR 17 and EUR 22 should also end abruptly. Investors should pay close attention to the remarks of the new CEO, Markus Hackstein. He will report on the third quarter on November 14. In conclusion: Observe and consider getting involved when momentum picks up!

**If experts are to be believed, the lithium market is directing itself into an absolute shortage situation. However, this scenario has not yet hit the markets due to the current poor economic situation and many geopolitical upheavals. Nevertheless, investments in e-mobility and energy storage should pay off in the long run. BASF and Varta are waiting for the fundamental turnaround. Standard Lithium and Edison Lithium are suitable stocks for the next commodity upside speculation.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.