August 27th, 2025 | 07:10 CEST

Let off some steam! Caution advised for DroneShield, RENK, and Hensoldt - but opportunities at Pasinex

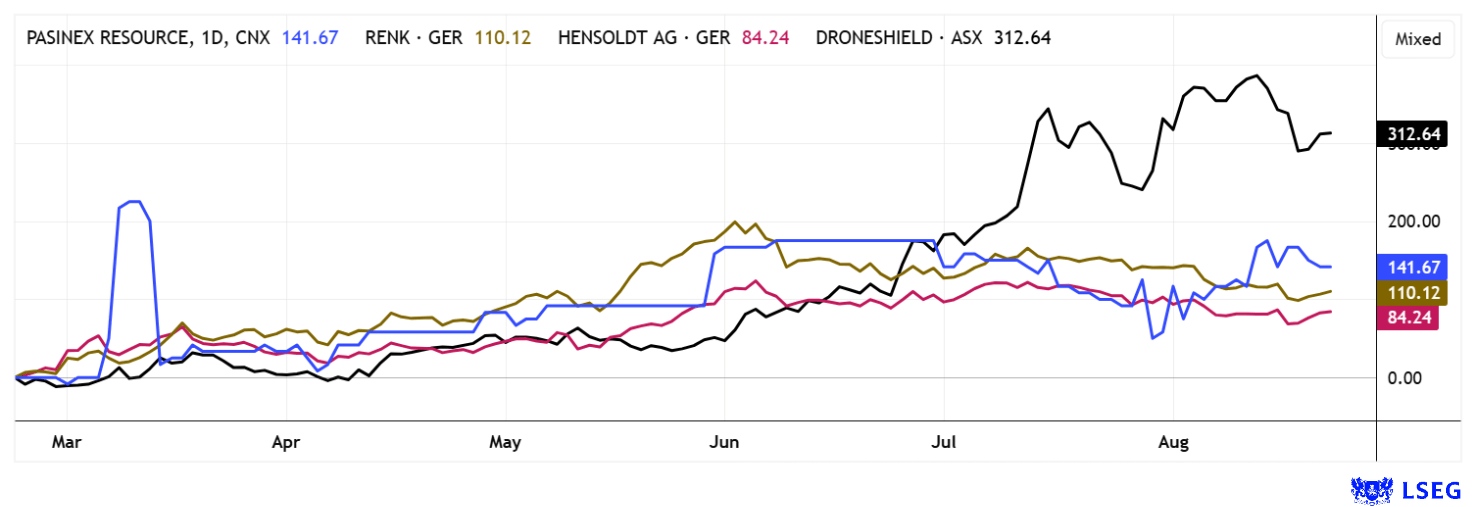

The stock market is entering a correction phase. For overheated stocks in the high-tech and defense sectors, this is a welcome opportunity to let off some steam. Now it is important to put the long-term prospects into perspective against the short-term hysteria. Doing so reveals where it may be worth buying after a correction. The charts are only just starting to rise, and a stronger correction should follow. In this context, the zinc projects of Pasinex Resources appear to be particularly attractive. As always, a balanced portfolio protects against unpleasant surprises. We present a few ideas.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

DRONESHIELD LTD | AU000000DRO2 , RENK AG O.N. | DE000RENK730 , HENSOLDT AG INH O.N. | DE000HAG0005 , PASINEX RESOURCES LTD. | CA70260R1082

Table of contents:

"[...] Boron is one of the most versatile elements in the whole world! Everyone reading this text regularly uses hundreds of products that depend on boron. [...]" Tim Daniels, CEO, Erin Ventures

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

DroneShield – Pay attention to the chart analysis

Today's drones are highly sophisticated, autonomous systems equipped with AI and complex sensors that have long gone beyond classic remote-controlled models. They are gaining importance in both civilian and military applications. Global tensions are driving rapid growth in demand for innovative defense solutions. DroneShield is considered an international trendsetter in drone defense and offers a wide range of products, from stationary systems to mobile jammers, which ensure the protection of airports and critical infrastructure. With locations in Australia and the US, as well as a strong development department, the Company is steadily expanding its global presence.

A massive jump in revenue in the second quarter of 2025 underscores the growth potential. Revenue of around AUD 39 million represents an increase of 480% over the previous year. By the end of 2026, annual production capacity is expected to rise to around AUD 2.4 billion thanks to investments of AUD 500 million. At the same time, locations in Europe are also being expanded. The share price is on a clear upward trend as a result of strong key figures and strategic expansion. Since the beginning of 2025, the share price has more than quintupled, but since July, the value has been stagnating. Although analysts consider further price increases possible, the short-term market technology is pointing dangerously downward.

Pasinex Resources: Zinc as a key metal for the future of energy

In the mobility transition, car manufacturers are investing billions in advanced battery technologies. As a result, not only lithium but also zinc is increasingly becoming the focus of many industries as an essential metal of the future. Zinc plays a key role in sustainable mobility and infrastructure. In emerging battery technologies such as zinc-air and zinc-ion systems, the metal is being researched as a cost-effective and safe alternative and impresses with its environmental compatibility. The use of galvanized steel in lightweight vehicle bodies is growing, further increasing demand for zinc.

The International Energy Agency sees zinc as a critical raw material for the upcoming global transformation to a CO₂-free economy in the coming years. Market experts therefore predict a very dynamic demand for zinc through 2030. According to recent studies, the global market could grow to up to USD 64 billion, with zinc products and chemicals in particular scoring well in the renewable energy, construction, and automotive segments. Its growing importance is also evident in sustainable architecture and new electronics, where zinc is becoming indispensable in sensors, cables, and paints.

At the same time, supply is becoming more scarce as existing mines are being phased out and the development of new deposits is becoming increasingly challenging. This is precisely where Pasinex Resources comes in and presents its initial plans. The Canadian zinc specialist is focusing on high-grade deposits in Turkey, where ore grades of 25 to 50% outperform the competition. The Company benefits from low production costs, rapid market entry, and an impressive operating margin of up to 50%. New projects such as Pinargozu and Serakaya are about to begin production and promise rapid revenue streams. Thanks to fresh financing and targeted exploration, Pasinex occupies a niche in the critical raw materials market. With manageable leverage, investors can bet on zinc prices and global growth through 2030. The market capitalization is still manageable at just under CAD 10 million! Collect!

Pasinex Chairman Dr. Larry Seeley presented at the 15th IIF Investor Conference. He spoke about high-grade deposits and significant margins in zinc mining. Watch here!

RENK and Hensoldt – The expected correction is taking its course

The German defense sector currently appears overbought and significantly overvalued. RENK, for example, has a 2026 P/E ratio of 32, with estimated revenue of approximately EUR 1.6 billion reflected three times over in the market value. Hensoldt also tops the charts with its key figures, with a 2026 P/E ratio of 40 and a P/S ratio of 4. Historically, such exaggerations are quite common. Sharp price increases are often followed by unstable transition phases—known as top formations—where momentum fades and volatility rises. In the values mentioned, further increases are not characterized by new highs, and demand is significantly lower than sales activity. In other words, the air is becoming extremely thin at the top, and the market is just waiting for a clear short signal. We do not yet know what that might be, but every investor can currently sell at favorable prices of around EUR 59 or EUR 89 without pressure. The experts on the LSEG platform expect average 12-month price targets of EUR 69.20 and EUR 91.50 for RENK and Hensoldt, respectively. Both stocks have recently been significantly overbid, so caution is advised!

The short-term outlook for high-tech and defense stocks remains uncertain. Investors who are still sitting on strong gains should consider taking profits, as current valuations are already pricing in ambitious growth expectations through 2030. Operating results may struggle to keep up with these elevated share prices. DroneShield, for example, is trading at a projected price-to-sales ratio of 10 for 2026. However, the projects of zinc explorer Pasinex Resources are exciting in view of future supply gaps in the commodities market.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.