January 16th, 2023 | 15:22 CET

Last Generation in Lützerath - Greentech shares jump! Siemens Energy, Auxico Resources, JinkoSolar, and Nordex in focus

Fossil energy supply is becoming increasingly uncertain and is a red rag for the "Last Generation". What is currently happening in Lützerath could become a blueprint for Germany's energy problems in the future. The political loss of the supplier and raw material giant Russia creates a dangerous undersupply, especially for Central Europe. Due to the mild winter, gas reserves are still abundant, but public pressure is on the industry. Production processes must become more sustainable, even if this initially increases costs in the short term due to necessary investments. In the long term, however, this will sustainably renew the German industrial landscape and make it much more competitive again. Which Greentech stocks should you keep an eye on?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

SIEMENS ENERGY AG NA O.N. | DE000ENER6Y0 , AUXICO RESOURCES CANADA | CA05334L1094 , JINKOSOLAR ADR/4 DL-00002 | US47759T1007 , NORDEX SE O.N. | DE000A0D6554

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

JinkoSolar - Analysts fuel the New Year rally

Solar panels remain the focus of investment in the climate protection sector. While their production is not exempt from CO2 emissions, they still save vast amounts of greenhouse gas over their 20 to 25-year lifespan. Zones with plenty of hours of sunshine are, therefore, ideally suited for building entire power plants. Spain alone now accounts for 56% of Europe's solar power production, while Germany is in second place with 33%.

JinkoSolar Holdings Co., Ltd. is one of the leading suppliers of panels and wafers to Europe. In the third quarter, the Company reported sales of around 10,850 MW of solar modules and cells, a 3% increase on the previous quarter and a whopping plus of 117% YOY. Due to upward price adjustments, sales increased by almost 128% YOY and reached the equivalent of USD 2.74 billion. Adjusted net income was USD 60.1 million, after a loss in the second quarter due to COVID restrictions and power shortages.

Currently, analysts are again looking positively at the solar specialist. Roth Capital recently upgraded the stock from Neutral to Buy with a new price target of USD 70 after USD 50. The Jinko share consolidated in 2022 to EUR 42 and has risen by over 30% year-to-date. Experts assess the 2023 P/E ratio in consensus at about 9, so the stock is no longer expensive and tempting to enter.

Auxico Resources - A source for critical metals

All green and high-tech products contain a certain amount of rare earths. As the name suggests, they are relatively rare and are mainly found in China, where they can also be mined profitably. However, because of their supply dependence on Beijing, Western industrialized countries are developing strategies to bring other suppliers to the market.

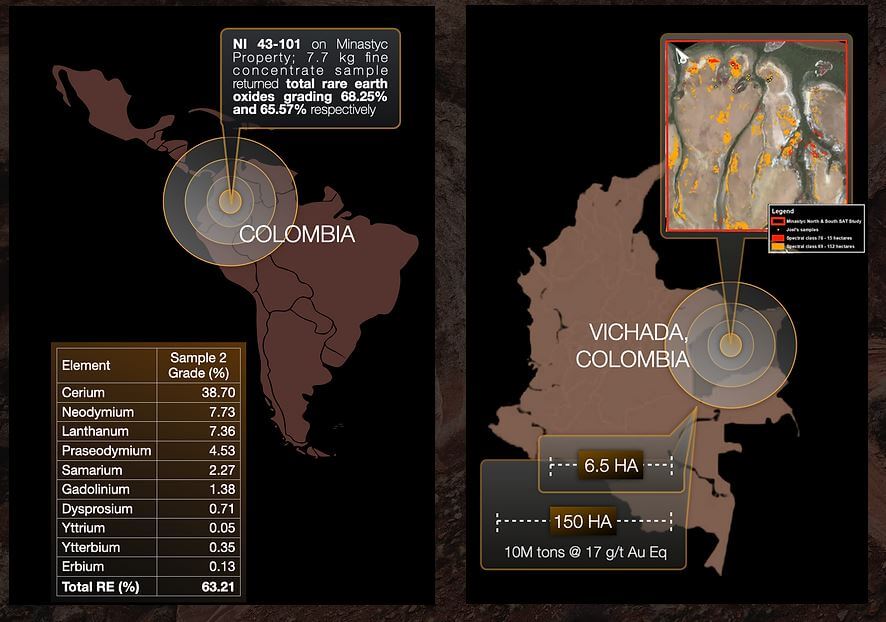

Canadian explorer Auxico Resources (AUAG) was founded in 2014 and focuses on producing critical minerals, including niobium, tantalum, platinum group metals (such as platinum and iridium), and rare earths. The Company is the exclusive commercial agent for rare earth concentrates from the Democratic Republic of Congo (DRC) and owns mineral rights in Colombia, Bolivia and Brazil directly or through joint ventures.

With access to nearly 4 million tons of critical minerals and rare earths, Auxico has one of the largest deposits outside of China, with average rare earth oxide (TREO) grades ranging from 54% to 63%. In Brazil, it has access to tin concentrates from a reprocessing plant in the Brazilian state of Rondonia. The Company has also licensed a technology called Ultrasound Assisted Extraction (UAEx), which has proven very successful in extracting rare earths and other critical minerals. In addition, they have 100% ownership of the Zamora property in Mexico. The property covers 15 historic mines and pits with high gold and silver mineralization. With a stronger focus, this asset could be sold profitably for shareholders. For the needs of the high-tech and Greentech industry, Auxico could grow into an important supplier in the coming years.

Analysts at Hallgarten & Company conducted a November 2022 valuation of the property and calculated a fair valuation of CAD 1.48. Although China is still likely to dominate in rare earth pricing, Auxico has excellent chances of securing a large piece of the global pie. The shares of Auxico Resources (AUAG) are trading stable in Canada in the corridor of CAD 0.42 to 0.47 and can also be purchased liquid in Germany. The Company is currently valued at around CAD 60 million, meaning that the commodity specialists from Montreal still have considerable potential in the current mixed situation.

Siemens Energy and Nordex - A good start to the new year

There are also first signs of life from the much-criticized Greentech stocks Siemens Energy and Nordex. Both shares suffered losses of 40 to 60% in the last 12 months. Due to their different focus and location, they currently have to deal with very differentiated requirements and problems.

Siemens Energy is a specialist in the sustainable conversion of power plants to new, environmentally compatible standards. In the current climate protection wave, the Company cannot save itself from orders. Most recently, it received an order worth billions from grid operator Amprion to connect wind farms in the German North Sea. In a consortium with Spain's Dragados Offshore, Siemens Energy will build converter stations for two new grid connection systems worth the equivalent of EUR 4 billion. The intention with Iraq is to build projects with a capacity of more than 6 GW over the next 5 years, involving the construction of conventional power plants, the expansion of renewable energies and the stabilization of the power grid. The stock is jubilant and has gained around 80% since October 2022 alone.

Nordex has procured fresh capital from scolded shareholders several times. With three profit warnings in a row, the Company now believes it will only become profitable again in 2024. The linchpin of the Hamburg-based company's profitability remains the high cost of upstream products, a lack of personnel and constant disruptions in its supply chains. Although Nordex announced in November that its operating loss is expected to reach 4% of sales in 2022, the lower end of its previous target range, the share price has since smoothly doubled. Like Siemens Energy, the stock market is betting on a consistent flood of orders, which has now been confirmed at the beginning of the year. The lows from 2022 are EUR 6.97 - with prices currently 100% higher at EUR 14, investors are very optimistic that Nordex will soon overcome its earnings weakness.

The availability of strategic metals could become the linchpin of climate change in the future. In order to drive Greentech, a wealth of raw materials that are not so easy to find everywhere on the globe are needed. China is leading the charge here, and Western industrial nations are looking for alternatives. Auxico Resources could become a major focus of strategic investors seeking greater liberalization of supply in 2023.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.