August 31st, 2022 | 10:36 CEST

JinkoSolar, Alpha Copper, Rheinmetall - Green revolution pushes the market

Over USD 10,800 was paid for a ton of copper last year. Rising demand due to climate neutrality lifted the red metal to new highs. However, the metal, which is known as an economic indicator, is currently undergoing a correction due to rising fears of recession. It has lost around a quarter of its value since the beginning of the year. In the long term, however, demand is enormous due to the achievement of climate targets. Experts forecast that more copper will be mined in the next 25 years than in the entire history of humanity. Thus, copper companies at corrected levels offer attractive long-term investment opportunities.

time to read: 5 minutes

|

Author:

Stefan Feulner

ISIN:

JINKOSOLAR ADR/4 DL-00002 | US47759T1007 , ALPHA COPPER CORP | CA02074D1087 , RHEINMETALL AG | DE0007030009

Table of contents:

"[...] We knew the world was rapidly electrifying and urbanising and needing significant amounts of copper to do so. [...]" Nick Mather, CEO, SolGold PLC

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

Rheinmetall AG - At the crossroads

"Heavy weapons for world peace!" The strategy of NATO members and its allies raises the hackles of not only the most hardened pacifist. Since Russia invaded Ukraine, the Western world has been planning additional investments in their respective defense budgets. As is already known, the German government approved a special fund of EUR 100 billion to bring the Bundeswehr, which has been neglected for years, back to its former glory. One of the leading suppliers was to be Düsseldorf-based Rheinmetall AG, which shortly after the announcement threw its hat into the ring with an offer worth EUR 42 billion, including ammunition, helicopters and tracked and wheeled tanks.

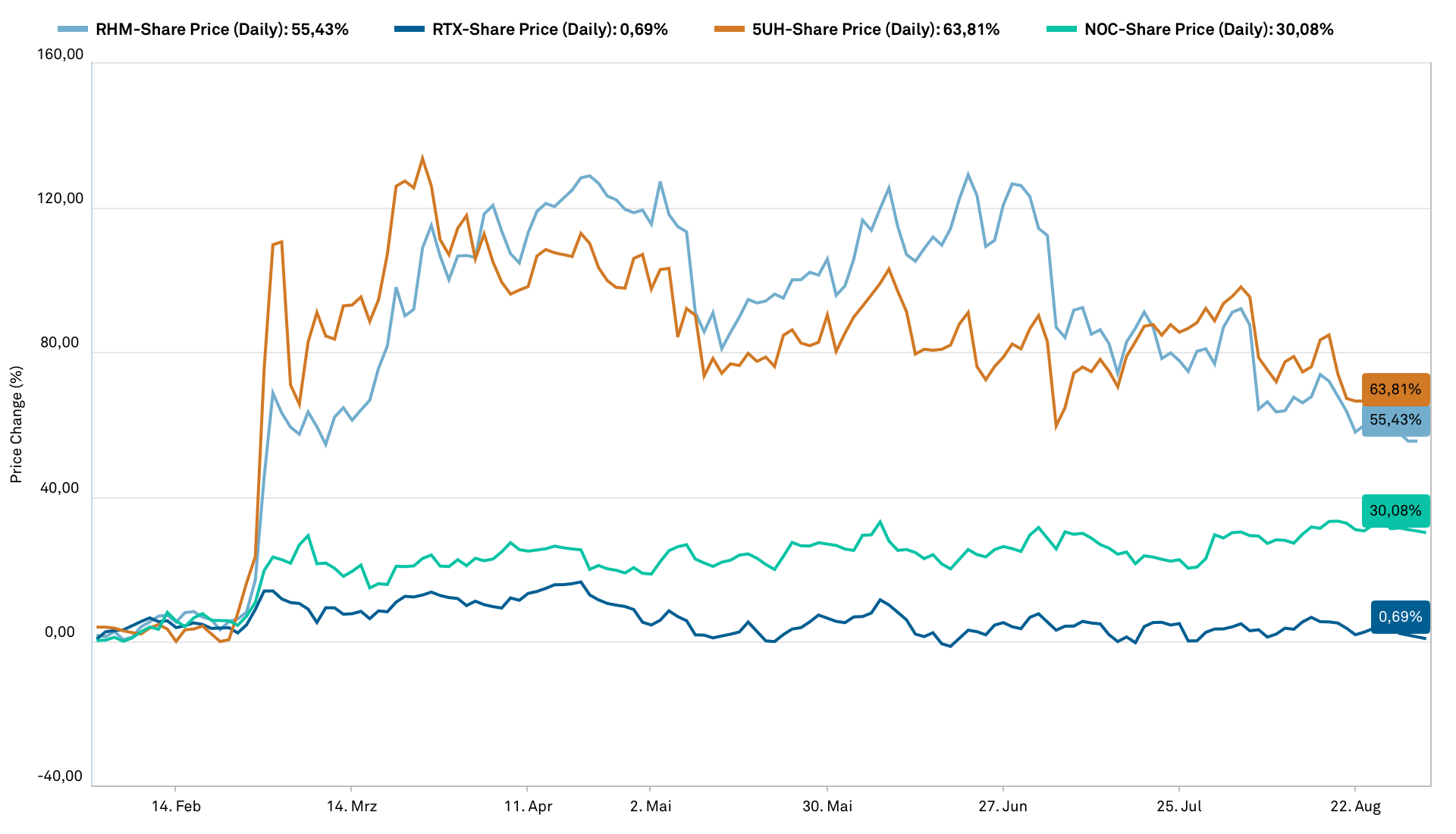

The consequence of the announcement of the special fund was an explosion in the prices of defense companies. The Rheinmetall share started the day after the announcement with an opening price of over 30% at EUR 129.20. The price rally extended to a level of EUR 227.90. However, the MDAX company then ran out of ammunition. Since then, the chart has formed a falling triangle, the lower edge of which should not fall below the EUR 159.80 mark. Due to the steep increase, the next support would be found at EUR 152.25. One floor further down would be devastating for the Bundeswehr's supplier. Because then the still wide open price gap at EUR 107.35 is already waiting. As can be read in textbooks, share prices usually anticipate events. One can only hope that the signs will then point to the de-escalation of geopolitics and that our politicians will pursue a new strategy: "Without weapons for world peace!"

.

Copper is becoming scarce

If a study by the International Energy Agency (IEA) is to be followed, demand for copper could increase by around 600% by 2030. One of the main reasons is the transformation of transport and the switch from fossil fuels such as oil and natural gas to renewable energies. Here, due to its conductivity, the red metal is one of the key elements of climate change. The demand is enormous. A battery-powered electric car requires up to four times more copper than a car with an internal combustion engine. The production of a wind turbine consumes 30t of copper per turbine, including connection to the power grid. By contrast, the increase in demand is likely to be met by a tight supply. The expansion of copper production takes time: expanding existing mines takes about three years, a completely new project eight years. Thus, despite the current recession fears, there is likely to be a significant deficit in the long term.

One of the main beneficiaries of the copper shortage could be the Canadian exploration company, Alpha Copper, as it already has 2 promising properties. The most advanced project is Indata, with a total area of 3,189 hectares. It contains 16 claims to date and is in a prime location surrounded by high-grade mines such as Northwest Copper's Kwanika Project. The Central Zone of the Kwanika project already has 57.7Mt at 0.48% copper and 0.55 g/t gold in the indicated category. Alpha Copper is primarily targeting the known copper porphyry in the so-called Lake Zone, which lies about 500m west of an area of polymetallic veins. A total of four copper mineralization zones have been discovered at Indata to date, with historical drill results including 148m at 0.2% copper, including 24.1m at 0.37% copper. A total of approximately 5000 metres of drilling is planned on the property this year. Alpha Copper holds an earn-in option on a 60% interest.

In addition, the Canadians are exploring the 4,613-hectare Okeover copper and molybdenum project. It is located on the south coast of British Columbia, only 25km from the Powell River deep water port facilities, and contains 11 claims. Alpha Copper can acquire up to 100% here by transferring shares worth CAD 250,000 after signing, further shares for CAD 500,000 within 12 months, and CAD 750,000 within two years.

A quality addition to the portfolio may now be imminent, as Alpha Copper intends to merge with industry peer CAVU Energy Metals Corp. To date, a non-binding letter of intent has been signed. The acquisition could give Alpha Copper access to the high-grade Star project in British Columbia's famed Golden Triangle. Historically, 106.98m of 0.77% copper has been discovered in a drill hole at Star, which is mineralized to a depth of 700m and is open for expansion. The Company added that more than 13,000m of modern drilling had been completed on the project area, which is permitted for advanced exploration work until 2026 and already has 200 drill locations.

In addition to Star, CAVU Energy Metals' portfolio includes the 74 sq km Hopper project in the Yukon, which has numerous porphyry copper, molybdenum targets. In addition, the project has significant peripheral copper-gold-silver skarn mineralization.

Completion of the deal would add significant quality to Alpha Copper's portfolio. Alpha Copper's market capitalization right now is CAD 23.87 million. With a sustainable rising copper price, the Company is more than interesting.

JinkoSolar - High sales, with a loss

Sales of the Chinese producer of solar cells, solar modules and mounting systems exploded in the second quarter of 2022 at the expense of profits. A total of 10.5GW of solar modules were shipped from April to June, representing USD 2.81 billion in revenue. Compared to the first quarter, this means an increase in revenue of almost 26%, and compared to the same period last year, JinkoSolar was even able to increase revenue by nearly 138%.

Gross profit also rose by a quarter to USD 414.00 million, but in terms of operating profit, the Chinese company slipped into the red with USD 43.2 million.

There is uncertainty in preparing annual forecasts due to the power rationing measures in Sichuan Province. "We are currently unable to assess how our business operations and financial results for the full year 2022 will be affected. It is uncertain how long the power rationing measures will last or when our production facilities in Sichuan will be able to resume full production," said Xiande Li, CEO of JinkoSolar. Thus, given the uncertainties surrounding the forecasts, analysts' voices were mixed. Credit Suisse continues to see JinkoSolar's stock as a buy candidate with a price target of USD 71. On the other hand, analyst Brian K Lee of Goldman Sachs downgrades to "sell" and considers a target of USD 35 realistic. The current share price is USD 62.12.

Rheinmetall shares are currently struggling with an important support line. On the other hand, solar module manufacturer JinkoSolar came up with high sales increases but also slipped into the red. Alpha Copper could become an outperformer in the copper market due to its growing, good-quality portfolio.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.