ELI LILLY

Commented by Nico Popp on January 30th, 2026 | 07:25 CET

The hunt for the cancer pill from BioNTech & Co.: Why Eli Lilly's billion-dollar bet is a wake-up call for Vidac Pharma

It is one of the oldest rules in the biotech sector: when the big pharmaceutical companies can no longer grow on their own, they open their coffers. The latest billion-dollar deal between US giant Eli Lilly and Dresden-based startup Seamless Therapeutics is more than just a headline – it is a wake-up call for the entire industry. Eli Lilly, now one of the most valuable companies in the world, is desperately seeking innovations to secure its pipeline beyond its booming weight-loss injections. This hunger for new mechanisms of action inevitably focuses attention on small, specialized companies researching revolutionary approaches. In this environment, Vidac Pharma is becoming the focus of strategic investors. The Company is working on an approach that is as elegant as it is radical: it aims to starve cancer rather than poison it by manipulating its metabolism. While Eli Lilly and BioNTech are spreading their billions across a wide range of areas, Vidac is delivering precisely the kind of specialized "deep science" that is often lacking in the pipelines of the big players.

ReadCommented by André Will-Laudien on November 4th, 2025 | 07:30 CET

Amazing! Rollercoaster ride with Beyond Meat, recovery at Novo Nordisk and Eli Lilly, big returns with PanGenomic Health

Volatility in the growth stock sector has caused quite a few swings in recent weeks. While Novo Nordisk and Eli Lilly are still struggling with margin declines from semaglutide injections, shares of the plant-based meat provider Beyond Meat have been bouncing around like a ball in orbit. After a rapid tenfold increase in October, November appears to be all about the reverse gear, with the stock currently down 80% from its peak. Those with strong nerves and a quick hand on the mouse are in luck. Things are calmer and steadier with PanGenomic Health. Here, the high levels since summer must first be digested before the next upward cycle can begin. We highlight a few opportunities.

ReadCommented by Fabian Lorenz on September 29th, 2025 | 07:00 CEST

Takeover in the Ozempic market! BioNxt Solutions next? Novo Nordisk, Eli Lilly, and Pfizer are fighting!

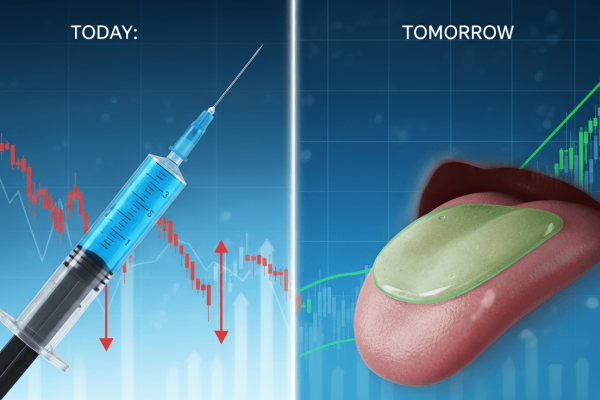

The battle against obesity is considered one of the biggest growth markets in the global pharmaceutical sector. According to estimates, the market for obesity therapies could reach a volume of up to USD 150 billion by 2030. So far, Novo Nordisk and Eli Lilly have dominated the market. But almost every major corporation and innovative challenger wants a piece of the pie. The latest example: Pfizer is planning a billion-dollar takeover of US-based Metsera, a company competing with novel drugs against obesity. BioNxt Solutions is also a hot takeover candidate. The Company aims to revolutionize the market and attract new customers with an oral dosage form, and the first prototypes have already been developed. That makes it an attractive prospect for virtually every pharmaceutical company.

ReadCommented by André Will-Laudien on September 9th, 2025 | 10:05 CEST

The next wave is coming! NetraMark and BioNTech are on the winning track - Can Novo Nordisk and Eli Lilly follow suit?

Artificial intelligence (AI) is transforming the development of new drugs by analyzing complex data at lightning speed and making clinical trials more efficient. AI technologies enable candidates to be selected more specifically for research projects and therapeutic successes to be predicted with greater precision. Companies such as NetraMark and BioNTech have already successfully used these tools, with the Mainz-based company currently even achieving breakthroughs in oncology. Meanwhile, Novo Nordisk and Eli Lilly, once stars of the obesity market, are now seen as "fallen angels". Will they manage to turn things around? Investors with foresight now have new opportunities in rapidly growing billion-dollar markets. A long-awaited interest rate cut in the US could be the spark the sector needs! Selection is now key!

ReadCommented by Fabian Lorenz on September 9th, 2025 | 07:20 CEST

Takeover candidate! Novo Nordisk and Eli Lilly eyeing BioNxt Solutions

A portfolio rocket for the coming weeks? The shares of BioNxt Solutions are certainly worth a closer look. There was no sign of a summer slump at this company - quite the opposite, as one major announcement followed another, and the newsflow continues into September. The Canadian-German life sciences company specializes in innovative drug delivery technologies. The latest bombshell: BioNxt aims to replace the Ozempic weight-loss injection with a tablet-like oral form of administration. This move opens the door to another billion-dollar market and positions the Company as a takeover candidate. Novo Nordisk, Eli Lilly, and others are engaged in fierce competition and are hungry for innovations – like those developed by BioNxt. The stock remains attractively priced.

ReadCommented by Nico Popp on September 4th, 2025 | 07:05 CEST

What comes after the weight loss injection? How does BioNxt intend to outperform Eli Lilly and Novo Nordisk?

The weight loss injection is all the rage. Not only are celebrities shedding significant pounds with it, but many people in our own circles are also losing weight effortlessly thanks to modern GLP-1 receptor agonists. Many patients report that they simply do not feel hungry anymore. This is already having an impact on the restaurant industry in the US – people are ordering more salads and splitting desserts. With Wegovy and similar drugs, one to two teaspoons of tiramisu is enough. But this billion-dollar market is far from reaching all patients. What groundbreaking developments in modern weight loss drugs are already in the pipeline, and how can investors benefit?

ReadCommented by André Will-Laudien on August 21st, 2025 | 07:05 CEST

The AI revolution is turning biotech into a gold mine! BioNTech, Eli Lilly, NetraMark Holdings, and Pfizer know how!

Artificial intelligence (AI) is becoming increasingly important in drug research and is revolutionizing the development of new active ingredients. Machine learning and neural networks enable large amounts of data to be analyzed and potential drugs to be identified more quickly. AI also plays a central role in the planning and execution of clinical trials by recognizing data patterns, identifying suitable patients, and thus increasing the chances of success. The market for AI in drug development is growing rapidly. Experts estimate it will reach several billion US dollars by 2025, with projected annual growth of over 40%. Where are the opportunities and risks for agile investors?

ReadCommented by André Will-Laudien on August 13th, 2025 | 07:15 CEST

Attention, Takeovers: Things are heating up! Bayer, Eli Lilly, Vidac Pharma, and Formycon in focus

Volatility is king! Great for speculators, often difficult for long-term investors. Biotech stocks are extremely sensitive to study and approval news, especially in cancer research. Vidac Pharma is developing drugs that are designed to target tumor cells and cause them to die – risky, but with great potential. Despite its restructuring, Bayer is strengthening its oncology pipeline, especially in niche indications. Eli Lilly is benefiting from the boom in modern immunotherapies and, thanks to its strong financial position, can support long development phases. Formycon is considering entering the oncology market to broaden its base. The sector offers opportunities and surprising takeovers, but requires a high tolerance for risk.

ReadCommented by André Will-Laudien on June 19th, 2025 | 07:00 CEST

Biotech: Weight loss and cancer – Takeovers ahead! Keep an eye on Evotec, Vidac Pharma, Eli Lilly, and Novo Nordisk!

For nearly two years, the biotech sector remained largely stagnant. But in the last few weeks, some heavily bombed-out life science stocks have seen significant gains, and takeovers are back on the agenda. Eli Lilly is acquiring Verve Therapeutics, and BioNTech has finally reached an agreement with CureVac. The carousel is slowly starting to turn, and tensions are rising. New rumors are circulating, especially as major pharma stocks like Eli Lilly and Novo Nordisk are showing negative 12-month performance - despite record highs in the major indices.

What is next?