August 21st, 2025 | 07:05 CEST

The AI revolution is turning biotech into a gold mine! BioNTech, Eli Lilly, NetraMark Holdings, and Pfizer know how!

Artificial intelligence (AI) is becoming increasingly important in drug research and is revolutionizing the development of new active ingredients. Machine learning and neural networks enable large amounts of data to be analyzed and potential drugs to be identified more quickly. AI also plays a central role in the planning and execution of clinical trials by recognizing data patterns, identifying suitable patients, and thus increasing the chances of success. The market for AI in drug development is growing rapidly. Experts estimate it will reach several billion US dollars by 2025, with projected annual growth of over 40%. Where are the opportunities and risks for agile investors?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BIONTECH SE SPON. ADRS 1 | US09075V1026 , ELI LILLY | US5324571083 , NETRAMARK HOLDINGS INC | CA64119M1059 , PFIZER INC. DL-_05 | US7170811035

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Eli Lilly – Weak share price, but high expectations

Despite technical and ethical challenges, AI has the potential to fundamentally improve the effectiveness of drug development and address previously unmet medical needs. Interdisciplinary collaboration between biologists, chemists, and data scientists is crucial to unlocking the full potential of AI. Overall, AI is a key factor for the future of biotechnology and drug research, with enormous market opportunities and strong innovation potential.

Eli Lilly continues to invest heavily in research and development, particularly in the areas of oncology and cardiometabolism. AI is being used specifically to accelerate drug discovery, make clinical trials more efficient, and advance personalized therapies. AI technologies support Eli Lilly in analyzing large amounts of data, enabling potential drug candidates to be identified more quickly and more accurate predictions to be made. The Company sees AI as an integral part of its innovation strategy and expects modern algorithms to optimize drug development significantly.

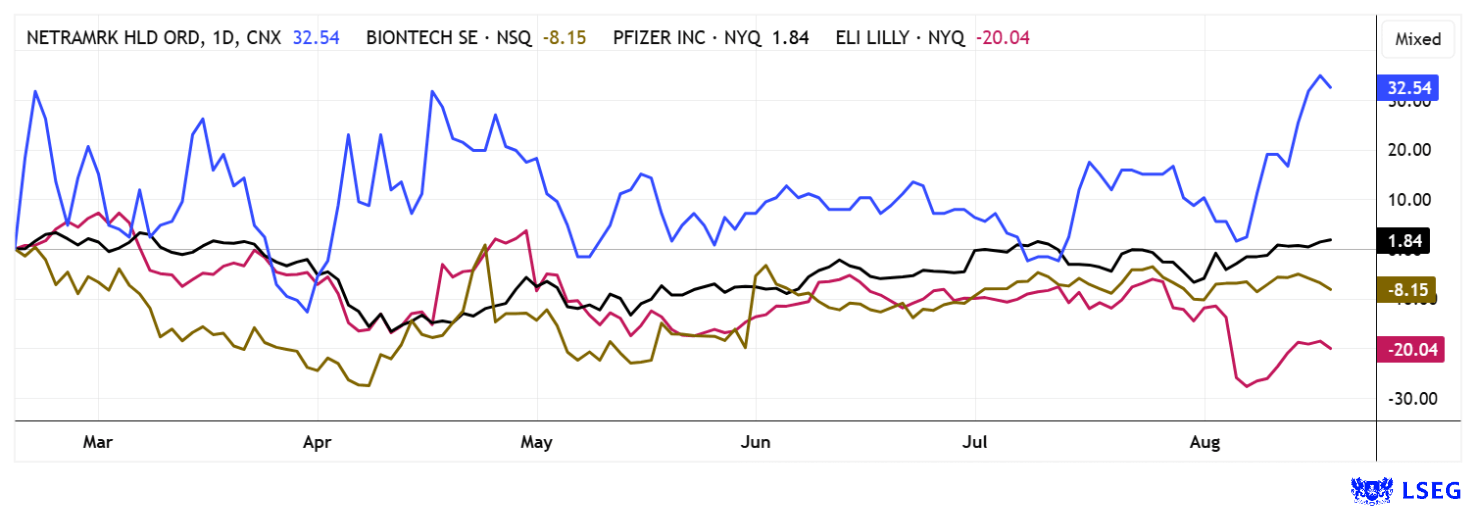

Eli Lilly reacted to its recently published quarterly figures with a 15% drop in its share price, despite a 38% increase in revenue and a rise in profits. The blockbuster drugs Zepbound and Mounjaro were the main drivers of growth. Adjusted earnings per share of USD 6.31 significantly exceeded expectations. Despite the short-term share price reaction, management remains optimistic and has raised its annual revenue forecast for 2025 to USD 60-62 billion. 23 of 31 analysts on the LSEG platform recommend a "Buy" with an average 12-month price target of USD 888 – at the current price of USD 692, possibly a good idea.

NetraMark Holdings – AI acceptance becomes a guarantee for the future

NetraMark Holdings, based in Canada, specializes in analyzing complex health data and uses electronic patient records, genomic data, and registries to make clinical research more efficient. With its NetraAI 2.0 platform, the Company is bringing a new generation of artificial intelligence to drug development. While conventional machine learning methods often fail when applied to real patient data, NetraAI can identify precise patterns and differentiate between patient groups. This allows participants for clinical trials to be identified more quickly and in a more targeted manner, saving time and increasing the success rate. Pharmaceutical companies in particular benefit from this technology, as complex data sets are simplified and condensed into clinically relevant key findings.

A current example is the collaboration with Asklepion Pharmaceuticals, where NetraAI is being applied in a Phase III study on pediatric heart surgery to better demonstrate the benefits of L-citrulline. The goal is to identify subgroups that particularly benefit from the treatment, thereby strengthening the evidence base. Asklepion sees the technology as a milestone for safer and more effective therapies for children. NetraMark relies on explainable AI that not only delivers results but also makes them transparent. This ability is considered key to increasing acceptance among physicians, patients, and authorities.

Further insights can be found in the following video: Click here for the presentation from May 21, 2025, at the 15th International Investment Forum with CEO George Achilleos. https://youtu.be/asqAzE7_2-M

At the same time, NetraMark is expanding its management team with the appointment of Dr. Jan Sedway as Senior Vice President of Clinical Science. Sedway brings over 20 years of experience from international studies and will accelerate market entry in additional therapeutic areas such as oncology and psychiatry. Sedway sees NetraAI as a key lever for unlocking value from even small and heterogeneous data sets. Her goal is to take precision medicine to a new level and deliver clear, measurable benefits to customers.

Strategically, the Company is also seeking dialogue with the US Food and Drug Administration (FDA) to reduce regulatory hurdles. Existing contracts with partners such as Worldwide Clinical Trials and new pipeline deals show that NetraMark is increasingly gaining a foothold in the market. The market for AI-driven optimization of clinical trials is growing rapidly worldwide, and NetraMark aims to position itself as a key player. With its combination of innovative technology, new partnerships, and experienced management, the Company is well-positioned to have a lasting impact on personalized medicine. At just under CAD 1.80, the share price is storming from one high to the next, and the Company is now valued at CAD 128 million. Every hesitation with the buy order is costing money!

BioNTech and Pfizer take first steps in AI

BioNTech and Pfizer are advancing the field of artificial intelligence (AI) in very different but complementary ways. BioNTech acquired British AI specialist InstaDeep, with whom it had been working closely since 2019, in 2023. Together, they operate an AI Innovation Lab in London and Mainz that focuses on the use of AI in the design of new mRNA therapies, the analysis of biological data, and the optimization of production processes. BioNTech also collaborates with DeepMind and has developed the AI agent "Laila," which performs routine tasks in the laboratory, monitors equipment, and thus reduces the workload of researchers. At the same time, BioNTech is investing up to £1 billion in British research centers, including an AI hub in London and a center for genomics and oncology in Cambridge, to secure its innovative strength in the long term.

Pfizer, on the other hand, is focusing heavily on strategic partnerships with specialized technology companies. It has a particularly close collaboration with Israeli AI start-up CytoReason, with which Pfizer has been working since 2019 and in which it plans to invest more than USD 100 million. The aim is to use AI to better model biological systems and thus accelerate drug development. Pfizer is also expanding its partnership with Saama to deploy AI-based "smart data quality" solutions in global clinical research, which should increase the efficiency of clinical trials and accelerate approval processes. The Company is also working with Data4Cure to develop a comprehensive knowledge graph system that integrates internal and external data sources to gain more accurate insights for drug discovery. With BioNTech still holding around EUR 16 billion in cash and Pfizer enjoying a similarly strong financial position, both companies remain well-capitalized. For long-term investors, both stocks appear attractive at USD 110 and USD 25, respectively, as the charts have already turned around technically.

**Intelligent systems and big data are increasingly revolutionizing key areas of the biotech and healthcare industries, where complex relationships must be precisely evaluated. Companies such as Eli Lilly, Pfizer, and BioNTech are increasingly turning to specialized AI solutions to accelerate research and development and make clinical trials more efficient. NetraMark complements this environment with innovative, AI-based analysis tools that optimize the selection of suitable patient groups and significantly improve the validity of study results.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.