September 9th, 2025 | 07:20 CEST

Takeover candidate! Novo Nordisk and Eli Lilly eyeing BioNxt Solutions

A portfolio rocket for the coming weeks? The shares of BioNxt Solutions are certainly worth a closer look. There was no sign of a summer slump at this company - quite the opposite, as one major announcement followed another, and the newsflow continues into September. The Canadian-German life sciences company specializes in innovative drug delivery technologies. The latest bombshell: BioNxt aims to replace the Ozempic weight-loss injection with a tablet-like oral form of administration. This move opens the door to another billion-dollar market and positions the Company as a takeover candidate. Novo Nordisk, Eli Lilly, and others are engaged in fierce competition and are hungry for innovations – like those developed by BioNxt. The stock remains attractively priced.

time to read: 3 minutes

|

Author:

Fabian Lorenz

ISIN:

NOVO NORDISK A/S | DK0062498333 , ELI LILLY | US5324571083 , Bionxt Solutions Inc. | CA0909741062

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

Oral version of Ozempic would be revolutionary

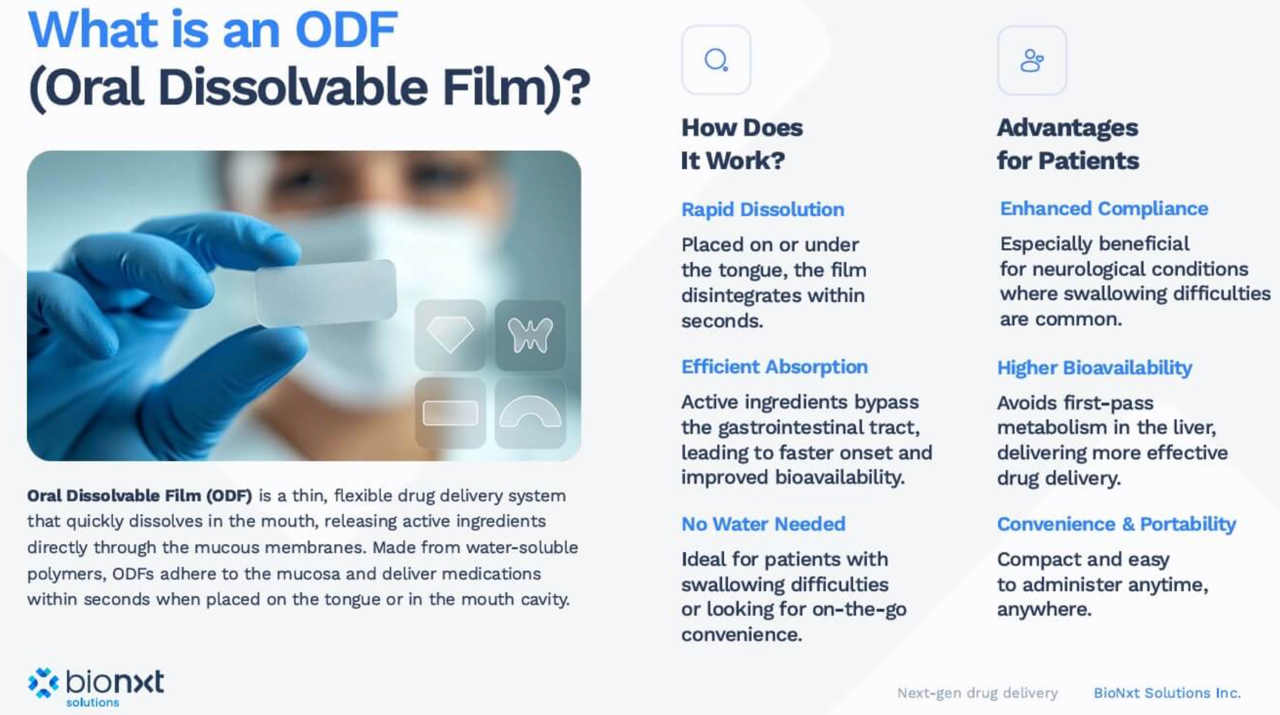

BioNxt is tapping into the next billion-dollar market: Last week, the Company received a shipment of semaglutide, the active ingredient contained in Novo Nordisk's blockbuster drugs Ozempic (for diabetes) and Wegovy (for weight loss). These drugs alone generated around USD 12 billion in revenue last quarter. BioNxt now aims to use the active ingredient to develop an oral form of semaglutide. The goal is to increase bioavailability to such an extent that an effective, tablet-like method of administration becomes possible. The active ingredient is to be transported via the oral mucosa in the form of an oral dissolvable film. Work is now underway at the development laboratory in Munich to refine the formulation. If successful, a patent application could be filed as early as the coming quarter. This would position BioNxt as an attractive partner or takeover candidate for major industry players.

Billion-dollar market for weight-loss injections slowed by injections

The market for GLP-1-based obesity therapies such as Ozempic (Novo Nordisk) and Mounjaro (Eli Lilly) is growing rapidly. According to analyst estimates, the drugs are expected to reach a volume of around USD 150 billion by the end of the decade. The market is currently dominated by Novo Nordisk and Eli Lilly. However, numerous companies such as Pfizer, Roche, and Amgen are working on their own preparations. Demand is huge, and the market would already be growing faster today if availability were not limited. Production capacities—including those of suppliers—are not growing fast enough. Almost all approved drugs are administered by weekly injection. Production, including the syringes, is correspondingly complex. In addition, many patients find this form of administration unpleasant or cumbersome. An easy-to-take, safe, and effective oral variant could therefore represent a real revolution: The inhibition threshold for starting therapy would decrease, and the duration of treatment would increase. With a tablet-like form of administration, an innovator such as BioNxt Solutions could cause a sensation and position itself as a partner or takeover candidate in this billion-dollar market.

Flagship project BNT23001 for cladribine sets new standards

The Ozempic project is not the only one with which BioNxt is targeting a billion-dollar market. The Company is also working intensively on its flagship project BNT23001. This is a melt film formulation of cladribine, an already approved therapy for multiple sclerosis. Here, too, BioNxt's innovation lies in releasing cladribine via a sublingual thin-film, placed under the tongue, designed to simplify administration and improve tolerability. In July, the Company presented a successful prototype. This is currently undergoing preclinical testing. Patents have already been obtained in Europe and other key markets. In addition to the cladribine formulation, the patent also covers the use of chemotherapeutic agents in neurological autoimmune diseases. Overall, this opens up exclusivity and licensing opportunities.

In the US, BioNxt has submitted its patent application for BNT23001 under the accelerated "Track One" procedure. Success would have a very positive impact on clinical development and subsequent commercialization.

Increased Visibility and tradability of the share

BioNxt has recently announced measures aimed at increasing both visibility and tradability of its shares - which are already actively traded on Tradegate. As of last Friday, BioNxt shares have been listed on the OTCQB market of the Canadian Securities Exchange. This uplisting from the OTC segment will facilitate access for US investors, while also increasing transparency standards. BioNxt CEO Hugh Rogers stated: "We have built a strong platform over the past 12 months, both in terms of capital markets and with regard to our future product candidates. With three distinct and proprietary sublingual drug development programs currently underway in Europe, and a promising contract for the administration of chemotherapeutic drugs nearing completion here in North America, the Company is well-positioned for value growth over the next 12 months."

Conclusion: Market capitalization with significant upside potential

BioNxt Solutions could become a real stock market rocket for investors in the coming weeks. With a market capitalization of less than EUR 100 million, there is certainly significant upside potential given the expected positive news flow. Even for big pharma, an attractive price premium for a takeover should not be a problem. If a marketable oral version of semaglutide can be developed, it would be a potential game changer in a market that is currently dominated by injections. Novo Nordisk and Eli Lilly are likely to be watching very closely—and investors should do the same.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.