September 9th, 2025 | 10:05 CEST

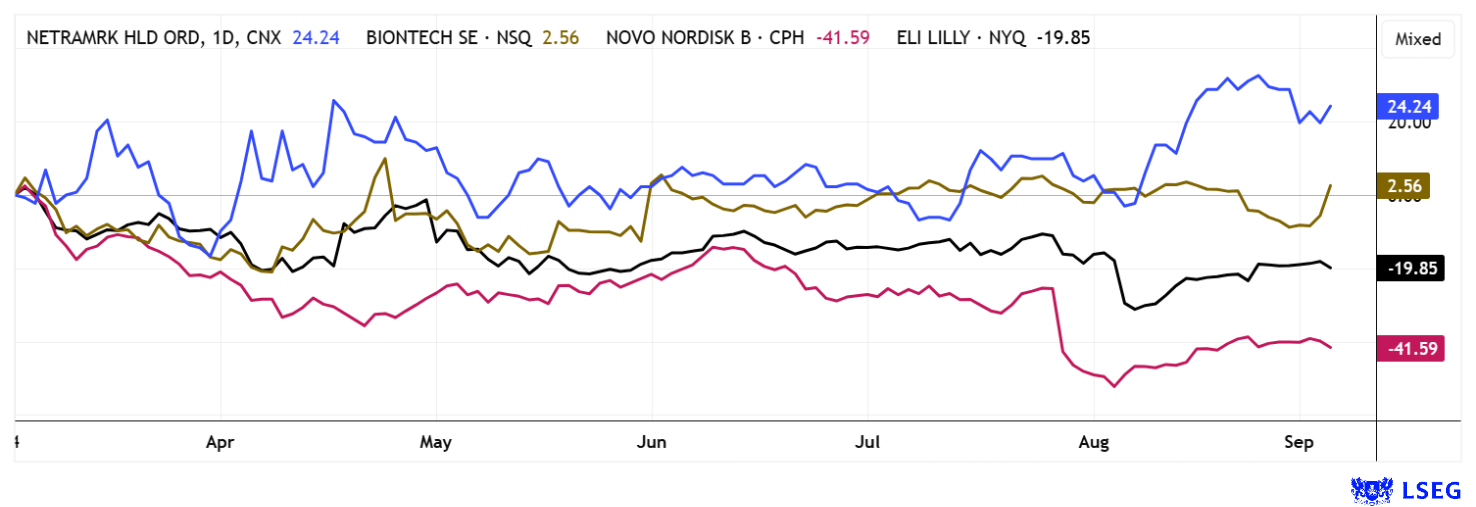

The next wave is coming! NetraMark and BioNTech are on the winning track - Can Novo Nordisk and Eli Lilly follow suit?

Artificial intelligence (AI) is transforming the development of new drugs by analyzing complex data at lightning speed and making clinical trials more efficient. AI technologies enable candidates to be selected more specifically for research projects and therapeutic successes to be predicted with greater precision. Companies such as NetraMark and BioNTech have already successfully used these tools, with the Mainz-based company currently even achieving breakthroughs in oncology. Meanwhile, Novo Nordisk and Eli Lilly, once stars of the obesity market, are now seen as "fallen angels". Will they manage to turn things around? Investors with foresight now have new opportunities in rapidly growing billion-dollar markets. A long-awaited interest rate cut in the US could be the spark the sector needs! Selection is now key!

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NETRAMARK HOLDINGS INC | CA64119M1059 , BIONTECH SE SPON. ADRS 1 | US09075V1026 , NOVO NORDISK A/S | DK0062498333 , ELI LILLY | US5324571083

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BioNTech – Share price jump due to breakthrough in breast cancer

BioNTech has achieved an important breakthrough in cancer research with BNT323, demonstrating significant improvements in progression-free survival in advanced breast cancer in a Phase 3 study in China. The innovative ADC technology enables targeted delivery of the drug to cancer cells, offering a chemotherapeutic treatment with fewer side effects. Analysts see this as the start of a new era for BioNTech, which is strategically shifting its focus from COVID-19 to oncology and sustainable sources of revenue.

BioNTech is using artificial intelligence to further accelerate the development of new cancer therapies and tailor them more precisely to the genetic characteristics of each tumor. With the help of modern AI models, clinical trials are designed more efficiently, relevant biomarkers are identified more quickly, and personalized drug combinations are developed. The combination of AI, mRNA technology, and data analysis strengthens BioNTech's position as an innovation driver and opens up new perspectives for tailored cancer treatments.

With international marketing rights, BioNTech can roll out its pipeline in the US and Europe and tap into a market worth billions. Investors rewarded the progress, with the share price rising significantly by 8% to over EUR 96 following the announcement of the study's success last week. The Company is clearly continuing to expand its expertise through partnerships and innovative mRNA and ADC products, and may therefore be on the verge of dynamic growth. With a good EUR 16 billion in the coffers, there is plenty of room for maneuver.

NetraMark Holdings – Step by step into a new dimension

Canadian company NetraMark is making waves in clinical research with its advanced AI platform, "NetraAI 2.0." At its core lies a new generation of artificial intelligence that enables precise identification of patient data and clear delineation of case subgroups. For pharmaceutical companies, this translates into more efficient clinical trials, reduced costs, and a higher success rate for regulatory approvals. One standout example is the collaboration with Asclepion Pharmaceuticals. Here, NetraAI is being used in a Phase III study in the field of pediatric heart surgery to evaluate the efficacy of L-citrulline. NetraAI identifies subgroups of children likely to benefit most from the treatment, thereby strengthening the scientific basis for its use. For Asclepion, this is an important step toward making treatment options in the sensitive field of pediatrics safer and more effective. NetraAI's ability to present results in a transparent and comprehensible manner is also considered a key factor in gaining acceptance among physicians, patients, and regulatory authorities.

At the same time, NetraMark is continuing to strengthen its team. Dr. Jan Sedway, an internationally experienced expert and proven specialist in clinical sciences, has been brought into the management team. Her focus lies in expanding AI applications in oncology and psychiatry, two fields where small and complex datasets have long posed challenges. Sedway views NetraAI as a decisive lever for advancing precision medicine. Strategically, NetraMark is gaining momentum: Discussions with the FDA are intended to reduce regulatory hurdles, while partnerships with players such as Worldwide Clinical Trials are strengthening its global market position. Initial successes are already evident, with the Company growing dynamically and steadily expanding its pipeline of projects. The stock recently climbed to around CAD 1.80, giving the Company a market capitalization of approximately CAD 140 million. Given the opportunities in the booming AI sector, NetraMark appears to offer significant upside potential. Buy!

Eli Lilly and Novo Nordisk – Is the great semaglutide wave over?

Eli Lilly and Novo Nordisk are engaged in fierce competition to slow the erosion of margins in the lucrative obesity and semaglutide business. Both companies are focusing on innovation to secure their market position: Eli Lilly is investing heavily in the development of oral GLP-1 preparations such as Orforglipron, which are easier to take, and plans to combine them with the active ingredient Mounjaro or Zepbound. Novo Nordisk, on the other hand, is expanding its pipeline with the active ingredient CagriSema, which combines semaglutide with cagrilintide and thus promises even greater weight loss. In addition, both companies are focusing on opening up new geographical markets. At the same time, they are countering price pressure from generics and increasing competition by working on improved formulations, combination drugs, and patient-friendly dosage forms. Novo Nordisk's oral semaglutide form, which is expected to hit the US market as early as 2026, could abruptly halt the downward trend for the Danish company. Eli Lilly was able to recover a good 15% from its low of around EUR 537. Novo Nordisk is also showing initial signs of recovery, but its share price is still 60% behind for the year. With a 2026 P/E ratio of 13 versus 26, Novo Nordisk is significantly cheaper than Eli Lilly.

Artificial intelligence is fundamentally changing healthcare and is becoming increasingly indispensable in diagnostics, therapy, and study evaluation. Companies such as NetraMark stand out with transparent, explainable AI models that analyze medical data in a targeted manner and make clinical studies more efficient. With breakthroughs in cancer therapy, BioNTech is demonstrating how AI innovations can accelerate progress and open up new avenues of treatment. Novo Nordisk and Eli Lilly aim to get the obesity market flying again, which may finally turn their shares around.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.