December 18th, 2025 | 07:20 CET

Turnaround with a 100% chance in 2026! Novo Nordisk, TeamViewer, Equinox, and Laurion Mineral on the launch pad

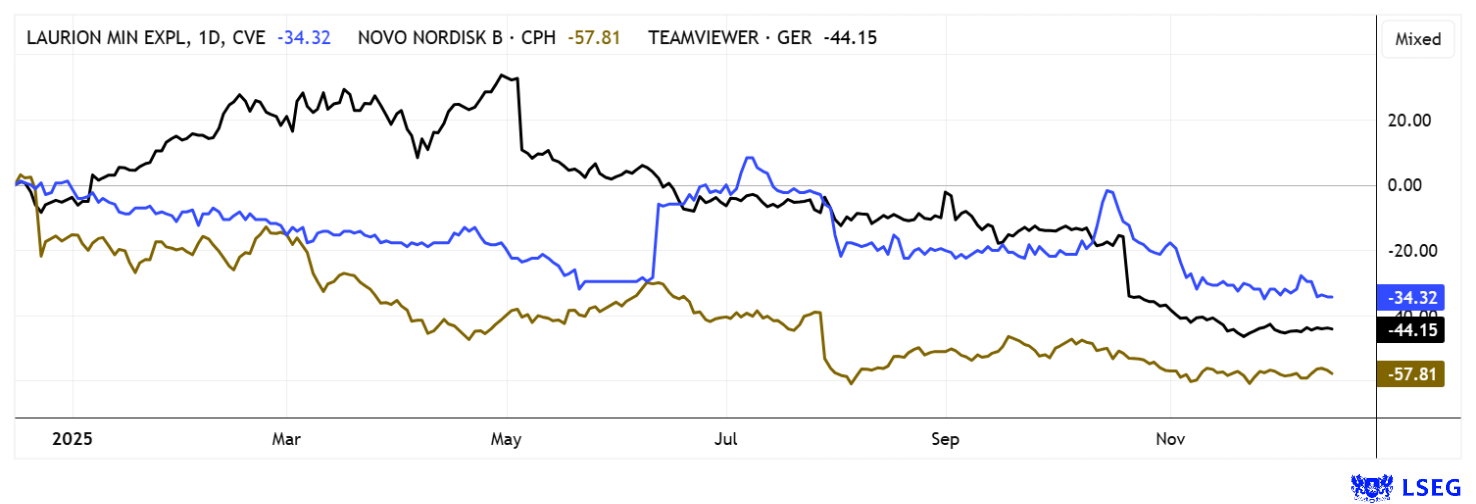

The 2025 stock market year did not go well for everyone involved. The stocks in our selection today can tell us a thing or two about how it feels to be at the bottom of the rankings. But sometimes the stock market gets it wrong, because although Novo Nordisk has issued three profit warnings, the Company is still making good money. The situation is similar at TeamViewer, where there have been some disappointments in terms of growth, but the EBIT margin is still above 30%. It is completely incomprehensible that Laurion Minerals is at the bottom of the chart compared to other explorers. The drill results from Ontario show good mineralization values in gold not far from Equinox's Greenstone Mine. With gold prices at USD 4,300, the stock should soon see a surge. We do the math.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

NOVO NORDISK A/S | DK0062498333 , TEAMVIEWER AG INH O.N. | DE000A2YN900 , EQUINOX GOLD CORP. NEW | CA29446Y5020 , LAURION MINERAL EXPLORATION INC | CA5193221010

Table of contents:

"[...] Our district-scale 104,000-hectare land package already hosts the Barsele deposit (2.4Moz Au) and multiple new gold anomalies identified through modern exploration techniques. [...]" Taj Singh, CEO & Director, First Nordic Metals Corp.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Novo Nordisk – The top pharmaceutical candidate for 2026

Obesity expert Novo Nordisk has suffered a severe slump. Declining sales, margin pressure, and new competing products led to a share price decline of over 57%. The main trigger was certainly the significant reduction in revenue and profit forecasts by management, especially for 2025 and beyond. Investors had previously had very high expectations for the growth of the weight loss and diabetes drugs Wegovy and Ozempic, which are now no longer meeting expectations. The US, in particular, saw slower prescription growth, raising doubts about the sustainability of the previous boom scenario.

In addition, competition has intensified significantly, particularly from rival Eli Lilly, whose GLP-1 products are gaining more and more market share. Furthermore, cheaper generic drugs from compounding pharmacies are weighing on prices. To make matters worse, operational issues such as production bottlenecks and supply chain problems also came into play. Overall, investor confidence remained weak, with no significant price recovery measurable even at the end of the year.

The forecasts for 2026 are therefore much more cautious than they were a year ago. Many analysts still expect growth, but at a significantly lower level than previously assumed. Some firms expect only single-digit sales growth for 2026, while others even warn of temporary declines in certain product segments. In the long term, more optimistic analysts see opportunities in new dosage forms, expanded indications, and better international market penetration. On the LSEG platform, 15 out of 28 experts are voting "Buy" or "Overweight." The average price target is DKK 405, with a current price of DKK 303 - around 33% upside potential for a titan of the European pharmaceutical landscape. Risk-conscious investors are buying!

Laurion Mineral Exploration – A gem not far from Equinox Gold

Laurion Mineral Exploration has also come under increased pressure recently. The Canadian exploration company focuses on the development of gold and polymetallic deposits in northern Ontario. Its focus is on the Ishkoday project, located approximately 220 km northeast of Thunder Bay in the Onaman-Tashota Greenstone Belt, a geologically highly prospective region with existing infrastructure and historical mining activity. Its location in the immediate vicinity of a rapidly developing gold camp around Equinox Gold's Greenstone Mine is promising. Equinox has been operating one of Canada's largest open-pit gold mines there since 2024. It controls an extensive package of properties along the most promising structures of the Geraldton-Beardmore Greenstone Belt, anchoring the region as an established mining jurisdiction with existing infrastructure, regulatory experience, and a growing service base.

Laurion pursues a technically disciplined exploration approach in accordance with NI 43-101 disclosure standards and positions itself as a medium-term development candidate with takeover appeal. To date, 470 drill holes totaling approximately 100,000 meters have been completed, with the exploration model aimed at extending the system of stacked, orogenically controlled gold veins along the Sturgeon River and Brenbar corridors. In 2025, 15 drill holes totaling 7,586 meters were drilled, with the best intersections including 15.35 g/t Au over 0.5 meters (LME25-069), 11.40 g/t Au over 0.7 meters (LME25-067) and 7.30 g/t Au over 0.5 meters at a depth of over 700 meters. Laurion also owns 100% of the adjacent Brenbar claims and the Twin Falls project (10.46 km²) to the west, where values of up to 32.47 g/t Au over 1.9 meters have already been achieved. In total, the contiguous concessions cover 57.43 km² and include a six-kilometer mineralized corridor that is being consolidated for a structurally interwoven exploration concept.

To strengthen its financial base, Laurion yesterday announced a flow-through private placement of up to CAD 1.6 million at a price of CAD 0.33 with a half warrant at CAD 0.39. The objective of the upcoming work is to define the mineralized bodies along the 6 x 2.5 km system and expand the resource base. With insider ownership of around 74%, Laurion remains strongly owner-managed. The share price should take off once further results are published. During the current placement, there are good entry opportunities in the CAD 0.28 range.

TeamViewer – 3 years of decline and now what?

For three years, TeamViewer's chart has been trending downward with minor interruptions. At the same time, however, the software company's revenue has risen from EUR 556 million to an estimated EUR 764 million. Earnings per share will reach EUR 0.79 in the current year, up from EUR 0.37 in 2022, if analysts' estimates on the LSEG platform are to be believed. That is an increase of more than 100% over the last three years. The crux of the matter is that at the end of 2022, TeamViewer's share price stood at EUR 15.50, but yesterday it was trading at EUR 5.59, around 75% lower. The weak performance of the stock is attributed to risks that are now creeping in due to the spread of artificial intelligence. JPMorgan analyst Toby Ogg sees major problems for European software and IT companies and rates the stock as "neutral" with a price target of EUR 7.50.

However, things are not actually going so badly in the AI sector. The consistent focus on artificial intelligence is paying off noticeably. Just a few months after the comprehensive market launch, around 10,000 customers are already relying on the new AI-based functions, which independently log and evaluate support sessions in the IT sector. Demand is growing rapidly, with the number of active users recently increasing by around 60% per month. This results in concrete productivity advantages for IT departments, for example, through significantly reduced processing times for support tickets. This development illustrates the growth potential that AI offers for the company's core solutions. On the LSEG platform, 9 out of 18 experts vote "buy" and see an average 12-month price target of EUR 10.86. Risk-conscious investors should strike now in the EUR 5.45 to 5.65 corridor and hold out for another 3 years!

The financial markets remain highly volatile at the end of the year. This is also due to the actions of institutional investors, especially fund managers. They want to be invested in stocks that have performed well for the year-end report and tend to remove the worst performers from their portfolios. Risk-conscious turnaround investors can take advantage of precisely such special movements.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.