June 19th, 2025 | 07:00 CEST

Biotech: Weight loss and cancer – Takeovers ahead! Keep an eye on Evotec, Vidac Pharma, Eli Lilly, and Novo Nordisk!

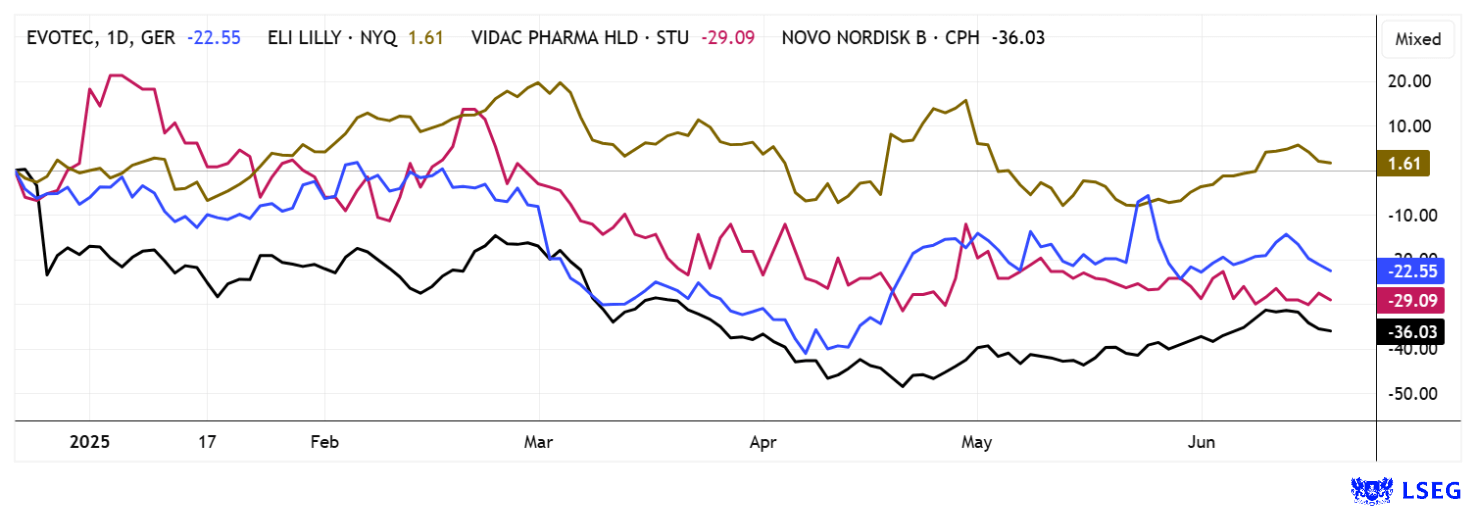

For nearly two years, the biotech sector remained largely stagnant. But in the last few weeks, some heavily bombed-out life science stocks have seen significant gains, and takeovers are back on the agenda. Eli Lilly is acquiring Verve Therapeutics, and BioNTech has finally reached an agreement with CureVac. The carousel is slowly starting to turn, and tensions are rising. New rumors are circulating, especially as major pharma stocks like Eli Lilly and Novo Nordisk are showing negative 12-month performance - despite record highs in the major indices.

What is next?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

EVOTEC SE INH O.N. | DE0005664809 , VIDAC PHARMA HOLDING PLC | GB00BM9XQ619 , ELI LILLY | US5324571083 , NOVO NORDISK A/S | DK0062498333

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Evotec – A comeback for takeover speculators

Rumors are once again swirling around the Hamburg-based drug discovery specialist Evotec. Short sellers were forced to cover their positions abruptly in January and April of this year, but the stock has fallen again in recent days. This is despite Warburg renewing its "Buy" rating with a price target of EUR 11.30. Analysts from northern Germany argue that the drug researcher's new strategy of reducing complexity, patiently divesting holdings and prioritizing profitability over expansion is finally pointing in the right direction. Nevertheless, experts believe a market recovery is unlikely before the end of 2025. Analyst Christian Ehmann made his assessment after the Annual General Meeting on June 3, which was held under the theme "Pioneering Drug Discovery". All items on the agenda were approved by a clear majority. CEO Dr. Christian Wojczewski explained the Company's current situation and reiterated the strategic outlook, with the revenue target remaining at EUR 850 million for the time being. The two new members of the Executive Board, Aurélie Dalbiez as Chief People Officer and Paul Hitchin as CFO, were also introduced to the public for the first time. Evotec's share price has resumed its downward trend. The shares lost when trading was halted at EUR 7.85 are now available at a reduced price of EUR 6.75. Technically, a good buying zone is between EUR 6.15 and EUR 6.45, and the all-time low of EUR 5.08 should not be reached again.

STEP Seal honors Vidac Pharma

The Vidac Pharma share price is moving rather quietly. Given the abundance of news, one might get the impression that investors are patiently waiting for operational progress at the biotech small cap. Founded in 2012, the Company is led by Prof. Max Herzberg, one of the founding fathers of the Israeli life sciences industry. Vidac is a clinical-stage biopharmaceutical company dedicated to developing first-in-class drugs in the oncology and onco-dermatology sectors. VDA 1102, its lead drug candidate, has proven effective against advanced actinic keratosis (AK) and cutaneous T-cell lymphoma (CTCL) in Phase 2 human trials.

There is currently reason to celebrate again. Vidac's latest project with the active ingredient VDA 1102 has been recognized by the European Commission as a high-quality proposal and awarded the prestigious STEP Seal (Strategic Technologies for Europe Platform). This recognition is the result of a highly competitive evaluation conducted by an international panel of independent experts as part of the Horizon Europe EIC Accelerator Program. The project, which focuses on the development of Tuvatexib (VDA 1102) for the treatment of highly proliferative actinic keratosis (AK), was recognized for its scientific merit, innovative strength, and strategic alignment with European technology priorities.

Vidac Pharma's proposal, entitled "Tuvatexib (VDA 1102) for highly proliferative actinic keratosis," was submitted under the HORIZON-EIC-2025-ACCELERATOR-01 call and officially recognized as contributing to the objectives of the STEP initiative. The project focuses on Tuvatexib, a first-in-class small molecule that targets the metabolic vulnerabilities of precancerous skin lesions. Actinic keratosis, often caused by prolonged sun exposure, affects millions of people worldwide and is widely recognized as a precursor to squamous cell carcinoma. Tuvatexib offers a promising non-invasive alternative to current treatments and has the potential to reshape the therapeutic landscape for the prevention of early-stage skin cancer.

"We are very honored by this recognition from the European Commission. It is a testament to the dedication of our scientific team and the transformative potential of our technology. Advancing Tuvatexib through the next stages of development brings us closer to our goal of offering a new solution for patients at risk of skin cancer", said CEO Dr. Max Herzberg.

The successful shortlisting marks the completion of the first phase of the Horizon Europe EIC Accelerator selection process. Vidac Pharma will now enter the next evaluation phase, with the potential to secure significant non-dilutive grants and equity investments from the European Innovation Council to accelerate its clinical development. With a current valuation of around EUR 24 million, existing shareholders look forward to external grants. For new investors, the entry price of EUR 0.47 is attractive, especially given that research firm Sphene Capital issued a "Buy" rating with a price target of EUR 4.90 in the summer of 2024. Exciting!

Eli Lilly versus Novo Nordisk – Who is ahead in the weight loss race?

Eli Lilly and Novo Nordisk are engaged in a fierce battle in the obesity sector. In Q1 2025, Eli Lilly and Novo Nordisk were able to further expand their leading position in the market for weight loss drugs, but their performances varied. Eli Lilly reported revenue of USD 12.73 billion, a strong increase of 45% over the previous year. The two top weight loss products, Mounjaro and Zepbound, contributed USD 3.84 billion and USD 2.31 billion, respectively. The gross margin reached a dream figure of 82.5%, reflecting more efficient production and high demand. Despite the strong growth, Lilly slightly lowered its profit forecast for the full year, citing one-time expenses, particularly for acquired development programs.

Novo Nordisk achieved an 18% increase in revenue to approximately USD 11.9 billion in the same period, with sales of Wegovy amounting to around USD 2.64 billion. With a 13% decline, the Danish company slightly missed analyst estimates. The decline is attributed to competition from low-cost generic drugs in the US and short-term supply bottlenecks. As a result, Novo lowered its revenue and earnings forecast by 3% from the year-end projected growth ranges of 16 to 24% in revenue and 19 to 27% in operating profit. However, Novo emphasizes the expansion of production capacities through acquisitions and plans to continue driving forward the global rollout of Wegovy in around 25 countries. Both companies continue to grow in the highly competitive GLP-1 market, which is currently dominated by Eli Lilly with Mounjaro and Zepbound and are sticking to their high revenue guidance. The share price performance speaks volumes. While Novo Nordisk has lost around 50% in the last 12 months, Eli Lilly has only consolidated by 18%. A total of 23 out of 29 analysts recommend buying Eli Lilly with around 23% upside potential, while 18 out of 28 experts even see room for a 32% increase in Novo Nordisk's share price. The apparent turnaround in the chart is likely tempting here. Looking at the estimated 2025 P/E ratio, Eli Lilly is valued at 36, twice as high as Novo Nordisk. Flip a coin!

The year 2025 is not exactly easy for popular biotech companies. However, the current takeovers also show that valuation levels have generally reached a low point, which is slowly forcing big pharma into a hunting position. With the STEP Seal, Vidac Pharma is again proving how well the active ingredient VDA 1102 is doing in the race. From the current level of EUR 0.47, multiples are possible. Diversification across standard stocks and small caps protects against unwanted portfolio fluctuations.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.