November 4th, 2025 | 07:30 CET

Amazing! Rollercoaster ride with Beyond Meat, recovery at Novo Nordisk and Eli Lilly, big returns with PanGenomic Health

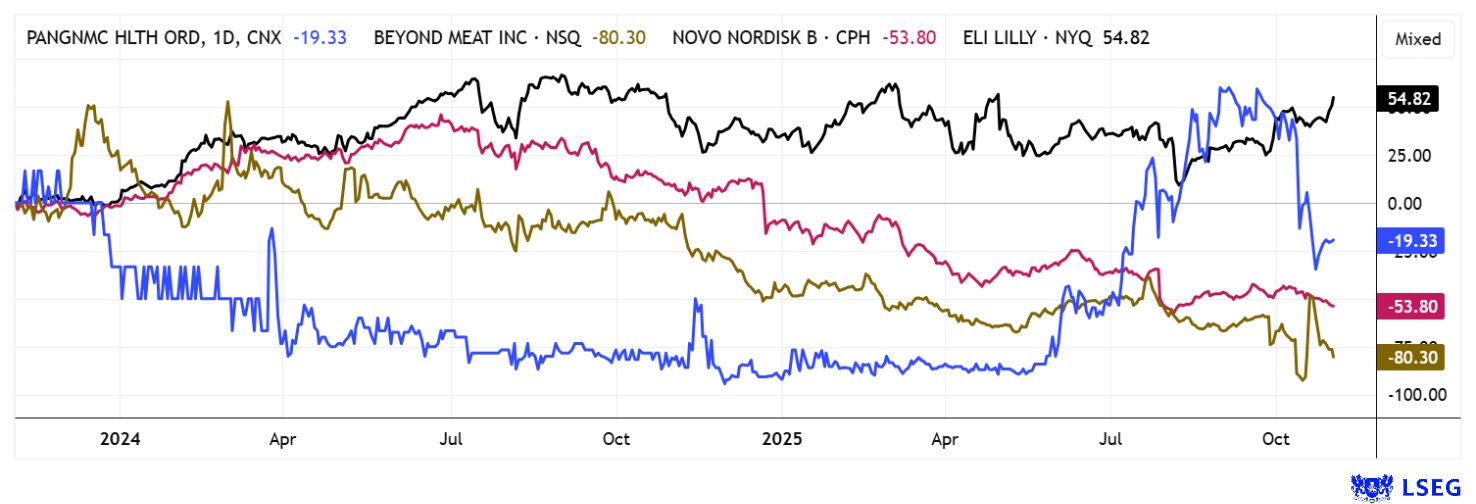

Volatility in the growth stock sector has caused quite a few swings in recent weeks. While Novo Nordisk and Eli Lilly are still struggling with margin declines from semaglutide injections, shares of the plant-based meat provider Beyond Meat have been bouncing around like a ball in orbit. After a rapid tenfold increase in October, November appears to be all about the reverse gear, with the stock currently down 80% from its peak. Those with strong nerves and a quick hand on the mouse are in luck. Things are calmer and steadier with PanGenomic Health. Here, the high levels since summer must first be digested before the next upward cycle can begin. We highlight a few opportunities.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BEYOND MEAT INC. | US08862E1091 , NOVO NORDISK A/S | DK0062498333 , ELI LILLY | US5324571083 , PANGENOMIC HEALTH INC | CA69842E4031

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Wellness 4.0 – PanGenomic builds AI ecosystem for global healthcare

The recent pullback in PanGenomic's share price gains from June to September appears to be stabilizing. This is good news, as since the COVID-19 pandemic, the Company has evolved from a small digital wellness provider to a pioneer in AI-supported preventive medicine, focusing on self-directed programs that combine naturopathic evidence and modern technology. This summer, the Company introduced the NaraCare.AI platform, which integrates the functions of NARA, Mindleap, and MUJN into a holistic ecosystem. Users receive personalized AI recommendations for alternative health approaches and can purchase suitable products directly from a connected store.

This strategy is meeting with particular interest in North America, where digital prevention and nature-based self-care are growing rapidly due to high healthcare costs. At the same time, PanGenomic is building a global platform for complementary medicine with Mindleap Health, which evaluates data from Western and Asian sources. A dedicated Health AI Hub in Hong Kong provides access to Asian AI research, new patient groups, and expanded market knowledge. The Company combines current trends such as AI, personalization, and fitness culture in a platform-oriented model and exploits early market opportunities in the digital self-care sector. Its future direction is based on a growing AI infrastructure and society's desire for more personal responsibility in healthcare. The platform is now set to launch in the fourth quarter of 2025 and will combine AI diagnostics with telemedicine to create individualized preventive care plans. Political developments in the US are increasingly supporting complementary healthcare solutions.

The Nara Mental Health App will serve as the centerpiece of mental health services in the future. It provides evidence-based herbal recommendations and connects users directly to the Agenta e-commerce store. This seamless integration of analysis, consultation, and product offerings creates a cohesive user experience while feeding valuable data into AI models. In addition, a global data center is being established in Hong Kong, which will bundle evidence data for non-pharmaceutical therapies from the end of 2025, thereby addressing the growing longevity market.

PanGenomic is now announcing another milestone: the launch of a DNA program as an extension of the NaraCare platform. To this end, PanGenomic is collaborating with a leading developer of genetic testing technology and will initially distribute Agenta DNA kits in Canada, followed by expansion into the US starting in 2026. According to CEO Maryam Marissen, genetic individuality forms the basis of true personalization, which is why genetic data will play a central role in the system in the future. The DNA tests provide information on nutrition, metabolism, fitness, cognitive health, and general well-being, which is fed directly into the AI analyses. At the same time, data protection and security guidelines for sensitive genomic information are emphasized. The kits are available via the Agenta e-commerce platform and expand the self-care offering with a biological basis. Overall, PanGenomic is positioning itself as a provider of precise, nature-based, and AI-supported health solutions tailored to individual profiles. It is hard to imagine greater tech penetration in the life sciences sector. With a market capitalization of around CAD 21 million, it represents a compelling acquisition opportunity for a strategic or specialist investor.

Novo Nordisk and Eli Lilly – The focus goes beyond obesity

The operating margins of the two semaglutide suppliers, Novo Nordisk and Eli Lilly, are still heading south. Novo Nordisk continues to generate good revenues with its blockbuster product, but growth expectations have clouded significantly. This is partly due to competitors such as Eli Lilly, which are promoting greater efficacy or alternative mechanisms of action. While Novo Nordisk is implementing significant job cuts and restructuring to protect profits, Eli Lilly is investing heavily, for example, in a partnership with Superluminal Medicines to implement AI-supported drug discovery, including for the development of new obesity and cardiometabolic drugs. Novo Nordisk is also pursuing further pipeline developments, planning to introduce a pill form of semaglutide, and advancing broader lifecycle management.

As a major price war has broken out for both providers under the new US administration, they are looking for ways out of the dilemma. Novo Nordisk, for example, has already introduced lower prices for self-paying patients through its own distribution channels, such as direct-to-pharmacy models in the US, aiming to increase volume and offset the price pressure in the traditional reimbursement market. Eli Lilly employs differentiated pricing strategies, discounts, and savings programs for self-paying patients in order to secure market access and drive higher volume sales. Eli Lilly, which is four times larger, trades at a 2027 P/E ratio of 23.6 compared to 11.4 for Novo Nordisk, reflecting its higher valuation, but its share price is also more stable. The Danish company could see a notable turnaround in 2026 after implementing its current programs. Exciting!

Beyond Meat – Alternative meat products on a rollercoaster ride

A quick note on Beyond Meat. The Company recently faced some tough quarters, with both revenue and margins coming under significant pressure. As a result, short sellers had increased their exposure to 54.2% of the outstanding shares. Insane! Meme traders promptly jumped in, recommending the stock on social media forums. This culminated in the stock being added to the Roundhill MEME ETF in mid-October. As if stung by a tarantula, the stock shot up by over 1,000% in just a few trading days. During this period, 20 times the outstanding shares were traded, and the short ratio fell to around 13%. A costly adventure for the short sellers – as was the case with GameStop – but also a welcome playground for speculators! Speculative tendencies are likely to cool down now, bringing the Company's fundamentals back into focus. After today's market close, it is time: the consensus expectation is -USD 0.397 per share – perhaps things will take off again after the announcement? Crazy!

Biotech and life science stocks are currently lagging behind the broader market. With interest rates falling in the US, it is conceivable that more investor capital will flow back into the sector, especially if profits start to materialize in the glamour areas of AI, defense, and high-tech. Technically, Eli Lilly and PanGenomic are favored, while Novo Nordisk has yet to find its turning point. Beyond Meat has been "abused" as a MEME stock and probably has 90% speculators on board – the casino-like stock is certainly not an investment, but it is fun for many traders!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.