January 2nd, 2026 | 07:15 CET

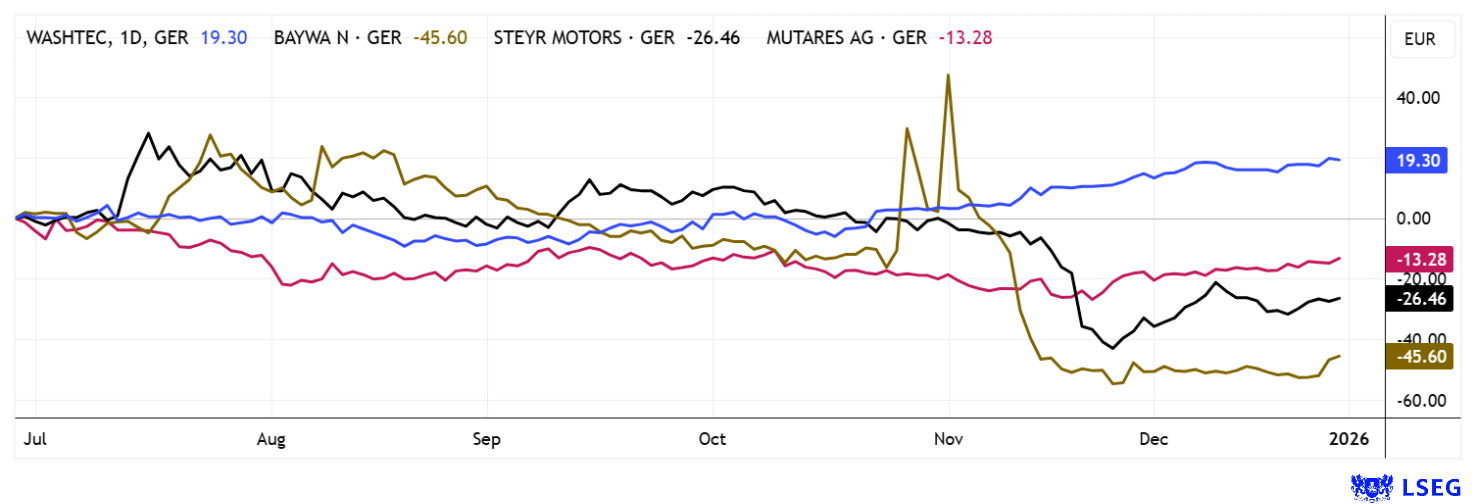

An unbelievable start to 2026: DAX record, WashTec leading the way, and BayWa, Mutares, and Steyr Motors gaining momentum

After a turbulent 2025, European investors are ending the year with solid portfolio gains. The EU confederation has decided to invest up to EUR 3 trillion in defense and to slowly increase the share of defense spending to 5% of GDP. These are huge investments in security, which at first glance will not affect consumers. In the long term, however, they are intended to create security and perhaps a new upward scenario for the ailing economy on the old continent. However, such massive spending will be largely debt-financed, as tax revenues alone are insufficient. This suggests that elevated inflation levels are likely to persist. Investors are therefore well advised to continue to reflect the positive outlook for global equities in their asset structure. The stock market is based on this paradox. High inflation means that the asset bubble will continue. Venezuela offers an extreme example - despite partial sovereign default and rampant inflation, its stock market rose more than 1,200%. Volatility will therefore remain a defining feature of markets, amplified by AI-driven trading models that increasingly anticipate human behavior. Against this backdrop, 2026 will demand strong nerves and disciplined stock selection. Best of luck navigating the year ahead.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

WASHTEC AG O.N. | DE0007507501 , BAYWA AG NA O.N. | DE0005194005 , MUTARES KGAA NA O.N. | DE000A2NB650 , STEYR MOTORS AG | AT0000A3FW25

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BayWa – EUR 600 million debt reduction at the end of the year

What a bombshell at the end of the year! The international trading and services group BayWa has fallen into a deep crisis over the last three years. With negative equity of over EUR 600 million and debt of EUR 4.5 billion, it is almost a miracle that the group is still solvent. However, the latest rights issue raised around EUR 179 million in gross proceeds. BayWa has now arranged the sale of all its shares in Cefetra Group B.V. to a consortium of several investors. The purchase price amounts to around EUR 125 million and is to be paid in several tranches. In addition, a further EUR 62 million will be generated in the course of Cefetra's refinancing through the repayment of shareholder loans. The deconsolidation of Cefetra from the consolidated balance sheet and the targeted debt repayment are expected to reduce the ailing group's bank liabilities by more than EUR 600 million. Of course, this transaction is only the beginning of the restructuring process. The Management Board expects the transaction to be completed in Q1 2026, with the annual financial statements for 2025 scheduled to be presented on March 26. The issuing bank Baader expects a successful turnaround and has given the share an "ADD" rating with a target price of EUR 5.12. If it works, that is a doubling of the share price. For speculative investors only!

WashTec AG – Continuing with share buybacks on the market

Augsburg-based WashTec AG is the world's leading provider of professional vehicle washing solutions. The medium-sized company very successfully combines the sale of its car wash and gantry systems with a high-margin service, chemical, and digital business. Digitally networked systems allow customers to centrally control maintenance, chemical use, and payment processes, reduce downtime, and deploy staff more efficiently. WashTec is thus increasingly positioning itself as a "performance partner" with scalable, recurring revenues. Strategically, WashTec has been transforming itself for years from a pure machine manufacturer to a technology-driven solution provider. Digital offerings such as "SmartCare" enable remote monitoring, data-based optimization, and higher system availability. At the same time, the "EasyCarWash" end customer app binds drivers through subscription and flat-rate models, creating a growing ecosystem of hardware, chemicals, and software. This development reduces the cyclical nature of the business and opens up additional economies of scale, comparable to the successful business models of international industrial groups. Profitable growth continues on the operational side. After nine months, revenue rose by 7.2% to EUR 358.2 million. EBIT grew disproportionately by 17.4% to EUR 32.4 million, and the margin improved from 8.2% to 9.0%, reaching a sensational 11.8% in the third quarter. Well done!

For investors, WashTec combines stable growth with a reliable dividend policy and an attractive cash flow profile. In addition, a share buyback program is underway, under which a total of 33,163 treasury shares were acquired via Xetra by the end of December 2025, sending a strong signal from management regarding long-term value development. Overall, WashTec is proving to be a high-quality small-cap with increasing technology valuation and potential for sustainably rising margins. Analysts expect the growing share of service and digital revenues to further strengthen profitability structurally. All four experts listed on LSEG currently recommend buying the stock and see its fair value at an average of EUR 54.25, representing a potential upside of over 16% over the next 12 months. WashTec plans to present its figures for 2025 on March 26. Continue to accumulate as a long-term strategic investment!

Mutares and Steyr Motors – It was a successful year

The small caps Mutares SE & Co. KGaA and Steyr Motors AG also delivered strong performance in 2025. Investors achieved double-digit returns, with Steyr Motors even reaching 1,000% at one point when rumors triggered a short squeeze on the stock market. Following a successful operational turnaround in mid-2024, Mutares listed Steyr Motors AG in the Scale segment of the Frankfurt Stock Exchange, with the share starting at EUR 15.90 on its stock market debut and reaching a market capitalization of around EUR 83 million. Through an accompanying private placement prior to the IPO, Mutares not only generated fresh capital but also involved institutional investors at an early stage. In the months following the IPO, Mutares was able to gradually place further shares and, in November, successfully sold the last 23% of its Steyr stake. Over the entire holding period, the Munich-based company generated gross proceeds of more than EUR 170 million. We would say that was a good move. If Mutares can achieve similar success in 2026, the current share price of around EUR 29.50 could offer further upside potential. By contrast, Steyr Motors' valuation appears ambitious: estimated 2025 revenues of roughly EUR 50 million are currently valued at around 3.5x sales. Sustained justification of this valuation will require the Company to deliver on its projected annual growth rate of around 50%. The LSEG platform calculates a bullish EUR 66 as the weighted 12-month price target. Almost double the current price of EUR 36!

The new year is starting much like the old one ended. With prices at record levels, identifying new market protagonists is becoming increasingly challenging. Investors in WashTec can look forward to solid growth combined with an attractive dividend yield exceeding 5%. BayWa could emerge as a surprise candidate in 2026, with the potential to deliver a turnaround. Mutares and Steyr Motors round out the small-cap portfolio. The editorial team wishes all readers a successful start to the new year!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.