August 13th, 2025 | 07:15 CEST

Attention, Takeovers: Things are heating up! Bayer, Eli Lilly, Vidac Pharma, and Formycon in focus

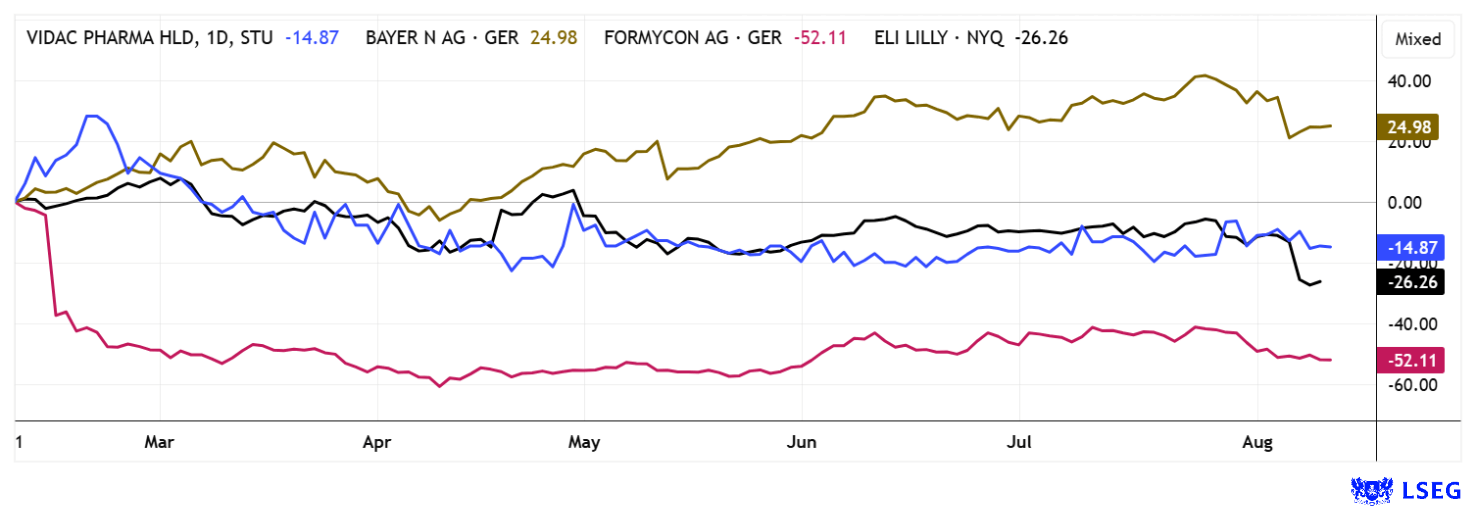

Volatility is king! Great for speculators, often difficult for long-term investors. Biotech stocks are extremely sensitive to study and approval news, especially in cancer research. Vidac Pharma is developing drugs that are designed to target tumor cells and cause them to die – risky, but with great potential. Despite its restructuring, Bayer is strengthening its oncology pipeline, especially in niche indications. Eli Lilly is benefiting from the boom in modern immunotherapies and, thanks to its strong financial position, can support long development phases. Formycon is considering entering the oncology market to broaden its base. The sector offers opportunities and surprising takeovers, but requires a high tolerance for risk.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BAYER AG NA O.N. | DE000BAY0017 , ELI LILLY | US5324571083 , VIDAC PHARMA HOLDING PLC | GB00BM9XQ619 , FORMYCON AG | DE000A1EWVY8

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Bayer – Things are already looking up

Bayer shares have performed impressively in recent months, rising by around 40% since the fall. The share price is currently just below the EUR 26 mark, with investors largely ignoring the ongoing legal proceedings in the US and focusing on positive news from the pharmaceutical pipeline. However, Bayer recently suffered a setback: US approval for the menopause drug Elinzanetant has been delayed as the FDA review period has been extended by up to 90 days. Bayer emphasizes that there are no fundamental concerns regarding approval and is continuing to work on approvals in the EU and other markets.

At the same time, Bayer has entered into a promising exclusive license agreement with US biotech company Kumquat Biosciences. Bayer has secured the rights to a KRAS G12D inhibitor that targets a common cancer gene mutation and could serve as the basis for new cancer drugs. Payments of up to USD 1.3 billion are planned for Kumquat for successful clinical development. Bayer will take over development and marketing beyond clinical Phase 1a, further expanding its expertise in precision oncology.

Analysts remain optimistic despite slight downward corrections: DZ Bank lowered its fair value from EUR 36 to EUR 35 but maintained its "Buy" recommendation. However, the surprisingly strong quarterly figures confirmed Bayer's operational strength. The US Attorney General's decision on the review of a glyphosate ruling, which is expected by the end of 2026, could provide a positive boost. The Leverkusen-based company is shining with solid fundamentals and new innovative strength in its pharmaceuticals division, and two-thirds of its rigorous cost-cutting program has already been completed. Now it is time to look ahead. Enter at the technical break between EUR 24.5 and EUR 25.8.

Vidac Pharma – There is still a lot to expect here

Vidac Pharma is very active in the market. The Company has long established itself as an innovative player in the field of oncological therapies. Experts are particularly eagerly awaiting the latest results for the drug candidates VDA-1275 and VDA-1102, which are based on a patented approach that specifically reverses cancer cell metabolism, thereby restoring normal cell function – a potential breakthrough in cancer treatment. Founded in 2012 by Prof. Max Herzberg, the Company has already made considerable progress in clinical development despite its modest market capitalization of around EUR 27 million.

VDA-1102 is in advanced Phase 2b studies for actinic keratosis (AK) and cutaneous T-cell lymphoma and is showing impressive efficacy: 40% of patients achieved complete lesion clearance, with an overall reduction of 80%. A further Phase 2b study focusing on advanced AK is planned for completion by the end of 2025. In a Phase 2a study in mycosis fungoides, an objective response rate of 56% was achieved with 22% complete remission within 8 to 12 weeks. This is significantly better than conventional therapies. VDA-1275 demonstrated promising results in preclinical studies both as monotherapy and in combination with standard chemotherapeutic agents such as cisplatin and sorafenib, with enhanced tumor reduction and an immune-activating effect. Clinical Phase 1 studies are planned for 2026.

Despite this promising progress and a strong pipeline, the share is still significantly undervalued at EUR 0.50 to 0.60. The renowned analysis firm Sphene Capital confirmed a "buy" rating with a price target of EUR 4.90 in the summer of 2024 and sees considerable price potential until 2027. Two aspects are particularly important for investors: First, Vidac benefits from the unique position of its patented mechanism of action, which could establish a completely new class of cancer drugs, supporting entry into large target markets with high demand. *Second, the upcoming listing on a major German stock exchange is likely to significantly improve liquidity and attract further investors to the Company. A price rally is expected in the coming weeks with further news.

Eli Lilly and Formycon – In the valley of tears

Neither the German biosimilar hope nor the pharmaceutical giant Eli Lilly is currently convincing. Formycon has completed recruitment for the Dahlia study on FYB206, a potential biosimilar to Merck's cancer blockbuster Keytruda. Instead of an expensive Phase III study, the comparability is being tested in a compact pharmacokinetic study with 96 patients after the FDA approved an accelerated development strategy. The first patients have already completed the full 17 treatment cycles, and results are expected in early 2026. The shortened development path saves Formycon considerable costs and positions it as one of the leading candidates in the race for a Keytruda biosimilar, which could be launched in the US in 2029.

While Formycon is at least playing the long-term card, Eli Lilly is currently in a weak phase despite its market leadership in the GLP-1 segment. The share price hit a 52-week low of around EUR 535 after study data on the new weight-loss pill Zepbound fell short of expectations. Although Q2 revenue rose by 19% to USD 9.99 billion, rising R&D expenditure, political price discussions and pressure from competitor Novo Nordisk are weighing on sentiment. Long-term demand in the obesity and diabetes market and new initiatives in the digital health sector remain positive. Looking ahead to the next six months, Formycon is unlikely to release any price-moving data in the short term, but interest could increase with each advance in the Dahlia study. The share price has recently fallen back from EUR 30 to EUR 25. Eli Lilly is heavily dependent on pipeline news in the GLP-1 sector. Without convincing updates, the share price is likely to remain volatile, but a rapid rebound is possible if study data is positive.

Bayer, Eli Lilly, Formycon, and Vidac Pharma offer different opportunities in the pharmaceutical sector. Bayer has a strong pipeline, including a new cancer drug, but is struggling with US litigation and approval delays. Eli Lilly is convincing in the long term with blockbuster drugs, but is currently in crisis. Formycon is at least showing growth in the biosimilars market. Vidac Pharma stands out as a small, innovative biotech company: studies on VDA-1102 and VDA-1275 show strong results in severe forms of cancer and skin cancer. The unique therapeutic approach, the enormous market potential and the corresponding takeover risk are particularly attractive for speculative investors!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.