March 7th, 2023 | 15:09 CET

Is e-mobility a done deal? Watch out for these hydrogen stocks: Plug Power, dynaCERT, Nel ASA and ThyssenKrupp

High prices, falling subsidies and a still inadequate charging network - Germans are losing their appetite for e-cars again. Sales since the beginning of the year have fallen short of expectations. In Berlin, the first liberal resistance to the EU's intentions to remove the internal combustion car from the roads is becoming apparent. For the final vote in the EU parliament, the FDP calls for the approval of synthetic fuels, which are produced under strict CO2 neutrality. Worldwide, the EU seems to be alone with its ban on internal combustion engines. Only California is planning similar legislation. What about the green alternative, hydrogen?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

PLUG POWER INC. DL-_01 | US72919P2020 , DYNACERT INC. | CA26780A1084 , NEL ASA NK-_20 | NO0010081235 , THYSSENKRUPP AG O.N. | DE0007500001

Table of contents:

"[...] We can convert buses and trucks to be completely climate neutral. In doing so, we take a modular and incremental approach. That means we can work with all current vehicle types and respond to new technology and innovation [...]" Dirk Graszt, CEO, Clean Logistics SE

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

ThyssenKrupp - Sentiment around the Nucera IPO is improving

ThyssenKrupp AG has had a difficult few years. The Group has been completely restructured until 2022, and the cost side adjusted accordingly. The fact that the construction industry currently needs less steel is bearable because the Duisburg-based company has been building up new pillars in high technologies for years. With its subsidiary Nucera, the Company has a hot potato in the fire, which could be listed on the stock exchange in the current year. At last, the hydrogen issue is gaining traction internationally, and Nucera is very well positioned.

Since the announcement in 2022, however, there has been a lull on the subject of an IPO and there is virtually no further information. Hydrogen, a green energy carrier, has gained significant interest in recent years. Nucera is a company that develops high-tech industrial equipment needed for the production of hydrogen. The overall market naturally has an important role due to energy transition plans. Nucera expects sales of up to EUR 1 billion by 2026, which is a respectable size for a stock market listing.

A new hydrogen hype could also give new impetus to ThyssenKrupp's stock. ThyssenKrupp's 66% stake is estimated to be worth between EUR 1.8 billion and EUR 2.3 billion, which would value Nucera at a total of EUR 2.9 billion to EUR 3.4 billion. With the IPO and a small share sale, ThyssenKrupp's account could be filled by up to EUR 600 million. The MDAX stock has compensated for the setback after the latest figures and is once again approaching the highs of around EUR 7.60 reached at the beginning of the year. According to Refinitiv Eikon, the Company is currently followed by 13 analysts, with a median 12-month price target of EUR 9.08. Four recommend buying, including Baader Bank, with a price target of EUR 16 - over 100% premium to the current price. On the opposite side is JPMorgan expert Dominic O'Kane with a target of just EUR 5.90.

dynaCERT - Entering a new era with Cipher Neutron

dynaCERT is igniting the next stage in technology partnerships. The Canadian hydrogen expert recently signed a cooperation agreement with Cipher Neutron Inc. to take their joint solutions forward. The goal is to use anion exchange membrane (AEM) technology to produce and commercialize green hydrogen industrially. The focus here is on large and important infrastructure projects. The Company also wants to further develop reversible fuel cell technology, which is used for emergency preparedness and the efficient storage of hydrogen as a long-term energy source.

New partner Cipher Neutron is a fast-growing technology company focused on electrolyzers for green hydrogen production and reversible fuel cells for power generation and energy storage. Underneath the futuristic company name is a global group of collaborating scientists, engineers, technology developers, hydrogen technology experts, investment bankers and individuals who have been involved in hydrogen and energy production for decades. Cipher Neutron's innovative products, such as the electrolyzers and reversible fuel cells under development, have unique advantages over other hydrogen production, power generation and energy storage solutions currently available on the global market.

The development of AEM electrolyzers, ranging from 5 to 250 KW output, and reversible fuel cells are on the agenda for the collaboration. It is good that, in addition to the top dogs Plug Power and Nel ASA, smaller companies are now driving progress in the H2 sector. In any case, the global climate debate is getting a good deal closer to a solution via hydrogen. The DYA share costs about EUR 0.13 and has a market capitalization of about EUR 50 million. dynaCERT could be one of the surprise stocks for the investment year 2023.

Nel ASA and Plug Power - Valuations still ambitious

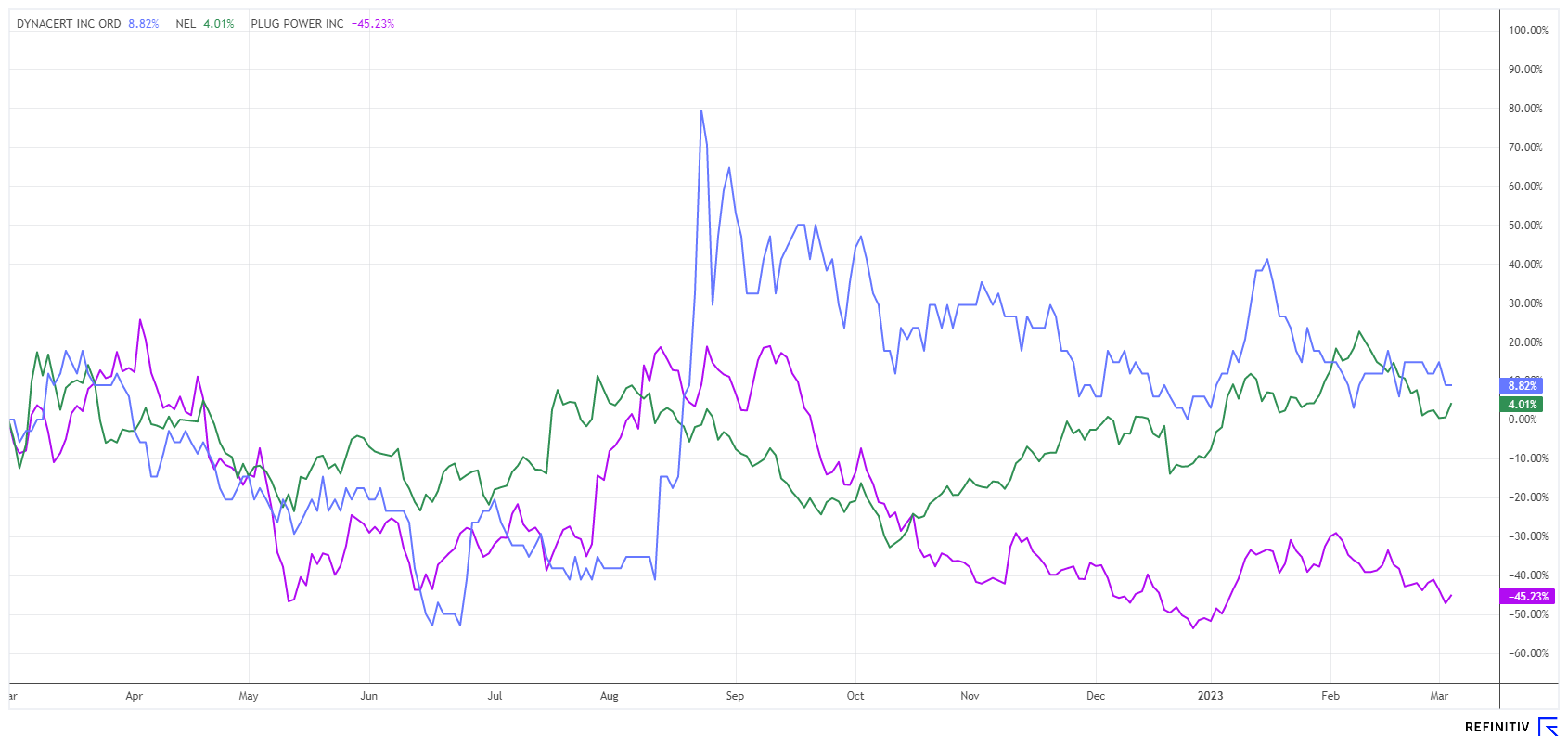

An analytical look at hydrogen top dogs Plug Power and Nel ASA still shows very ambitious valuations.

In 12 months, the shares of the US company have now lost a good 39%, and the current figures are not very inspiring either. Plug Power reported just under USD 221 million in sales for the past quarter. Here, the estimates of the experts amounted to an average of USD 281 million, after USD 162 million was achieved in the previous year. For the full year 2022, a loss per share of USD 1.25 was reported compared to USD 0.82. Plug Power's annual revenue was USD 701 million, up from USD 502 million, which is still a 39% increase. Although sales are expected to nearly double in the current year, the Company is not expected to be in the black until 2025. The share is therefore valued at 6 times sales. Still too expensive!

Nel ASA surprised with a sales report of NOK 993.6 million, but the losses could only be reduced slightly from NOK -1.67 to -1.17 billion. From a pure balance sheet perspective, major write-downs were made in the H2 refueling equipment business. "We are experiencing strong market momentum and high order intake and expect this trend to continue in the future," CEO Håkon Volldal told the press. "Conditions are improving and we are now winning attractive large projects with solid margins and manageable risk profiles." A total of 25 analysts are rallying around the Norwegians, with a median 12-month price target of NOK 16.21. After the figures, analyst firm Jefferies left its rating at "buy" with a price target of NOK 20.

Hydrogen stocks were among the shooting stars in 2021 - but now reality is returning - the billions of euros in private and public investment are still missing. Presumably, the e-mobility hype will have to pass before H2 takes off again. Well-positioned blue chips are ThyssenKrupp, Plug Power and Nel ASA. The Canadian company dynaCERT is also extremely innovative.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.