August 8th, 2023 | 09:50 CEST

Is Artificial Intelligence facing a crash? Facing the bear market with profit enthusiasm: BYD, VW, Nikola, and Power Nickel

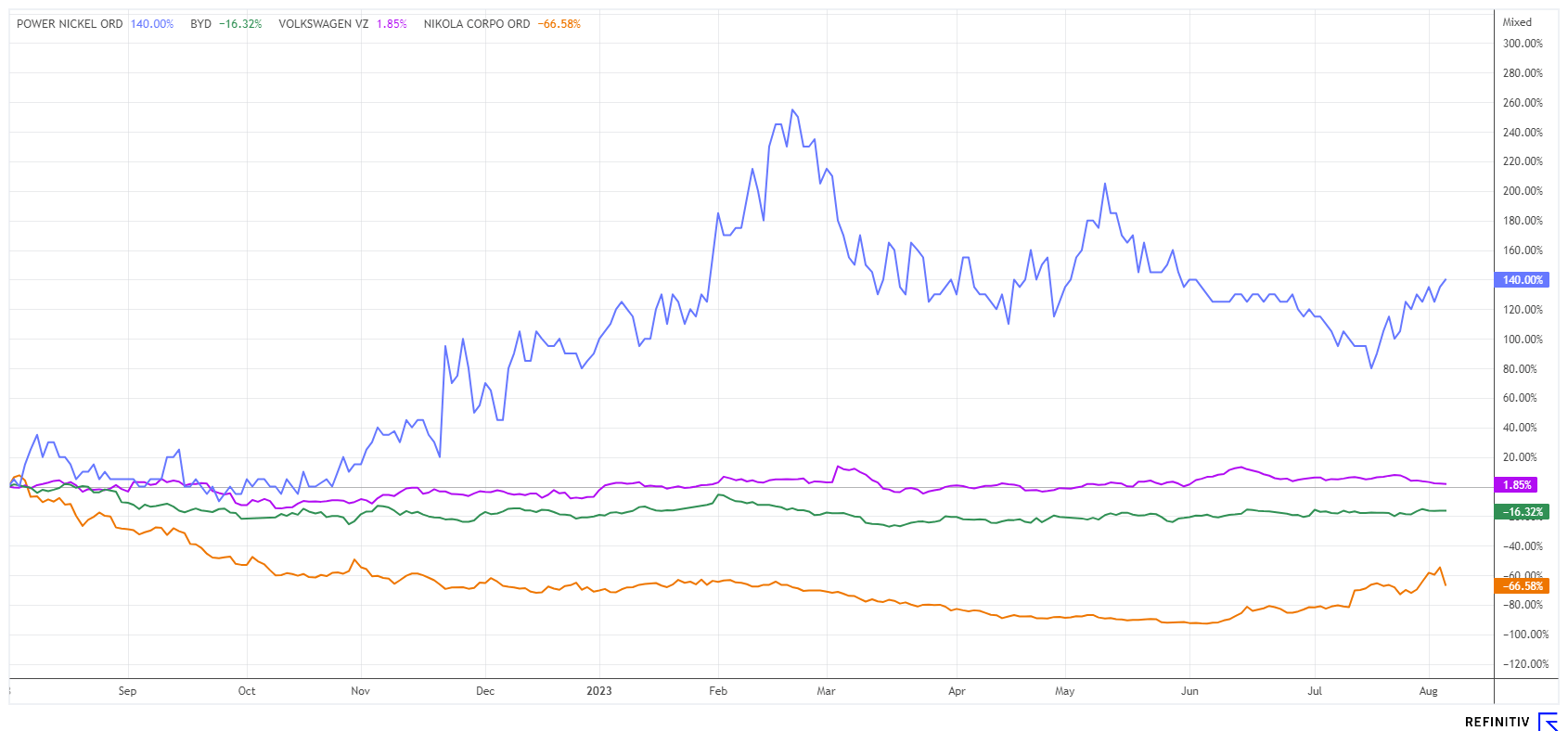

The major stock markets reached new highs for the year last week. With interest rates continuing to rise, inflation still on the rise and recessionary tendencies, many market participants are wondering if the bull market will pause for a while. Because what has failed to materialize so far is a significant consolidation, which would be necessary to finally let off some steam and prevent losses of 20 to 50% within 6 weeks, as seen in 2000, 2008, 2011, 2015 and 2022. The respective starting points in those years were the volatile late summer months of August and September. Stocks such as Nividia, C3.ai and Palantir recently gained as much as 250% and have been buoyed by the AI wave. But how far can this trend go? Looking at the battery market, BYD, Nikola, and Power Nickel could be the next profit generators.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , VOLKSWAGEN AG VZO O.N. | DE0007664039 , NIKOLA CORP. | US6541101050 , Power Nickel Inc. | CA7393011092

Table of contents:

"[...] Nickel, therefore, benefits twice: firstly from its growing importance within batteries and secondly from the generally growing demand for such storage. [...]" Terry Lynch, CEO, Power Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD - Surpassing Tesla and VW in e-mobility

Elon Musk is currently making more headlines with the new X logo for Twitter, and he does not want to think about Tesla and the Chinese market. The reason: the local competitors in the e-mobility market have neatly outstripped Tesla in the domestic market despite multiple price reductions. And the expansion abroad continues. The top dog BYD is present with its vehicles in more and more countries, which is clearly reflected in the sales figures. In the first half of 2023, more than 1.25 million BYD-branded electric vehicles were sold worldwide, representing an increase of 96% compared to the same period in 2022.

The pioneer Tesla was only able to sell around 900,000 vehicles globally. At VW, the e-market share in China even fell below the 3% mark with less than 100,000 units. After decades of dominance in China's car market, the top position has now been lost. Because of its closed production chain, BYD is among the global market leaders not only with its vehicles but also with its new "Blade" battery. The unit, which is manufactured entirely in-house, is considered to be the latest and, at the same time, safest battery technology for electrically driven vehicles that has been launched on the market to date. In terms of service life, the engineers are talking about around 5,000 charging cycles and more than 1.2 million total km.

At the end of July, BYD had pre-announced a strong jump in profits for the first half of 2023, resulting in a net income of about EUR 1.46 billion, a jump of about 200% compared to the same period last year. The Company will not present its detailed half-year report until August 28. The stock is trading at a solid EUR 31.20 but is still in a recovery cycle since bottoming out at EUR 20.70 in November 2022. In terms of market capitalization, BYD, with EUR 90 billion, surpasses VW, which, with its 12 brands, weighs in at only EUR 66 billion. Investors can remain invested in BYD long-term but should tighten the stop to EUR 28.50.

Power Nickel - Concentration on the battery material nickel

Anyone thinking about battery technologies cannot avoid nickel, graphite and cobalt in addition to lithium because nickel-manganese-cobalt (NMC) cathodes are currently the most successful lithium-ion system. They offer a good compromise between general electrochemical performance, high energy densities and reasonable production costs.

Since 2022, electric vehicle manufacturers have had a nickel procurement problem, as demand for lithium-ion batteries currently consumes nearly 10% of the world's annual nickel production of 3.3 million tons. About half of this comes from Indonesia, far ahead of the Philippines and Russia. The geo-conflict over Ukraine makes nickel a strategically important metal. Shortly after the invasion of the neighbouring Russian country, the nickel price peaked at USD 47,000; currently, the price is just under USD 21,000. According to a study by the Nickel Institute from 2021, the Ni share in modern batteries will already develop from approx. 39 to 58% in 2025. North America and Europe should have recognized the signs of the times and pushed for a change in procurement structures to stabilize supply chains.

Canadian explorer Power Nickel (PNPN) owns a flagship project called NISK in Quebec, a gold project in British Columbia, and another 4 properties in Chile. With mineralization for nickel, copper, cobalt, palladium, and platinum, NISK slays almost all the major future metals in one property. The Company has now exercised its existing option to acquire 50% of the NISK nickel PGM project. With the completion of a NI 43-101 resource estimate in the fall of 2023, Power Nickel could exercise another option to its partner Critical Elements Lithium Corp (CRE) for a 30% interest. With focus from NISK, the Company is looking to spin off marginal operations into a separate company soon. Last week, the Company announced a tax-deferred CAD 2.25 million financing at a 100% higher price of CAD 0.50. Still, the stock is currently trading at about CAD 0.24. Promising!

Nikola Motors - The short sellers must be sweating

The stock of electric truck maker Nikola Motors has come under significant pressure since its 2020 IPO, as founder Trevor Milton fell out of favour with untrue statements shortly after the listing. Even his swift resignation failed to restore confidence in the California tech company. After a highly volatile journey, the share price fell back to EUR 0.50 in June 2023, and the market capitalization fell back to EUR 340 million after the Company was once valued with a market value of almost EUR 40 billion shortly after the IPO.

After over 24% of shares were sold short in early June, the tide turned, and Nikola Motors became the focus of the Reddit community. As a so-called meme stock, the Company managed a six-fold increase in price in just 6 weeks. The outstanding share capital has since been turned over 10 times. After positive funding news from the US government, news arrived yesterday that ex-Opel boss Michael Lohscheller is stepping down from the CEO post after less than a year. Not good omens for the highly volatile stock, which had just been on the rise again. Management recently announced the start of production of the first fuel cell truck, which is to be delivered as early as September. High tension for speculators!

The battery market is going into the next round. In the medium term, the demand for nickel will increase enormously. Power Nickel shares are well positioned for this with a promising property. In contrast, a small-scale war with high margin pressure has broken out among electric car manufacturers, in which German manufacturers will probably lose out to China and the USA.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.