October 11th, 2023 | 08:30 CEST

Investing against the tide! Rheinmetall, BYD and Power Nickel with 100% potential?

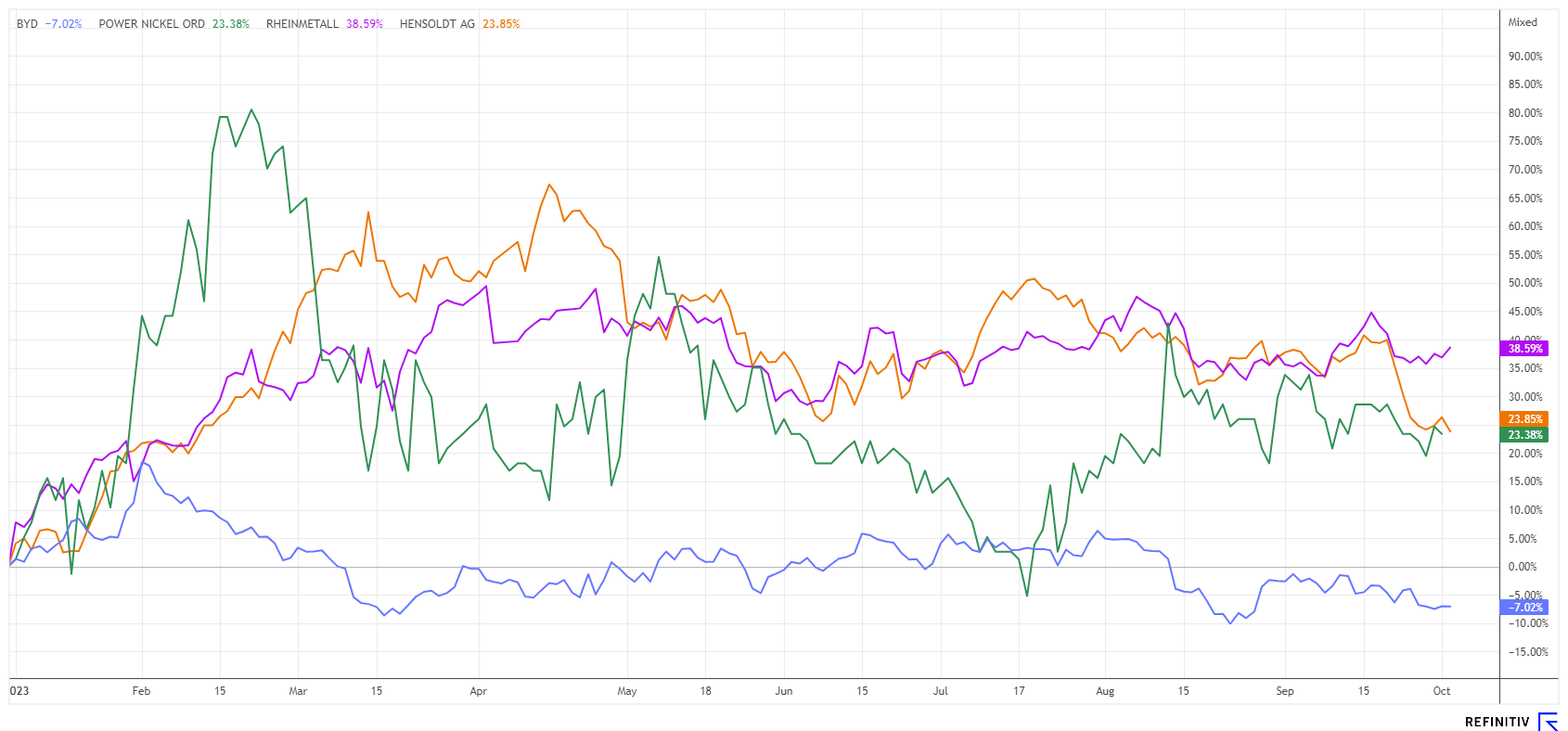

In challenging times, it takes a lot of nerve to weatherproof one's investment strategy. Despite all the crises, however, there is no denying that the key underlying trends in the economy will continue. Occasional setbacks, therefore, always provide new entry levels for the agile investor, naturally in the conviction that we in Germany can do little to change the global situation and its upheavals. Life goes on, and stock market prices have to find a new equilibrium. In the area of defense and mobility solutions, Rheinmetall, BYD and Power Nickel stand out with good positioning. Where do the opportunities lie?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , BYD CO. LTD H YC 1 | CNE100000296 , Power Nickel Inc. | CA7393011092

Table of contents:

"[...] The collaboration with CVMR offers two primary advantages for Power Nickel: We can cover a larger portion of the value chain in the future, and despite the extensive cooperation with all its positive outcomes, we have remained significantly independent. [...]" Terry Lynch, CEO, Power Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Rheinmetall - Emerging from Consolidation with Momentum

The Rheinmetall share has actually been in an extensive consolidation movement for months. The share price had only reached a new 9-month low of EUR 230 at the beginning of October. Then there were terrorist actions in the Middle East, and suddenly, there it is again: the armament idea! In the hope that new orders will flow into the mechanical engineering and technology group soon, investors significantly increased their investment quota. But who is right now? The sellers or the buyers

Despite the ongoing conflicts, a look at the fundamental data provides an assessment of the current expectations. Rheinmetall is expected to increase its revenue by over 50% by 2026 and significantly boost earnings per share from the current EUR 10.82 to EUR 24.50 per share due to scale effects. The current price of EUR 255 translates to a P/E ratio of around 10.5 and a price-to-sales ratio of 1 with a 3-year horizon. For an internationally sought-after stock with a "crisis wing", this is not too expensive in the long term. However, the Company would have to bring in substantial orders to maintain this level in the short term. 13 experts on the Refinitiv Eikon platform see an average 12-month price target of EUR 299.80. Technically, the next hurdle is between EUR 262 and 266. That is not too far away!

Power Nickel - Continuing Forward with Great Strides

What was clearly noticeable at the IAA in Munich is the fear among executives of being cut off from access to raw materials by external effects. The European automotive industry lags behind the global development in the field of e-mobility by at least two years, so any regression in production possibilities would be associated with a loss of market share. In addition to copper and lithium, the essential cathode material for electric vehicles is Nickel-Manganese-Cobalt (NMC). The percentage of nickel used will increase from the current 50% to at least 60% for technological reasons. In 2022, 50% of the global nickel production of 3.3 million tons came from Indonesia, far ahead of the Philippines and Russia. So far, supply relationships have been stable - but is that set for the future?**

Canadian explorer Power Nickel is showing good progress so far at its premium NISK deposit in Quebec. The latest published drill results suggest a further expansion of the resource. In addition to nickel, important technical metals such as copper, cobalt, palladium and platinum are also in the ground - an excellent setup for future supply to the high-tech industry with the advantages of a secure jurisdiction. A German business delegation secured some supply concessions from Canada in early 2023 - further demand is gigantic and growing daily. From today's perspective, Power Nickel could be the next producer of these coveted metals.

The Power Nickel share (PNPN) is now consolidating somewhat after a steep rise at the beginning of the year. This opens up an opportunity for new investments in the CAD 0.22 to 0.24 range. Power Nickel recently refinanced at CAD 0.50, which is good money for further progress in the NISK project. Top up!

BYD - Now expanding into new markets

In recent weeks, the stock market has felt great momentum in the automotive sector. Electromobility and the latest developments in this area are increasingly attracting the attention of the masses. Ultimately, there was only one topic at the IAA in Munich: Which supplier can deliver a coherent concept, offering a compromise between design, price, functionality and durability?

The Chinese car manufacturer BYD is one of the favorites in the industry, and its good reputation on the domestic market contributes to this. Abroad, they are becoming more active every month, opening up in one market after another. Of course, this initially causes extreme market entry costs, which only pay off later through new vehicle sales and increasing market shares. In Europe, BYD can offer 20 to 30% lower prices, which has already attracted the attention of the EU antitrust authorities. Suspected subsidies from the Chinese state are to be investigated. These investigations will likely take years and ultimately come to nothing because there are mutual dependencies between Europe and China.

The BYD Seal is to be offered in Germany from 2024 for around EUR 45,000 in order to compete with the Tesla Model 3. Volkswagen will probably not be able to keep up here because the last price battle in China had already put the Wolfburg-based company and Tesla in their places. We will only know in retrospect to what extent the BYD Group will be able to operate profitably here - at present, it is a question of new market shares in a strongly growing segment. The BYD share fluctuates wildly back and forth between EUR 26 and EUR 30 with every news update from China. Investors hope the expected growth figures will materialize and pay a 2023 estimated P/E ratio of 24, which could drop to around 10 in 3 years. If the trends continue, this is quite achievable. Active investors are taking advantage of the volatility of the last few days for a cheap entry between EUR 25 and 27.

Currently, there are many reasons to be cautious on the stock market. At the same time, regardless of significant upheavals, there are also unstoppable long-term trends that will continue to advance in any environment. BYD is in an extended consolidation, Rheinmetall has been the talk of the town again for days, and Canadian Power Nickel is delivering consistently. A colorful mix of viable ideas.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.