August 8th, 2022 | 12:45 CEST

Infineon, BrainChip, Nvidia - Chip shortage will continue in 2022

The chip shortage is not only omnipresent in the automotive industry. Most recently, AOK was no longer able to issue electronic health cards to its policyholders because the chips were missing. According to McKinsey, the semiconductor industry is expected to grow by 6-8% annually until 2030. Nancy Pelosi's visit to Taiwan could further fuel the chip crisis in the future. It is important to know that the island nation produces about two-thirds of all microchips needed worldwide. There is a latent danger that China will want to annex Taiwan. The USA is already trying to make itself less dependent on Asia. To that end, a USD 369 billion semiconductor manufacturing stimulus bill has been passed by Congress. Today we look at three companies that will benefit from the investment.

time to read: 5 minutes

|

Author:

Armin Schulz

ISIN:

INFINEON TECH.AG NA O.N. | DE0006231004 , BRAINCHIP HOLDINGS LTD | AU000000BRN8 , NVIDIA CORP. DL-_001 | US67066G1040

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

Armin Schulz

Born in Mönchengladbach, he studied business administration in the Netherlands. In the course of his studies he came into contact with the stock exchange for the first time. He has more than 25 years of experience in stock market business.

Tag cloud

Shares cloud

Infineon - Strong quarterly figures with a forecast increase

Infineon is the chip producer in Europe. The Group should therefore benefit from the EU's Chips Act. EUR 45 billion will be made available from Brussels to ensure that at least 20% of all global chips are manufactured in Europe by 2030. In this way, the EU is taking a similar path to the US in order to break away from its dependence on Asia. Infineon should be able to secure at least part of the sum. The Villach plant officially opened its doors in September 2021. The timing was ideal because the chip crisis had already fully erupted, and so the production facility was able to process orders directly.

On August 3, the Group presented its figures for the third quarter and again increased its forecast for the current year. Sales amounted to around EUR 3.6 billion, an increase of 33% YOY. Of particular note was the increased demand from the automotive sector. The margin was 23.3%, generating earnings of EUR 842 million. The weak euro is also providing more positive figures. If the euro/USD exchange rate remains at 1.05, sales of EUR 3.9 billion are expected for the fourth quarter. Currently, the exchange rate is even lower. The new forecast calls for sales of around EUR 14 billion, with a margin of more than 23%.

"In difficult general economic conditions, Infineon continues to perform well thanks to its differentiating portfolio," said Jochen Hanebeck, Infineon's CEO. The Group is also affected by rising energy costs and higher raw material prices but is currently able to absorb this well. At the beginning of July, the share found its low at EUR 20.67 after a longer setback. From there, the share price rose by almost 42%. The share is currently trading at EUR 27.56. After the quarterly figures, there were 3 buy recommendations out of 6 with price targets between EUR 38 and EUR 45.30. Only Jeffries saw the stock as a sell candidate with a price target of EUR 18.

BrainChip - Partnership with ARM creates fantasy

The world is transforming from an analogue world to a digital world. Sensors are playing an increasingly important role in this transformation. An iPhone has 7 sensors, for example, for facial recognition. A car now has around 70 sensors. At the moment, conventional semiconductor chips are still used for this. In the future, the chips will become more intelligent and use artificial intelligence (AI) to evaluate the data. This is referred to as edge AI, and it is here where BrainChip has taken a pioneering role. The Company provides AI-on-chip processing and learning through a neuromorphic processor called Akida that mimics the human brain.

Mercedes-Benz is taking advantage of the chip's capabilities in its Mercedes Vision EQXX. Using the chip in the device reduces the massive power consumption and associated emissions of data centers, which is good for the climate. In addition to energy efficiency, latency is significantly lower, the chip learns directly, and data security is significantly increased. The latter succeeds because the chip does not need an Internet connection. A CPU is also not required, in contrast to competing products. ARM recently joined BrainChip's partnership program. This partnership could turn into a big hit because ARM processors can be found in almost all cell phones, tablets and other IoT devices. It is safe to assume that ARM is putting the Akida chip through its paces. If ARM is convinced and acquires licenses from BrainChip, this would be a quantum leap for the Australian company.

As an investor, you still need patience here. But the growth prospects for the sector are excellent according to a study by McKinsey. The market is expected to grow 17% annually until 2025. The Company itself sees good growth opportunities in the industrial and smart home sectors, in addition to the automotive sector. After the shares of all chip producers weakened, the BrainChip share price also fell. In mid-January, the share price peaked at AUD 2.34 per share before consolidation set in, pushing the share price down to AUD 0.765 by mid-June. From the low, the share gained over 78%. Currently, the stock stands at AUD 1.13. Closing prices above AUD 1.365 bring further significant upside potential.

Nvidia - Waiting for the quarterly figures

Nvidia is the top dog when it comes to the development of graphics chips (GPUs). The Company describes itself as the pioneer of GPU-accelerated computing. Today, the Company is more broadly positioned and serves the gaming market with its graphics cards. It is also active in the areas of professional visualization, data centers and the automotive industry. The partnership with Mercedes-Benz shows how strong Nvidia has become in the automotive sector. Together, they want to upgrade vehicles for autonomous driving and develop intelligent cockpits.

The Group had to digest a setback. The demand for graphics cards decreased due to the cryptocurrency crisis. If you look back at 2018, the Group suffered from the crypto crash. However, the omens are different today. The latest quarterly figures showed that revenue from data centers exceeded that of the gaming division for the first time. In terms of growth, data centers were just ahead of gaming at USD 3.62 billion, or up 31%, with an 83% increase to USD 3.75 billion. That shows the Group is no longer as dependent on graphics card sales. AI, Omniverse, robotics and autonomous driving are the business areas of tomorrow.

It took until the beginning of July for the industry leader to find a low in its share price. That was at USD 140.55. Since then, the stock has gained about 37% and is currently priced at USD 192.74. The downward trend was broken on July 20 and the upward trend is currently intact. The weak Intel figures provided only short-term pressure again. The quarterly figures on August 24 will show whether Nvidia has also been hit. However, there are many indications that no other chip manufacturer has the same problems as Intel. Therefore, a positive surprise would also be possible here. Investors who want to invest should currently wait for a setback.

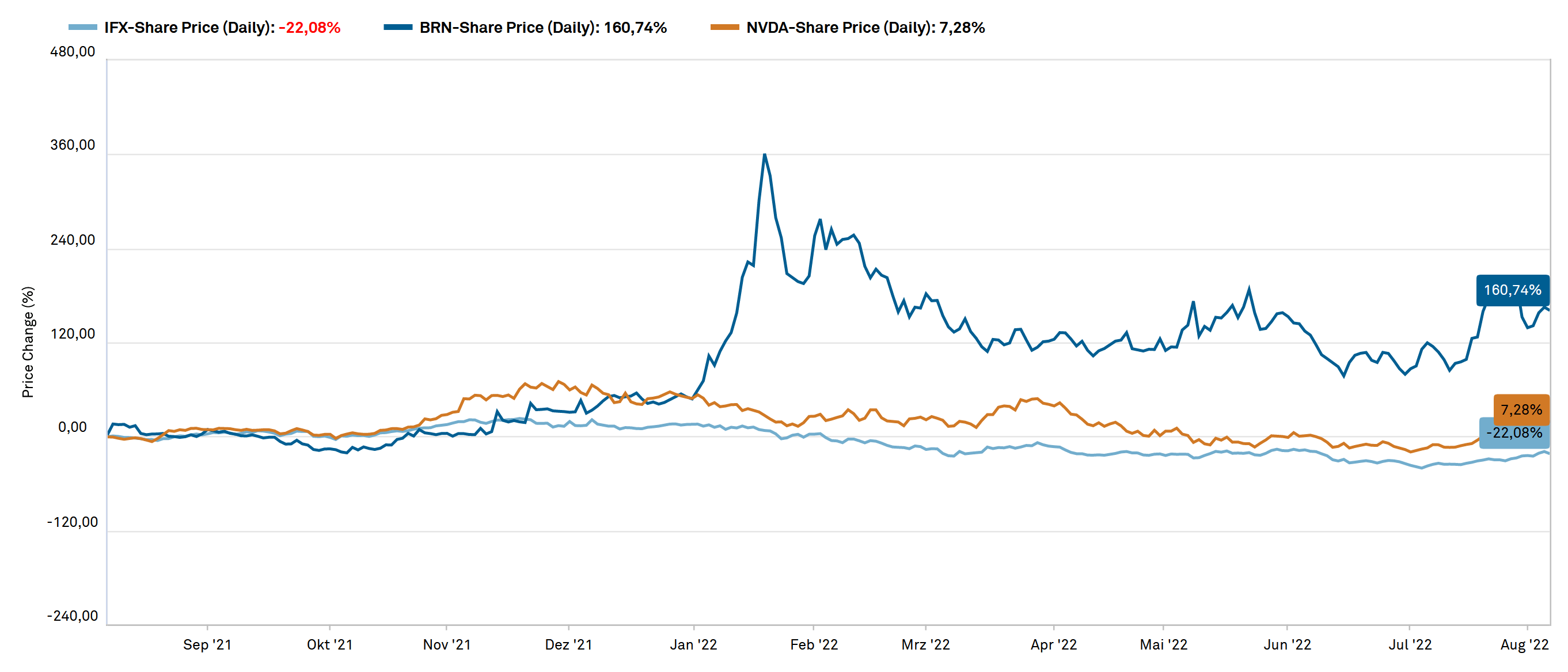

As you can see on the chart, all chip manufacturers had to struggle with falling prices. On an annual basis, BrainChip has fared best. There is still a lot of potential there, as the Company is only at the beginning. Second place goes to Nvidia, which is the measure of all things in the graphics card sector. Infineon is the loser with a performance of -22%. However, there may be some catch-up demand in terms of performance here.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.