September 13th, 2023 | 08:45 CEST

IAA Mobility - There is more to come! Pressure on Volkswagen, BYD and Power Nickel increases

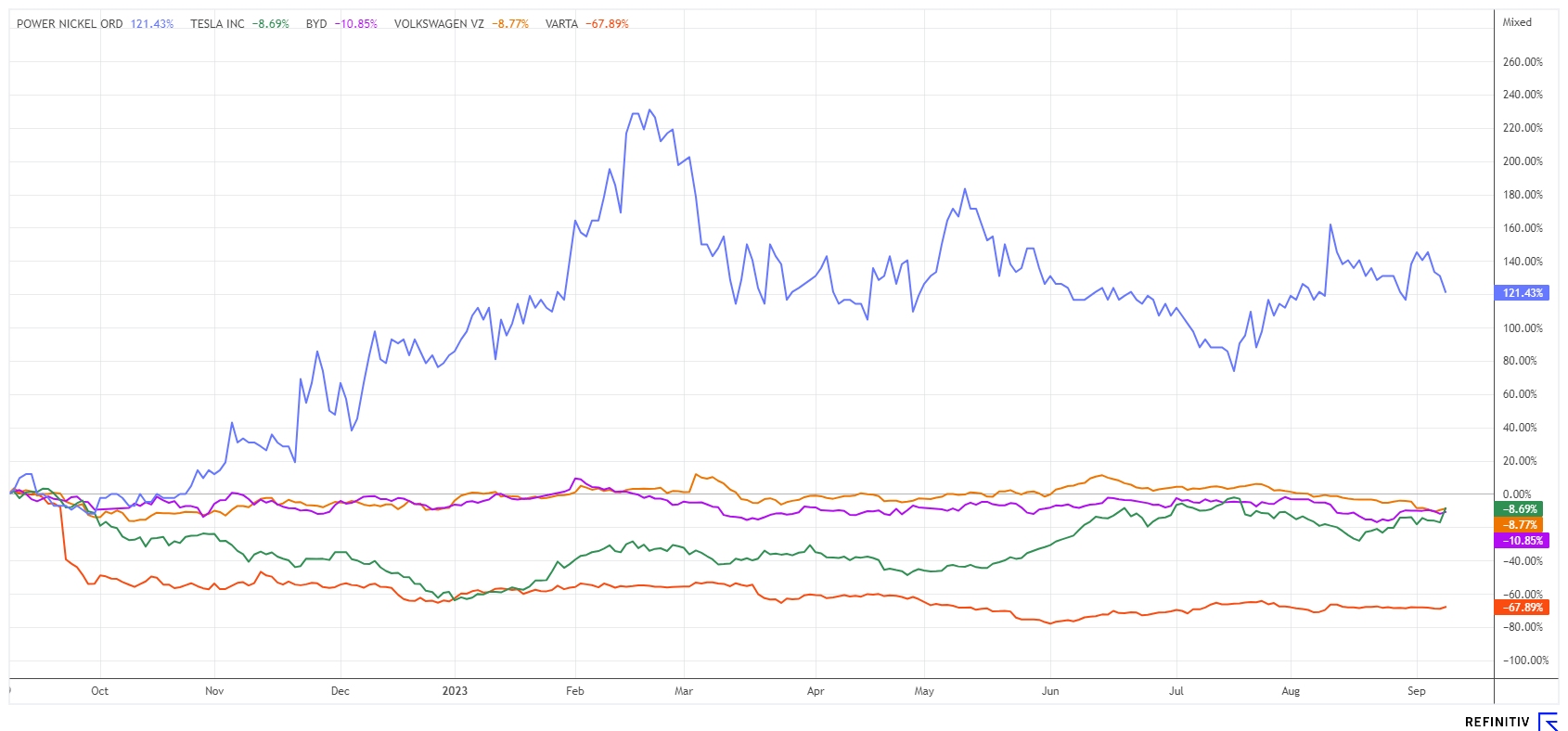

The IAA Mobility closed its doors over the weekend. It was supposed to exude glitz and glamour, but the spark in the field of e-mobility doesn't seem to be flying, and sales figures are declining in Germany. There were only a few real innovations in Munich, but at least progress is being made with e-bikes. More than half of the 750 exhibitors came from abroad, a fact that the German automotive industry is feeling more and more. The Chinese manufacturer BYD presented five models, which will soon be launched in Germany. They are in direct competition with Volkswagen's ID range. Where do the opportunities lie for investors?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

VOLKSWAGEN AG ST O.N. | DE0007664005 , VOLKSWAGEN AG VZO O.N. | DE0007664039 , BYD CO. LTD H YC 1 | CNE100000296 , Power Nickel Inc. | CA7393011092

Table of contents:

"[...] The collaboration with CVMR offers two primary advantages for Power Nickel: We can cover a larger portion of the value chain in the future, and despite the extensive cooperation with all its positive outcomes, we have remained significantly independent. [...]" Terry Lynch, CEO, Power Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD - New models at the IAA Mobility in Munich

BYD's exhibition space at the IAA Mobility in Munich met with the highest level of interest. In a European premiere, the Chinese automaker presented the SUV version of the SEAL model, an offshoot of the successful e-sedan. The spacious SUV with the "U" in its name will be launched with two LFP battery versions, which offer between 420 and 500 km of WLTP range. BYD is thus expanding its range in Europe with a sixth electrified model. BYD had already introduced the Atto 3, Han and Tang models in the spring, with two more models to follow in the fall. The delivery date for the SEAL U in Europe is still unknown.

BYD continues to innovate and presents two new technologies, Cell-to-Body and iTAC, which ensure a more space-saving, stable and safe battery installation. For the first time in Europe, BYD will also present its luxury sub-brand Denza, a joint venture between BYD and Mercedes-Benz. The Denza D9 is a premium-segment, seven-seat large sedan. The new models increase the margin in the group. At the half-year, BYD had reported a strong jump in profits for the first half of 2023, with a net income of about EUR 1.46 billion, a jump of about 200% compared to the same period last year. After a sellout at the end of 2022, BYD was able to continue its rally, which has been in place since 2019, and exceeded the EUR 30 mark again in September. Sales are growing steadily at 20% p.a., and earnings are rising even faster. A 2024 P/E ratio of 19 is thus relatively inexpensive.

Power Nickel - New discoveries in recent drilling program

The major car manufacturers are dependent on the secured supply of battery metals. For this reason, there are already some government initiatives worldwide to alleviate the regional dependencies on raw materials, especially on Asia and Russia. In addition to the familiar metals such as copper and lithium, e-mobility cannot get around the important cathode material nickel-manganese-cobalt (NMC) in particular. Worldwide, most batteries are created according to this design because, according to the latest knowledge, it promises good performance, relatively high energy densities and reasonable production costs.

But the new e-mobility boom poses major challenges for the industry, as automotive production already swallows up around one-third of the global output, plus key sectors such as construction, steel finishing and medical technology. With over 50% world market share, Indonesia leads the way in nickel mining, ahead of Russia and the Philippines. The Nickel Institute has estimated the demand for future battery versions to be around 60% from 2025, compared to around 40% currently. This is the crux of the matter for a rapidly growing industry.

An explorer from Canada could rise to become the supplier of nickel. We are talking about Power Nickel (PNPN) and its premium Nisk deposit in Quebec. With mineralization for nickel, copper, cobalt, palladium and platinum, Nisk slays almost all the major future metals in one property. The recent Step Out drill hole at Nisk returned good data, encountering approximately 25 m of massive and semi-massive sulfides at a depth of 457 m. CEO Terry Lynch is excited by the results and expects further enrichment in the southeast trend.

"The southeast plunge within the mineralized horizon is a compelling observation. Testing the identified dips at progressively greater depths is the strategy behind this initial drilling of our fall campaign. Although grades cannot be estimated at this time, the successful intersection of these massive and semi-massive sulphides is a very encouraging start to our program", summarized Kenneth Williamson, VP of Exploration. PNPN shares are currently trading quite actively in the CAD 0.24 to CAD 0.27 corridor, with the most recent capital increase in August occurring at CAD 0.50. The upcoming news will be extremely exciting!

Volkswagen - Structural weakness is causing problems

With great concern, investors are currently looking at the world's second-largest car manufacturer, Volkswagen AG from Wolfsburg. For a long time, the Lower Saxons had their nose in front of the Chinese market, but now, in 2023, they have been overtaken by domestic manufacturers. Despite massive price cuts, VW cannot keep up with its Far Eastern competitors. In the face of reduced growth, investors are also increasingly looking at the debts of over EUR 400 billion that have now been accumulated. They will have to be rolled over in the next few years as interest rates double - a burden for a weakening profit dynamic.

The 26 analysts on the Refinitiv Eikon platform are still optimistic. They expect an average price target of EUR 152.50. The VW preferred share had this price exactly one year ago. In the meantime, it is 29% behind on a 12-month view at only EUR 109, just above the year's low of EUR 104.50. Technically, apart from the psychological mark of EUR 100, there is only the sell-off level from the Corona crash of February 2020 at around EUR 85. Consensus earnings estimates for 2023 are still around EUR 31.30 per share, resulting in a P/E ratio of 3.4. The dividend yield is approaching the 8% mark, provided that the last dividend of EUR 8.76 can be maintained. It is recommended to keep an eye on Volkswagen for an initial entry below EUR 100!

Electromobility has received little tax support in Germany since September 1 and will come to a complete halt in the course of 2024. That means the new mobility segment will have to face up to market realities. Nevertheless, the boom is likely to continue unabated worldwide, so the standard stocks BYD and Volkswagen should offer good opportunities in the long term. Given the increasing shortage of raw materials, the Power Nickel share is a speculative trigger for the portfolio.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.